Brent Crude Oil: the instrument develops "bearish" momentum

Current trend

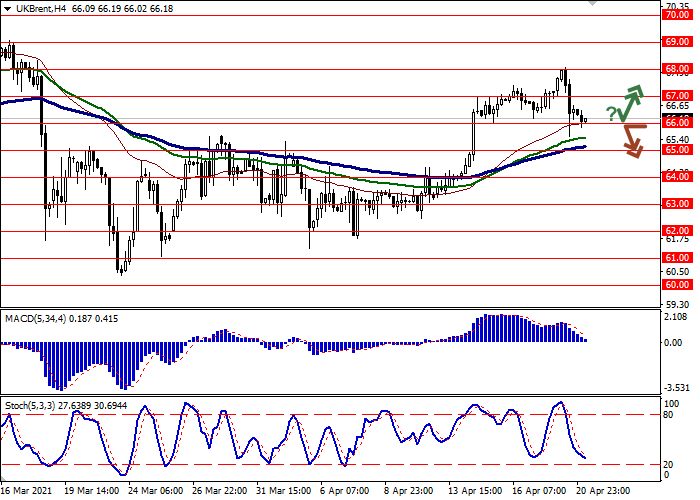

Brent crude oil prices are showing a slight decline, developing the "bearish" momentum formed the day before and preparing to test 66.00 for a breakdown. The instrument's positions are under pressure from the alarming situation with the incidence of coronavirus in Asia, while interruptions in the supply of Libyan oil somewhat counterbalance the situation.

The report of the American Petroleum Institute (API) on oil reserves released yesterday did not have a noticeable effect on the dynamics of the instrument. For the week ending April 16, published data showed a slight increase by 0.436M barrels after a decline of 3.608M barrels in the previous period.

Today, investors are waiting for the statistics on crude oil stocks from the US EIA. Forecasts assume a further 2.86M barrels decline after a 5.889M barrels decline in the previous period.

Support and resistance

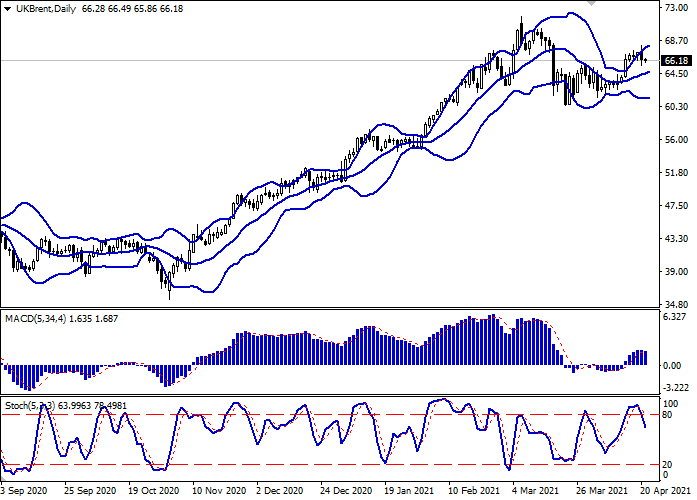

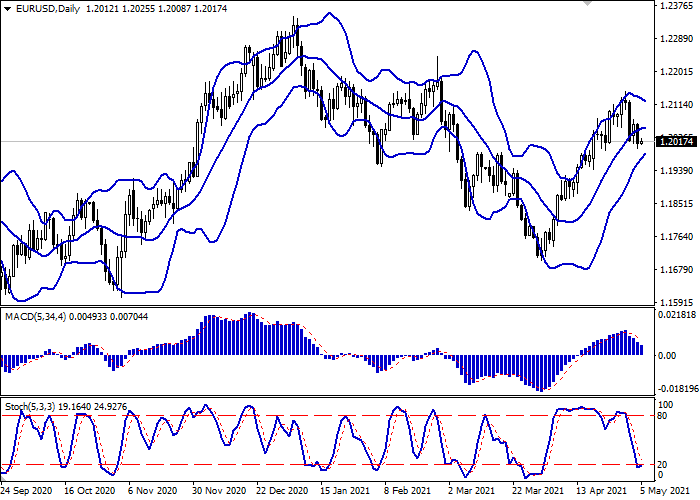

Bollinger Bands in D1 chart show weak growth. The price range is slightly expanded from above, remaining spacious enough for the current activity level in the market. MACD reversed downwards having formed a weak sell signal (located below the signal line). Stochastic is showing similar dynamics, retreating from its highs, indicating the overbought instrument in the ultra-short term.

Current indicators do not contradict the further development of the "bearish" trend in the ultra-short term.

Resistance levels: 67.00, 68.00, 69.00, 70.00.

Support levels: 66.00, 65.00, 64.00, 63.00.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks