WTI Crude Oil: a sharp drop in crude stocks supported prices

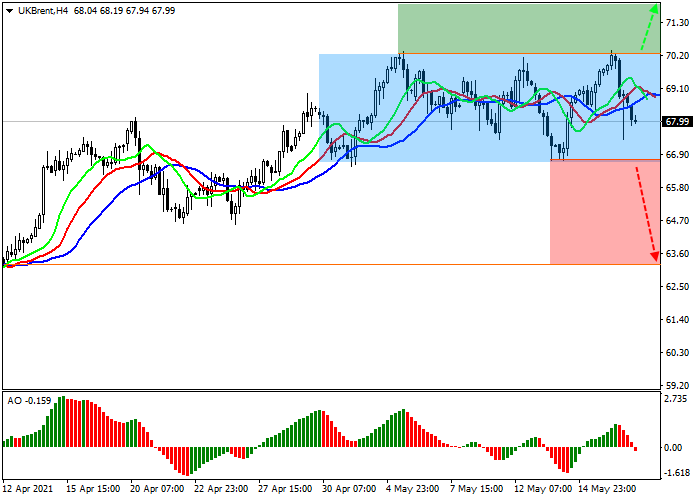

Current trend

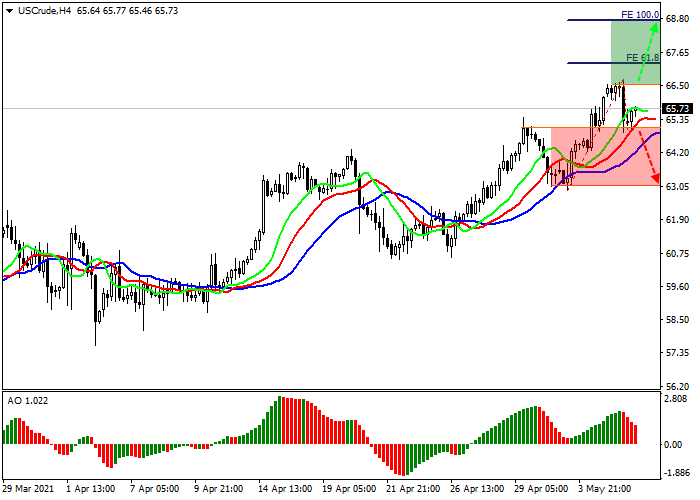

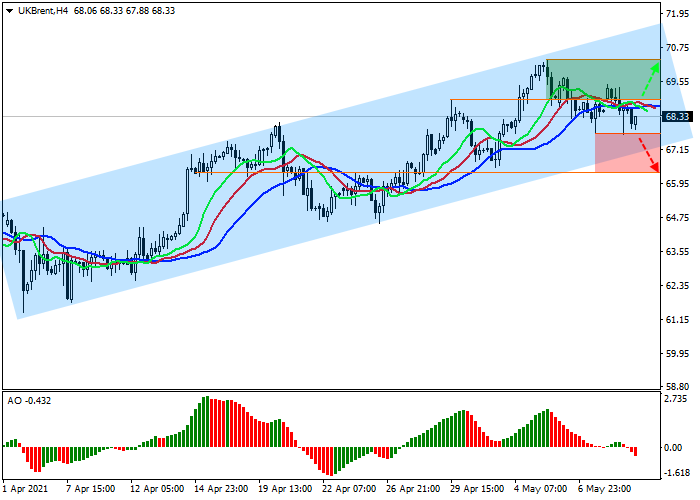

The price of North American light oil, WTI Crude Oil, moves within a corrective uptrend, trading at the level of 65.73.

The quotes received significant support after the American Petroleum Institute (API) and the Energy Information Administration (EIA) published their reports on reserves this week. According to API data, inventories in storage facilities decreased by 7.688M barrels, which is significantly higher than the expected decrease by 2.191M. A day later, the EIA reported a drop in inventories of American firms by 7.990M barrels, which is significantly higher than the expected 2.346M. for a week, could not but provoke the growth of the instrument. The upward dynamics may continue until the end of the week.

Support and resistance

On the local chart, the price continues its corrective growth, trading above the key level of $65. Technical indicators are in the state of a buy signal, completing a local correction: the fluctuation range of the Alligator EMA is ready for a new extension, and the AO oscillator histogram is in the buy zone, although it is still forming downwards bars.

Resistance levels: 66.50, 68.70.

Support levels: 65.00, 63.00.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks