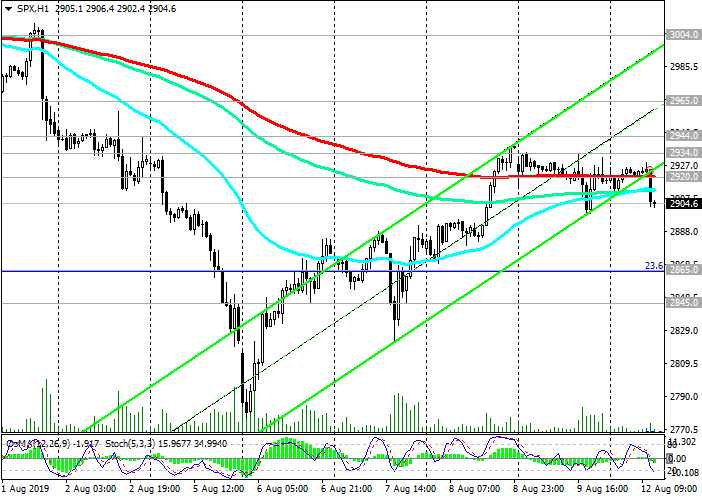

S&P500: Current Dynamics and Recommendations

08/12/2019

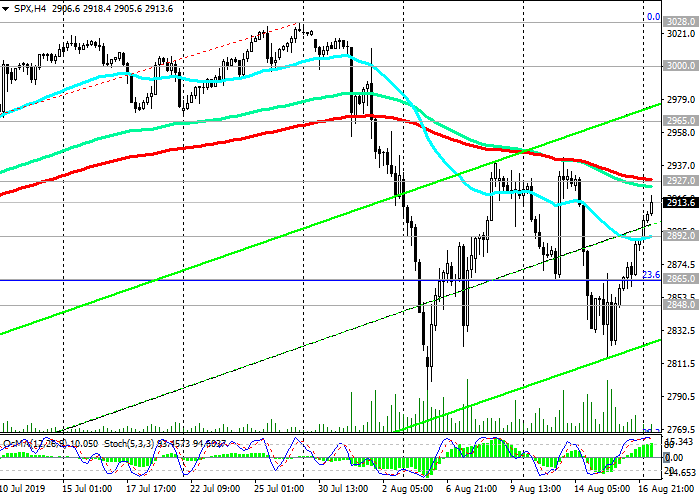

In July, the S&P500 rose to record highs near 3028.0, which is about 22% higher than the opening price at the beginning of the year.

The growth of US stock indexes was contributed by the expectations of lower interest rates by the Fed and the positive macro statistics coming from the USA. However,

investors' concerns about the slowdown in global economic growth and the aggravation of trade confrontation between the US and China caused a sharp increase in volatility in world stock markets and a drop in indices. After sharp fluctuations, all three leading US indices finished the week with a decline of about 1%.

S&P500 completed last week at around 2918.0.

"We are not ready to conclude an agreement, but we'll see how everything goes", Trump told reporters on Friday. "We'll see if China meets with us in September".

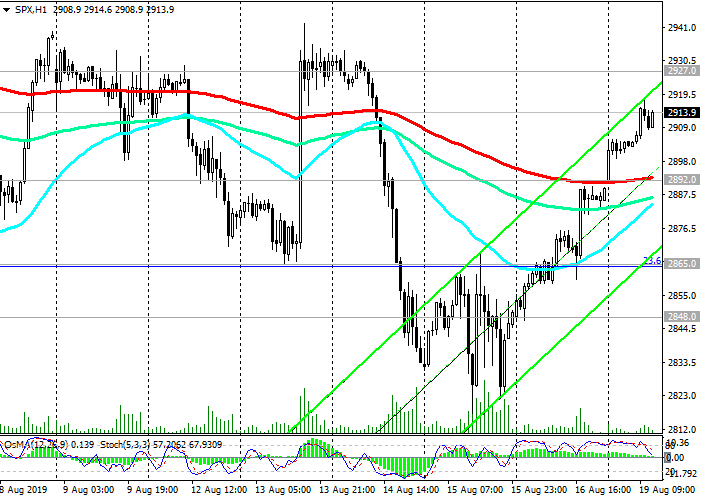

During today's Asian session, the S&P500 and other major US stock indexes rose, but fell again at the beginning of the European session. Thus, S&P500 futures are trading at the beginning of the European session on Monday near the level of 2907.0, 14 points below the opening price today.

The S&P500 futures are trading below resistance levels at 2944.0 (ЕМА200 on the 4-hour chart), 2934.0, 2920.0 (ЕМА200 on the 1-hour chart).

Below the short-term resistance level of 2920.0, short positions with targets located near the support levels of 2845.0 (ЕМА200 on the daily chart), 2865.0 (Fibonacci level 23.6% of the correction to growth since December 2018 and mark 2335.0) are preferable. Above these support levels, the S&P500 bullish trend remains.

The breakdown of support levels 2845.0, 2865.0 can trigger a deeper decline to support levels 2765.0 (Fibonacci 38.2%), 2680.0 (Fibonacci 50%).

You can return to shopping after fixing the S&P500 in the zone above the resistance level of 2944.0.

Support levels: 2900.0, 2865.0, 2845.0, 2765.0, 2730. 2680.0

Resistance Levels: 2920.0, 2934.0, 2944.0, 2965.0, 3000.0, 3028.0

Trading recommendations

Sell by market. Stop-Loss 2945.0. Goals 2900.0, 2865.0, 2845.0, 2800.0

Buy Stop 2945.0. Stop-Loss 2910.0. Goals 2965.0, 3000.0, 3028.0, 3100.0, 3200.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks