Monday morning blues as EY forecast worse UK recession than expected

For almost two years, there have been constant looming thoughts that the United Kingdom's economy may face a long, drawn out recession.

During 2021, a time when the interest rates were rising at levels not seen in the past five decades across Europe and North America, there were reports casting a dark shadow over the future of the economy in many Western countries, often stating that it the circumstances at the time may lead to the worst recession in hundreds of years.

Lockdowns which caused low productivity among large companies whilst causing many smaller businesses to go out of business, a global supply chain disruption, and energy price increases which in some cases rocketed by several hundred percent due to geopolitical instability ae some of the reasons which have cast doubt in the minds of many, as costs for individuals and businesses soar whilst double-digit inflation causes earnings to depreciate.

The much-discussed forthcoming recession has not yet arrived, however. Yes, there is a severe cost of living crisis, and belts across Europe and the United Kingdom are very much tightened until their last buckle-hole, but still there is not an actual recession.

This has caused many analysts to consider the possibility that when it comes, it will be severe. Now, global consultancy Ernst & Young (EY) has begun to show its grave concern that a major recession which is worse than predicted, is on the horizon.

Reduced government support, higher taxes and an overall worsening outlook have all led the firm’s analysts to conclude that the next three years could be worse than they anticipated three months ago.

EY's prediction includes a forecast that the United Kingdom's gross domestic product could drop by 0.7% this year, but may increase again in the following years.

A year is a long time, however, and given the market volatility which has taken place over the past two years, looking at a very extensive recession which could last a whole year before any improvement is experienced is a big consideration.

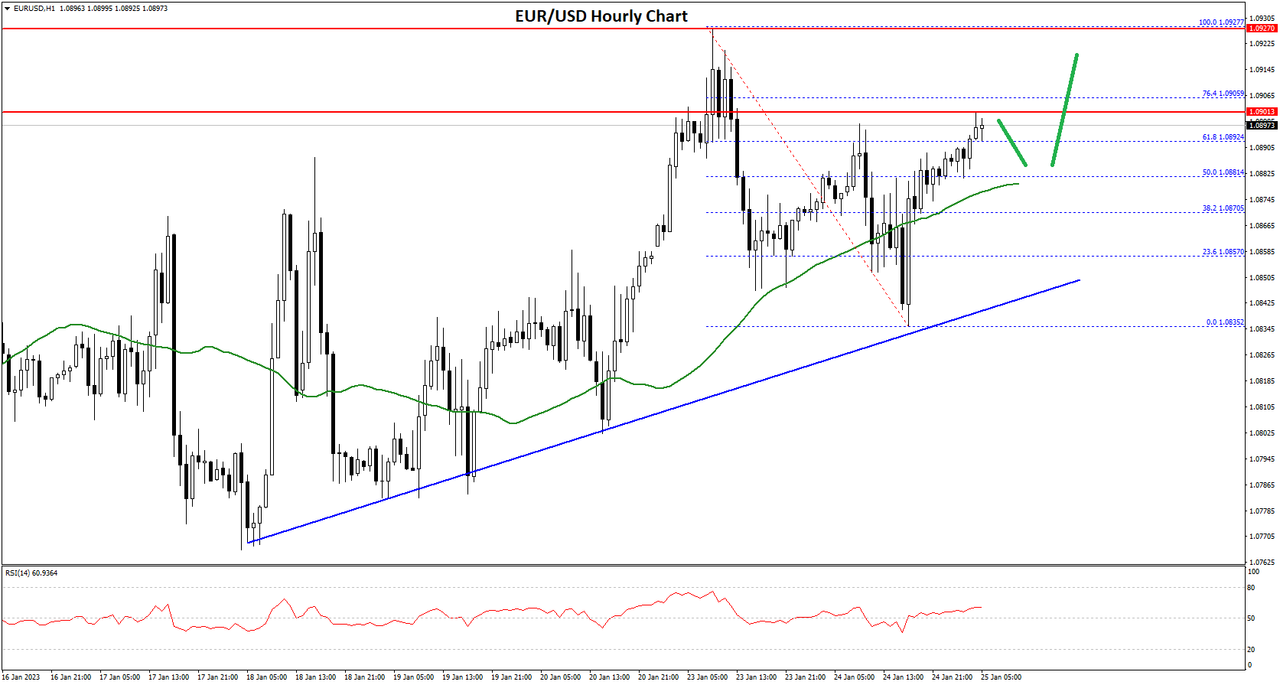

It may be only one report, but EY is a large enough consultancy for the markets to take notice of. This morning the British Pound declined against the Euro and by 8.00am in the London trading session, it was trading in the low 1.14 range, a slight downturn after it rose to almost 1.15 late last week.

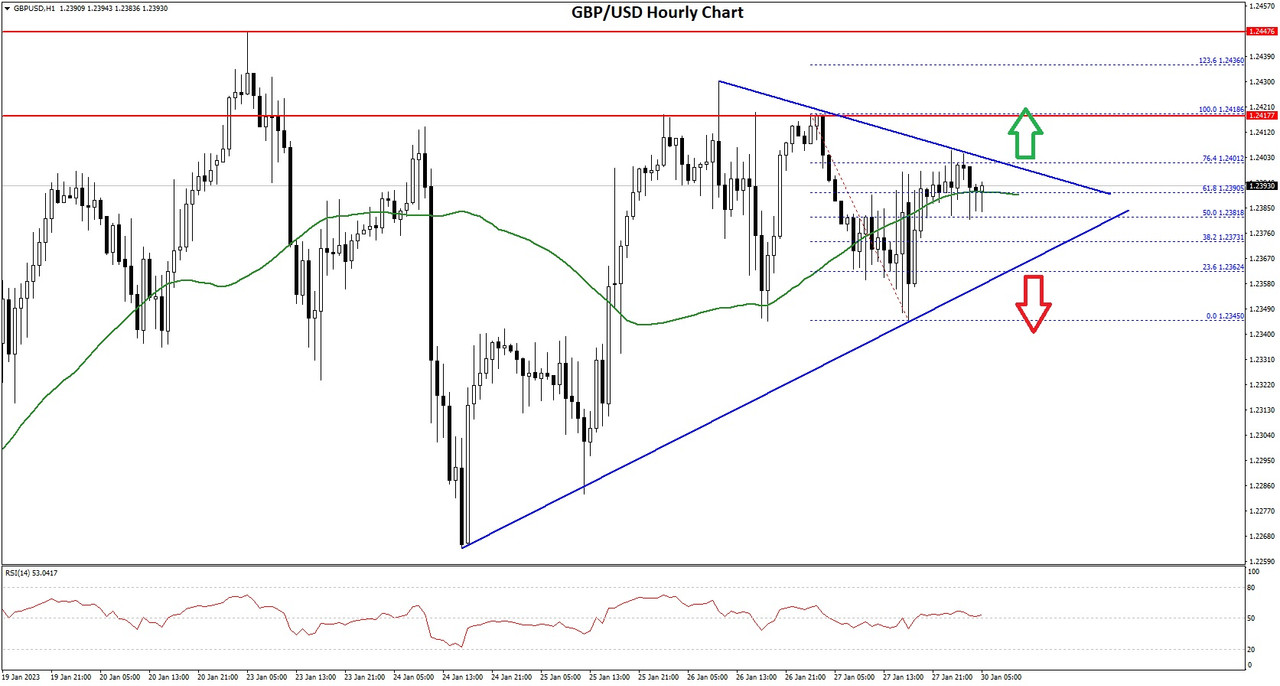

By contrast, the Pound remains stable against the US Dollar, therefore showing robustness despite the gloomy outlook.

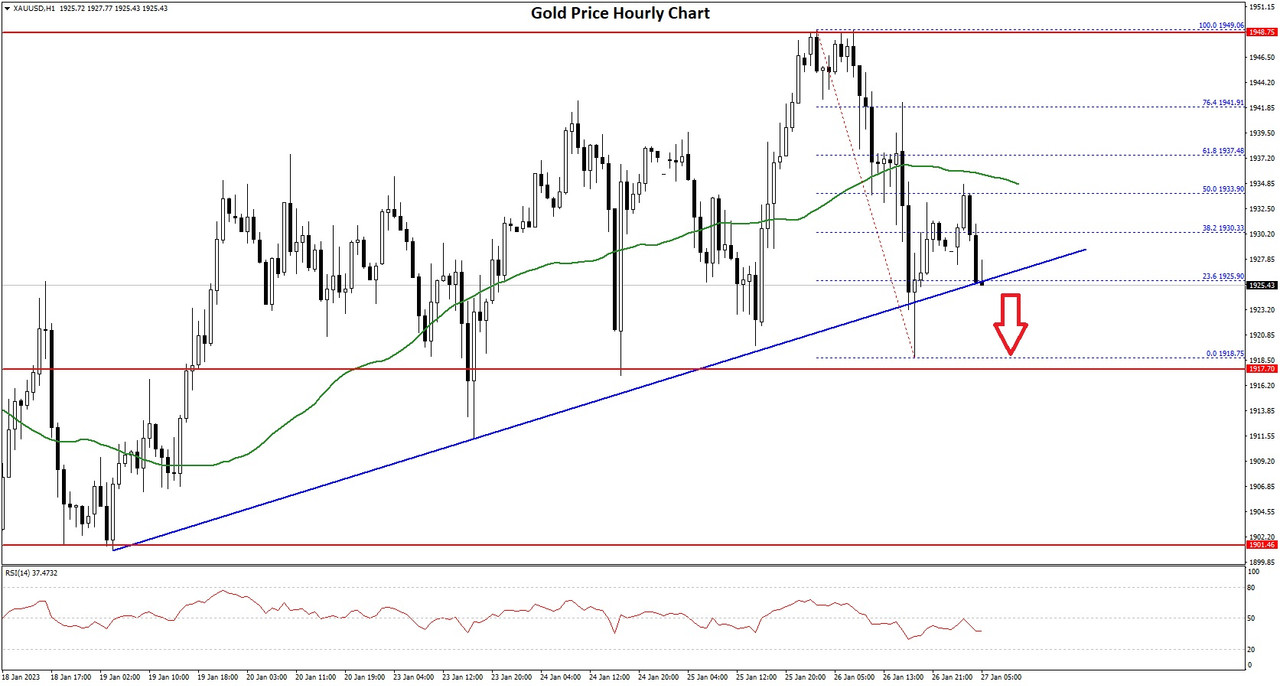

It is worth noting that the FTSE 100 index is booming and has been doing so for a few weeks now, giving rise to the notion that despite the gloomy economic outlook, British blue chip stocks are extremely popular and the traditional companies making up the FTSE 100 index are performing strongly overall, compared to the tech stock carnage that has taken place on the NASDAQ exchange in the United States over the past few weeks.

It appears that whilst the US economy is doing overall better than the British economy, the big money is still sitting in the British low-tech and old school stocks whilst investors turn their back on volatile and depreciating US tech stocks.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks