AUD/USD: Current Dynamics

01/07/2019

As part of the G20 summit held in Osaka last Sunday, US President Trump and Chinese President Xi Jinping agreed to suspend a trade war between these countries. The United States will indefinitely postpone the introduction of duties on Chinese goods worth about $ 300 billion, while China promised to start buying large amounts of agricultural products in the United States.

Investors are inspired by the outcome of the G20 summit in Osaka, which ended last weekend, and global stock indices once again rushed up.

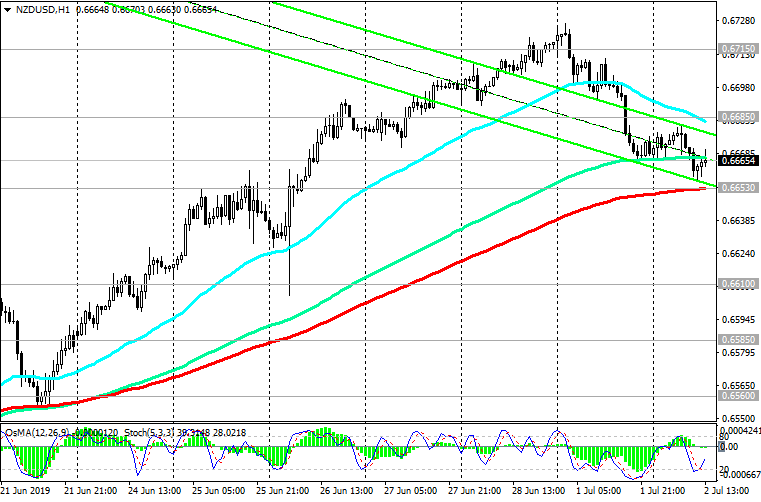

The dollar also rose from the opening of today's trading day, and the AUD / USD pair has dropped sharply, despite the very successful start of the trading day.

According to Caixin, in June, the Purchasing Managers Index (PMI) for the manufacturing sector in China fell to 49.4 from 50.2 in May. The indicator for the first time in four months was below the threshold of 50.0, separating the growth of activity from its decline.

The official PMI for the manufacturing sector of China, published by the National Bureau of Statistics of China on Sunday, remained unchanged in June, reaching 49.4, which is also below the threshold of 50.0.

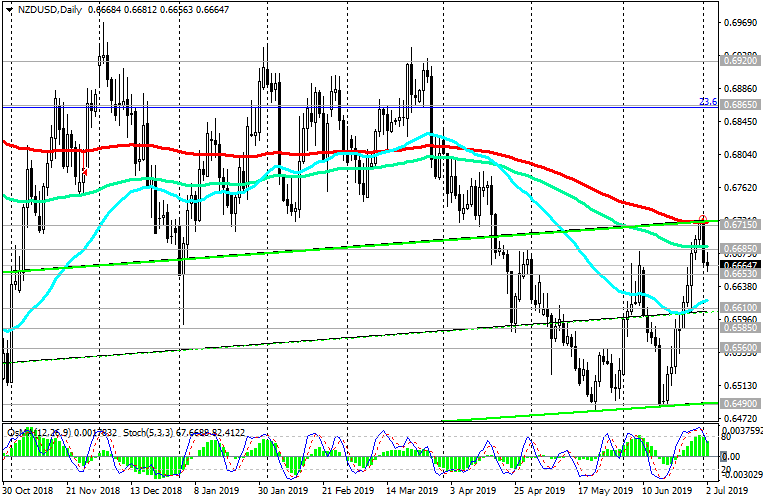

Negative macro statistics from China put pressure on New Zealand and Australian dollars.

On Tuesday, the RB of Australia will decide on the interest rate. Early last month, the Reserve Bank of Australia lowered its key interest rate by 25 bps. to 1.25%, for the first time since August 2016, and its head, Philip Lowe, said that "there is reason to expect a lower key rate".

As expected, on Tuesday, the RBA will again lower its interest rate by 0.25% to 1.00%. This is a strong negative fundamental factor for AUD.

Publication of the RBA decision on rates is scheduled for Tuesday (04:30 GMT), and at 09:30 GMT, the speech of the head of the RBA, Philip Lowe, will begin. A sharp increase in volatility is expected in the AUD / USD.

The different directions of the monetary policies of the RBA and the Fed is a strong fundamental factor for reducing AUD / USD.

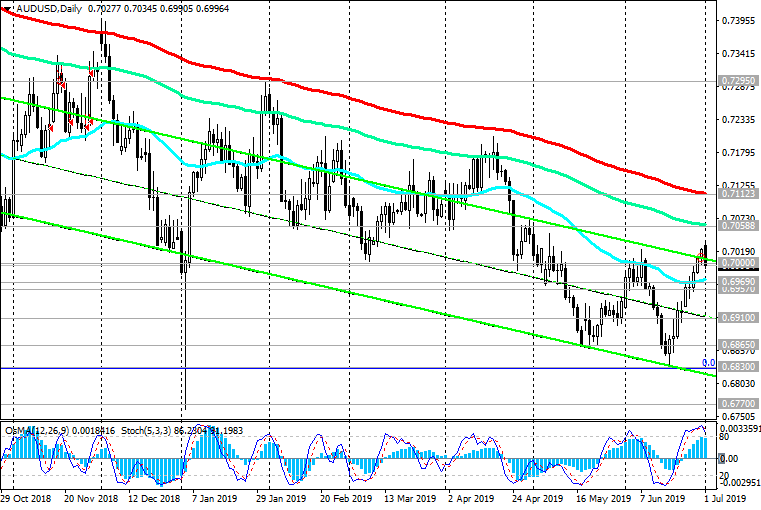

The medium-term goal of the decline is located at around 0.6770 (2019 lows). Below the key resistance levels of 0.7060 (EMA144 on the daily chart), 0.7110 (EMA200 on the daily chart) short positions remain preferable.

Support Levels: 0.6969, 0.6957, 0.6910, 0.6865, 0.6830, 0.6800, 0.6770

Resistance Levels: 0.7000, 0.7060, 0.7110

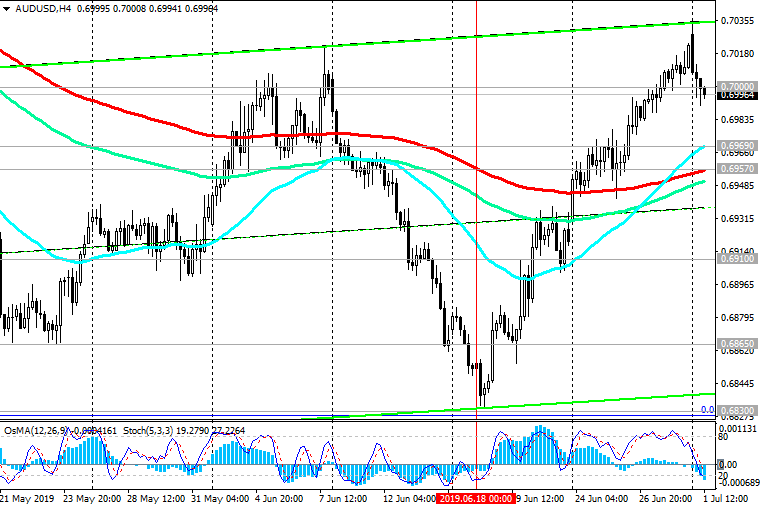

Trading Recommendations

Sell in the market. Stop Loss 0.7040. Take-Profit 0.6969, 0.6957, 0.6910, 0.6865, 0.6830, 0.6800, 0.6770

Buy Stop 0.7040. Stop Loss 0.6990. Take-Profit 0.7060, 0.7110

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks