USD/CAD: US dollar resumed growth

09/01/2020

Current Dynamics

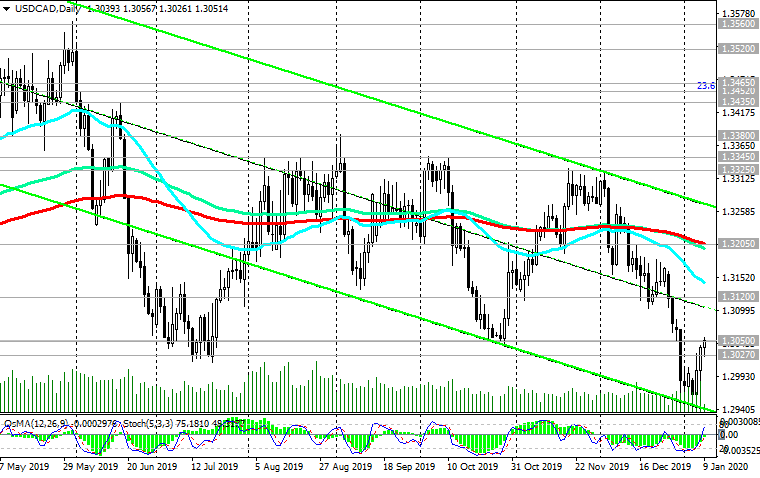

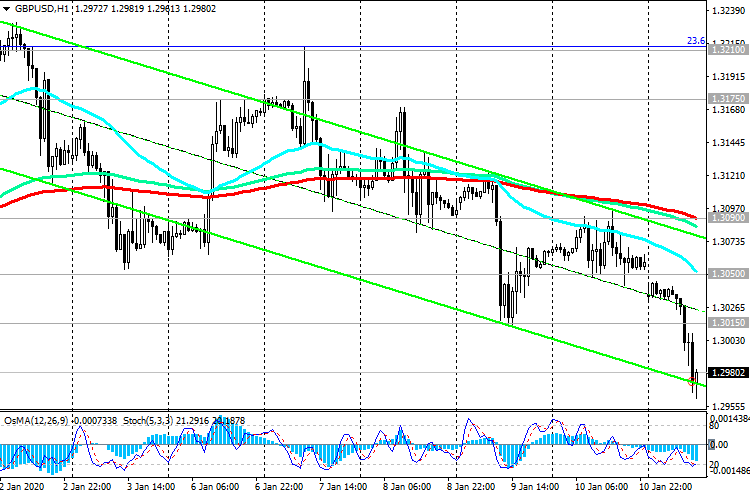

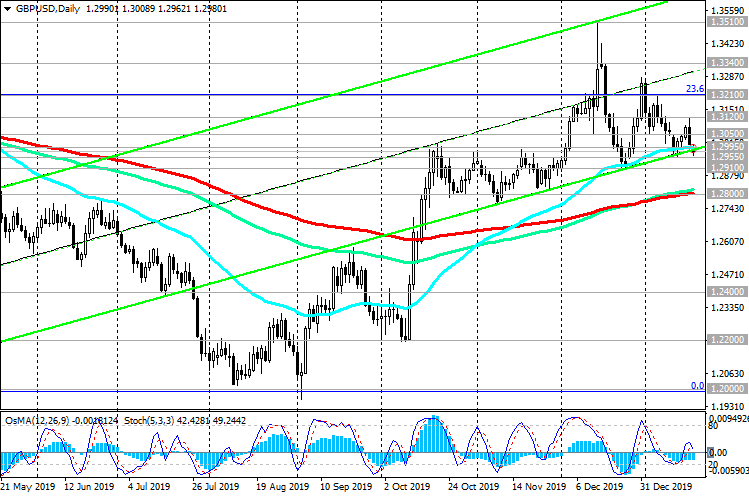

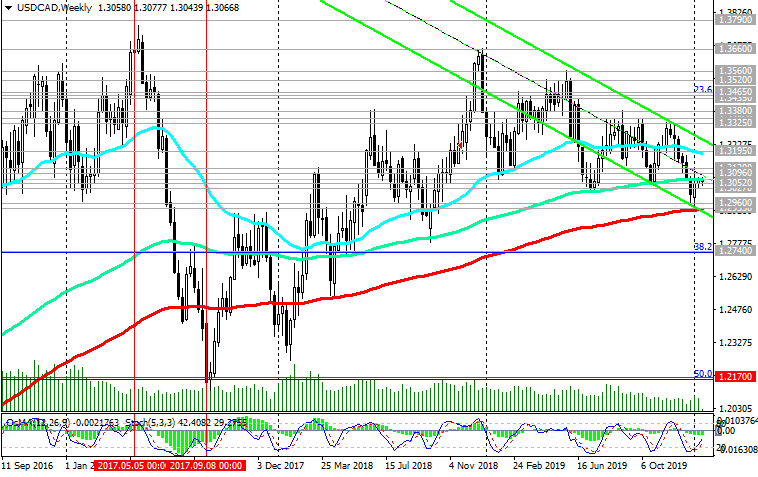

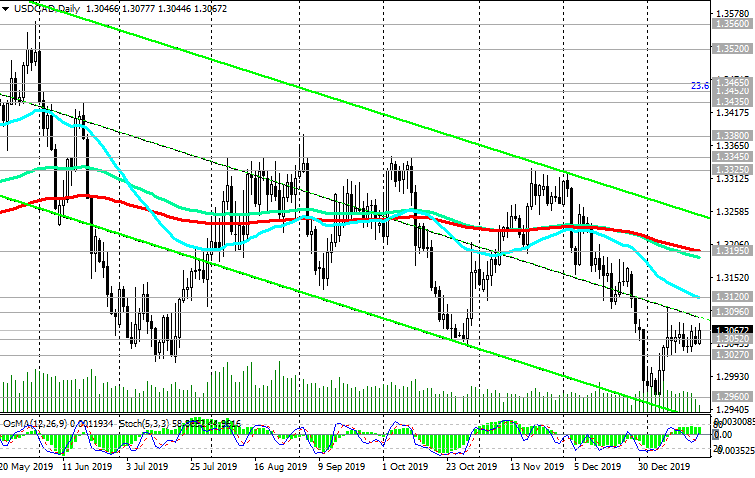

Against the backdrop of the weakening US dollar, the USD / CAD pair broke through the key support level 1.3205 (EMA144 and EMA200 on the daily chart) last month and reached 1.2957 in early January. Further decline and breakdown of the long-term support level of 1.2930 (EMA200 on the weekly chart) would mean breaking the bullish trend of USD / CAD.

Nevertheless, there was no further decrease in USD / CAD and today the pair has been growing for the third day in a row.

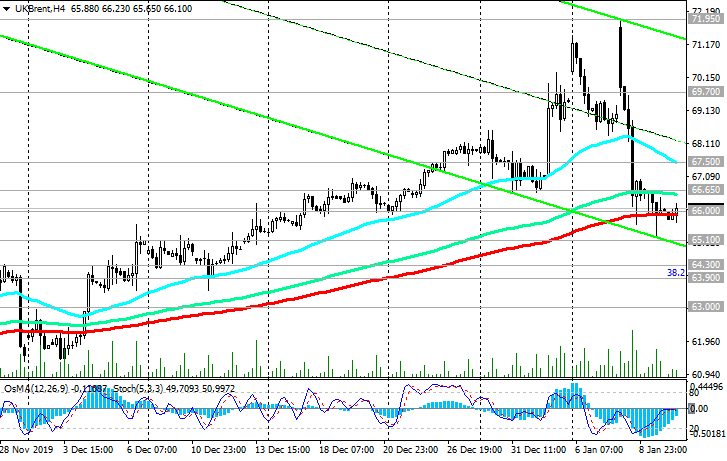

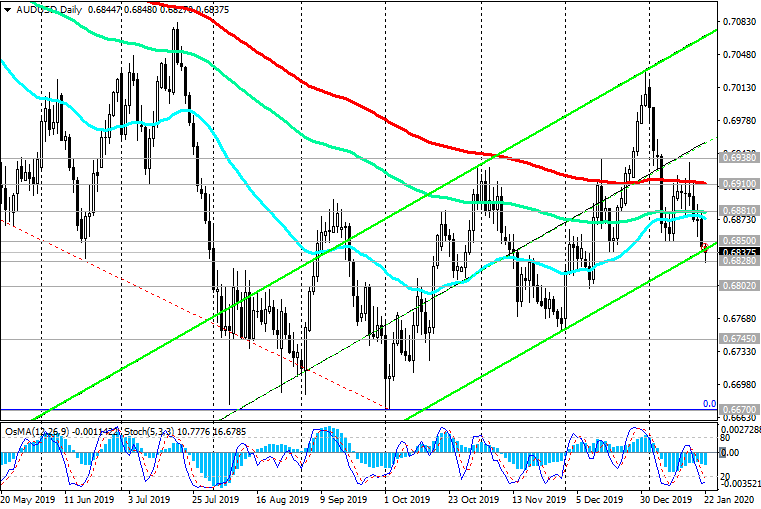

The pair’s growth is facilitated by both the strengthening of the US dollar and the decline in oil prices that followed after their significant increase on the eve amid a sharp aggravation of the geopolitical situation in the Middle East. As you know, on Tuesday night, Iran launched a missile attack on US military bases in Iraq.

However, as follows from the statements of the White House, none of the US military was injured.

In turn, the Iranian Foreign Minister tweeted that the missile attacks were not intended to escalate the conflict or start a war.

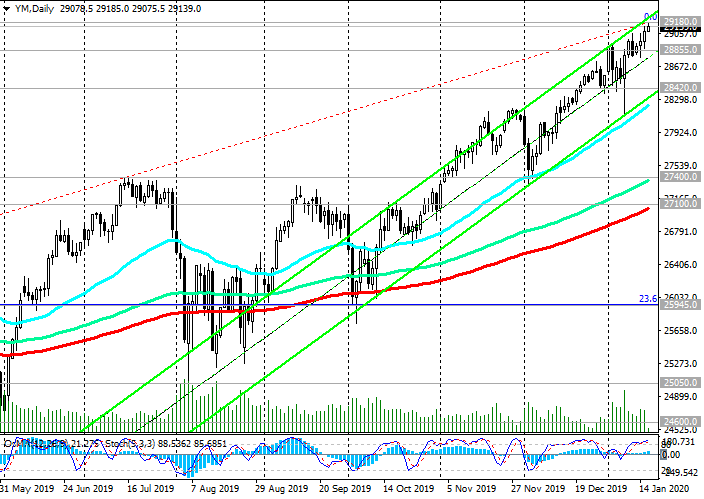

The words of US President Trump that "everything is fine", and Iran, it seems, does not intend to continue the conflict, reassured investors, which helped to renew the rally of US stock indices and the USD.

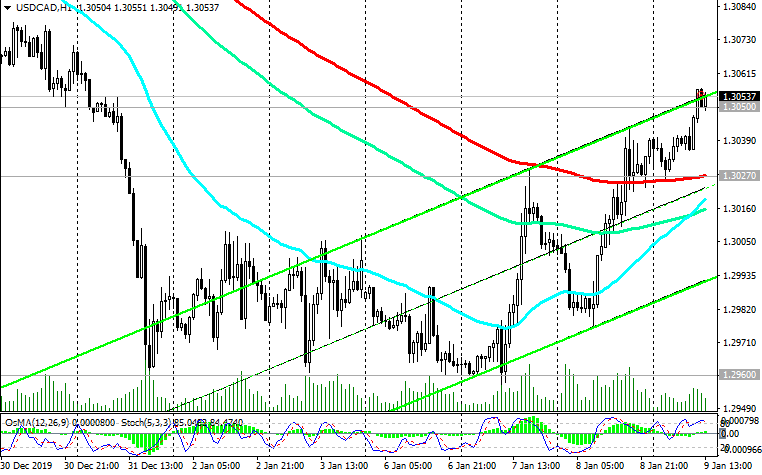

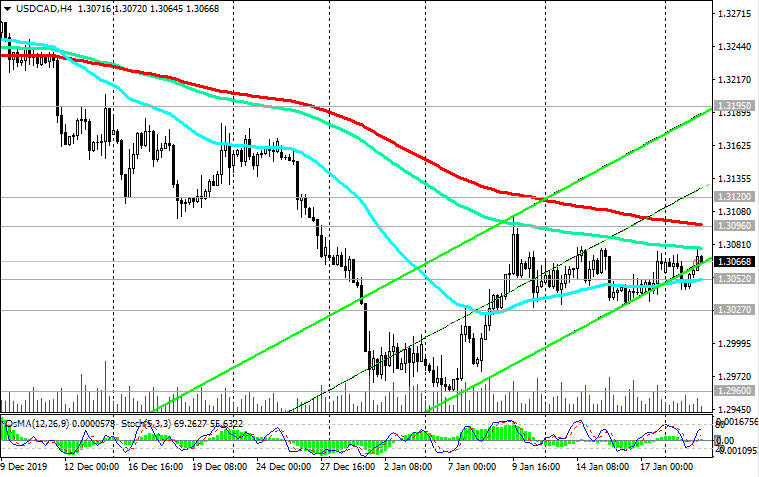

USD / CAD broke through the short-term resistance level 1.3027 on Wednesday (EMA200 on the 1-hour chart), which was the first signal to resume long positions, and is trading on Thursday near the local resistance level 1.3050 (October lows).

If the growth continues, USD / CAD will go to the resistance level 1.3120 (ЕМА200 on the 4-hour chart), and in case of breakdown, the growth will accelerate to the key resistance level 1.3205.

The December report of the US Ministry of Labor will be published on Friday. Economists expect jobs to reach +160,000, while unemployment remains at 3.5%, as in November.

Also, on Friday at the same time (at 13:30 GMT) will be published data from the Canadian labor market. In December, Canada's unemployment rate is expected to be 5.8%. This is slightly better than the November figure, but still worse than the average for 2019 (about 5.6% - 5.7%). Growth in unemployment is a negative factor for the national currency. If the data turn out to be worse than the forecast of 5.8%, then the Canadian dollar will drop sharply, and the growth of USD / CAD will continue.

In an alternative scenario and after the breakdown of the short-term support level 1.3027 (ЕМА200 on the 1-hour chart), short positions will again become relevant.

Nevertheless, in this period of time (13:30 GMT) on Friday, a sharp increase in volatility in the foreign exchange market is expected, and above all - in the pair USD / CAD.

From the news today it is worth paying attention to the speech at 19:00 (GMT) of the head of the Bank of Canada Stephen Poloz. If in his speech today he touches on the topic of monetary policy, the volatility of Canadian dollar quotes will increase. If Stephen Poloz speaks out in favor of the need for a softer monetary policy of the Bank of Canada, then the weakening of the Canadian dollar and the growth of USD / CAD will accelerate.

Support Levels: 1.3027, 1.3000, 1.2960, 1.2930

Resistance Levels: 1.3050, 1.3120, 1.3205, 1.3300, 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

Trading Scenarios

Sell Stop 1.3025. Stop-Loss 1.3065. Take-Profit 1.3000, 1.2960, 1.2930

Buy Stop 1.3065. Stop-Loss 1.3025. Take-Profit 1.3120, 1.3205, 1.3300, 1.3325, 1.3345, 1.3380, 1.3400, 1.3452

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks