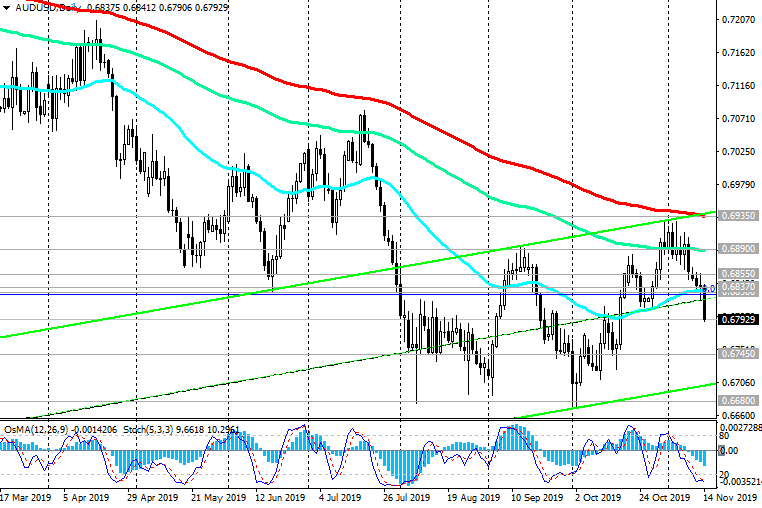

AUD/USD: Current dynamics and recommendations

11/04/2019

Positive news about the US-China trade negotiations supported the Australian currency. The United States and China are Australia's largest trade and economic partners, and a positive shift in trade relations between the two countries has a positive effect on the mood of consumers and investors in the Australian economy.

Meanwhile, a trade agreement could face an insurmountable obstacle. The US is demanding China’s commitment to buy US $ 50 billion worth of agricultural products be included in the trade agreement, which could be an obstacle to reaching that agreement. This is 2 times more than China bought before the conflict began. Purchases of this scale will far exceed the real needs of China and lead to a significant surplus in the domestic market, economists say.

Another breakdown of the agreement between these countries could negatively affect both the world and Australian economies.

On Tuesday (03:30 GMT), the decision on the rate will be made by the RB of Australia. In October, the RBA made the 3rd rate cut this year, bringing it to 0.75%.

At the same time, the RBA leadership does not exclude the possibility of further easing of monetary policy.

If tomorrow the RBA will lower the rate or directly declare such a reduction before the end of the year, then the Australian dollar runs the risk of falling under active sales.

Also, in the dynamics of AUD, much will depend on the rhetoric of the accompanying RBA statement, which will also be published on Tuesday (at 03:30 GMT).

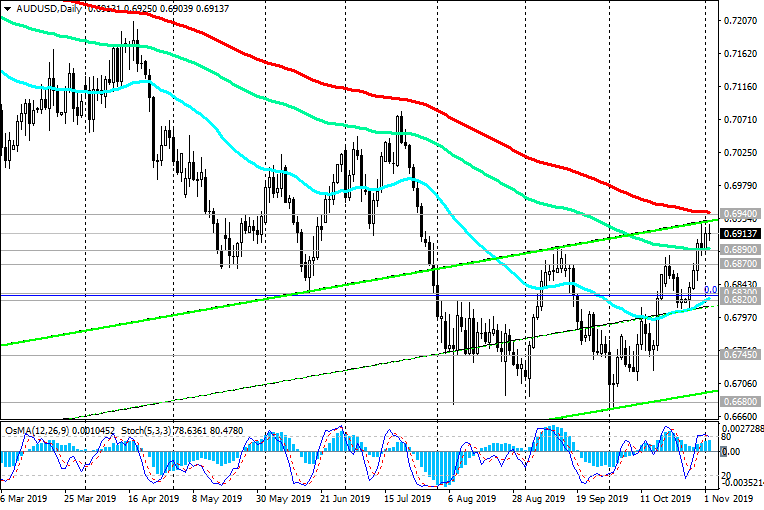

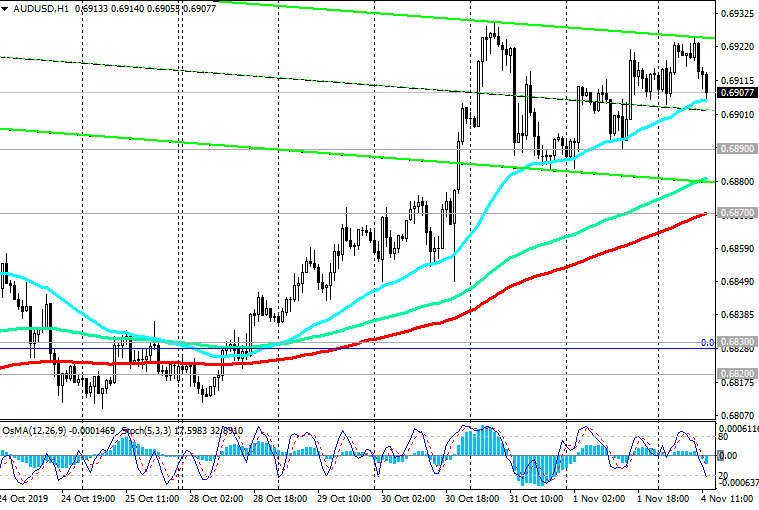

At the beginning of the European session on Monday, AUD / USD is trading near 0.6910, remaining in a long-term downtrend, below the key resistance level of 0.6940 (ЕМА200 on the daily chart).

The breakdown of the short-term support level of 0.6870 (EMA200 on the 1-hour chart) will be the first signal to resume sales of AUD / USD.

In this case, the targets will be the support levels 0.6680, 0.6600. The immediate target is located at support levels of 0.6830 (ЕМА50 on the daily chart), 0.6820 (ЕМА200 on the 4-hour chart).

In an alternative scenario, the correctional growth of AUD / USD will be limited by the resistance level of 0.6940.

Support Levels: 0.6890, 0.6870, 0.6830, 0.6820, 0.6745, 0.6700, 0.6680, 0.6600, 0.6300

Resistance Levels: 0.6940

Trading Recommendations

Sell by market, Sell Stop 0.6860. Stop-Loss 0.6950. 0.6830, 0.6820, 0.6745, 0.6700, 0.6680, 0.6600, 0.6300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks