Watch FXOpen's January 2 - 6 Weekly Market Wrap Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

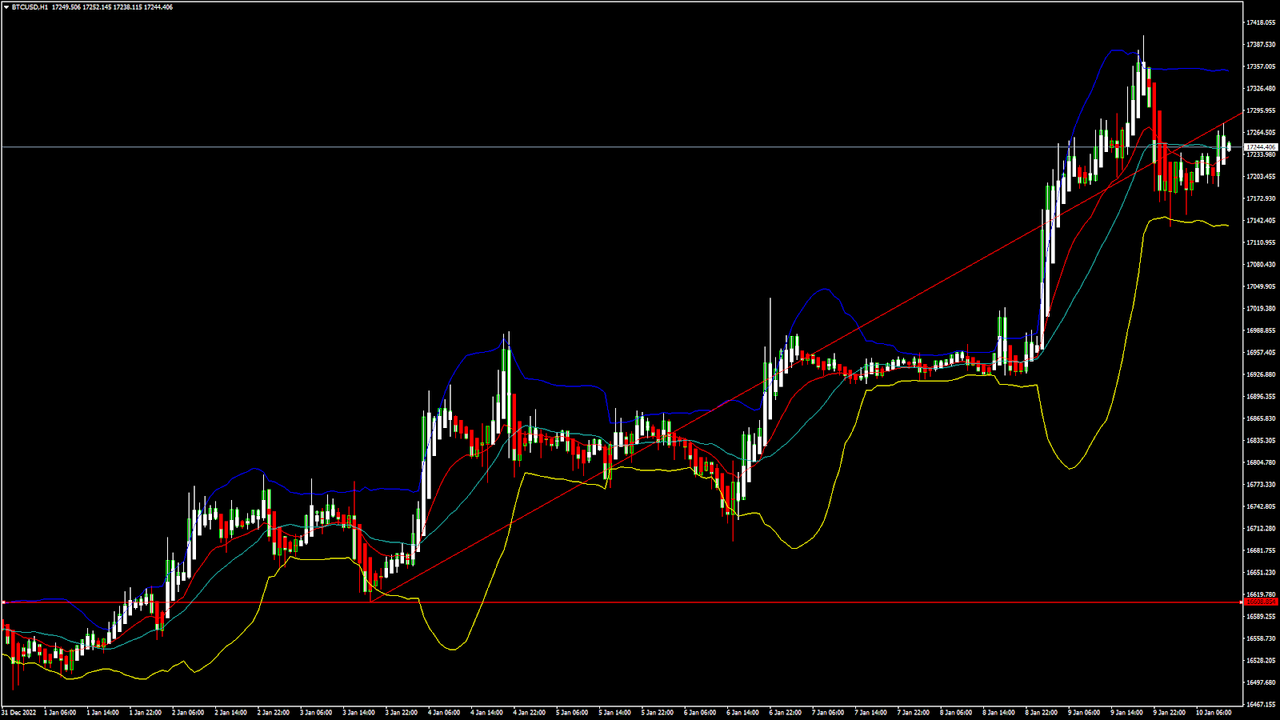

- What to expect in stock market in 2023

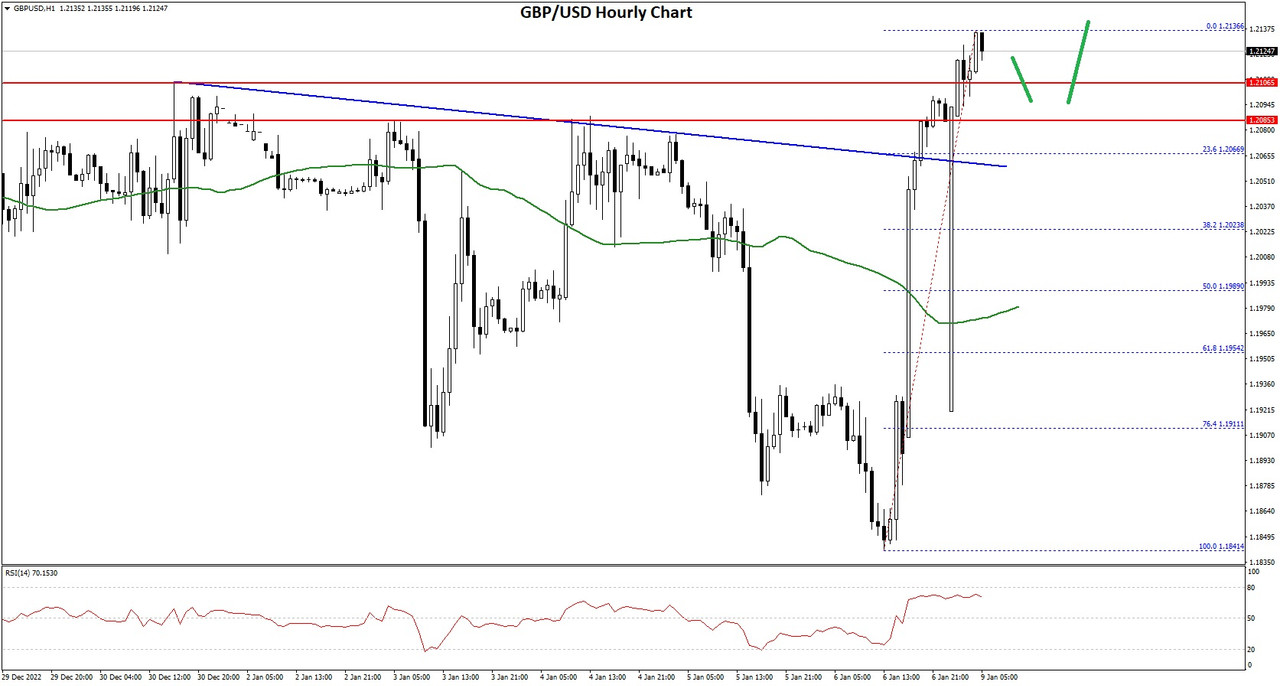

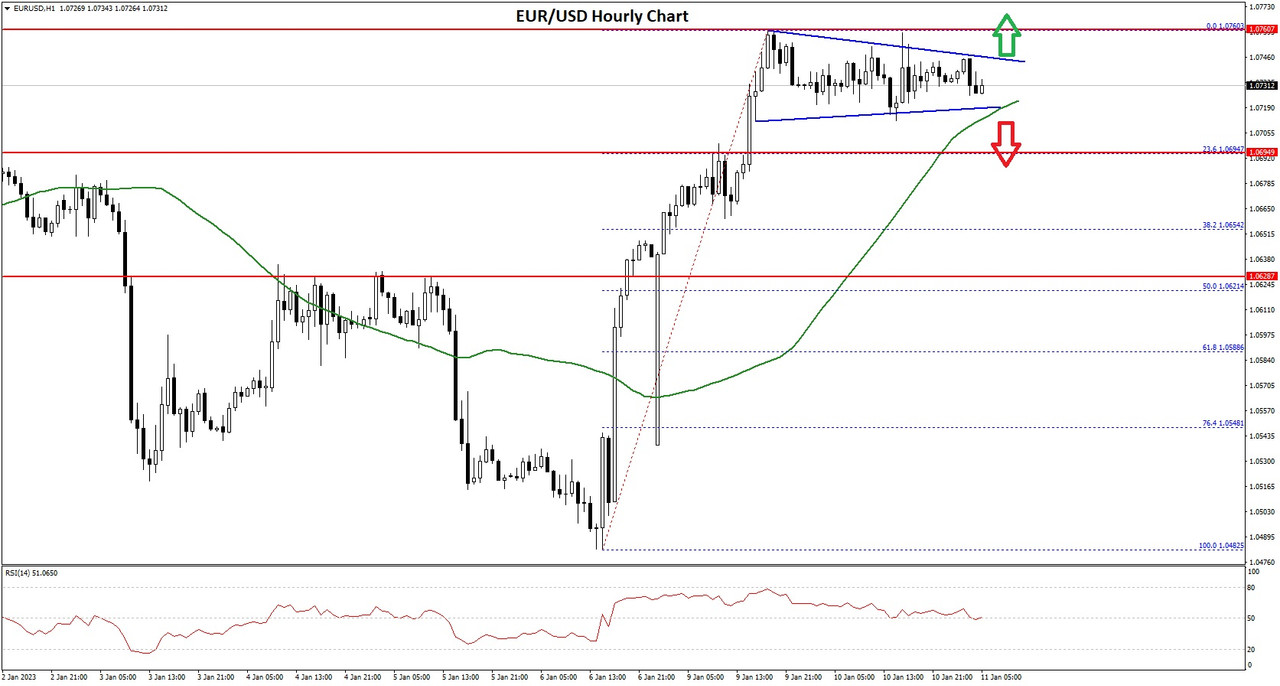

- British pound crashes against USD

- USD rally short-lived

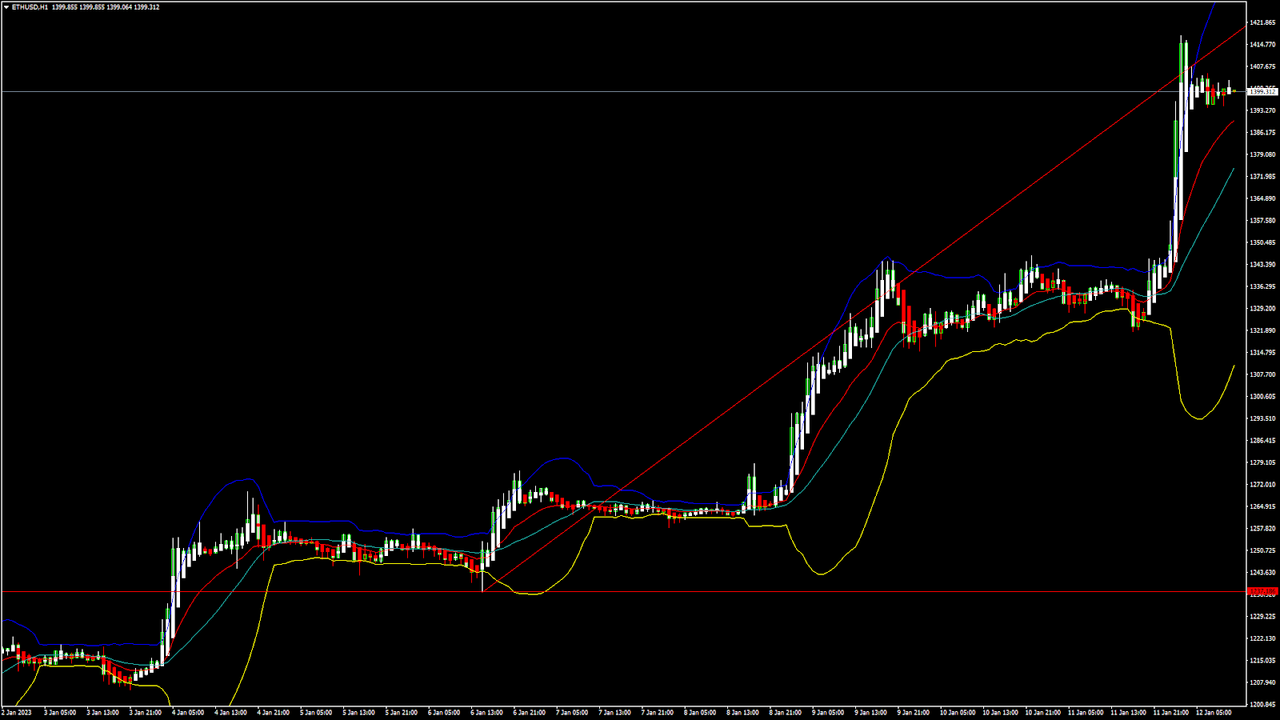

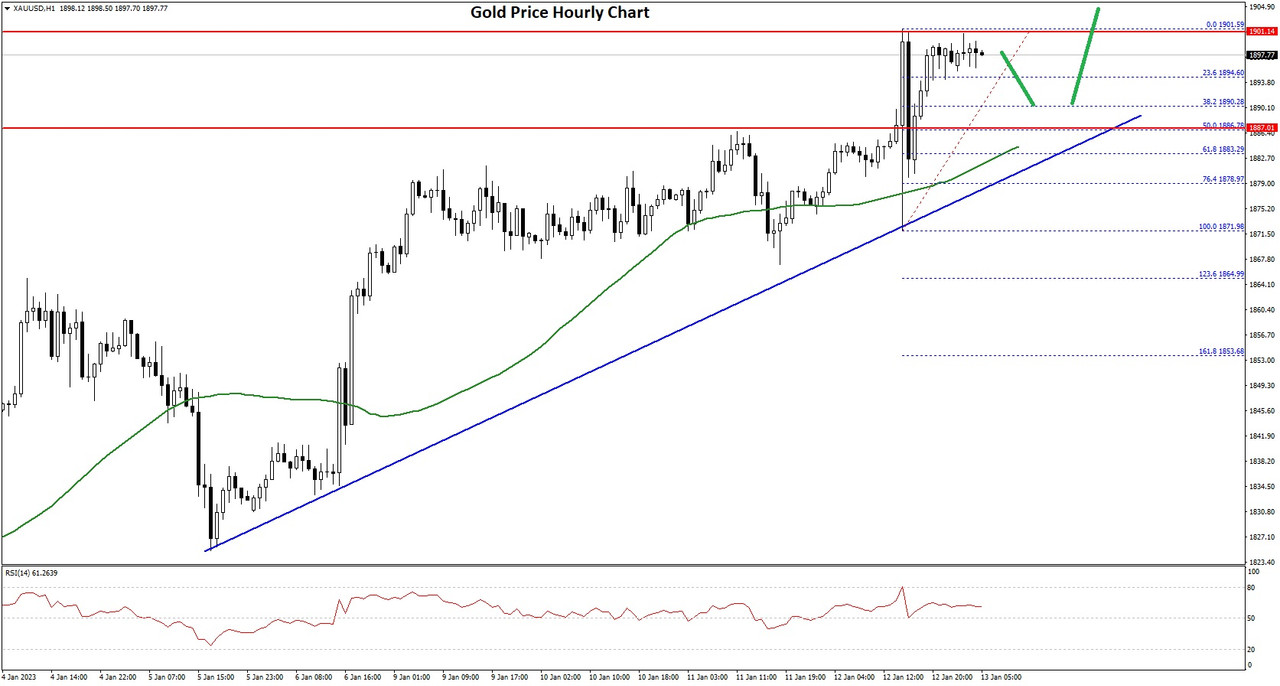

- Gold starts 2023 with strong growth

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks