AUD/USD: on the eve of the RBA meeting

03/04/2019

Investor sentiment has recently improved by easing tensions in trade relations between the United States and China. Waiting for the early conclusion of a new trade agreement between the United States and China, commodity currencies, primarily the Australian dollar, rose at the beginning of today's trading day. The AUD / USD opened trading near the level of 0.7105, which is about 30 points higher than the closing price on Friday.

However, in the first half of the trading day, the AUD / USD decline resumed after the publication of weak macro data received in the morning from Australia.

At the beginning of the US trading session, the AUD / USD pair will trade near the 0.7085 mark.

On Tuesday, the RB of Australia makes a decision on the interest rate. The publication of the decision on rates is scheduled for 03:30 (GMT). In February, the RBA did not change interest rates, expressing a cautious propensity to increase them, given the increasing internal and external risks.

Probably, at tomorrow's meeting, the RBA will also signal an intention to continue to maintain the current monetary policy unchanged.

Interest rates may remain unchanged even longer, given the weak wage growth and slowdown in the Australian economy. "The Board does not see a weighty argument in favor of adjusting the key interest rate in the short term", said one of the latest statements of the RBA.

Economists also warn that due to the weak housing market and the continued weakening of housing prices in large cities, the RBA will not change rates until 2020.

In view of this, and also against the background of the strengthening US dollar, the AUD / USD will continue to decline.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

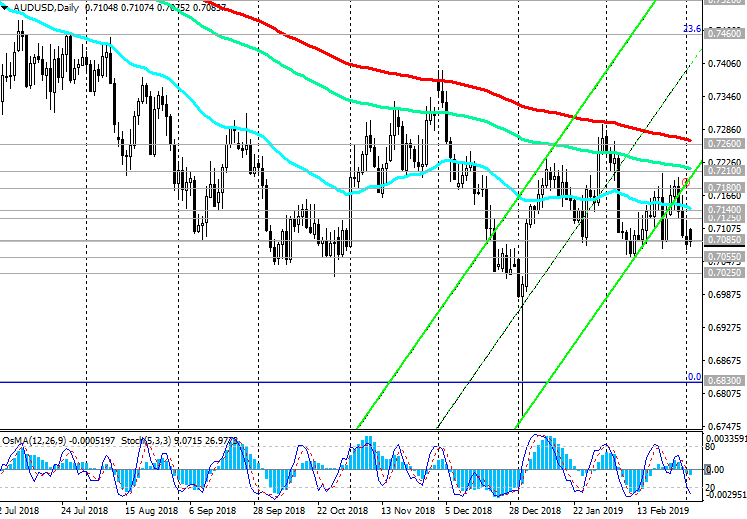

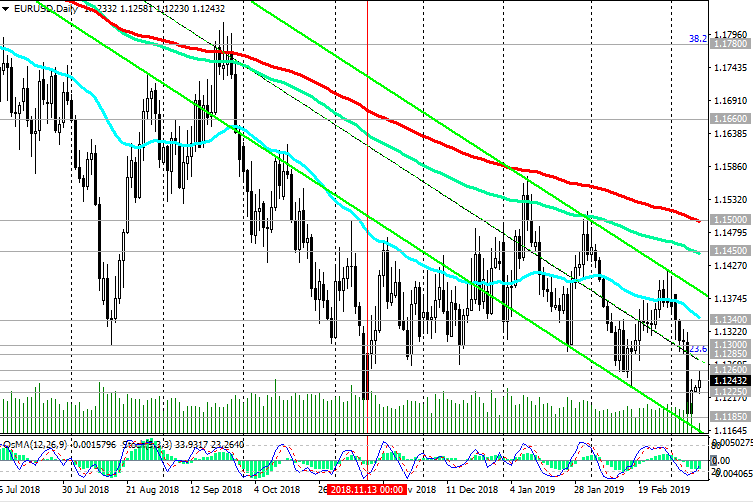

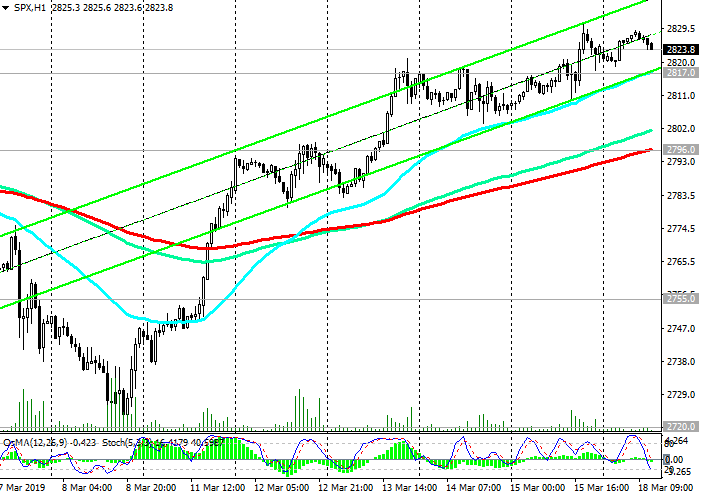

Downward trend resumed. AUD / USD continues to trade in a bearish trend and downward channel on the weekly chart, the lower limit of which passes near the level of 0.6600.

Below the key resistance level of 0.7260 (ЕМА200 on the daily chart), short positions with targets at the support levels of 0.6910 (lows of September 2015), 0.6830 (2016 lows) are preferable.

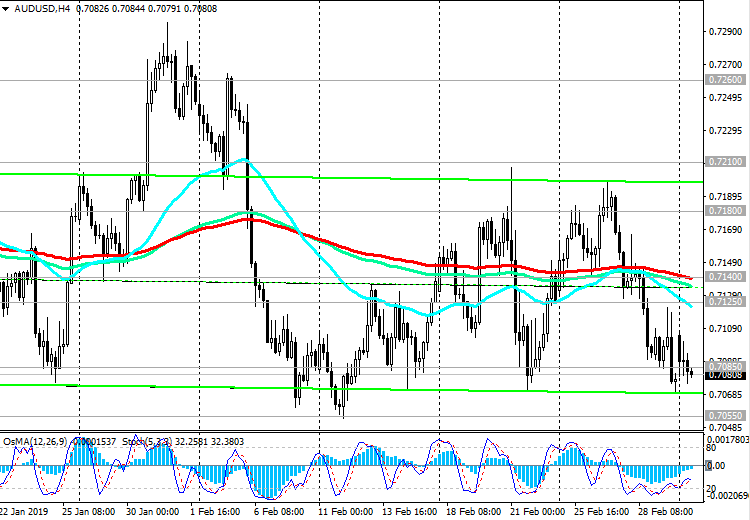

Consideration of long positions can be returned only after the breakdown of the local resistance level of 0.7140 (ЕМА50 on the daily chart, ЕМА200 on the 4-hour chart). Growth above the resistance level of 0.7260 is unlikely.

Support Levels: 0.7055, 0.7025

Resistance Levels: 0.7125, 0.7140, 0.7180, 0.7210, 0.7260

Trading Scenarios

Sell Stop 0.7070. Stop Loss 0.7110. Take-Profit 0.7055, 0.7025, 0.6910, 0.6830

Buy Stop 0.7110. Stop Loss 0.7070. Take-Profit 0.7125, 0.7140, 0.7180, 0.7210, 0.7260

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks