BTCUSD and XRPUSD Technical Analysis – 23rd NOV, 2021

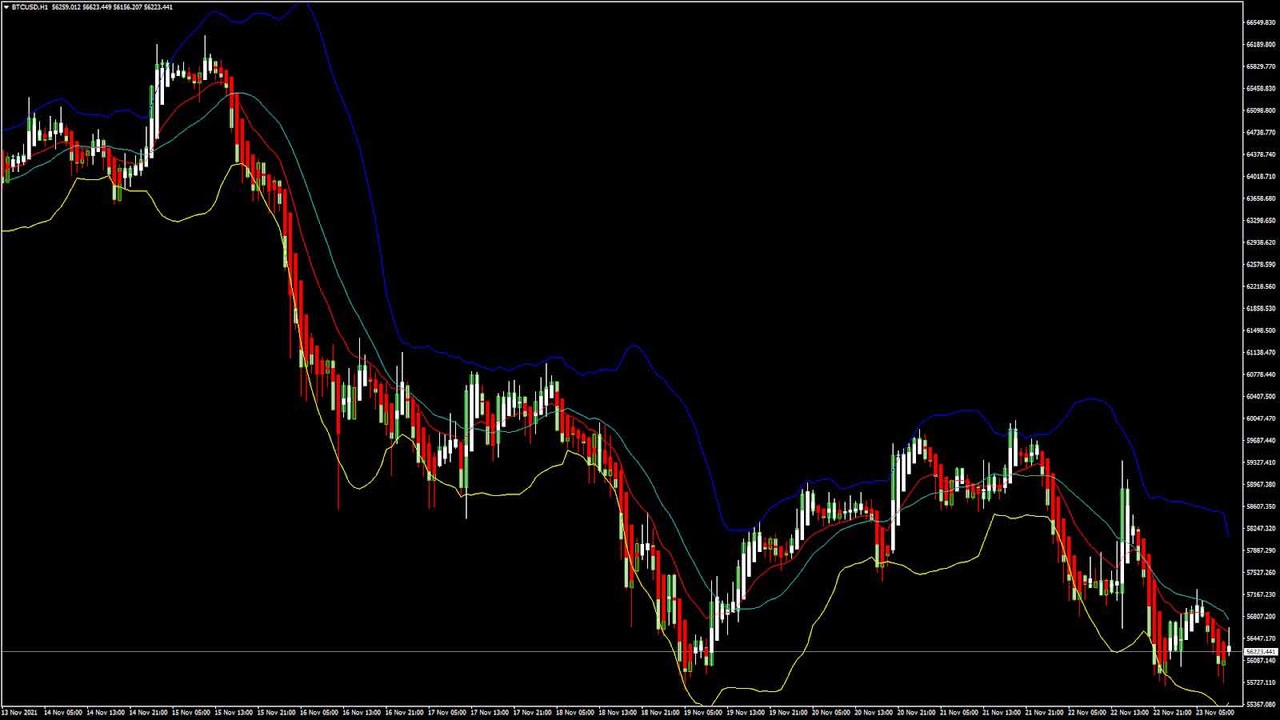

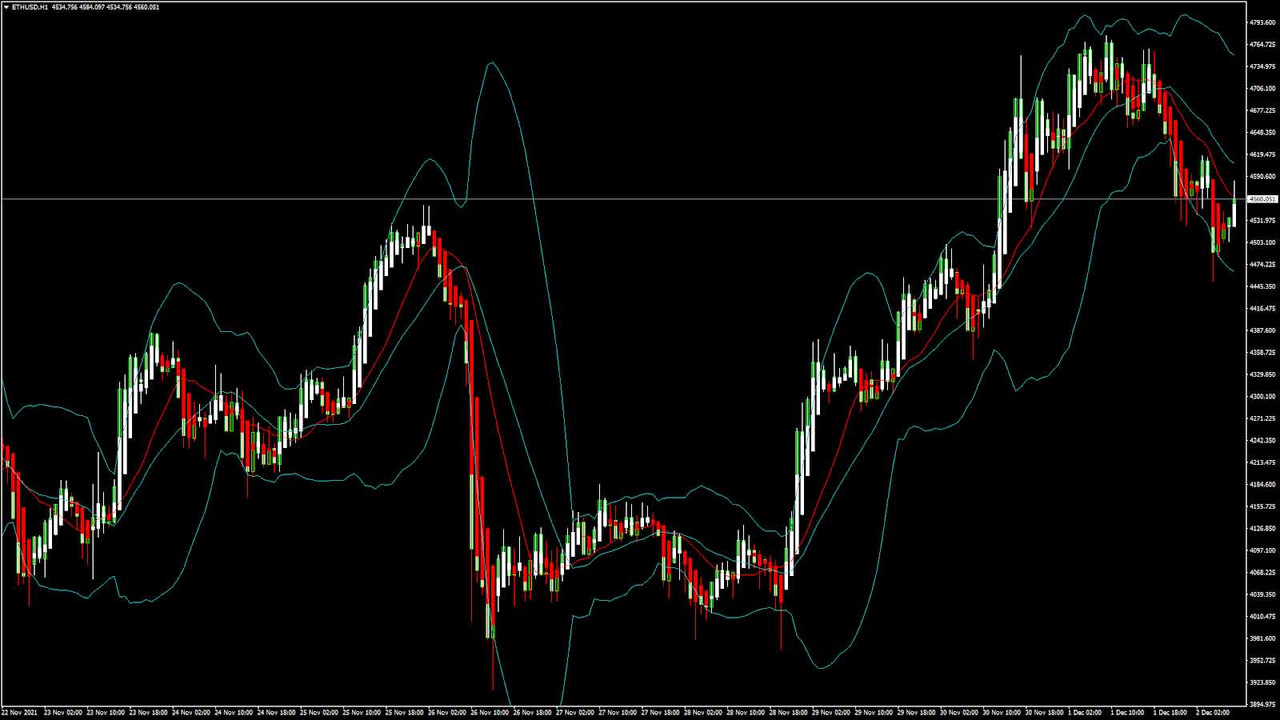

BTCUSD: Head and Shoulders Pattern Below $60,000

Bitcoin is moving in continuation of a strong bearish trend this week, and any attempts towards a bullish reversal failed. This is the reason we see BTCUSD trading below the $60,000 handle in the European trading session today.

We can clearly see a head-and-shoulders pattern below the $60,000 level which signifies that we are in a confirmed downtrend.

Yesterday, we saw yesterday BTCUSD touching an intraday high of $59,965 after which the prices started to decline and touched an intraday low of $55,676, with today’s intraday low of $55,864.

We can see a continuous downwards selling pressure in bitcoin today, and more losses are expected in the coming days.

The immediate short-term outlook for bitcoin turned bearish, and now we are looking at levels of $55,000 and $52,000.

Williams percent range is overbought which signifies that more selling is expected today in the US trading session which will push the prices of BTCUSD below the $55,000 handle.

Bitcoin is now moving below both the 100 hourly simple and exponential moving averages.

The average true range is indicating less market volatility which means that markets are due to enter a consolidation phase soon.

- Bitcoin’s downtrend continues aiming for downsides below $55,000

- Stoch is indicating OVERBOUGHT levels

- The price is now trading just below its pivot level of $56,080

- All moving averages are giving a STRONG SELL signal at current market levels of $56,278

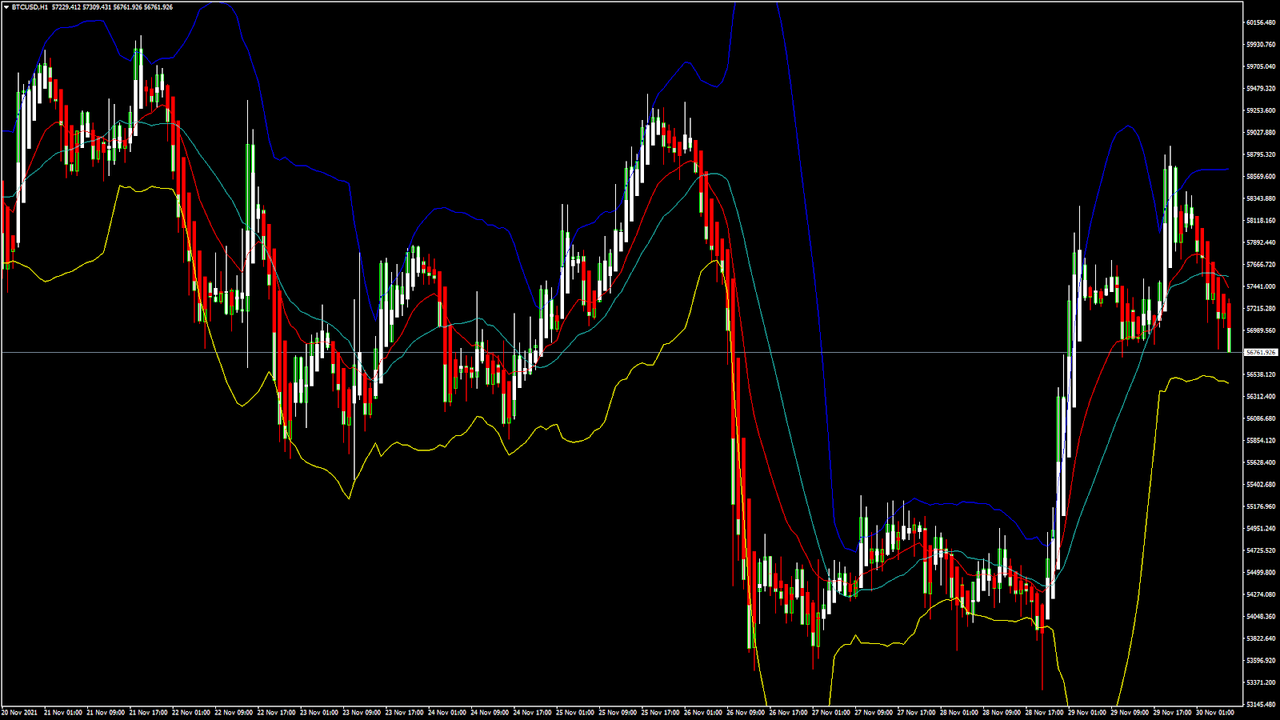

Bitcoin: Strong Bearish Trend Towards $55,000

BTCUSD has already broken its support level of $56,500 and is now about to break its important psychological support level of $55,000.

The price of BTCUSD is trading above its classic support level of $55,242 and Fibonacci support level of $55,874 in the European trading session.

In the last 24hrs, BTCUSD has gone DOWN by -2.21% with a price change of -1271$ and has a 24hr trading volume of USD 35.677 billion.

Bitcoin Bonds

El Salvador has become the first country to issue a $1 billion bitcoin bond with a 10-year maturity on the Liquid Network.

The new bitcoin-linked bond appears to be the highest-yielding fixed income instrument globally. This bond will yield a 6.5% rate of annual interest payments to its investors.

The credit rating for this bitcoin bond is negative due to the distressed-debt situation of El Salvador.

El Salvador adopted bitcoin as legal tender in June 2021, after which Moody's Investors Service downgraded the long-term foreign-currency issuer and senior unsecured ratings to Caa1 from B3.

The Week Ahead

The downward selling pressure seen in Bitcoin is expected to push its prices to the $52,000 range, after which a fresh wave of consolidation and an uptrend move is expected.

The bearish trend formation continues and is expected to push the prices below the level of $54,000 this week. After touching a low of $52,000, a potential bullish trend reversal is expected for which we will have to wait until next week.

The prices will need to remain above the important support level of $52,682 for a bullish reversal of the markets.

Technical Indicators:

Relative strength index (14-day): at 35.28 indicating a SELL

Average directional change (14-day): at 40.639 indicating a SELL

Moving averages convergence divergence (12,26): at -442.90 indicating a SELL

Ultimate oscillator: at 40.127 indicating a SELL

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks