The low Turkish Lira and the tourism opportunity

Turkey, a huge nation which is home to over 84 million people, is in an interesting position economically and politically and has been for some time.

The current economic outlook is one of surprising doom, and the focus over the past day by mainstream economists in Western countries has been on the anticipation of a rate cut which has caused the Lira to plunge to a new low, which is quite a significant market event given that it began this month at a very low value.

Yesterday was a particularly interesting session for the Lira, given that it was trading at 14.33 to the dollar at 1:25 p.m. in Istanbul, representing a slight recovery from the record low of 14.99 earlier in the day but still languishing at all time lows.

The mere thought that a commonly-traded currency which is not a major and could be considered to be one of the 'exotics' which is often traded against majors would plunge to a lower value than ever recorded could well prove to be a point of interest among traders and market participants.

Turkey may well be having a fiscal apocalypse in the eyes of its own central bank and policymakers and financial leaders globally, as the nation's own central bank began to intervene directly in the FX market on Monday this week by selling dollars to prop up the lira, but there are two sides to this situation which could lead to some degree of volatility.

Whilst President Recep Tayyip Erdogan has taken a hardline stance against raising interest rates, Turkey's finance minister aligns with the idea as do many global economists which agree would actually aid the currency and go toward stemming the rampant inflation, which is now at approximately 20%.

Thus, the currency is in the doldrums but the wider economy of Turkey has perhaps some degree of potential, as it is one of the only countries within which tourism makes up a vast percentage of the national industry base which is welcoming tourists without many restrictions.

In 2018, Tourism directly accounted for 7.7% of total employment in Turkey, directly employing 2.2 million people and total income from tourism was 3.8% of GDP.

The nation's nominal per capita income - effectively the average salary per person - in Turkey is $9,300 which is considerably short of the national average per capita GDP in Western nations which are home to major currencies, which means that any movement in the all important tourist industry makes all the difference to the outlook within Turkey and therefore could directly affect the value of the Lira

Turkey's government has officially announced just three weeks ago that it will not be implementing any lockdowns going forward, and Turkey remains open to tourists.

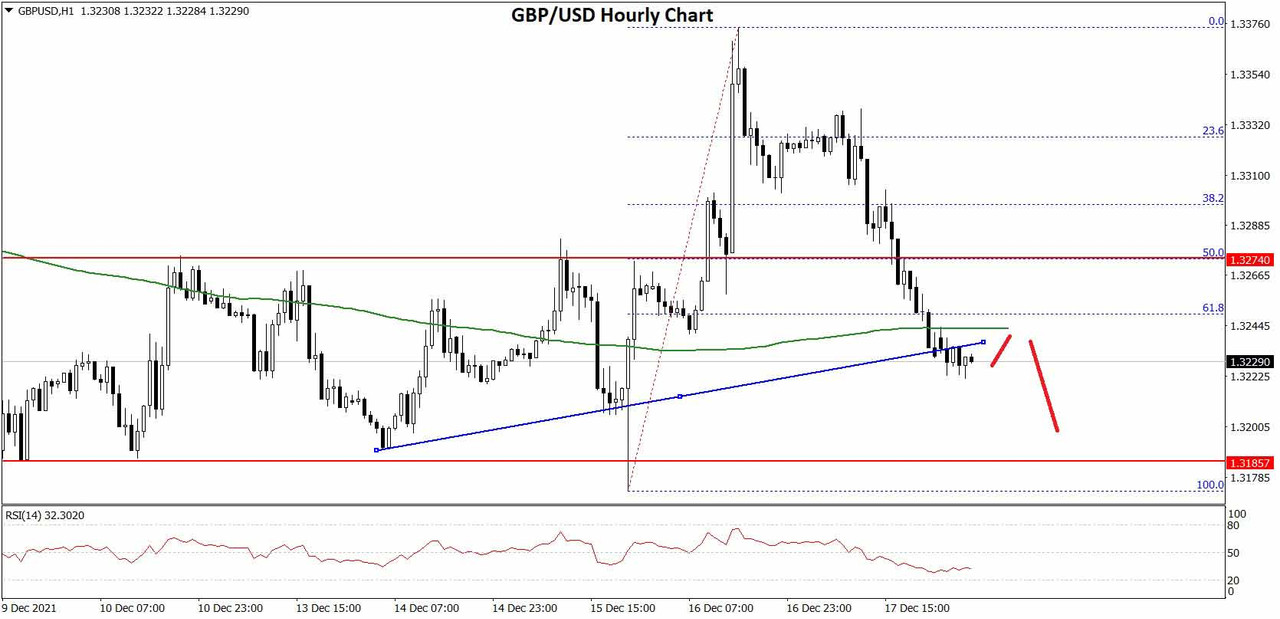

Every year, over one million British tourists flock to Turkey's sun-soaked resorts and with those resorts very much open for business, the possibility of restrictions being implemented across the United Kingdom over the winter period and the low value of the Turkish lira meaning that British travelers get more bang for their buck, it could be that the Turkish economy may get a boost from those looking for an escape from further curtailment of freedoms to a warmer climate for a few weeks with a great exchange rate.

Many residents of Germany visit Turkey each year, some for vacation and others to visit their families and FX transactions between Germany and Turkey put the Euro and the Lira against each other very regularly.

Given Germany's current strict Covid rules, Turkey's low value Lira and open society with little restrictions may appeal.

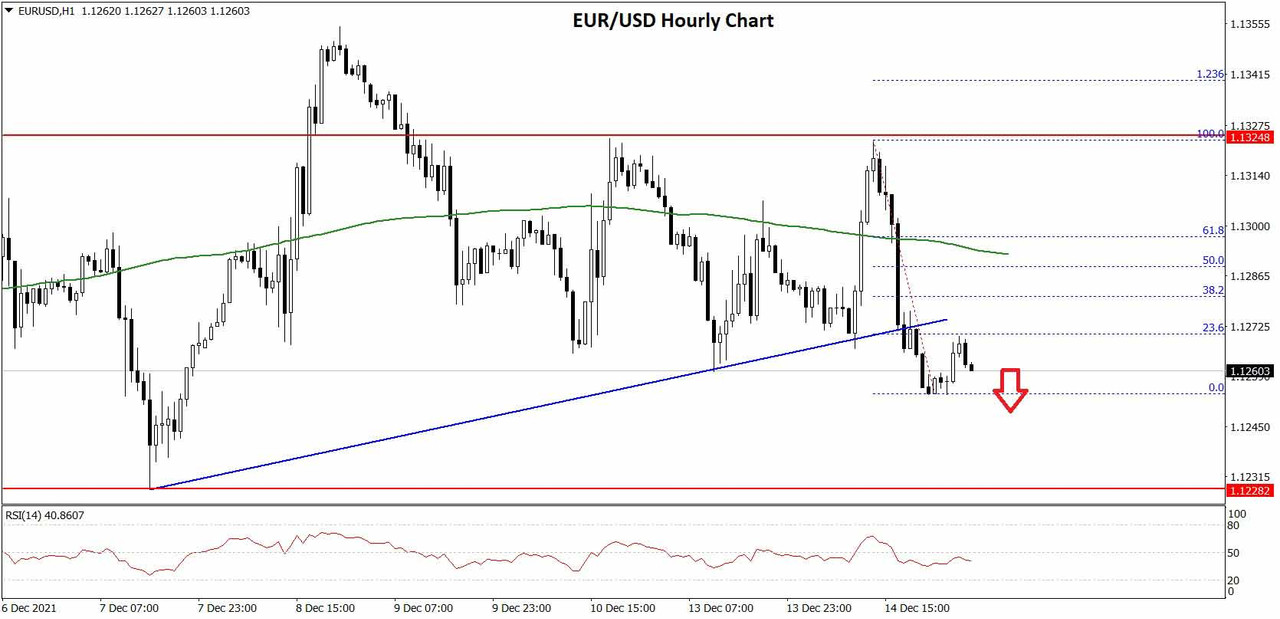

Bearing in mind the internal issues of inflation and a beleaguered economy and the restrictions in Europe which may drive an open-for-business Turkish tourist industry forward, there may be some degree of volatility in the Lira when traded against the Euro or the Pound.

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks