EUR/USD: EUR is strengthening

Current trend

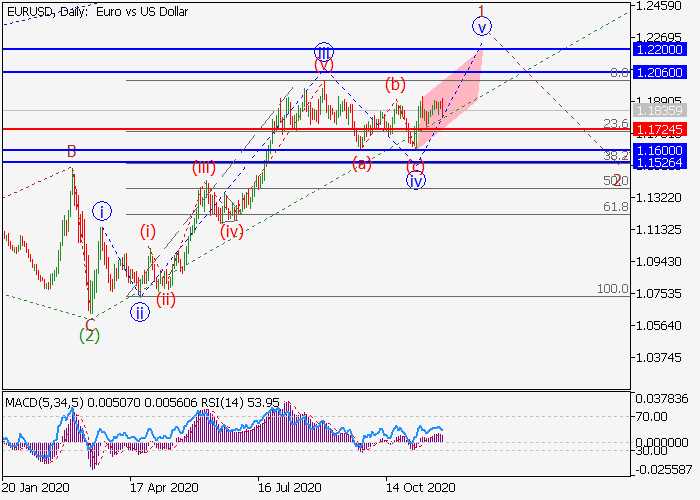

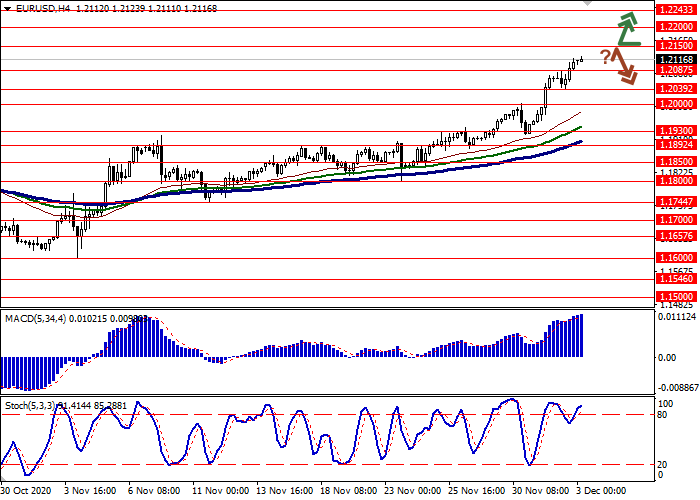

EUR is climbing again against USD during today's Asian session, recovering from a slight decline last Friday, which was triggered by the emergence of corrective sentiment in the market. USD positions remain under pressure, as the fundamental picture has changed slightly recently. Investors are concerned about the deteriorating epidemiological situation in the USA, which may eventually lead to additional budget spending and new restrictive measures, which have been diligently avoided by Donald Trump's administration.

However, investors pin their main hopes on the development of a vaccine against coronavirus. Unverified information appears in the media that vaccination of Americans may begin as early as December. Today, traders are focused on the publication of statistics on business activity in the euro area (Germany and France separately) for November. The indices in the manufacturing and services sector are expected to decline, which will be the projected response to restrictive measures in many EU countries.

Support and resistance

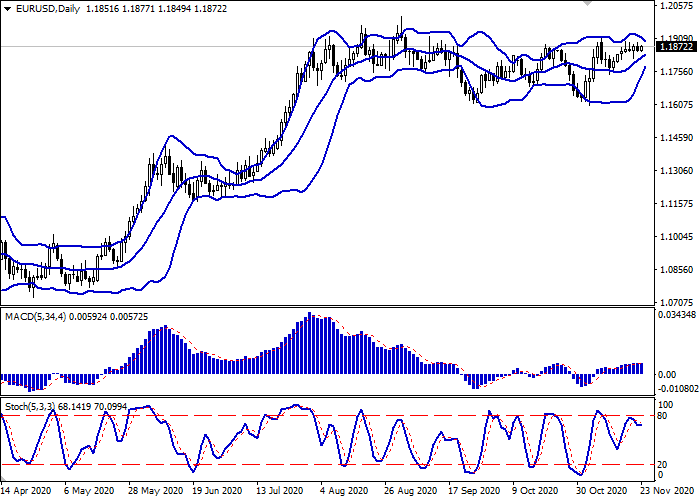

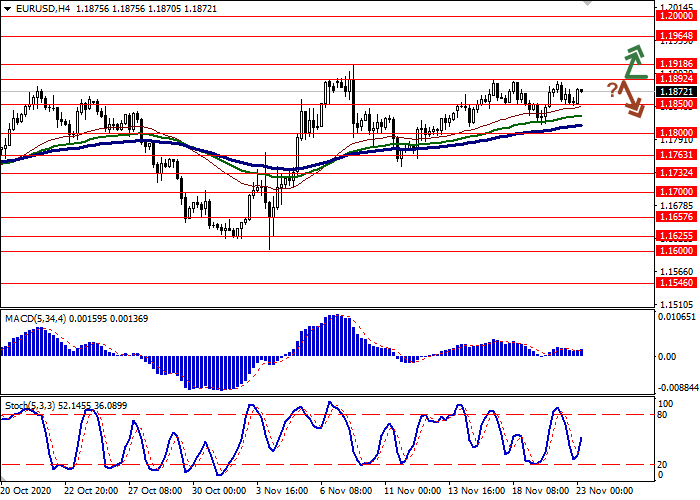

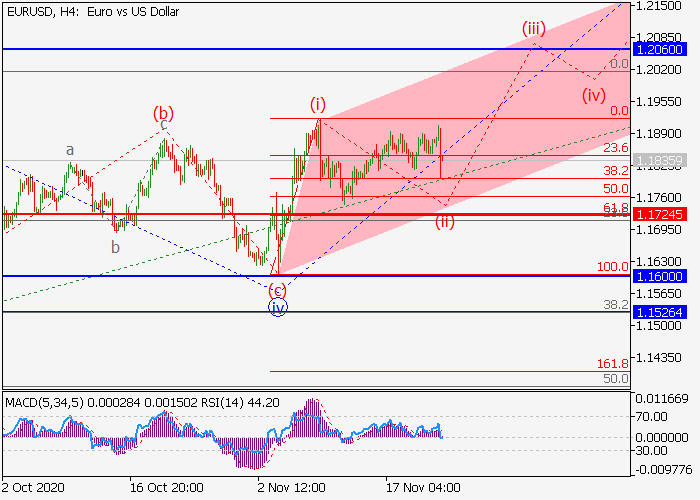

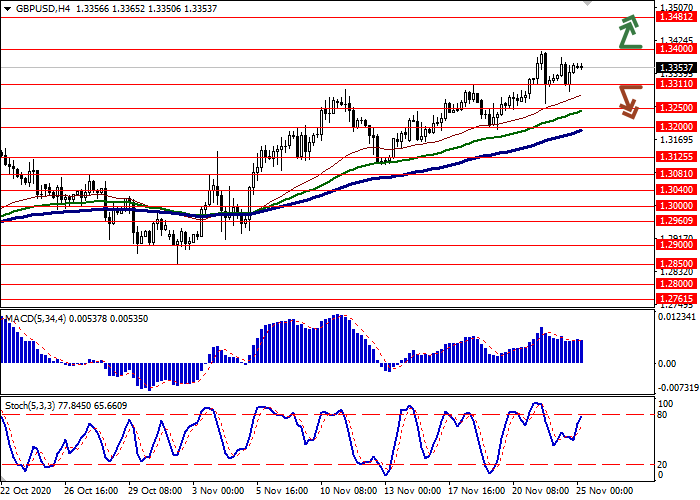

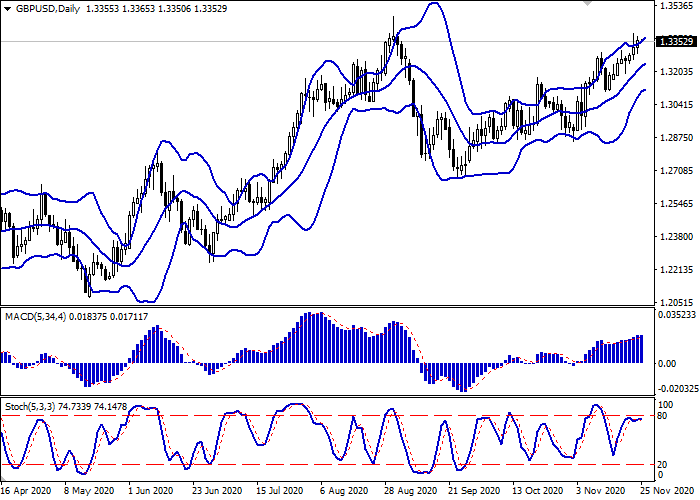

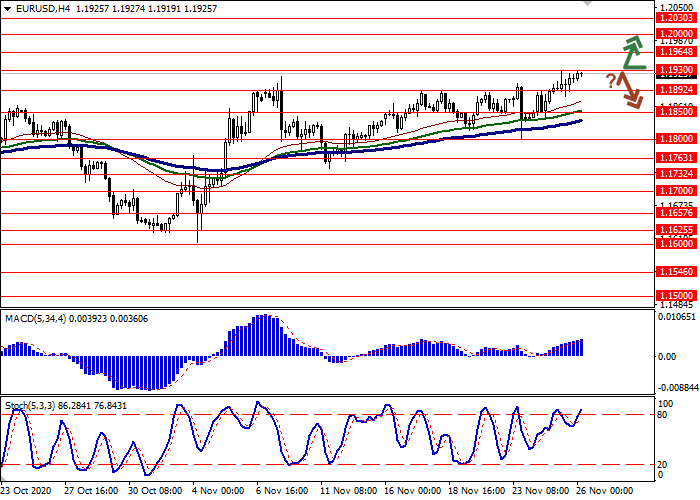

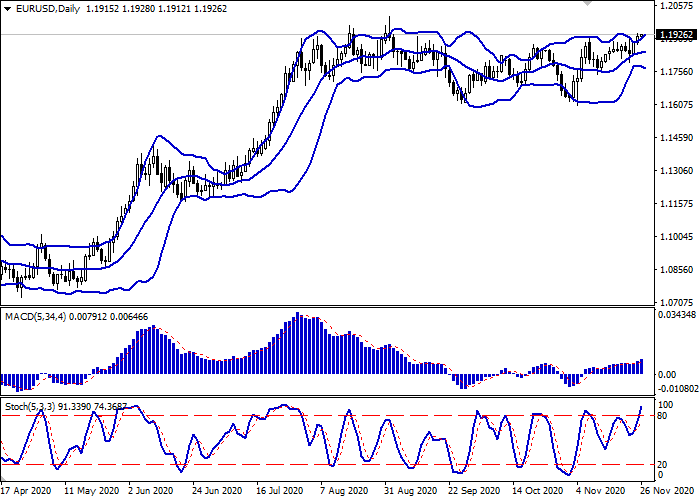

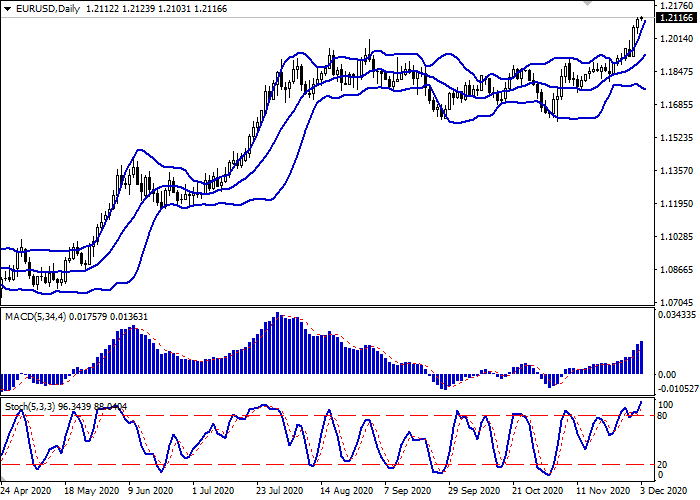

Bollinger Bands in D1 chart show moderate growth. The price range is actively narrowing, pointing at the flat nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic, having retreated from the level of "80", reversed into a horizontal plane, indicating fragile balance of power in the ultra-short term.

To open new trading positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 1.1892, 1.1918, 1.1964, 1.2000.

Support levels: 1.1850, 1.1800, 1.1763.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks