USD/CAD: Before Important Events

30/04/2019

According to data published at the beginning of today's Asian session, the official Purchasing Managers Index (PMI) for the non-manufacturing sector in China fell to 54.3 in April from 54.8 in March. The index for the non-production sphere reflects the dynamics of activity in such areas as retail, air travel, software development, real estate market and construction. The decline was due to a weakening of demand and activity in construction.

The official PMI for the manufacturing sector in China also fell in April, to 50.1 from 50.5 in March. The decline in the index was due to the weakening of production and domestic demand.

According to Caixin, PMI for China's manufacturing sector in April was 50.2 against 50.8 in March. Unlike the official index, which reflects the dynamics of activity of large state-owned companies, PMI Caixin pays more attention to the status of private producers.

The data presented caused a short-term strengthening of the US dollar, primarily against the RMB and commodity currencies, including the Canadian dollar.

In the course of the European session, the dollar is falling again. Investors are switching their attention to future important events. On Wednesday (18:00 GMT) the decision of the Fed on the interest rate will be published, and on Friday (12:30 GMT) - data from the US labor market.

Some economists expect the Fed to cut rates in December due to lower US inflation rates. Comments by Fed officials and labor market data will provide insight into the current state of the US economy and give the dollar a new impulse, either for growth or for decline.

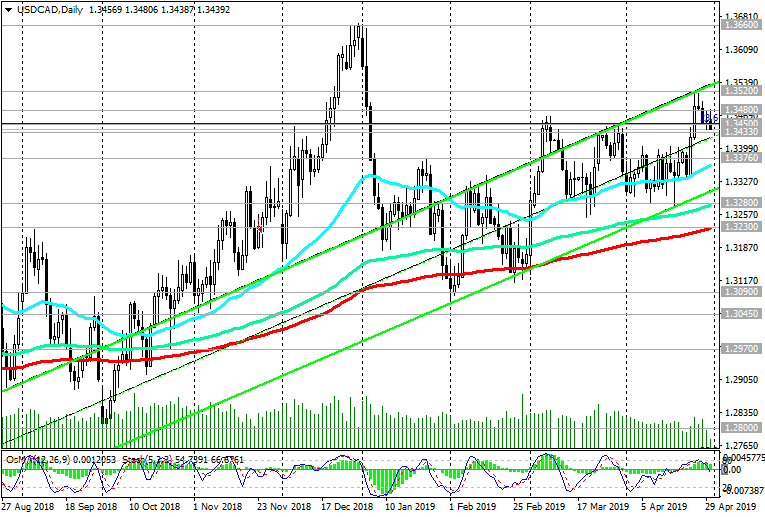

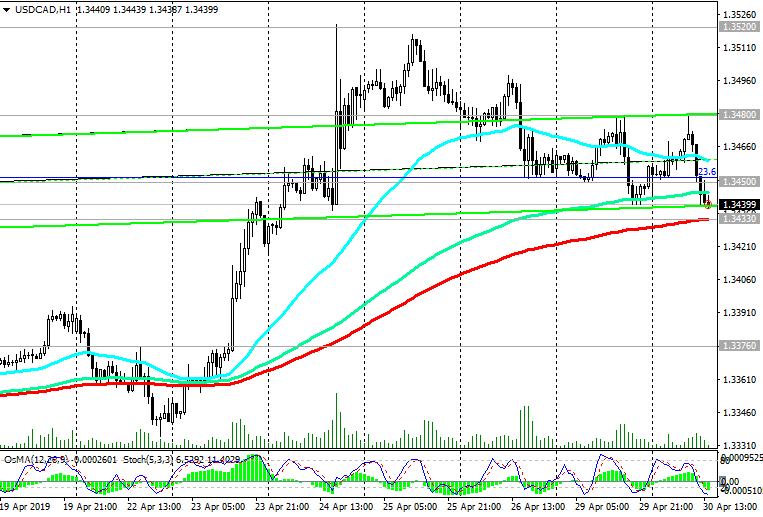

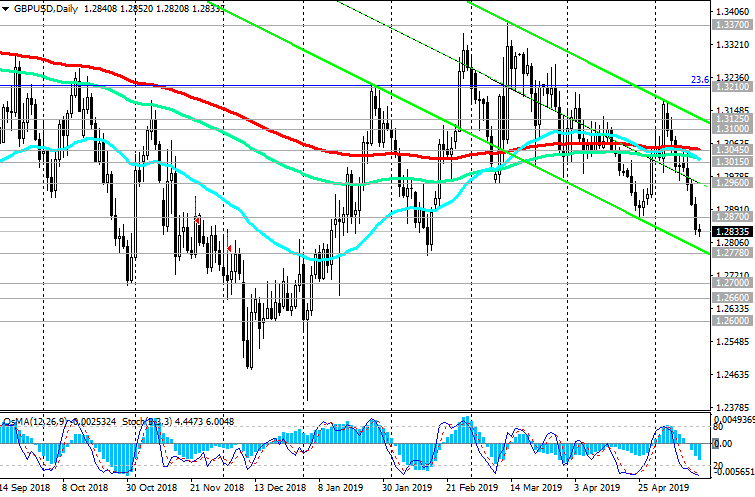

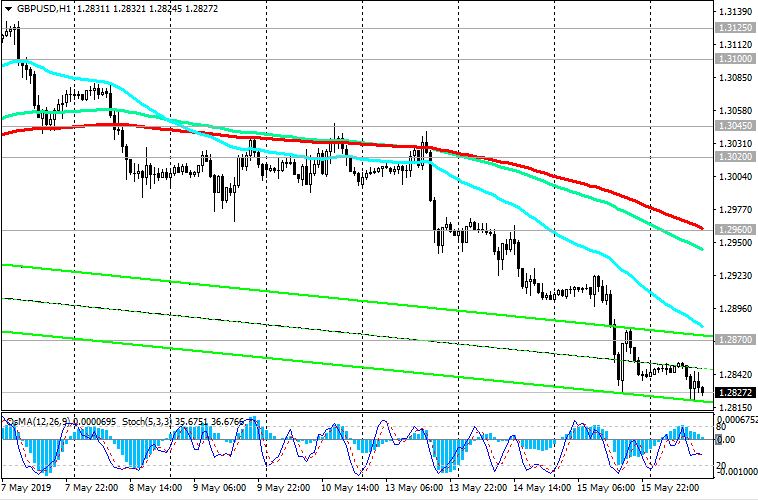

Despite the current decline, USD / CAD maintains a long-term positive trend, trading above key support levels of 1.3280 (EMA144), 1.3230 (EMA200 on the daily chart). The breakdown of local resistance levels of 1.3480, 1.3520 will be a signal for the resumption of long positions with targets at resistance levels of 1.3660 (highs of 2018), 1.3790 (highs of 2017).

Support Levels: 1.3433, 1.3400, 1.3376, 1.3300, 1.3280, 1.3230

Resistance Levels: 1.3480, 1.3520, 1.3600, 1.3660, 1.3790

Trading Scenarios

Sell Stop 1.3425. Stop-Loss 1.3490. Take-Profit 1.3400, 1.3376, 1.3300, 1.3280, 1.3230

Buy Stop 1.3490. Stop Loss 1.3425. Take-Profit 1.3520, 1.3600, 1.3660, 1.3790

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks