EUR/USD: the dollar fell after the Fed decision

01/31/2019

Current situation

At the regular meeting the ECB last Thursday kept its current monetary policy unchanged. ECB President Mario Draghi reported on the prevalence of downside risks for the Eurozone economy, including protectionism in international trade and geopolitical tensions. Earlier, the central bank noted a general balance of risks.

Last Wednesday, the Fed also did not change its monetary policy, maintaining interest rates at the same level.

The cautious position of the US Federal Reserve and the statements of its head Jerome Powell that "the arguments in favor of raising rates have weakened a bit", raised the EUR / USD to a 3-week high near the 1.1515 mark.

Powell reiterated that future policy will be “completely dependent on data”.

Market participants expect the Fed will not raise rates this year.

Now, after the statements of Powell, data from the US labor market, expected on Friday, will attract increased attention of market participants. Data worse than the forecast values and data for December will weaken the likelihood of further tightening of monetary policy and adversely affect the dollar quotes.

From the news today it is worth paying attention to the publication (from 13:30 to 15:00 GMT) of US macro data: data on unemployment applications last week and sales of new homes in November. Positive macro data will provide short-term support for the dollar. Conversely, weak data will adversely affect the dollar quotes and support the EUR / USD pair, which is falling on Thursday after the publication of the weaker-than-expected 4-quarter Eurozone GDP data. According to Eurostat, in the 4th quarter, Eurozone GDP grew by +0.2% (+1.2% in annual terms). Thus, the GDP growth in the Eurozone in 2018 was 1.8% versus 2.4% in 2017. The data again indicate a slowdown in the European economy in 2018.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading scenarios

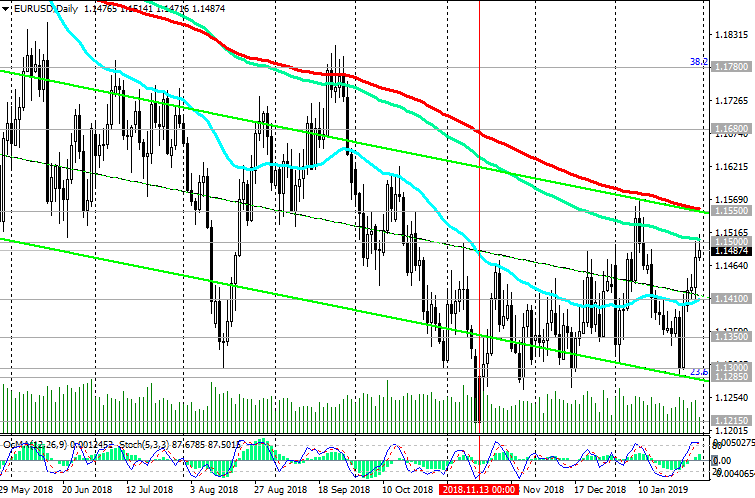

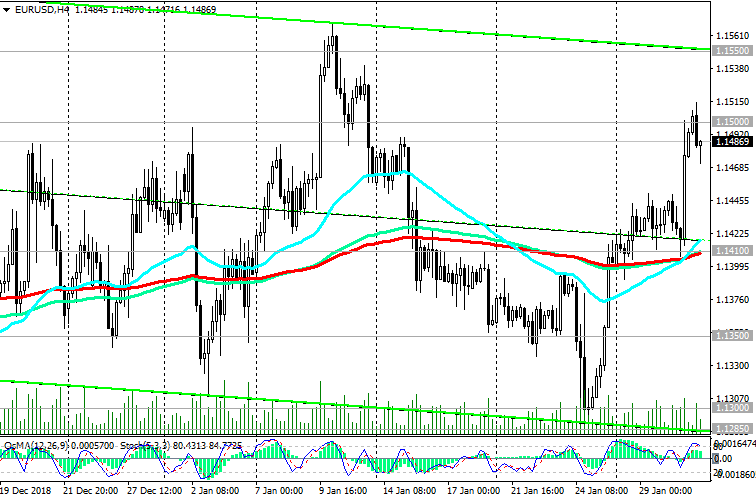

Meanwhile, the EUR / USD holds positions reached last Thursday near an important resistance level of 1.1500 (EMA144 on the daily chart).

The OsMA and Stochastic indicators on the 4-hour, daily charts still recommend long positions.

In the current situation, long positions with targets at resistance levels of 1.1500 (EMA144 on the daily chart), 1.1550 (EMA200 on the daily chart) look preferable.

The alternative scenario assumes a resumption of the decline. The signal for the development of this scenario will be the breakdown of support levels 1.1418 (ЕМА200 on the 1-hour chart), 1.1410 with targets at support levels 1.1300, 1.1285 (Fibonacci level 23.6% of the correction to the fall from 1.3900 level, which began in May 2014), 1.1270 (December lows), 1.1215 (November and year lows).

Support Levels: 1.1418, 1.1410, 1.1350, 1.1300, 1.1285, 1.1215, 1.1120

Resistance Levels: 1.1500, 1.1550, 1.1680, 1.1780

Trading scenarios

Sell Stop 1.1460. Stop Loss 1.1510. Take-Profit 1.1410, 1.1350, 1.1300, 1.1285, 1.1215, 1.1120

Buy Stop 1.1510. Stop-Loss 1.1460. Take-Profit 1.1550, 1.1680, 1.1780

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks