Brent Crude Oil: the trend reversed downwards

Current trend

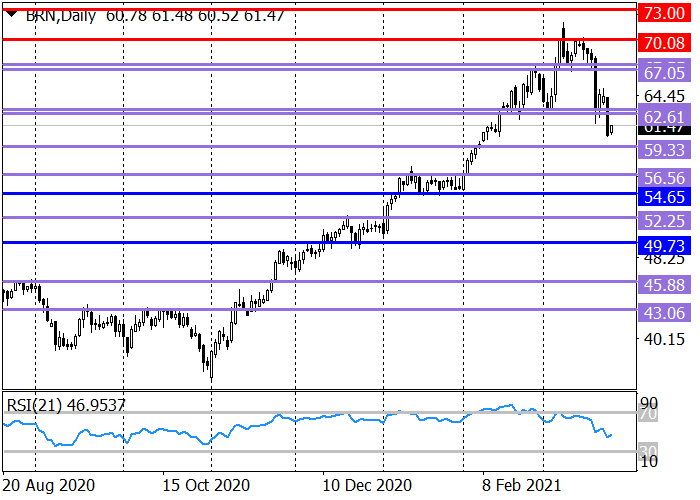

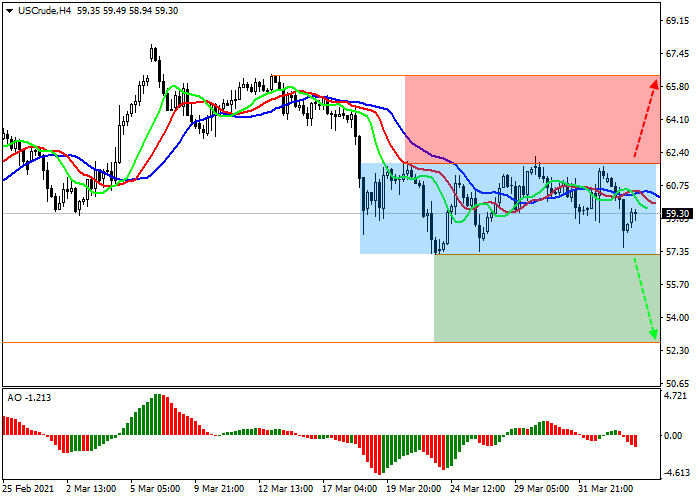

On Tuesday, Brent crude oil price hit its lowest level since early February, falling by 15% from recent highs in early March.

Yesterday, trading in futures closed at 60.79, the spread for the coming months for Brent and WTI Crude Oil turned into contango, where contracts are cheaper than in later months, which indicates a decrease in demand for crude oil. Market sentiment remains “bearish” as analysts fear a slowdown in demand recovery after new pandemic restrictions in Europe. For example, Germany, the largest oil consumer in the region, extended its isolation until April 18. In the US, the number of new infections may also grow during the spring break.

Over the past week, according to the American Petroleum Institute, US stocks of crude oil increased by 2.9M barrels, contrary to analysts' expectations of a decline of 900K. Official data from the Energy Information Agency will be released today. According to the forecast, a slight decrease in reserves by 272K barrels is expected.

Support and resistance

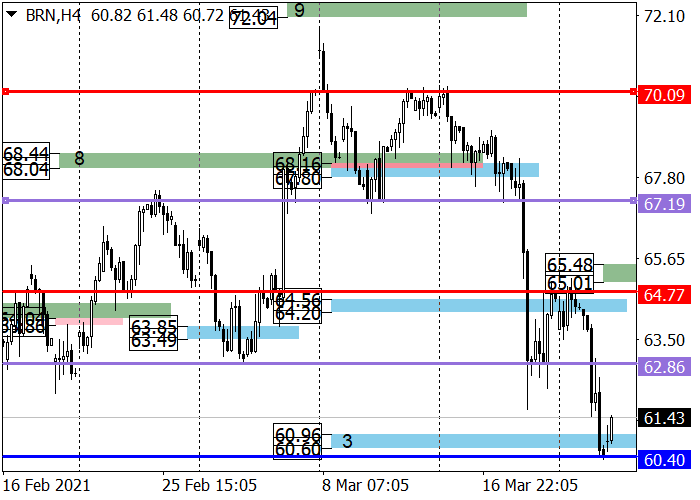

Yesterday, the key support of the long-term uptrend at the level of 63.03–62.61 was broken. The next downward target is the level of 59.33.

Within the medium-term downtrend, target zone 3 (60.96–60.60) was reached. The breakdown of 60.40 allows decline will continue to target zone 4 (57.36–57.00). The trend border shifts to 65.48–65.01.

Resistance levels: 63.03, 65.00, 67.55.

Support levels: 60.40, 59.33, 57.17.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks