Gold Price and Oil Price Could Extend Gains

Gold price started a fresh increase above the $1,960 resistance. Crude oil price is also rising and might climb further above the $107.

Important Takeaways for Gold and Oil

- Gold price started a fresh increase above $1,930 and $1,950 against the US Dollar.

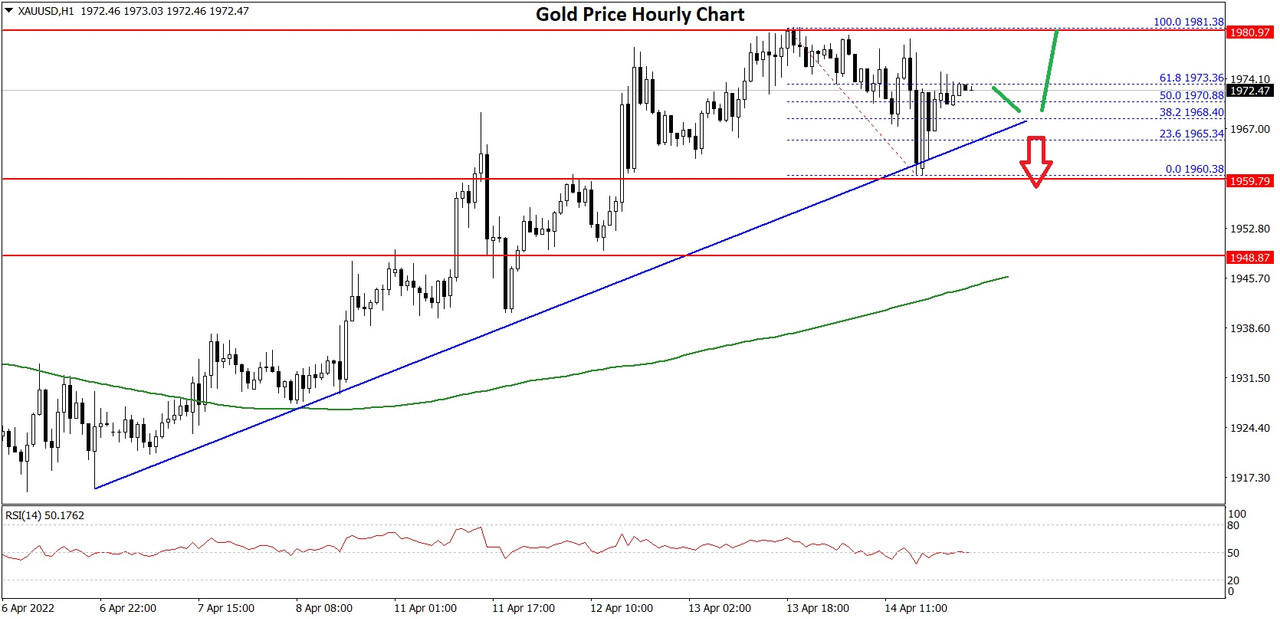

- There is a key bullish trend line forming with support near $1,968 on the hourly chart of gold.

- Crude oil price gained pace after it broke the $100 and $102 resistance levels.

- There is a key bullish trend line forming with support near $103.20 on the hourly chart of XTI/USD.

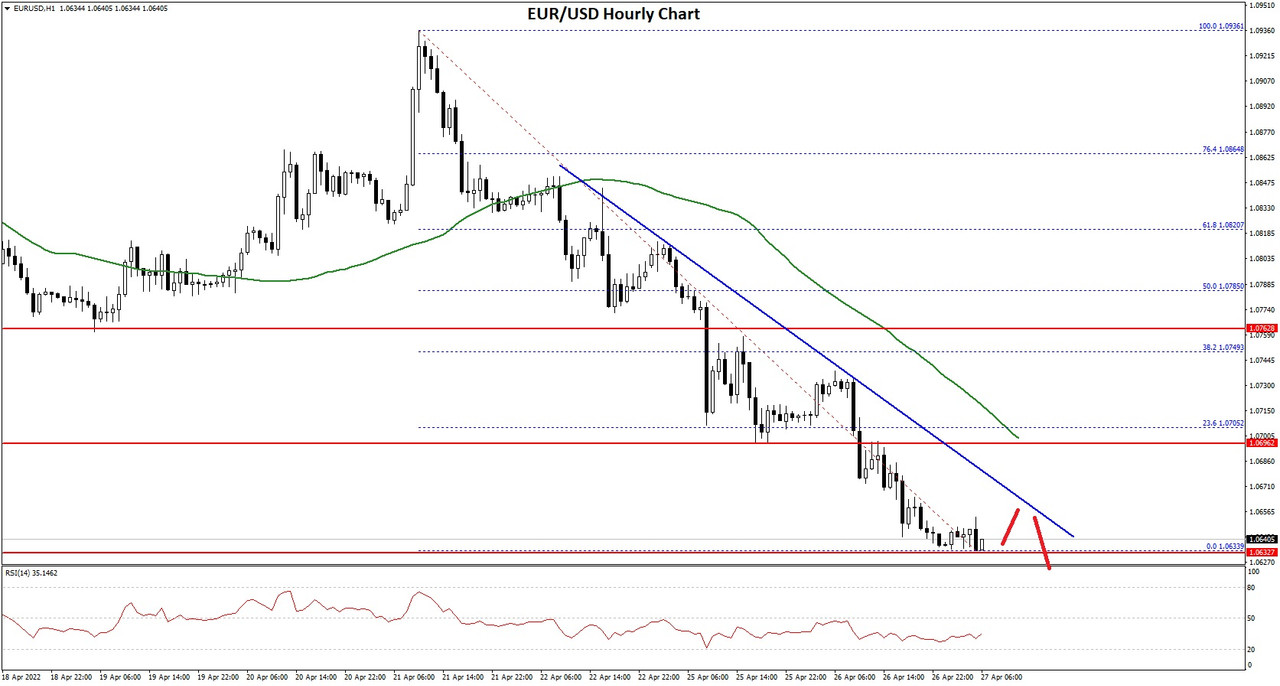

Gold Price Technical Analysis

Gold price formed a support base near $1,910 and started a fresh increase against the US Dollar. The price gained pace for a move above the $1,925 level to move into a positive zone.

There was a clear move above the $1,960 level and the 50 hourly simple moving average. The price even climbed above the $1,975 resistance level. However, it faced resistance near the $1,980 and $1,982 levels.

Gold Price Hourly Chart

A high is formed near $1,981 on FXOpen and the price is now consolidating gains. There was a minor decline below $1,970, but the bulls were active near $1,960.

The price recovered and climbed above the 50% Fib retracement level of the downward move from the $1,981 swing high to $1,960 low. The price is now trading well above $1,960 and the 50 hourly simple moving average.

On the upside, the price is facing resistance near the $1,975 level. The main resistance is now forming near the $1,980 level. A close above the $1,980 level could open the doors for a steady increase towards $1,990. The next major resistance sits near the $2,000 level.

On the downside, an initial support is near the $1,970 level. There is also a key bullish trend line forming with support near $1,968 on the hourly chart of gold.

The next major support is near the $1,960 level, below which there is a risk of a larger decline and the price might even struggle to stay above $1,950.

Daily Market Analysis By FXOpen

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks