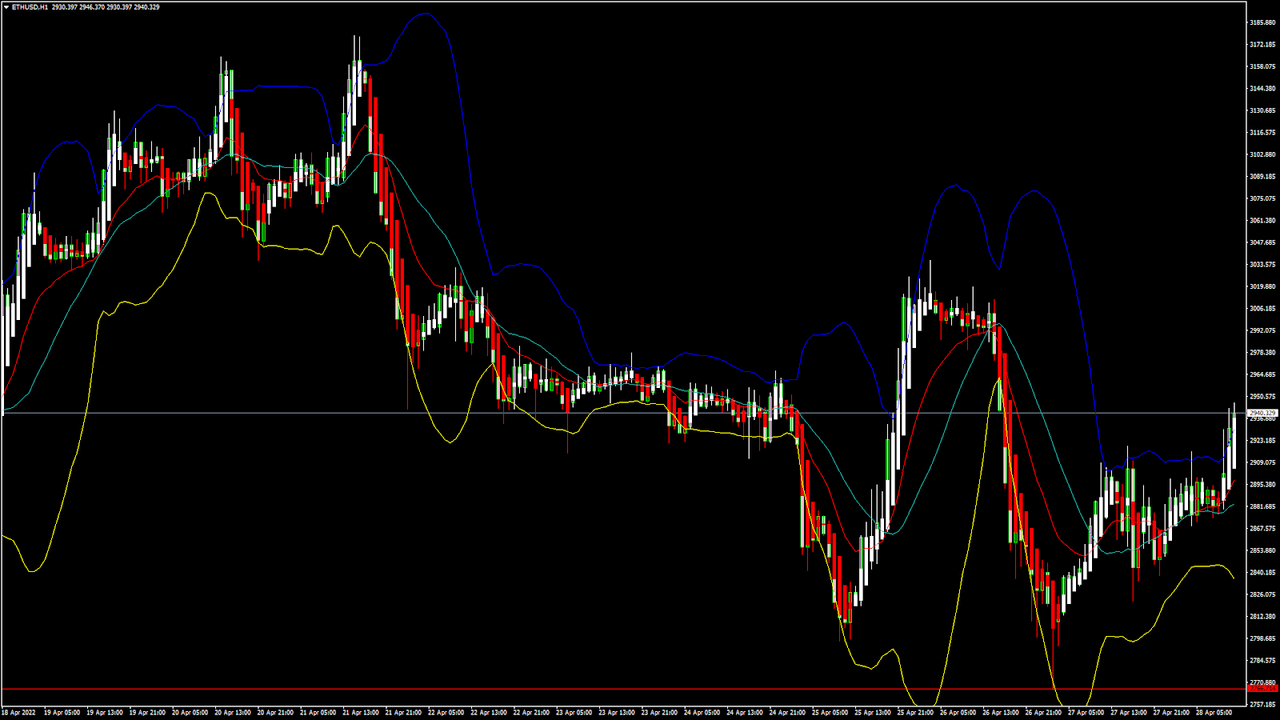

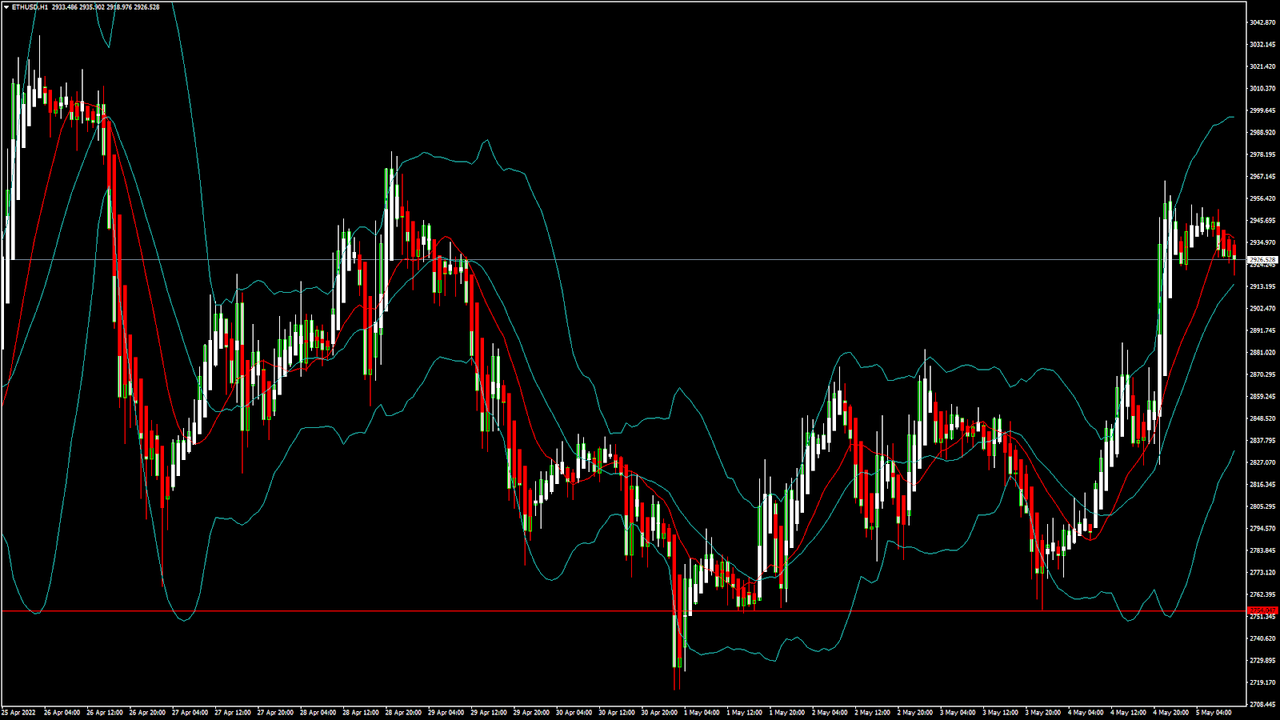

ETHUSD and LTCUSD Technical Analysis – 28th APR, 2022

ETHUSD: Rounding Bottom Pattern Above $2,700

Ethereum was unable to sustain its bullish momentum this week, and after touching a high of $3,036 on April 26th started to decline against the US dollar.

The bearish momentum has pulled down the prices of Ethereum below the $2,800 handle touching a low of $2,766 on April 26th.

The price has entered a consolidation channel above the $2,700 handle; we are in a mildly bullish phase in the European trading session.

We can clearly see a rounding bottom pattern above the $2,700 handle, which is a bullish pattern signifying the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of $2,924 and is moving in a mildly bullish channel. The price of ETHUSD is testing its classic resistance level of $2,948 and Fibonacci resistance level of $2,966, after which the path towards $3,100 will get cleared.

The relative strength index is at 63 indicating a STRONG demand for Ethereum and the continuation of the bullish trend.

Both the StochRSI and Williams percent range are indicating an overbought level which means that the prices are due to decline in the short term.

All of the technical indicators are giving a STRONG BUY market signal.

All of the moving averages are giving a STRONG BUY signal, and we are now looking at the levels of $3,200 to $3,350 in the short-term range.

ETH is now trading above both the 100 hourly and exponential MAs.

- Ether: bullish reversal seen above the $2,700 mark

- Short-term range appears to be mildly BULLISH

- The daily RSI is below 50 at 45, indicating a NEUTRAL market

- The average true range is indicating LESSER market volatility

Ether: Bullish Reversal Seen Above $2,700

ETHUSD is now moving in a mildly bullish channel, with the price trading above the $2,900 handle in the European trading session today.

Ethereum’s demand is increasing, which is leading to a slow rise in its levels, and now we are looking at the immediate targets of $3,000 and $3,150.

ETHUSD is now facing its immediate resistance level of $3,149 and $3,203, after which we will see a linear progression towards $3,300. The key support levels to watch are $2,869 and $2,880, and the price of ETHUSD need to remain above these levels for the continuation of the bullish trend.

ETH has gained 1.88% with a price change of 54.35$ in the past 24hrs, and has a trading volume of 17.239 billion USD.

We can see a decrease of 16.56% in the total trading volume in the last 24 hrs, which appears to be normal.

The Week Ahead

We can see the formation of a bearish harami pattern in the 15-minute timeframe, which indicates a potential short-term reversal in its levels. This is also confirmed by the MA200 crossover pattern located at $2,964 and $2,943.

The transaction fees of Ethereum continue to decline by more than 90% in a period of 6 months. At present, the average transaction fee is about $5.80.

The on-chain metrics are also indicating a bullish scenario for Ethereum in the medium-term range with a projection level of $3,800 to $4,000.

The immediate short-term outlook for Ether has turned mildly BULLISH; the medium-term outlook has turned neutral; the long-term outlook for Ether is NEUTRAL in present market conditions.

This week, Ether is expected to move in a range between $3,000 and $3,200, and next week, Ether is expected to enter a consolidation phase above the level of $3,200.

Technical Indicators:

Stoch (9,6): at 51.80 indicating a NEUTRAL level

The moving averages convergence divergence (12,26): at 9.17 indicating a BUY

The ultimate oscillator: at 56.21 indicating a BUY

Bull/ Bear power (13-day): at 78.86 indicating a BUY

Read Full on FXOpen Company Blog...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks