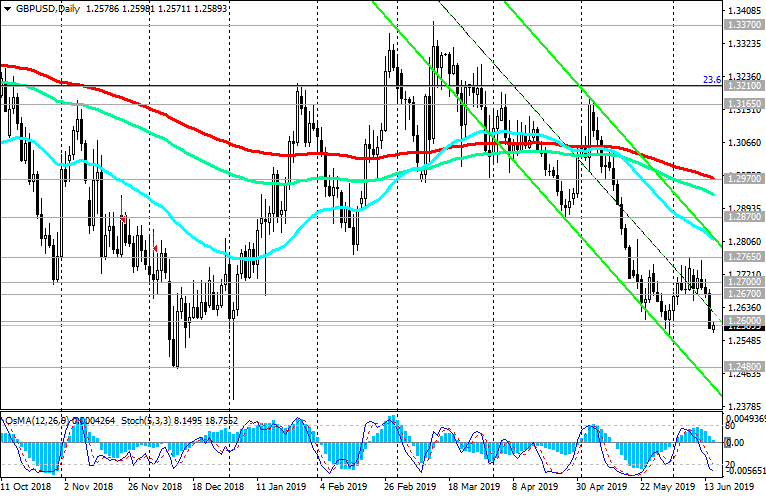

GBP/USD: Current Dynamics

17/06/2019

Negative momentum continues to dominate the pound. Domestic political risks are added to weak macro statistics after Theresa Mayís resignation from the post of prime minister and against the background of increasing likelihood of a hard Brexit. On Tuesday, the second round of voting for the candidacy of the new head of the Conservatives will take place. A favorite among 6 candidates is Boris Johnson.

The pound will also be pressured by the risk of early elections in the UK, which may take place in December.

And this week, investors will follow the meeting of the Bank of England. On Thursday (11:00 GMT) the decision of the Bank of England on the rate will be published. Probably, the rate will remain unchanged, at the level of 0.75%. However, volatility may rise sharply in the foreign exchange market if unexpected statements are made by the management of the Bank of England. Signals in favor of tightening monetary policy, which, however, is unlikely in the current situation, will cause a sharp short-term strengthening of the pound.

However, below the key resistance levels of 1.2970 (ЕМА200 on the daily chart), 1.3210 (Fibonacci level 23.6% of the correction to the decline of the GBP / USD pair in the wave that started in July 2014 near the level of 1.7200) long-term negative dynamics prevail.

Still, short positions are preferred.

Support Levels: 1.2480

Resistance Levels: 1.2600, 1.2670, 1.2700, 1.2765, 1.2800

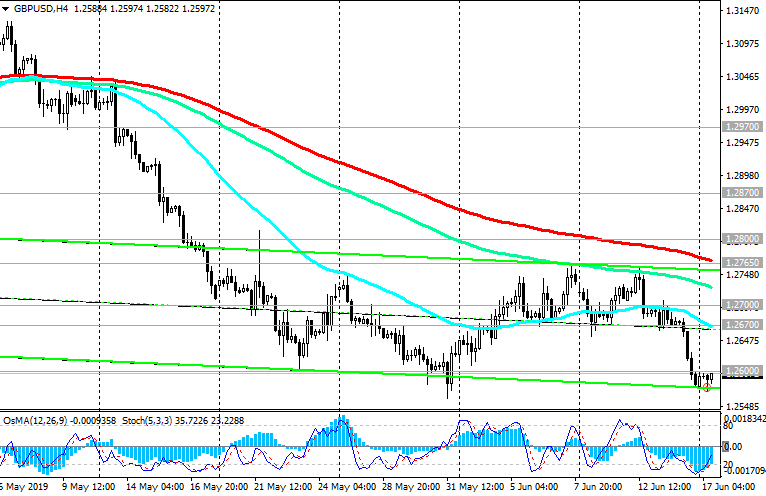

Trading Recommendations

Sell in the market. Stop Loss 1.2620. Take-Profit 1.2480

Buy Stop 1.2620. Stop Loss 1.25800. Take-Profit 1.2670, 1.2700, 1.2765, 1.2800

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks