BTCUSD and XRPUSD Technical Analysis – 22nd MAR 2022

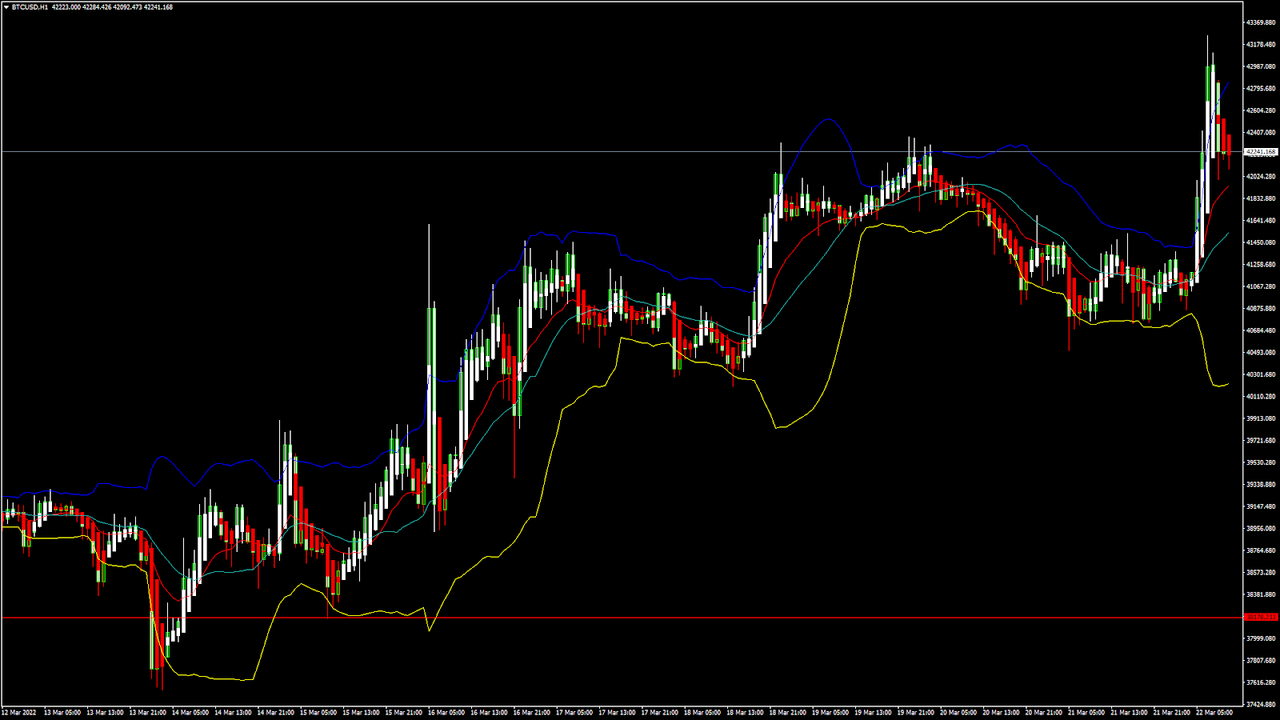

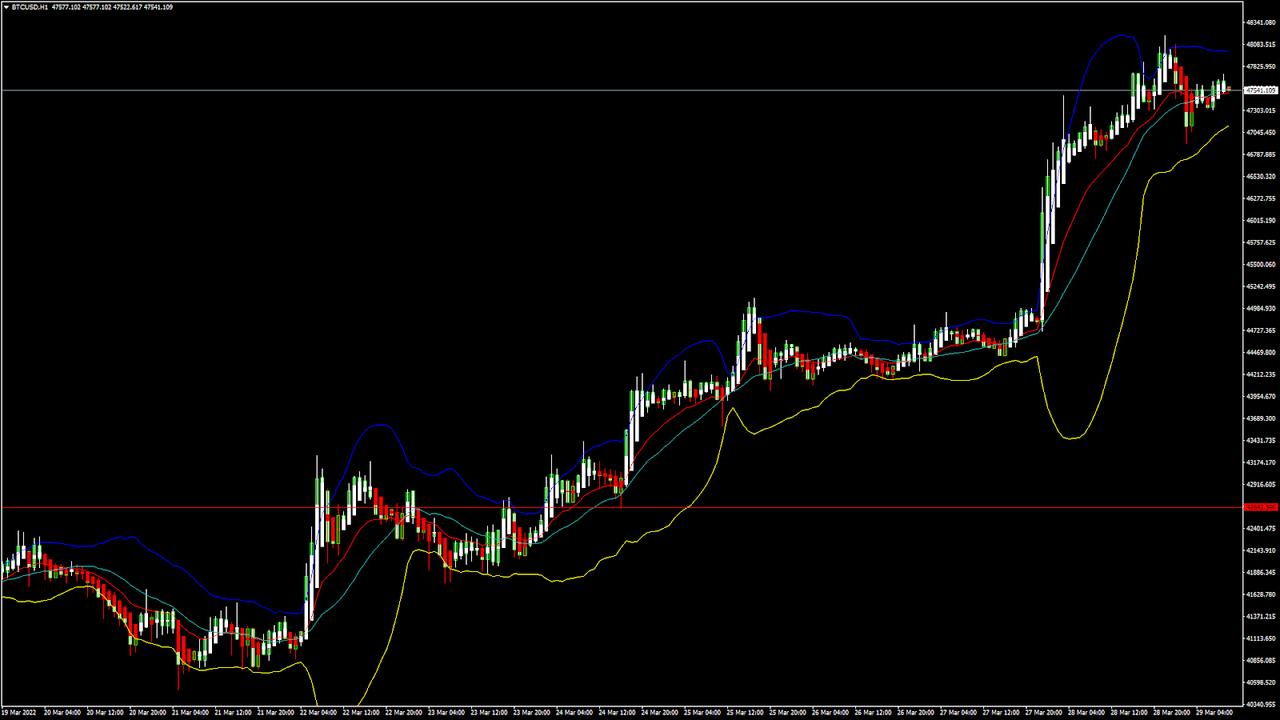

BTCUSD: Bullish Engulfing Pattern Above $38,000

Bitcoin’s bearish phase has ended after touching a low of $37,649 on March 14th. As of now, the price of BTCUSD is moving in a bullish momentum above the $40,000 handle.

A renewed interest in bitcoin is observed as an alternative means of currency in Russia after the global bans imposed against Russian banks. This is one of the reasons why many investors are now buying bitcoin at present market levels.

In today’s European trading session, the propagation of the bullish trend continues with bitcoin trading above $42,000.

We can clearly see a bullish engulfing pattern above the $38,000 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

The Stoch and Williams percent range are indicating an overbought level which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 60 indicating a STRONG demand for bitcoin at the current market levels.

Bitcoin is now moving above its 100 hourly simple moving average and its 200 hourly EMA.

All of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short term we are expecting targets of $43,000 and $45,000.

The average true range is indicating HIGH market volatility with a strong bullish momentum.

- A bullish reversal is seen in bitcoin above $38,000

- The Williams percent range is indicating an OVERBOUGHT level

- The price is now trading just below its pivot level of $42,357

- All of the MAs are giving a STRONG BUY market signal

Bitcoin: Bullish Reversal Seen Above $38,000

Bitcoin continues its strong bullish momentum with an upwards projection towards the level of $43,000 in the European trading session today.

In the immediate term, we are expecting a continuation of this bullish trend with the price of bitcoin ranging between $41,000 and $44,000 as it is due to enter into a consolidation phase.

The surge in the prices of bitcoin can also be explained by the optimism around the widespread usage of bitcoin in international cross border transactions between Russia and its trade partners.

The immediate short-term outlook for bitcoin is strongly bullish; the medium-term outlook is neutral; and the long-term outlook remains neutral under present market conditions.

The price of BTCUSD is now facing its classic resistance level of $42,703 and Fibonacci resistance level of $43,197, after which the path towards $44,000 will get cleared.

We can see that the daily RSI is also printing at 56 which indicates that in the medium-term prices are expected to appreciate further.

In the last 24hrs, BTCUSD has gone UP by 2.45% with a price change of $1,009, and has a 24hr trading volume of 33.989 billion USD. We can see an increase of 53.18% in the trading volume as compared to yesterday, which is due to its increased global demands.

The Week Ahead

The price of bitcoin is due to enter a consolidation phase below $43,000. We can see some range-bound movements in its levels between $41,000 and $44,000.

The on-chain metrics are also indicating a bullish outlook for bitcoin in the short-term range.

In the immediate short term this week, bitcoin’s bullish momentum is expected to continue pushing its levels above the $44,000. Also this week, the price of BTCUSD will need to remain above the important support level of $40,000.

The weekly outlook is projected at $44,000 with a consolidation zone of $42,500.

Technical Indicators:

The relative strength index (14-day): at 56.28 indicating a BUY

The average directional change (14-day): at 20.49 indicating a BUY

The rate of price change: at 9.16 indicating a BUY

The MA convergence divergence (12,26): at 420.80 indicating a BUY

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks