USD/CAD: Current Dynamics

02/04/2019

The PMI index for the US manufacturing sector, published on Monday, calculated by the Institute for Supply Management (ISM), rose to 55.3 in March against 54.2 in February.

The DXY dollar index, reflecting its value against a basket of 6 major world currencies, is at the beginning of the European session on Tuesday near 96.92, 12 points higher than the closing price on Monday. Today is the 6th day of the continuous growth of the DXY dollar index, and it looks like its positive dynamics will continue until the end of the week, when data from the American labor market will be published. Expected strong data that will support the US dollar in confirming the forecast.

From the news today we are waiting for important macro statistics from the United States. At 12:30 (GMT), data on durable goods orders will be published, involving large investments.

In January, the indicator came out with a value of +0.3%. Forecast for February: -1.8%. This is negative information for dollar buyers. If February’s data is even weaker, the US dollar may decline significantly.

Data better than the forecast will strengthen the dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

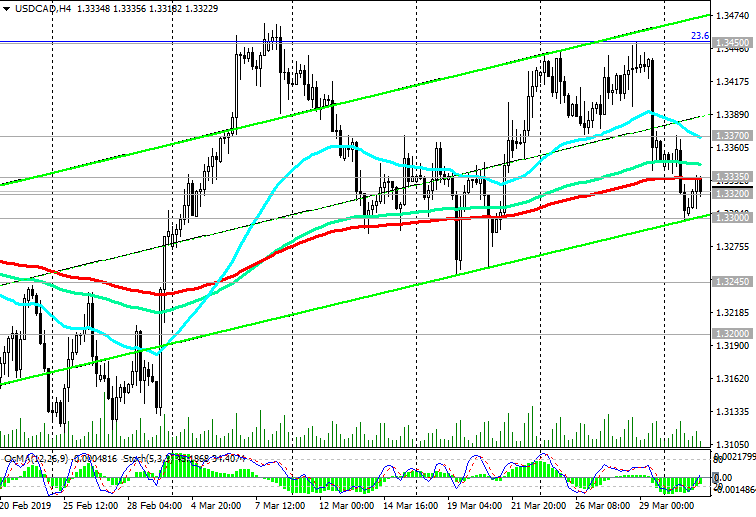

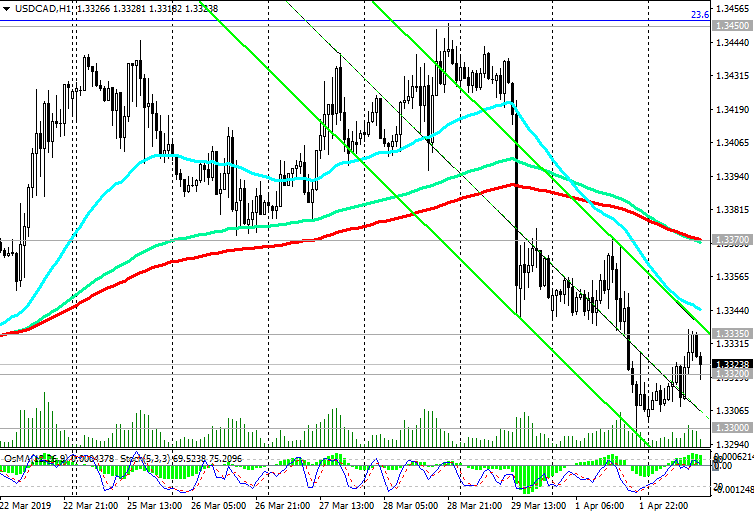

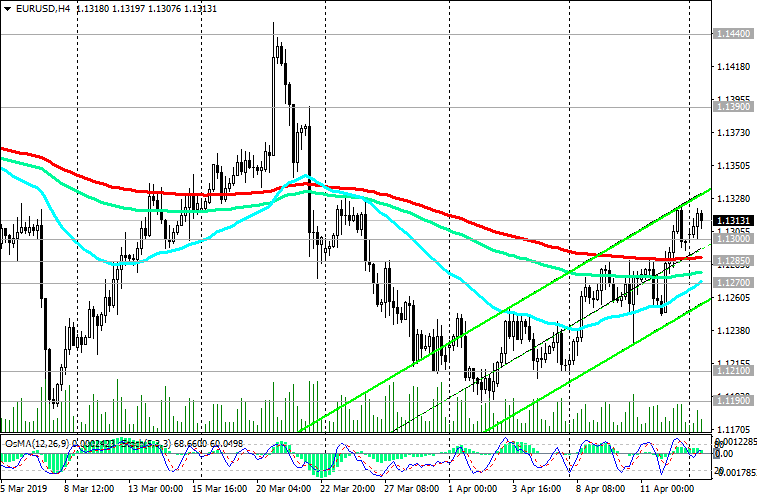

Meanwhile, the USD / CAD continues to trade near the support levels of 1.3335 (ЕМА200 on the 4-hour chart), 1.3320 (ЕМА50 on the daily chart).

A break of the short-term resistance level of 1.3370 (ЕМА200 on the 1-hour chart) will confirm the scenario for the growth of USD / CAD. The growth targets will be the resistance levels of 1.3450 (Fibonacci level 23.6% of the downward correction to the growth of the pair in the global uptrend since September 2012 and 0.9700), 1.3660 (2018 highs), 1.3790 (2017 highs).

Confirmed breakdown of the local support level of 1.3300 will create prerequisites for further reduction to support levels of 1.3245 (ЕМА144 on the daily chart), 1.3200 (ЕМА200 on the daily chart).

In general, the positive dynamics of USD / CAD remains; long positions are preferred.

Support Levels: 1.3300, 1.3245, 1.3200, 1.3155, 1.3090, 1.3045

Resistance Levels: 1.3320, 1.3335, 1.3370, 1.3450, 1.3600, 1.3660, 1.3790

Trading scenarios

Sell Stop 1.3290. Stop Loss 1.3340. Take-Profit 1.3245, 1.3200, 1.3155, 1.3090, 1.3045

Buy Stop 1.3340. Stop-Loss 1.3290. Take-Profit 1.3370, 1.3450, 1.3600, 1.3660, 1.3790

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks