DJIA: a new strong drop in indices

08/26/2019

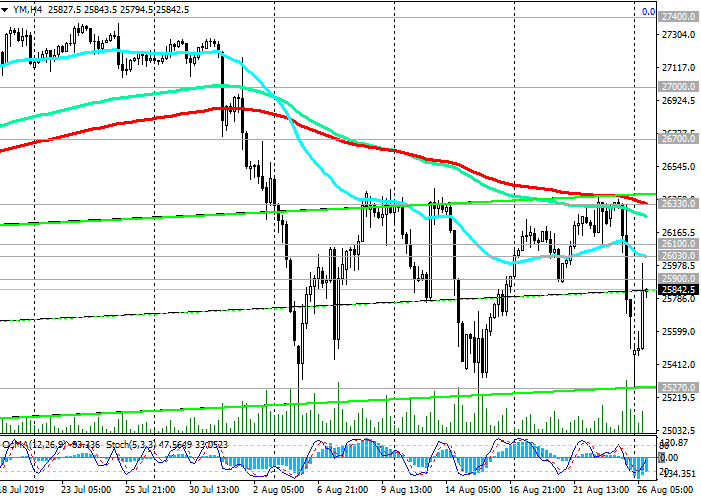

Last month, the DJIA updated its absolute and annual maximum near the 27400.0 mark on expectations of a softer Fed monetary policy. Earlier, Trump has repeatedly criticized the Fed and called for lowering the interest rate by 1% at once, saying that this will accelerate growth in the stock market and support American producers.

The Fed lowered the rate by 0.25% at the end of July, however, stock markets reacted with restraint to this news, as many investors expected a rate cut by 0.50%.

However, stock indices, including DJIA, plummeted after Trump tweeted about the introduction of new 10% duties on Chinese goods from September 1.

August turned out to be extremely volatile. Fears of a slowdown in the global economy and further escalation of international trade conflicts do not leave investors.

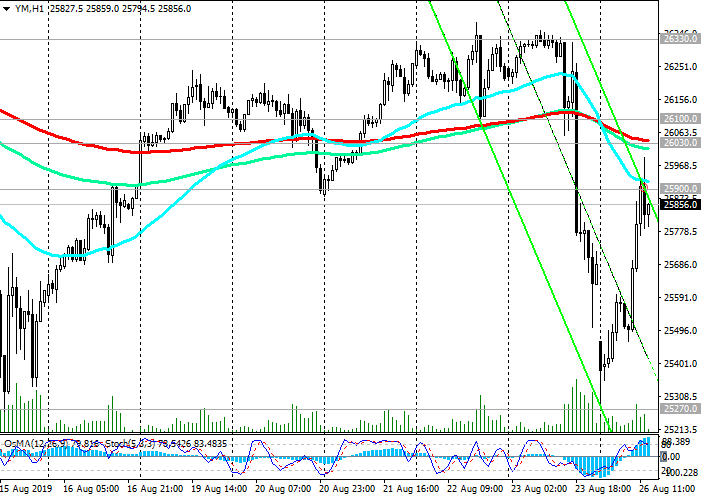

Last Friday, global stock indices collapsed after China announced the introduction of duties on US goods worth $ 75 billion, and Donald Trump announced a response to this step of China.

On Monday, markets recovered some of the losses previously sustained after China Vice Premier Liu He said he wanted to resolve trade issues with the United States.

Market participants continue to follow any comments by the US and Chinese authorities regarding trade negotiations.

The deterioration of prospects in this direction may again bring down stock indices. Conversely, a warming or easing in trade disputes between the US and China will support stock indices.

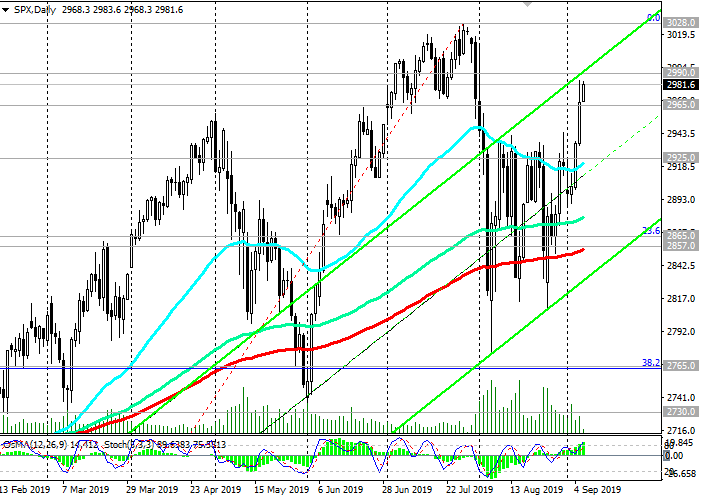

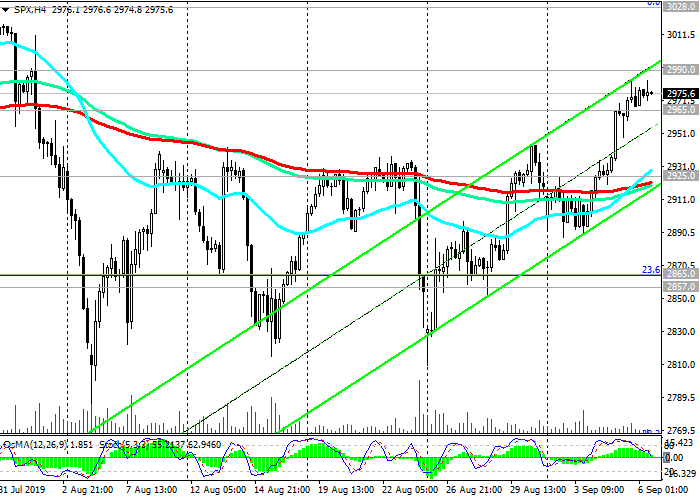

The return of the DJIA to the zone above the resistance level of 26330.0 (EMA200 on the 4-hour chart, EMA50 on the daily chart and local maximums) will indicate a recovery in the bull trend and the resumption of purchases.

Nevertheless, the OsMA and Stochastic indicators on the 4-hour, daily, weekly charts are still on the side of the sellers. Shopping is still premature.

Support Levels: 25270.0, 24600.0

Resistance Levels: 26030.0, 26100.0, 26330.0, 26700.0, 27000.0, 27400.0

Trading Scenarios

Buy Stop 26500.0. Stop-Loss 25800.0. Take-Profit 27000.0, 27400.0, 27500.0

Sell Stop 25600.0. Stop-Loss 26100.0. Take-Profit 25300.0, 24600.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks