S&P500: Current dynamics before the Fed meeting

07/29/2019

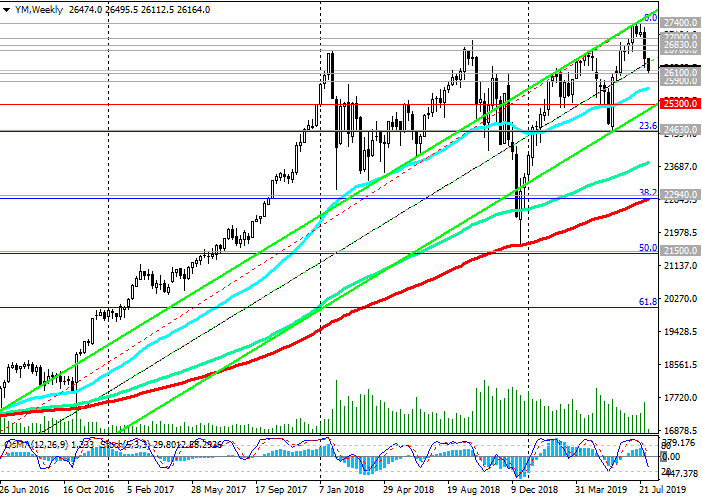

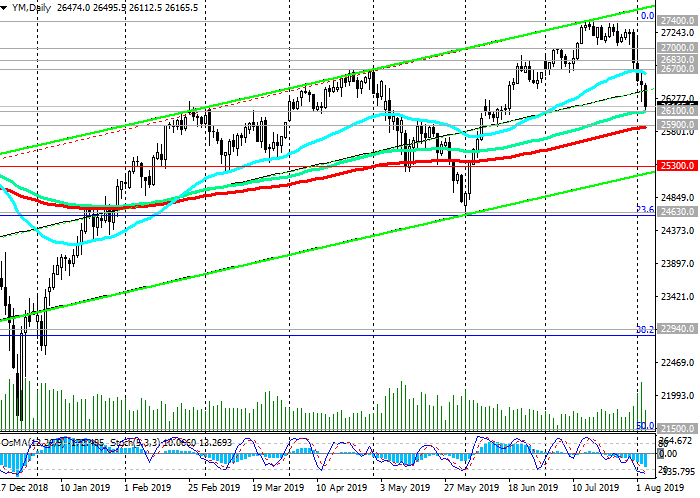

Expectations of easing of the monetary policy of the Fed and positive macro statistics coming from the United States are pushing major US stock indexes to new heights.

Last week, the S&P500 index updated its record high near the 3028.0 mark after the US Department of Commerce released a report, according to which GDP grew in the 2nd by +2.1% (annualized) after +3.1% in the 1st quarter, with a forecast of +2.0%. At the same time, consumer spending, which accounts for more than two-thirds of the US economy, in the 2nd quarter grew at the highest rate since the end of 2017, reaching +4.3%.

Trump again lashed out at the Fed after the publication of GDP data, calling the US central bank "a burden hanging on our neck", although GDP growth, in his opinion, was "not bad, given" the Fed's policy.

At the same time, the GDP report did not affect expectations that the Federal Reserve will lower its key interest rate by 0.25 percentage points at the meeting July 30 - 31, given the continuing risks of a downturn in the global economy and the need to achieve the target inflation rate.

Interest for investors will be the accompanying statements by the Fed leadership and a press conference following a meeting of the central bank. If Jerome Powell signals a propensity to lower the rate in September or before the end of the year, in this case, US stock indexes will accelerate their growth.

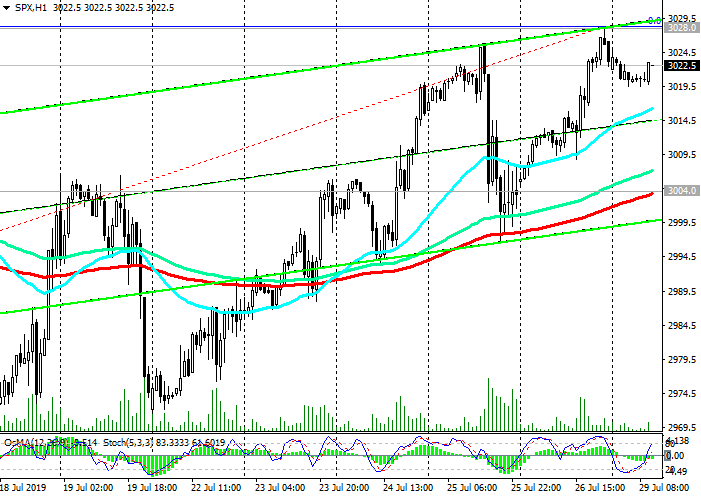

Since the opening of today's trading day, the S&P500 is trading in a narrow range near the 3020.0 mark.

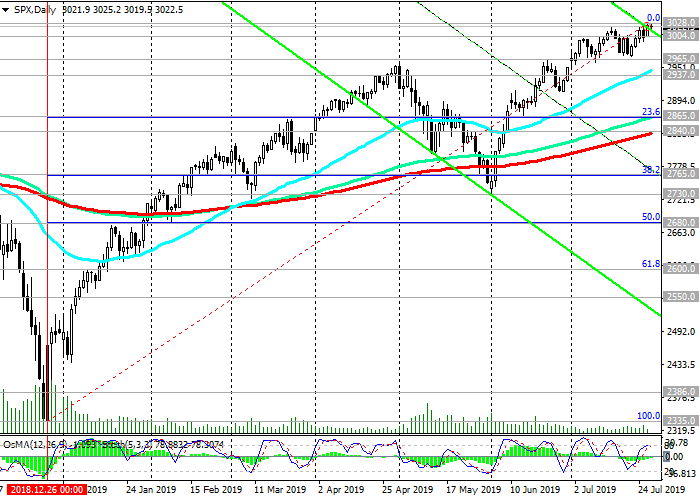

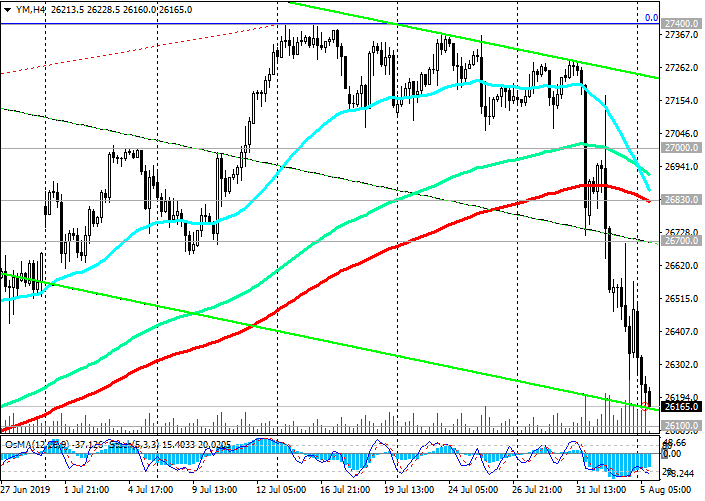

Above support levels 2840.0 (ЕМА200 on the daily chart), 2865.0 (Fibonacci level 23.6% of the correction to the growth since December 2018 and 2335.0 mark), the bullish trend of the S&P500 remains.

The signal for sales and the start of a downward correction will be the breakdown of the short-term support level of 3004.0 (ЕМА200 on the 1-hour chart) with targets at the support levels of 2965.0 (ЕМА200 on the 4-hour chart and highs of May), 2937.0 (2018 highs).

So far, long positions are preferred. However, it is also likely that the S&P500 will remain in the current range until the end of the Wednesday when the Fed’s decision and plans are known.

Support Levels: 3004.0, 2965.0, 2937.0, 2865.0, 2840.0, 2765.0

Resistance Levels: 3028.0

Trading Recommendations

Sell Stop 2990.0. Stop-Loss 3030.0. Targets 2965.0, 2937.0

Buy Stop 3030.0. Stop Loss 2990.0. Targets 3050.0, 3100.0, 3200.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks