EUR/USD: EUR is declining

Current trend

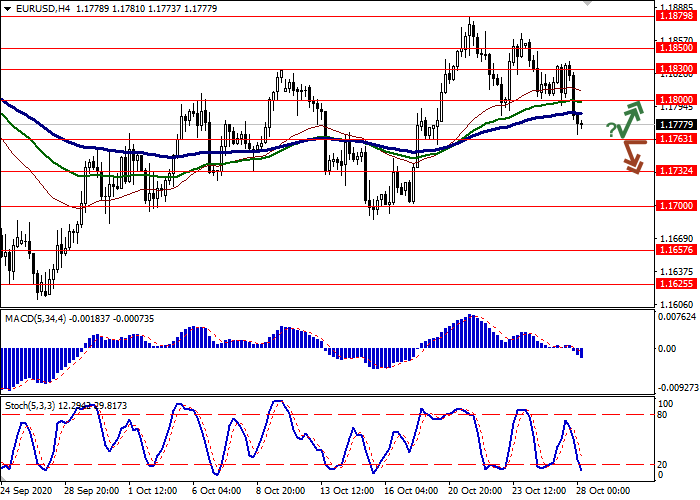

EUR shows moderate decline against USD today, retreating from local highs since September 16, updated the day before. Technical factors were the reason for the appearance of the "bearish" trend for the instrument, while USD remains under pressure amid expectations of new measures to support the American economy.

The deadline for the ultimatum put forward by the House of Representatives Speaker Nancy Pelosi expired the day before, but she chose to extend the deadline for one more day. In turn, Donald Trump has stepped up pressure on the Republican Party in an attempt to approve a larger aid package.

On Thursday, in addition to news regarding the long-awaited stimulus measures for the US, investors expect the publication of data on jobless claims in the US. Interesting data from Europe will appear on Friday, when the business activity indicators for October are released in Germany and the eurozone.

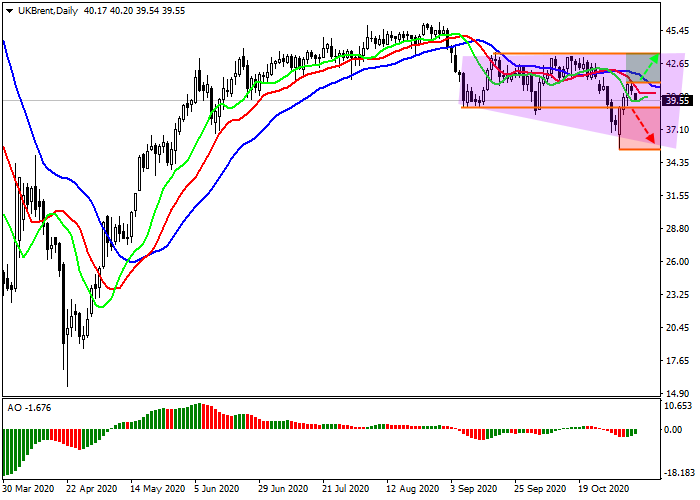

Support and resistance

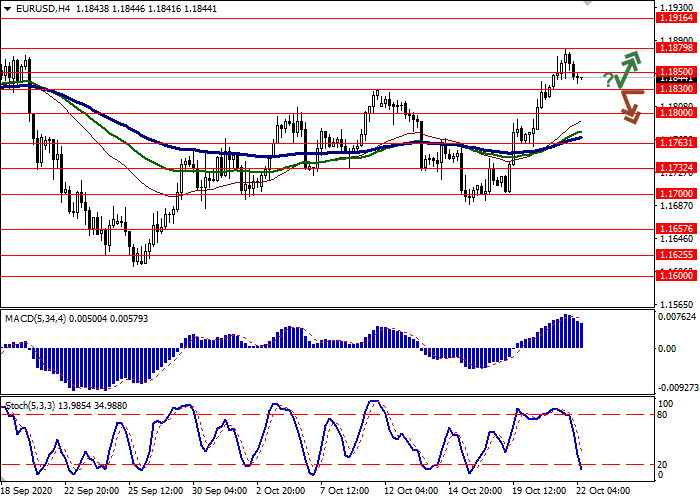

Bollinger Bands in D1 chart show moderate growth. The price range is expanding from above, but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing preserving a stable buy signal (located above the signal line). Stochastic keeps the uptrend but is approaching its highs, which reflects the risks of overbought EUR in the ultra-short term.

Technical indicators do not contradict the further development of the "bullish" trend in the short and/or ultra-short term.

Resistance levels: 1.1850, 1.1879, 1.1916, 1.1950.

Support levels: 1.1830, 1.1800, 1.1763, 1.1732.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks