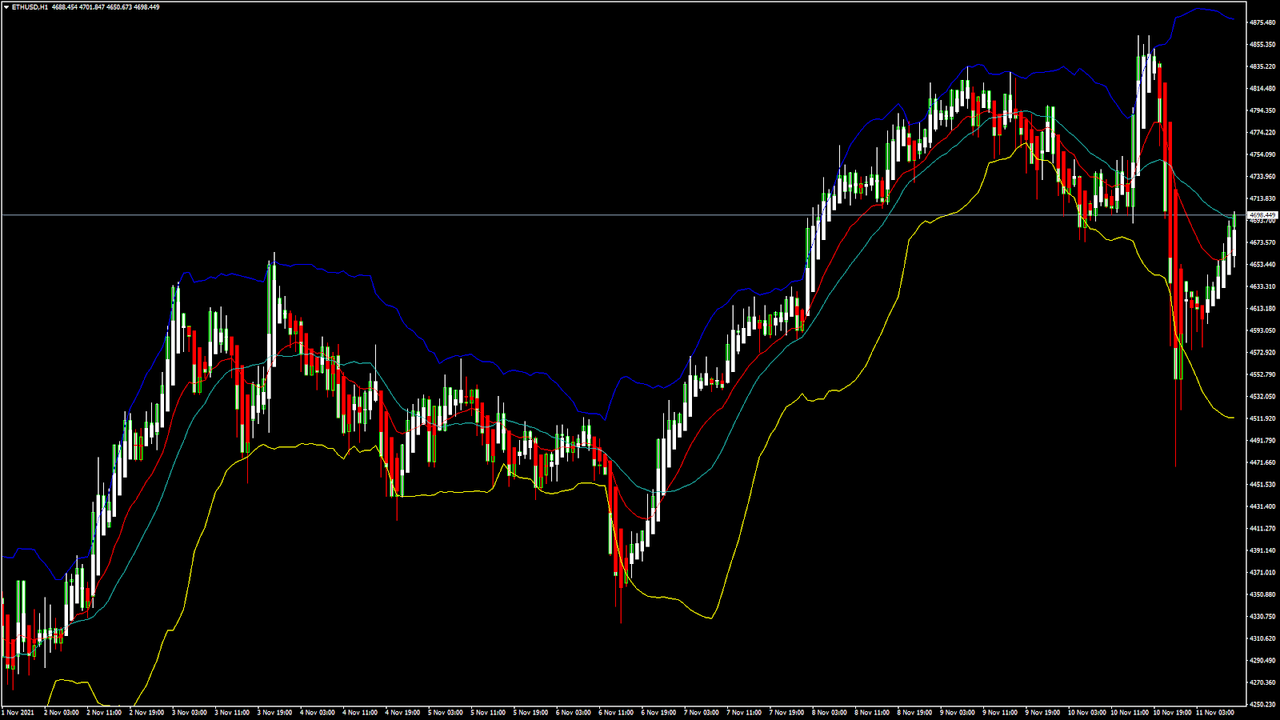

ETHUSD and LTCUSD Technical Analysis – 11th NOV, 2021

ETHUSD: Evening Star Pattern Above $4,500

We observed Ethereum moving in a bearish channel after it touched an all-time high of $4,865, continuing with a sharp drop in profit-taking seen across all the major cryptocurrency exchanges.

The price dynamics of Ethereum has shown an Evening Star pattern above the $4,500 handle, signifying a potential reversal of the bearish trend and the continuation of the medium to long-term bullish trend.

ETHUSD touched an intraday high of $4,847 in yesterday’s US trading session, after which the price saw a downward correction of more than 7%, dropping to an intraday low of $4,471. A consolidation wave towards the level of $4,600 followed next.

ETH is now trading above its classic support level of $4,647 and Fibonacci support level of $4,675. In today’s US trading sessions, it is forming a bearish trend reversal pattern and is about to enter the bullish channel once again.

The bearish correction occurred due to profit taking seen at higher levels, but the dips remain well supported. The price of Ethereum continues to trade above the $4,600 handle in the European trading session.

All the major technical indicators are giving a STRONG BUY signal.

ETH is now trading just above its 200 hourly simple and exponential moving averages.

- Ethereum trend reversal pattern is seen above the level of $4,500

- Mid-term range appears to be bullish for ETHUSD

- Average true range indicates less market volatility

- Relative strength index is NEUTRAL

Ether Bearish Trend Reversal Above $4,500 Confirmed

ETHUSD has been surging in a steep trend line since 20th Jul, 2021 when it was ranging at the level of $1,700, yielding its long-term investors profits on a continuous basis.

The uptrend rally is not yet over, and we are still awaiting for Ether to cross the $5,000 handle, after which more upsides will be seen towards the $5,200 to $5,500 range in the coming months.

At present, the price of Ethereum is in a aub-consolidation phase, forming a bearish trend reversal pattern since yesterday.

The relative strength index is at 45, indicating a NEUTRAL market; we could see a range bound movement in the prices of ETHUSD in the US trading session today.

ETH has lost 0.22% with a price change of -$10.33 in the past 24hrs, and has a trading volume of 23.638 billion USD.

The Week Ahead

We have seen a moving averages crossover in the 5-hour range, which signifies a short-term potential trend reversal. ETHUSD will need to remain above the $4,700 handle for the bullish trend confirmation, and this week, we are looking for levels of $4,800 to $4,950.

StochRSI is OVERBOUGHT which indicates that the prices are going to REVERSE very soon.

The current levels are very attractive for entering into the markets with the target of $5,000.

The price of ETHUSD has already broken its pivot level of $4,674 and Fibonacci resistance level of $4,700. We should see the prices of ETHUSD touching an all-time high again next week, printing at above the $5,000 handle.

Technical Indicators:

Stoch (9,6): at 74.34 indicating a BUY

Average directional change (14-day): at 21.96 indicating a BUY

Ultimate oscillator: at 68.83 indicating a BUY

Commodity channel index (14-day): at 60.54 indicating BUY

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks