EUR/USD and EUR/JPY: Euro Holding Key Supports

EUR/USD declined from the 1.2170 zone, but it is holding the 1.2080 support. EUR/JPY climbed higher towards 128.50 and it is currently correcting gains.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro spiked above the 1.2150 resistance, but it struggled to clear 1.2170.

- There was a break below a connecting bullish trend line with support near 1.2135 on the hourly chart of EUR/USD.

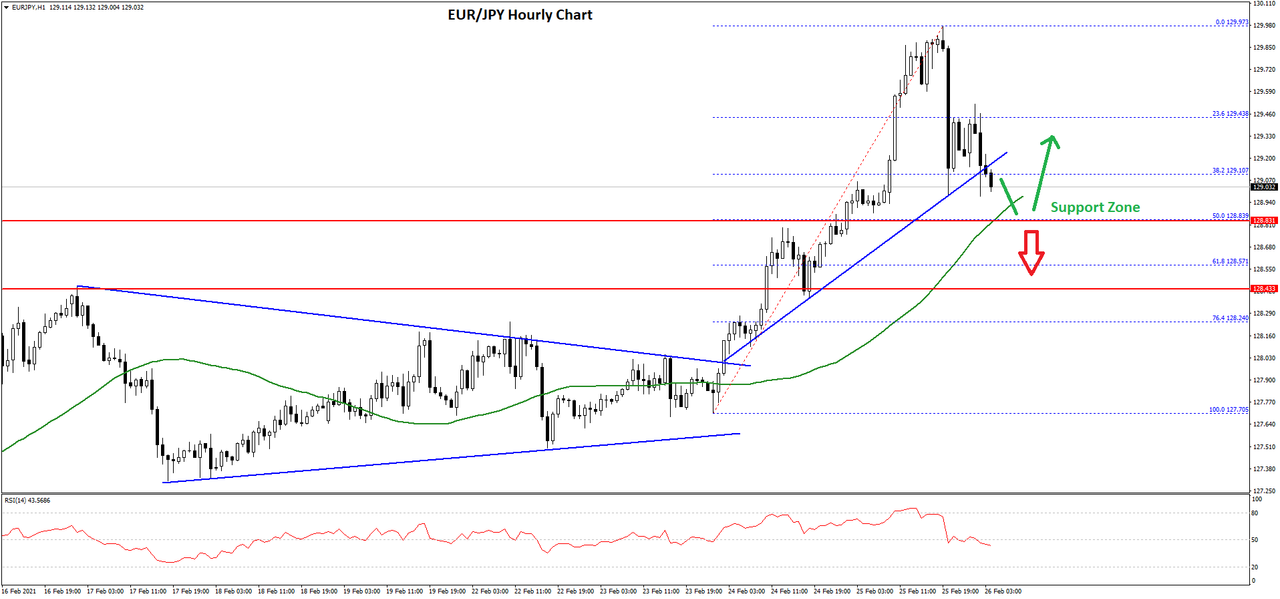

- EUR/JPY started a strong increase above the 126.50 and 127.80 resistance levels.

- There is a major bullish trend line forming with support near 127.70 on the hourly chart.

EUR/USD Technical Analysis

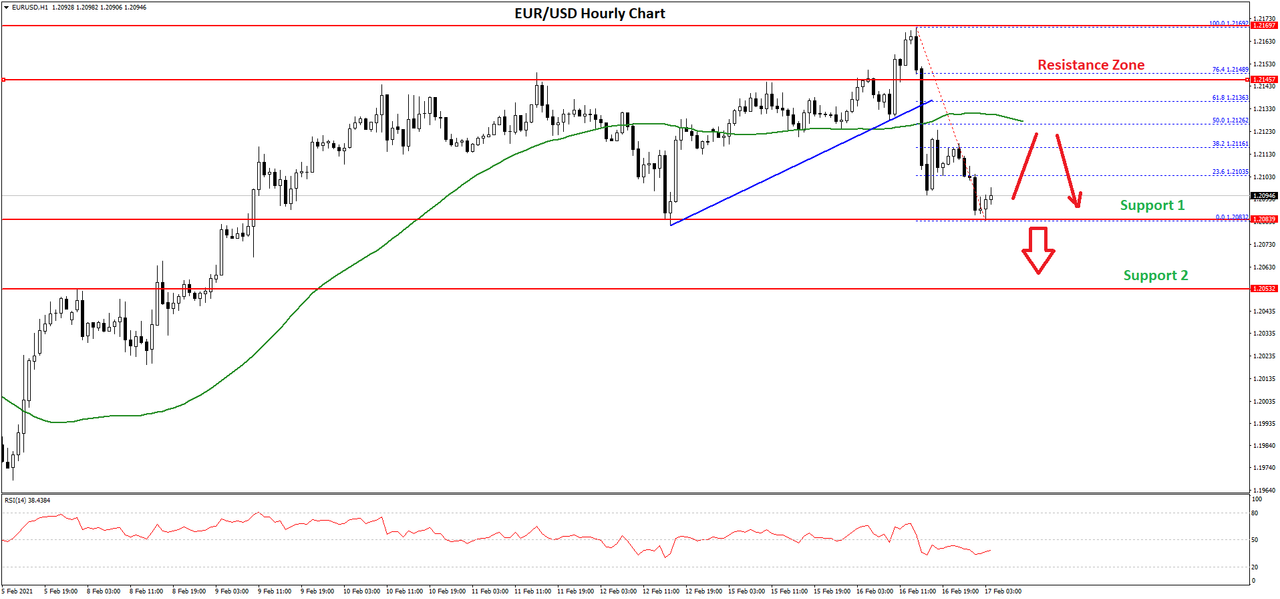

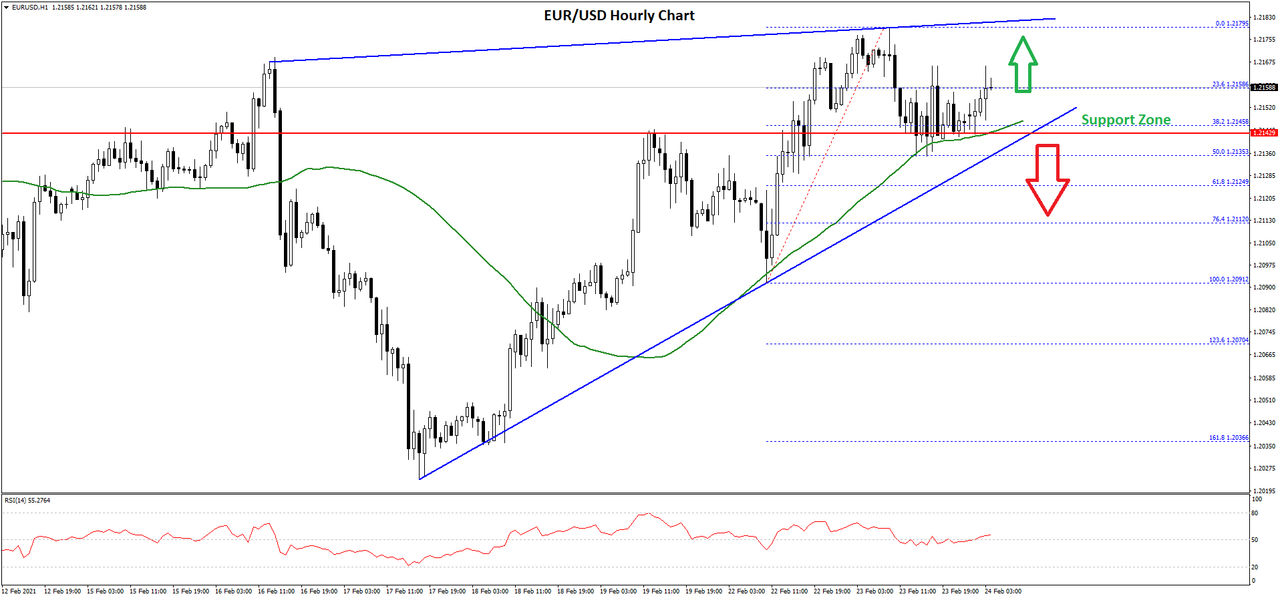

In the past few days, the Euro remained stable above the 1.2050 and 1.2080 support levels against the US Dollar. The EUR/USD pair even made an attempt to gain strength above the 1.2150 resistance level.

The pair spiked above 1.2150 and settled above the 50 hourly simple moving average. However, it failed to continue higher above the 1.2170 level. A high was formed near 1.2169 on FXOpen before the pair started a fresh decline.

There was a break below a connecting bullish trend line with support near 1.2135 on the hourly chart of EUR/USD. The pair even broke the 1.2100 support and the 50 hourly simple moving average.

It found support near the 1.2080 zone and traded as low as 1.2083. It is currently consolidating losses above the 1.2080 support level. An initial resistance is near the 23.6% Fib retracement level of the recent decline from the 1.2169 high to 1.2083 low at 1.2100.

The next major resistance is near the 1.2125 level and the 50 hourly simple moving average. It is close to the 50% Fib retracement level of the recent decline from the 1.2169 high to 1.2083 low. Any more gains could open the doors for a fresh increase above 1.2150.

If EUR/USD fails to recover, it could break the 1.2080 support level. The next major support is near the 1.2050 level, below which the pair could dive towards the 1.2000 support level.

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks