GBP/USD and GBP/JPY At Risk of More Downsides

GBP/USD started a fresh decline and traded below the 1.3300 support zone. GBP/JPY is also trading in a bearish zone and is facing hurdles near 150.00.

Important Takeaways for GBP/USD and GBP/JPY

- The British Pound started a fresh decline after it faced sellers near 1.3360 against the US Dollar.

- There is a major bearish trend line forming with resistance near 1.3280 on the hourly chart of GBP/USD.

- GBP/JPY also declined heavily below the 150.00 and 150.00 support levels.

- There is a key bearish trend line forming with resistance near 150.65 on the hourly chart.

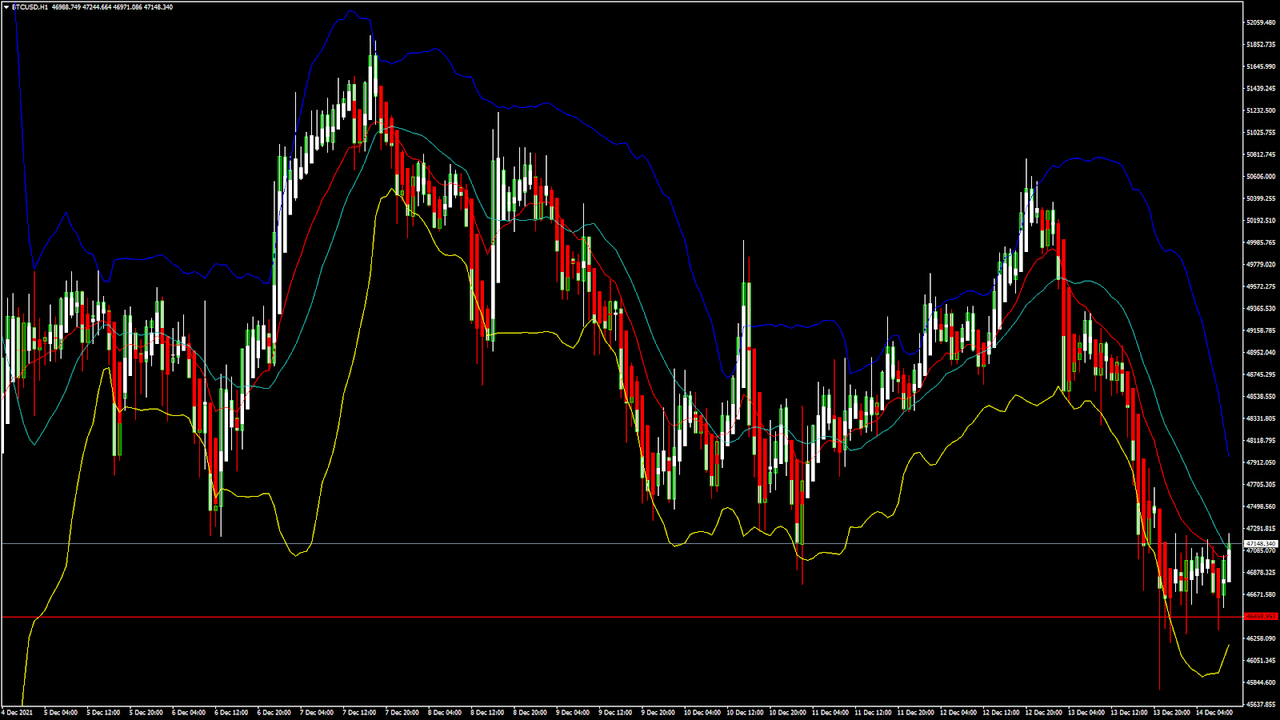

GBP/USD Technical Analysis

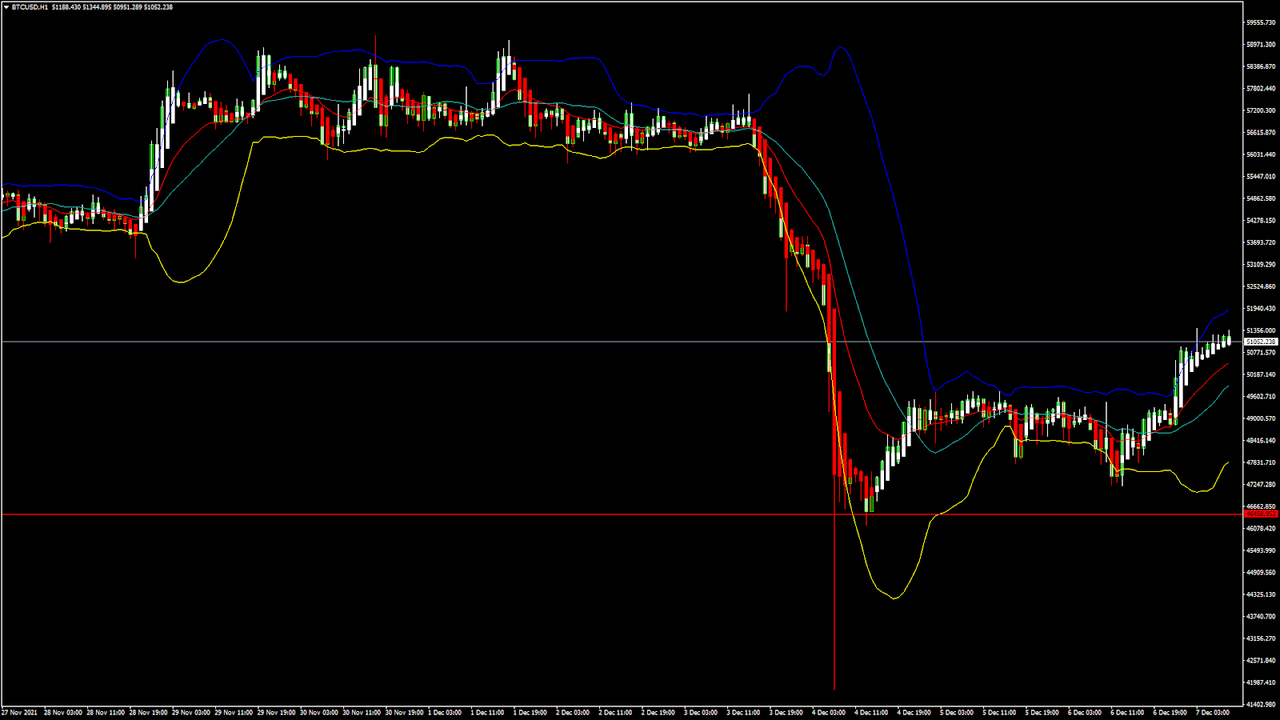

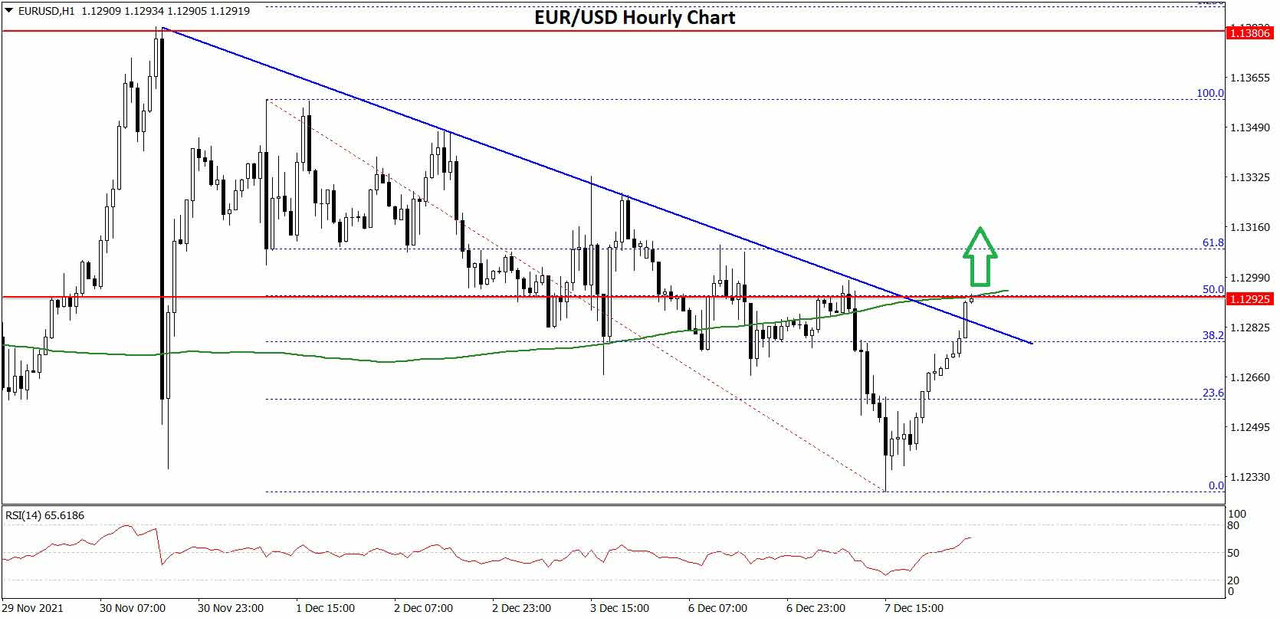

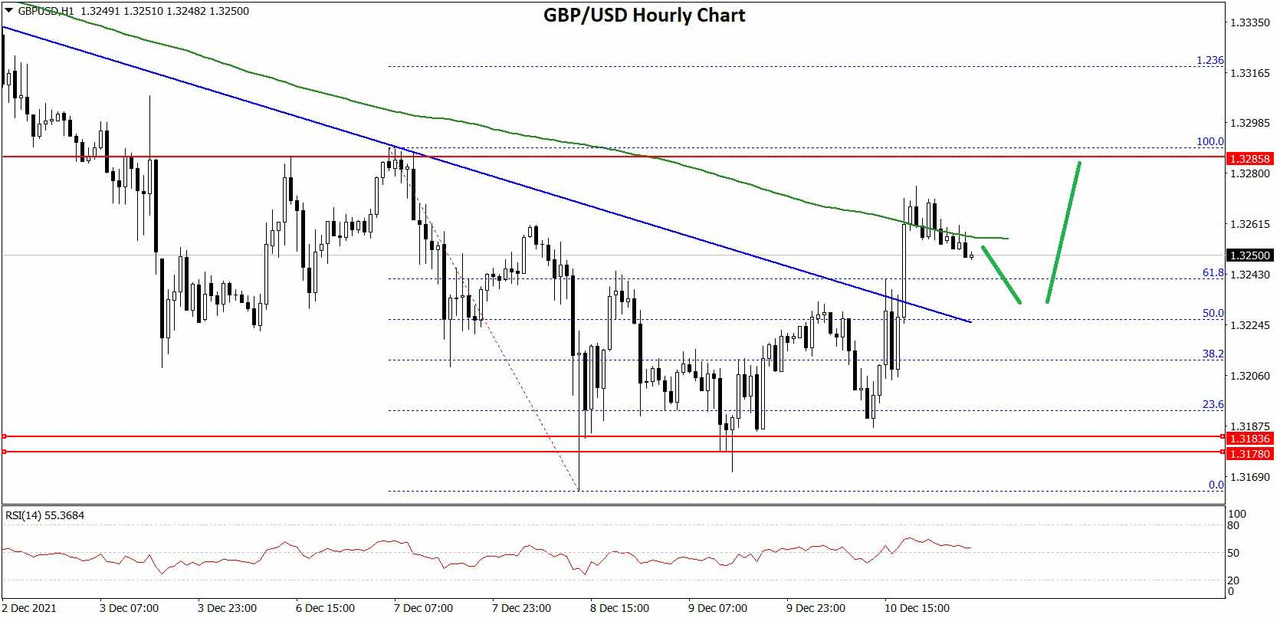

This past week, the British Pound started a fresh decline after it failed near 1.3360 against the US Dollar. The GBP/USD pair broke the 1.3320 and 1.3300 support levels to enter a bearish zone.

There was also a break below the 1.3260 support zone and the 50 hourly simple moving average. It traded as low as 1.3207 on FXOpen and is currently consolidating losses. It recovered a few points above the 1.3230 level.

GBP/USD Hourly Chart

There was a break above the 23.6% Fib retracement level of the recent decline from the 1.3308 swing high to 1.3207 low.

The pair is now facing resistance near the 1.3260 level. It is close to the 50% Fib retracement level of the recent decline from the 1.3308 swing high to 1.3207 low. There is also a major bearish trend line forming with resistance near 1.3280 on the hourly chart of GBP/USD.

A close above the 1.3280 level could open the doors for more gains. The next major hurdle is near 1.3315 and the 50 hourly SMA, above which the pair could surge towards 1.3350.

On the downside, an immediate support is near the 1.3220 level. The next major support is near the 1.3200 level. If there is a break below the 1.3200 support, the pair could test the 1.3150 support. If there are additional losses, the pair could decline towards the 1.3050 level.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

[

[

Bookmarks