WTI: pessimism grows - oil becomes cheaper

05/31/2019

The financial markets are dominated by pessimism of investors who prefer defensive assets, such as the yen, gold, and government bonds.

Thus, the yield on 10-year US government bonds after a decline last week to a multi-month low of 2.292%, today updated the minimum, dropping to 2.154%, marks in September 2017.

After the White House increased import duties on Chinese goods worth $ 200 billion last month, and US President Donald Trump threatened to expand barrage measures, in response, China imposed duties on US goods in $60 billion.

Last Monday, Donald Trump said that he was “not yet ready” to conclude a trade agreement with China.

New threats from the White House, now to the address of Mexico, have added another batch of negative to investors. On Friday, Trump threatened to impose duties on 5% for goods from Mexico on June 10. The threat will be enforced if the Mexican authorities do not take measures to prevent illegal immigration to the United States. Taxes on Mexican goods will be raised to 10% from July 1, to 15% from August 1, to 20% from September 1 to 25% from October 1, and will continue until Mexico’s authorities take effective measures to combat illegal immigration in USA.

In June, the attention of traders will switch to the scheduled OPEC meeting at the end of the month. Representatives of OPEC member countries, including Russia, have to decide whether to extend the agreement to reduce total oil production by the end of 2019. A slowdown in the global economy and a downward trend in oil prices may force the organization to continue to implement production reduction agreements in order to support prices.

In anticipation of this event, oil prices are likely to remain under pressure.

At 17:00 (GMT), the American oilfield services company Baker Hughes will present a weekly report on the number of active drilling rigs in the United States. Previous reports showed a decrease in the number of active oil platforms in the United States to 797 units.

Oil reserves in the United States remain at about 476.50 million barrels (22-month high), which is 5% higher than the average 5-year value for this time of year. If the Baker Hughes report indicates an increase in the number of such installations, this may give an additional negative impetus to prices.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

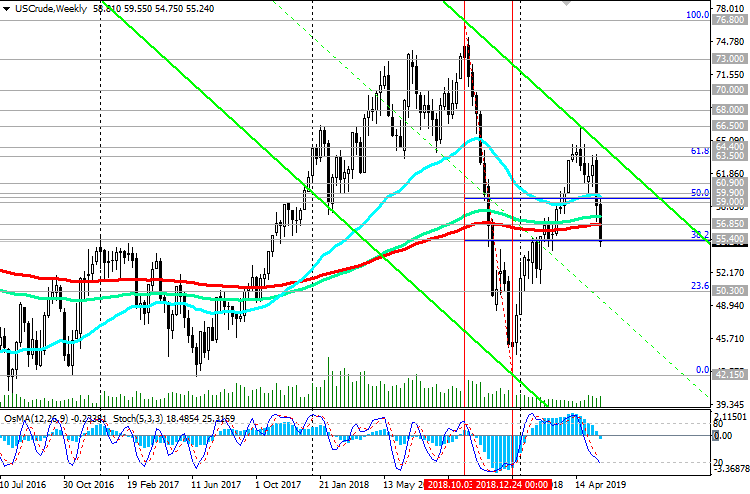

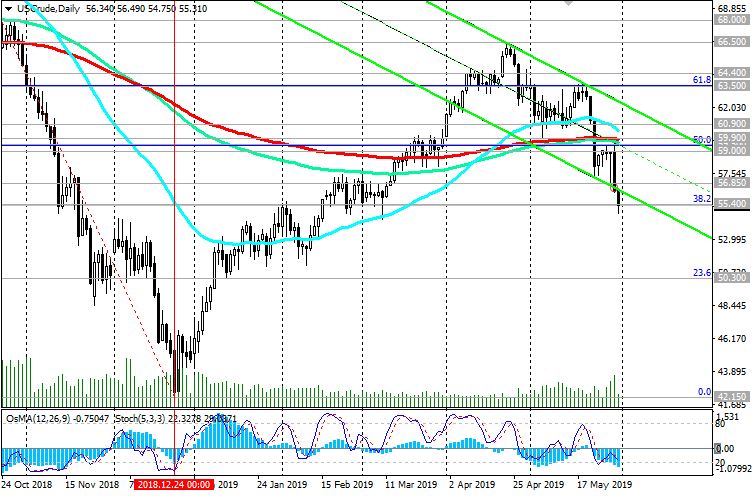

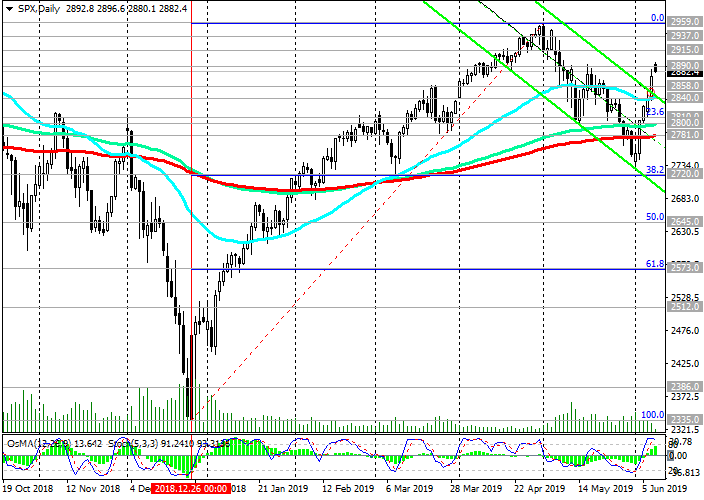

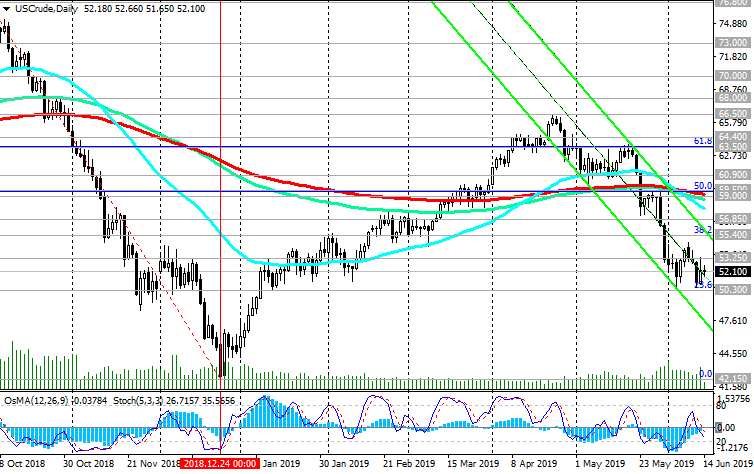

Mostly negative dynamics. At the beginning of the European session, WTI crude oil is quoted at $ 55.16 per barrel, below the important levels of 59.90 (ЕМА200, ЕМА144 on the daily chart), 59.50 (50% Fibonacci level). Last Thursday, the price of WTI crude oil broke through another major and key support level of 56.85 (ЕМА200 on the weekly chart).

If next week the price remains in the zone below support level 55.40 (Fibonacci level 38.2% of the upward correction to the fall from the highs of the last few years near 76.80 to support level near 42.15), then long-term short positions with targets at support levels 50.30 (Fibonacci level 23.6%), 42.15 (Fibonacci level 0% and minimums of December 2018) will be relevant.

Only the return of prices to the zone above the level of 59.90 will resume the bull trend.

Support Levels: 55.40, 50.30, 42.15

Resistance Levels: 56.85, 59.00, 59.50, 59.90, 60.90

Trading Scenarios

Sell Stop 54.50. Stop Loss 56.90. Take-Profit 50.30, 43.00

Buy Stop 57.10. Stop-Loss 55.30. Take-Profit 59.00, 59.50, 59.90, 60.90, 61.50, 61.85, 63.50, 64.40, 66.50

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks