XAU/USD: Market expectations

18/12/2018

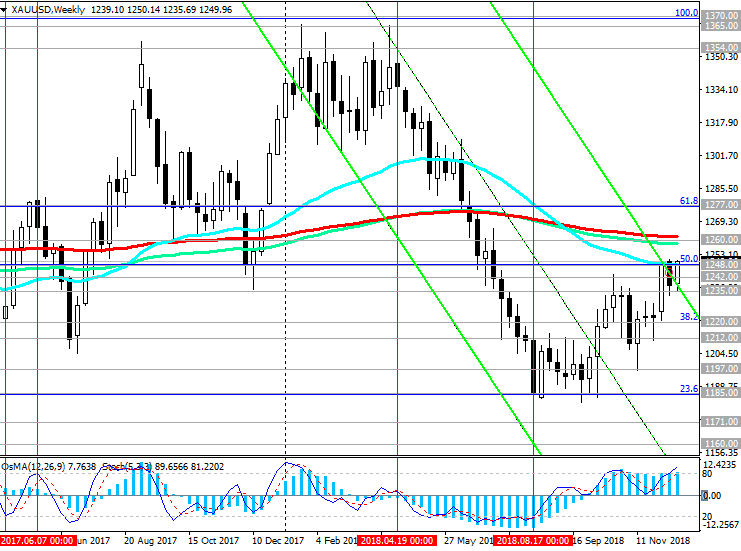

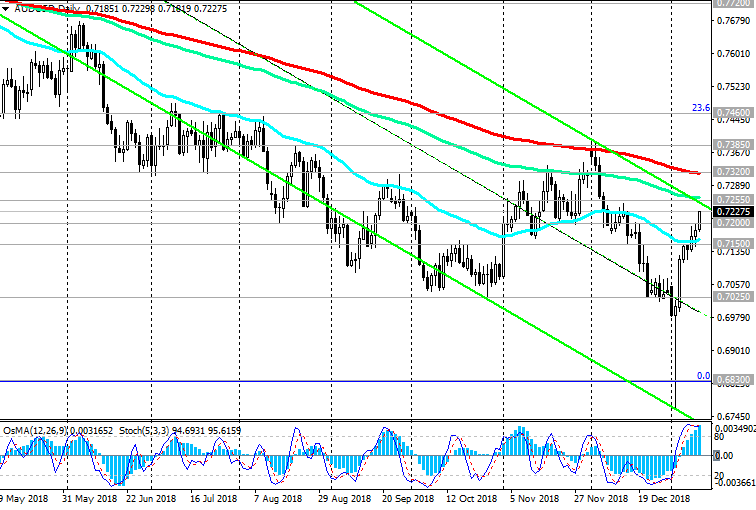

Against the background of monetary tightening by the Fed since April, gold prices have been in a steady downward trend. In mid-August, the XAU / USD pair reached an annual minimum near the mark of 1160.00, however, then an upward correction began, raising gold prices to the current mark of 1249.00 dollars per troy ounce. Nevertheless, the overall gold trend remains bearish, and the upward correction may end near the reached resistance levels of 1242.00 (ЕМА200 on the daily chart), 1248.00 (Fibonacci level 50% of the correction to the decline wave from July 2016), if the Fed will give clear signals to further tighten its monetary policy in 2019.

About 70% of market participants, according to the CME Group, believe that the rate will be increased in 2019 at least 2 more times. At the same time, the rate increase on December 19, at the last Fed meeting this year, by 0.25% to 2.5% is not in doubt.

The press conference of the Fed will begin on Wednesday 19:30 (GMT). Unambiguous signals from US Federal Reserve Chairman Jerome Powell, indicating a propensity to continue tightening monetary policy, will cause a rise in the dollar and a drop in gold prices. In the face of an increase in interest rates, gold is difficult to compete with other income-generating assets, such as government bonds, for example. At the same time, the cost of acquiring and storing gold is growing.

The breakdown of the support level of 1235.00 (EMA144 on the daily chart) will be the beginning of the return of XAU / USD to the bearish trend.

The soft rhetoric of statements by Fed officials could contribute to weakening the dollar and further rising gold and XAU / USD quotes towards resistance levels of 1260.00 (EMA200 on the weekly chart), 1277.00 (Fibonacci level 61.8%).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support Levels: 1242.00, 1235.00, 1220.00, 1212.00, 1204.00, 1197.00, 1185.00, 1160.00

Resistance Levels: 1248.00, 1260.00, 1277.00

Trading scenarios

Sell Stop 1234.00. Stop Loss 1250.00. Take-Profit 1220.00, 1212.00, 1204.00, 1197.00, 1185.00, 1160.00

Buy Stop 1250.00. Stop Loss 1234.00. Take-Profit 1260.00, 1277.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks