NZD/USD: the likelihood of a decline in the USD increased

Current trend

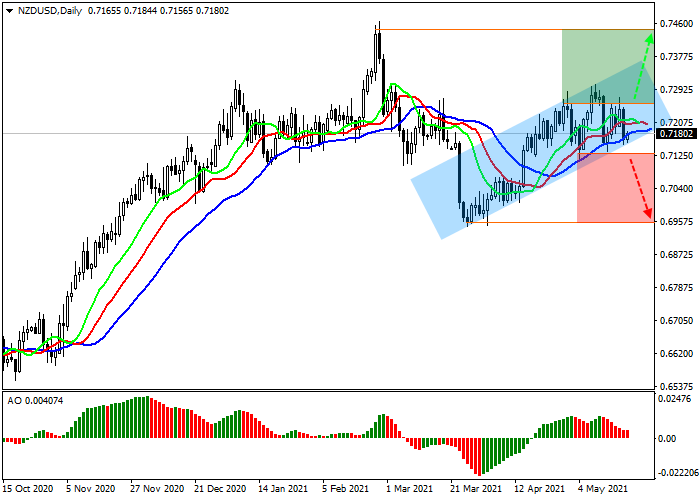

The NZD/USD pair corrects and is currently trading near the level of 0.7181, trying to consolidate within an uptrend.

The latest statistics from New Zealand did not affect the price significantly. Thus, the Q1 producer purchase price index increased by 2.1%, while a quarter earlier the growth was only 0.1%. The selling price index increased by 1.2%, which was higher than the previous value of 0.5%. The Reserve Bank of New Zealand's net debt may fall to 34.00%, up from 39.70% in the last analyst forecast.

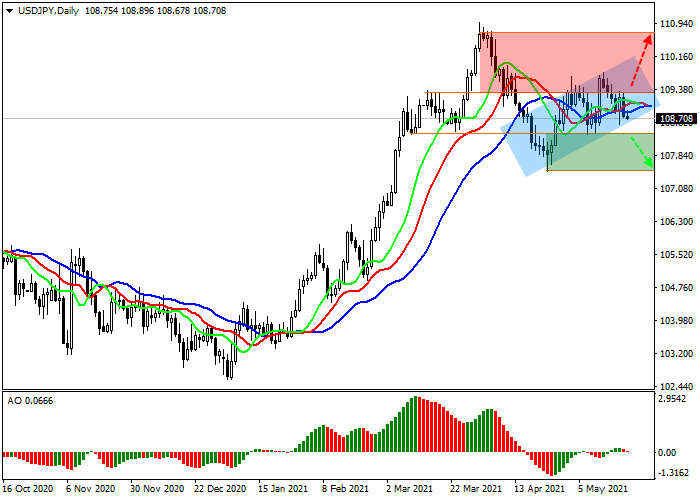

Although the publication of the US Federal Reserve Open Market Committee (FOMC) Meeting Minutes did not give clear hints of further actions of the regulator on monetary policy, the statements of several officials forced investors and analysts to take even more seriously a possible change of course at the next meetings. Inflation is accelerating and the authorities need to take measures to contain it. The debt market reacted sharply to the increased likelihood of rate hikes. The yield on the key 10-year US Treasuries reached 1.680%, while yesterday morning it was 1.641%. An increase in yield is a negative signal for USD, which is now on the verge of a new cycle of decline.

Support and resistance

The price moves within the local upward correction. Technical indicators keep a poor buy signal: fast EMAs on the Alligator indicator are above the signal line, and the AO oscillator histogram is in the buy zone.

Support levels: 0.7131, 0.6950.

Resistance levels: 0.7257, 0.7443.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks