EUR/USD and EUR/JPY: Euro Remains At Risk of More Downsides

EUR/USD started a fresh decline and it settled below 1.1900. EUR/JPY is showing bearish signs and upsides are likely to remain limited above 131.00.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro declined below the 1.1920 and 1.1900 support levels, and tested 1.1800.

- There was a break below a short-term ascending channel with support near 1.1865 on the hourly chart.

- EUR/JPY started a major decline after it failed to stay above the 131.50 support.

- There is a key bearish trend line forming with resistance near 131.80 on the hourly chart.

EUR/USD Technical Analysis

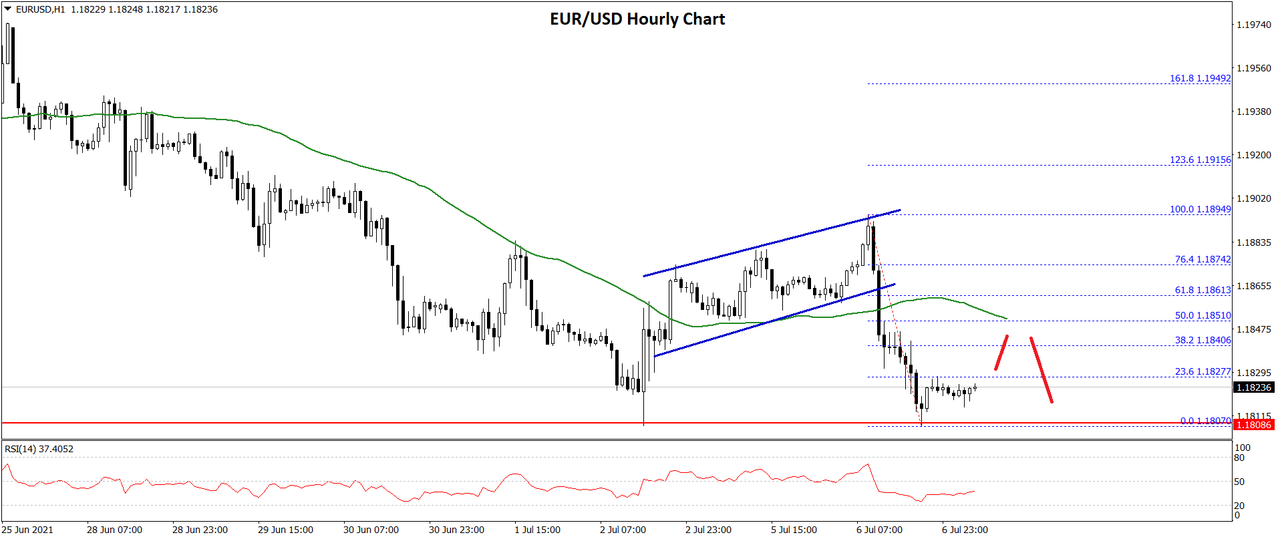

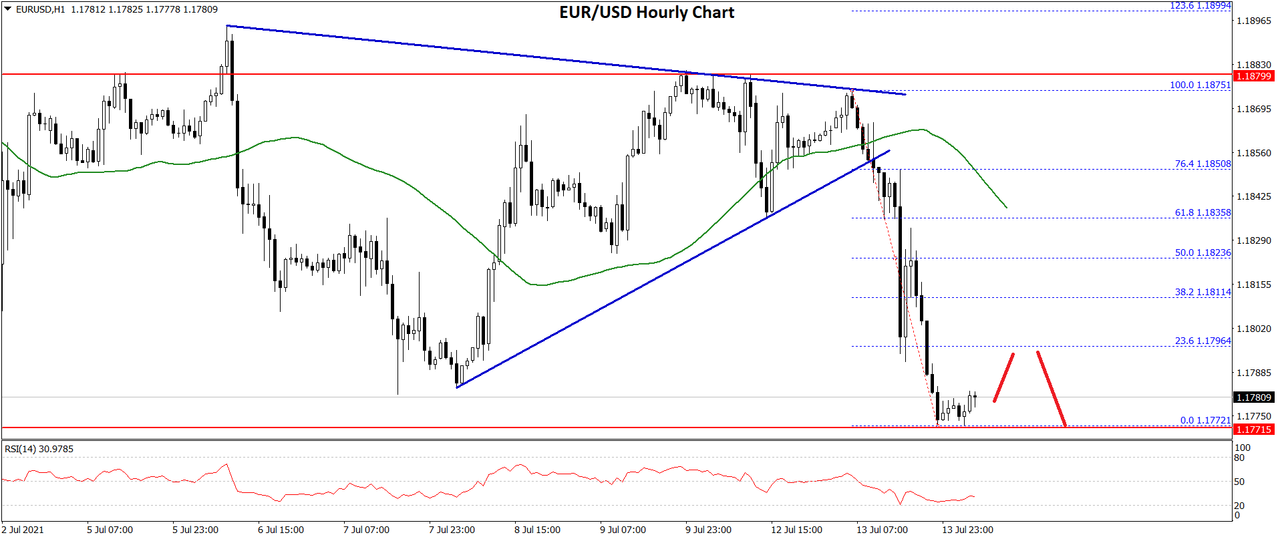

The Euro started a fresh decline from the 1.2000 resistance zone against the US Dollar. The EUR/USD pair broke the 1.1920 and 1.1900 support levels to move into a bearish zone.

The pair even settled well below 1.1900 and the 50 hourly simple moving average. Recently, there was a break below a short-term ascending channel with support near 1.1865 on the hourly chart.

A low was formed near 1.1807 on FXOpen and the pair is now consolidating losses. An immediate resistance is near the 1.1828 level. It is near the 23.6% Fib retracement level of the recent decline from the 1.1894 high to 1.1807 low.

The first major resistance is near the 1.1850 level. It is near the 50% Fib retracement level of the recent decline from the 1.1894 high to 1.1807 low.

Any more gains could set the pace for a move towards the 1.1900 level. The next major resistance is near the 1.1950 level. On the downside, an immediate support is near the 1.1800 level.

If there is a downside break, EUR/USD might continue to move down towards the 1.1760 support. Any more losses could open the doors for a test of the 1.1700 region. An intermediate support could be near the 1.1720 level.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks