S&P500: New Year rally continues

12/02/2019

After progress appeared in US-China trade negotiations, growth in the US stock market accelerated.

According to statements by the Ministry of Commerce of China made last month, the parties "agreed to properly resolve key issues and confirmed that the technical consultations on some parts of the text of the agreement have basically been completed".

Last week, US President Donald Trump signed law to support protesters in Hong Kong, but China refrained from retaliation. The parties are still set to sign a trade agreement. Trump is likely to also refrain from introducing December 15 previously announced new import duties on Chinese goods.

On Monday, world and US stock indices received additional support after the publication of positive macro data, indicating that the second largest economy in the world continues to grow, despite a trade conflict with the United States. So, the Procurement Managers Index (PMI) for China's manufacturing sector according to Caixin in November rose to 51.8 from 51.7 in October. The indicator is growing above level 50, signaling an increase in demand for Chinese goods.

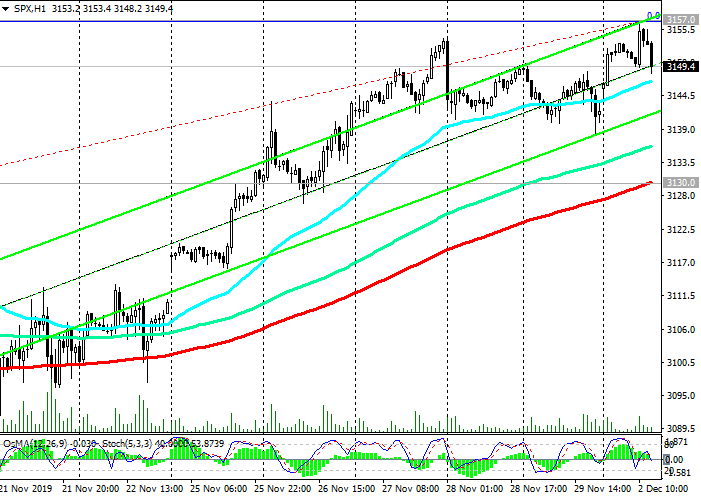

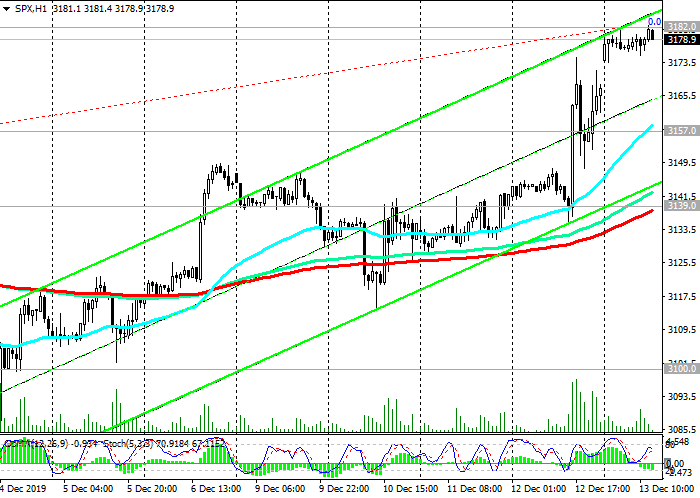

US stock indices are rising, rewriting absolute highs and continuing New Year's rally. At the beginning of the European session on Monday, the S&P 500 is trading near the 3155.0 mark, the Dow Jones Industrial Average - near the 28200.0 mark, and the Nasdaq100 - near the 8450.0 mark.

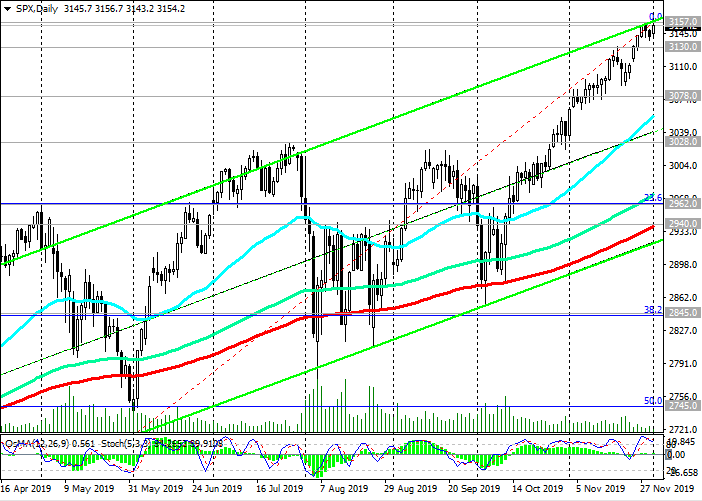

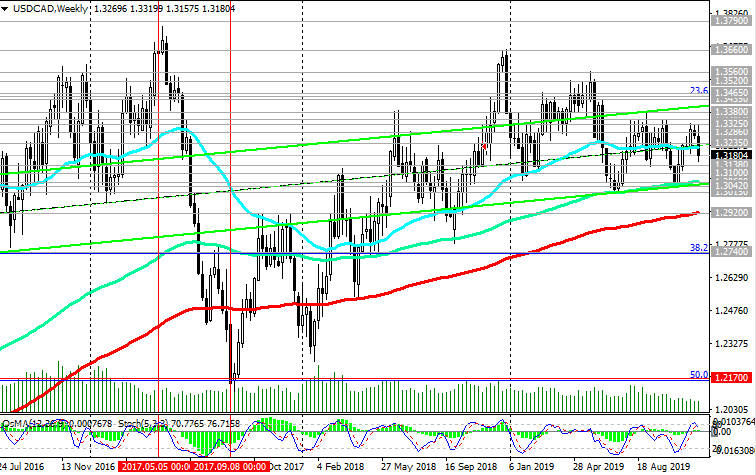

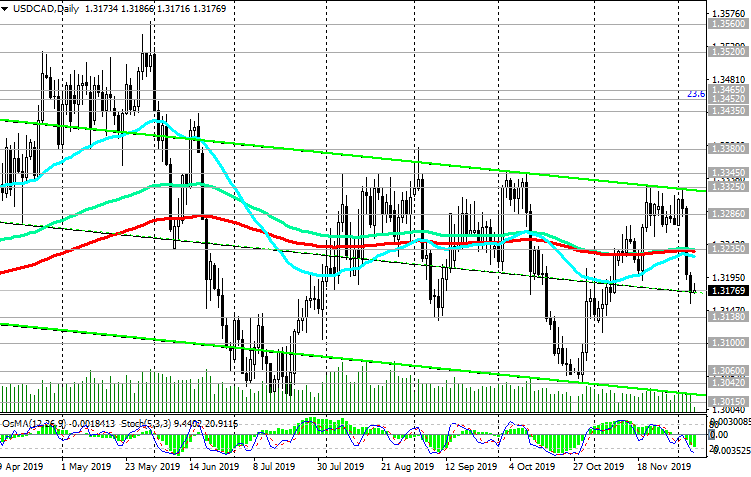

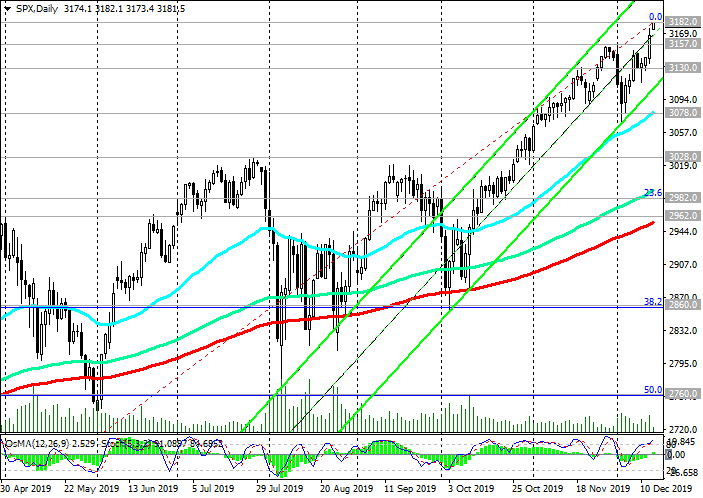

Trading above the key support level of 2940.0 (EMA200 on the daily chart), as well as the level of 2962.0 (Fibonacci level 23.6% of the correction to the growth since December 2018 and the level of 2335.0), S&P500 maintains a long-term positive dynamics.

Long positions are preferable, and above support levels 3130.0 (ЕМА200 on the 1-hour chart), 3078.0 (ЕМА200 on the 4-hour chart) purchases look safe.

Support Levels: 3130.0, 3078.0, 3028.0, 2962.0, 2940.0, 2845.0

Resistance Levels: 3157.0

Trading recommendations

Sell Stop 3128.0. Stop-Loss 3158.0. Objectives 3078.0, 3028.0, 2962.0, 2940.0

Buy Stop 3158.0. Stop-Loss 3128.0. Objectives 3150.0, 3200.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks