Morning Market Review

EUR/USD

EUR is showing ambiguous trading dynamics during today's Asian session, consolidating at 1.1730. The day before, EUR showed a steady decline and retreated from its local highs since September 21, which was associated with a rather unexpected statement from Donald Trump, who suspended negotiations on a new program to support the US economy until the November elections. Interestingly, Trump made this statement just a few hours after the speech by the US Fed Chairman Jerome Powell, who reiterated the urgent need for new stimulus measures and pointed out the risks of a recession in the American economy. The President of the ECB Christine Lagarde also spoke about the need for new support measures on Tuesday, reminding the markets that the regulator is still able to reduce rates to negative values.

GBP/USD

GBP is trading with multidirectional dynamics during today's morning session, slightly recovering after the active decline the day before, which interrupted the uncertain "bullish" trend for the instrument since September 24. GBP reacted with a confident fall to the statements of Donald Trump, who decided to end the controversy over a new stimulus program for the US economy and postponed this process until after the November presidential elections. Investors were disappointed with these statements, as at the beginning of the week the market was dominated by direct opposite sentiments and traders were selling USD on growing expectations of a quick approval of a new package of measures. Today, traders are focused on the US Fed Meeting Minutes and the speech by the Fed representative John Williams.

AUD/USD

AUD shows a slight increase against USD during today's Asian session, correcting after an active decline yesterday, which was triggered by a new wave of growth in investor demand for safe assets. USD has significantly strengthened after Donald Trump's statement on the decision to postpone the discussion of a new package of measures to support the American economy until the November presidential elections. Some pressure on AUD on Tuesday was also exerted by the decision of the RBA to keep interest rate at 0.25%. However, despite extensive discussion of the possibility of further rate cuts, little was expected from the regulator at the current meeting. The dynamics of Exports was much more disappointing, as the figure fell by 4.2% MoM in August after falling by 3.4% MoM in the previous month. Against the background of a slowdown in Imports from +6.2% MoM to +2% MoM, this led to a sharp decrease in the Trade Surplus from AUD 4.652B to AUD 2.643B, which turned out to be significantly worse than market expectations at AUD 5.154B.

USD/JPY

USD has shown a slight increase during today's morning trading session, recovering from an uncertain decline the day before, which did not allow USD to consolidate at new local highs since September 15. The market has actively reacted to Donald Trump's intention to suspend the process of discussing new support measures for the American economy, but JPY is already in high demand as a safe haven currency today. The speech of the US Federal Reserve head Jerome Powell also contributed to the reduction of the demand for risk on Tuesday. The Chairman of the regulator noted that the process of recovery of the American economy is far from complete and there are still significant downside risks on the market, associated with the renewed increase in the incidence of coronavirus. Powell called for support for households, but now it seems that this will have to wait a while, unless party representatives are able to take the initiative and make significant concessions.

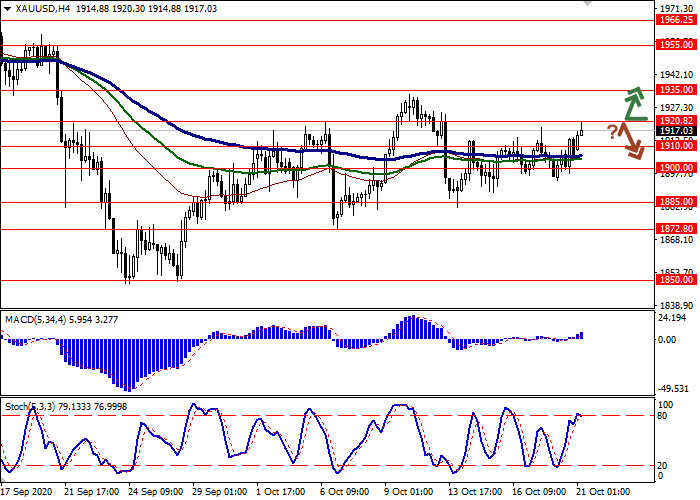

XAU/USD

Gold prices are showing ambiguous dynamics during today's Asian session, staying below 1900.00, the breakdown of which was recorded the day before. The strengthening of the "bearish" dynamics on Tuesday was associated with a rather unexpected statement by Donald Trump, who decided to suspend the negotiations on a new fiscal stimulus package until the end of the presidential elections in November. The President's statement came against the backdrop of numerous calls for further support for the American economy, as well as against the backdrop of outlined progress in the discussions (at the beginning of the week, regular talks were held between House Speaker Nancy Pelosi and US Treasury Secretary Steven Mnuchin).

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks