Rising Yields Spark Dollar’s Rally

Financial market participants were taken by surprise last week. The US dollar, on a steady decline since April of last year, has pared losses and started to rally.

It gained across the board, trading higher against the euro, the pound, or the Australian dollar. The move higher in the dollar comes against all forecasts at the end of last year. Investment banks across the world forecasted a lower dollar to be the theme for the entire 2021, but that trend lasted only for the first two months of the year.

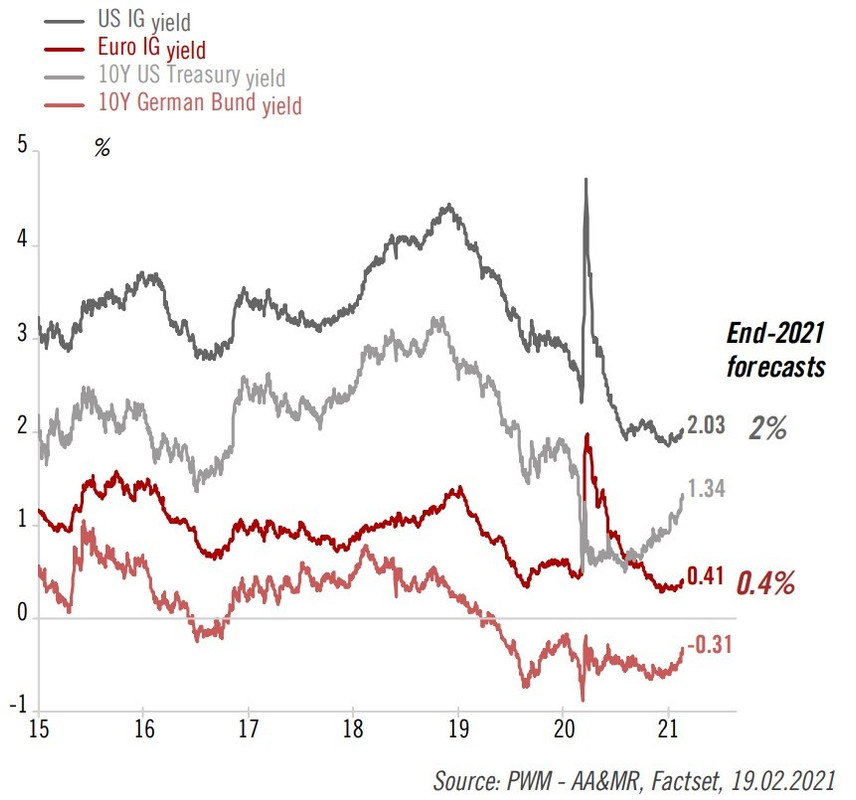

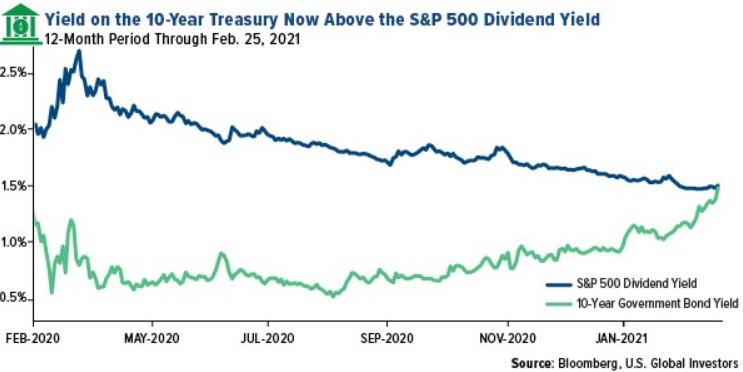

The move higher in the dollar was sparked by a dramatic increase in the US 10y yields. The Treasury yield is already at the end-2021 forecast, with only two months ended in the trading year.

Higher Yields, Higher Dollar

The rising yields pose a threat to the reflation theme and the risk-on environment. Whenever yields are rising, the rise brings an unwanted tightening in financial conditions.

At this point, investors are speculating that the tightening of financial conditions during a pandemic will trigger more action from some central banks. However, the Fed looks trapped due to higher inflation and the Treasury issuance plan. Therefore, the chances are that other central banks, in particular the ECB and the RBA, will likely ease, further fueling the move higher in the dollar.

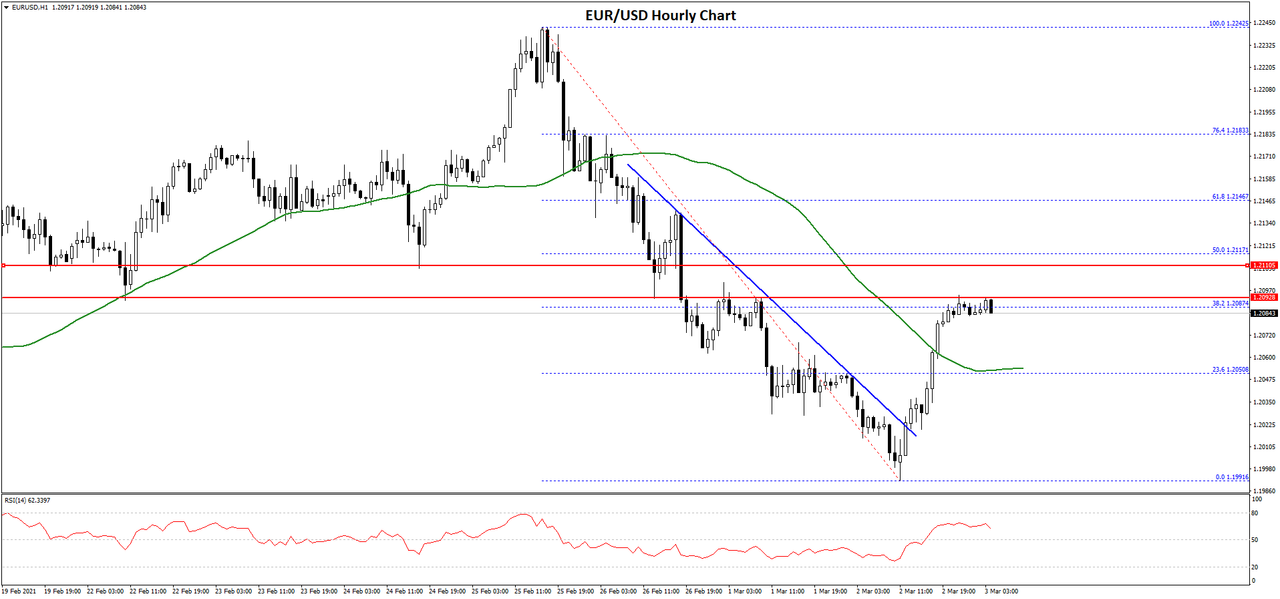

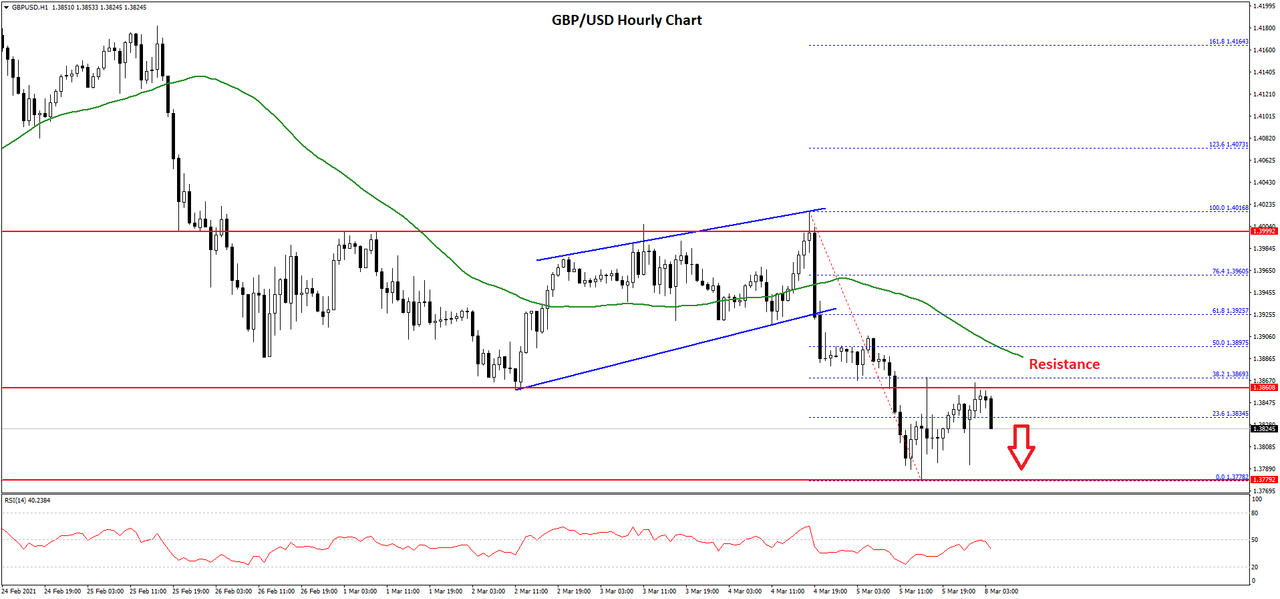

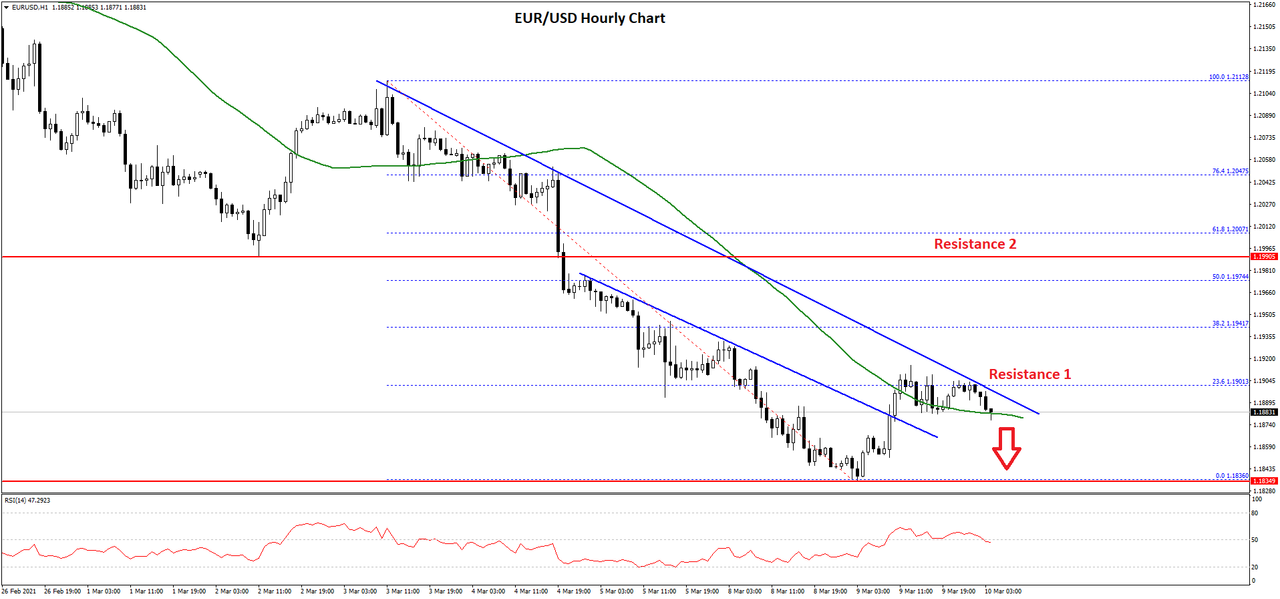

The EURUSD and the AUDUSD pairs lows over two big figures last week, and the trend lower continues. At the time of writing this article, the EURUSD traded close to 1.20, after only last Thursday it was as high as 1.2240. The move lower is almost vertical, and the same is seen on the AUDUSD pair.

In other words, this is a higher dollar move triggered by financial tightening and the risk-on environment changed. Should we see, yields continuing to rise, the dollar’s strength will continue as well.

This is the NFP week, and trading is tricky until the jobs data is released next Friday. However, this time the release may not be so relevant for markets unless the yields give away some of the recent games.

Also, investors will focus on what the RBA will do tomorrow, as well as the signals from the ECB. Any signs of further easing should trigger a new leg lower in the EURUSD and AUDUSD pairs.

FXOpen Blog

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks