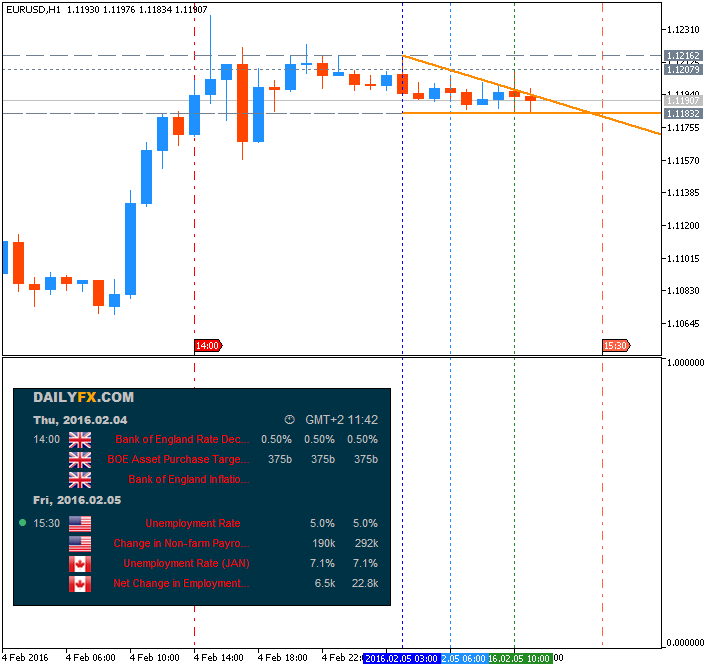

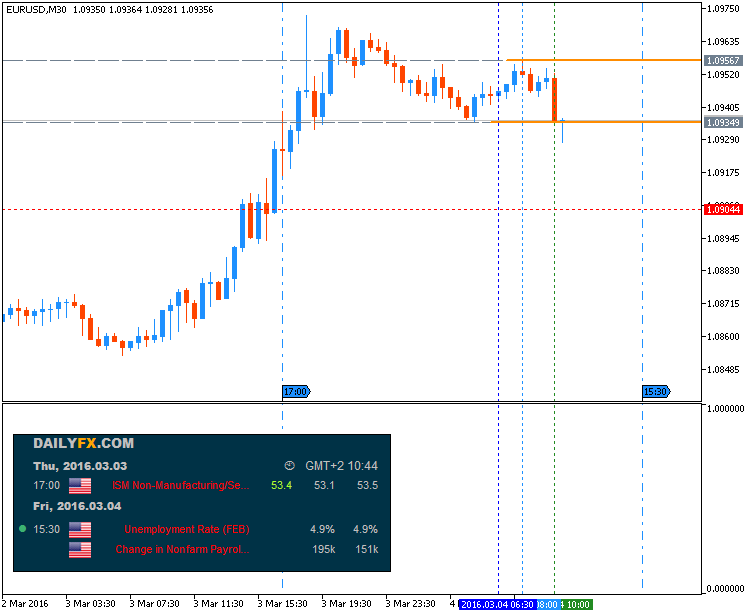

Trading the News: U.S. Non-Farm Payrolls

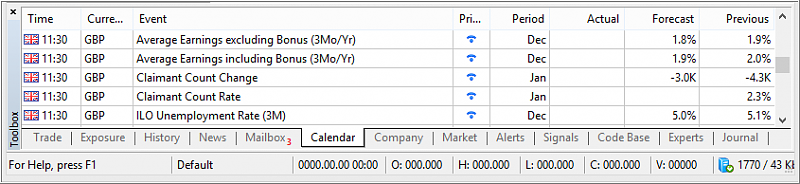

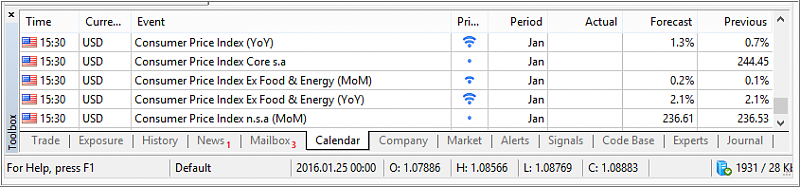

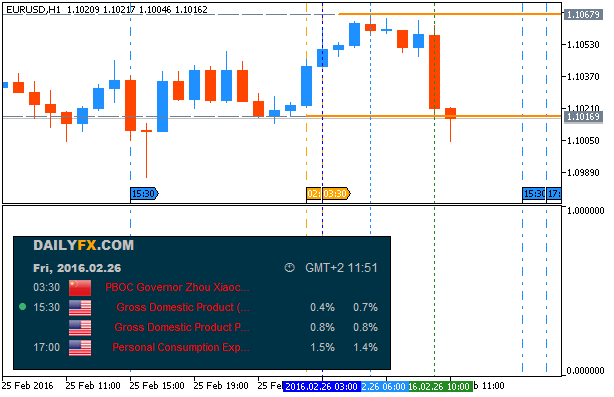

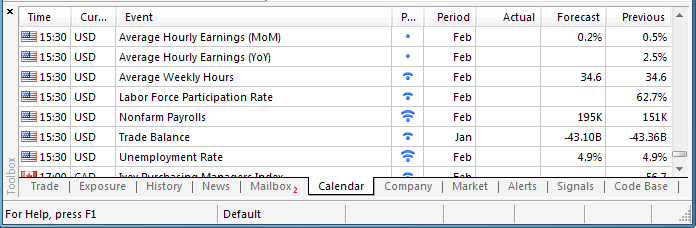

Another 190K expansion in Non-Farm Payrolls (NFP) may boost the appeal of the greenback as the U.S. economy approaches ‘full-employment,’ but a marked slowdown in wage growth may fuel the near-term rally in EUR/USD as it dampens bets for a Fed rate-hike in the first-half of 2016.

What’s Expected:

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) appears to be on course to implement higher borrowing-costs over the coming months, the disinflationary environment across the major industrialized economies may keep the Fed on the sidelines for most of the year as central bank officials look for greater evidence of achieving the 2% target for price growth.

However, the persistent slack in private-sector consumption paired with the rise in planned job-cuts may drag on employment, and a soft labor report along with a marked slowdown in wage growth may spark a further depreciation in the dollar as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk

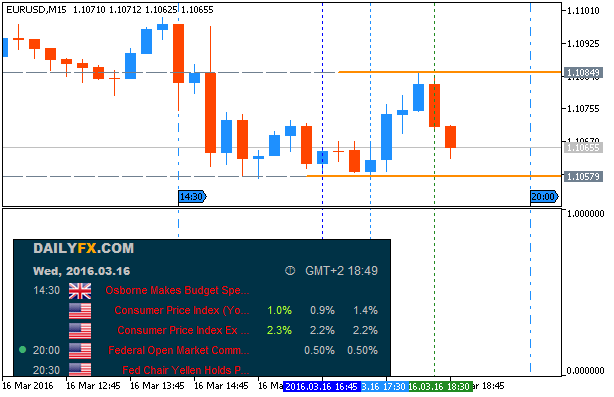

Bullish USD Trade: NFP Climbs 190K+, Hourly Earnings Highlight Sticky Wage Growth

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Employment Report Fails to Meet Market Forecast

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

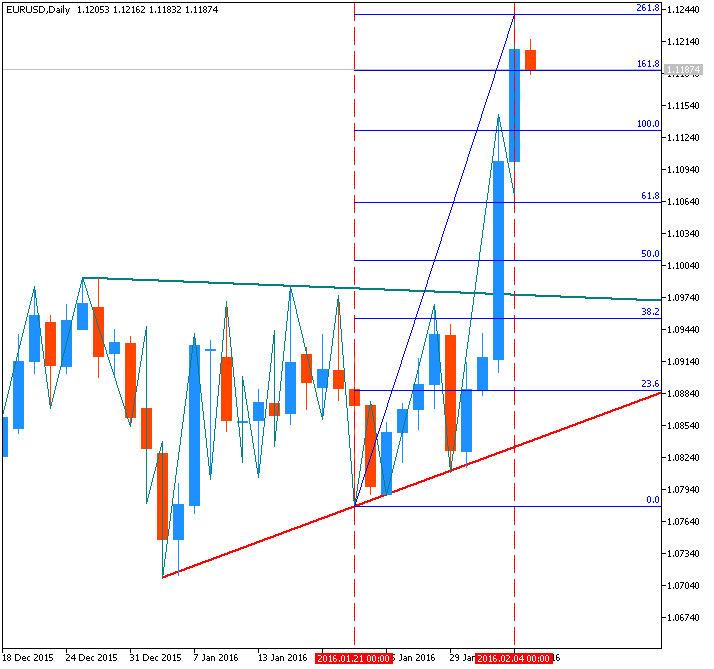

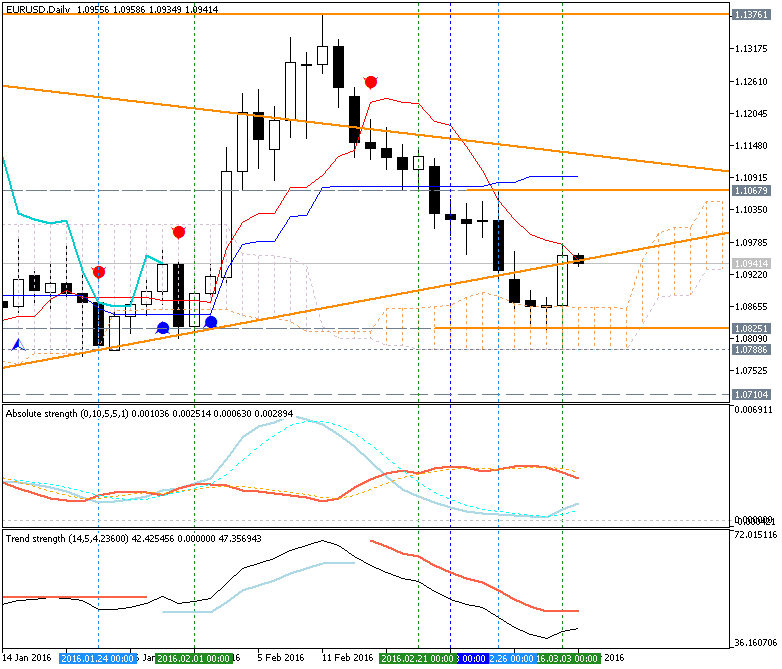

Potential Price Targets For The Release

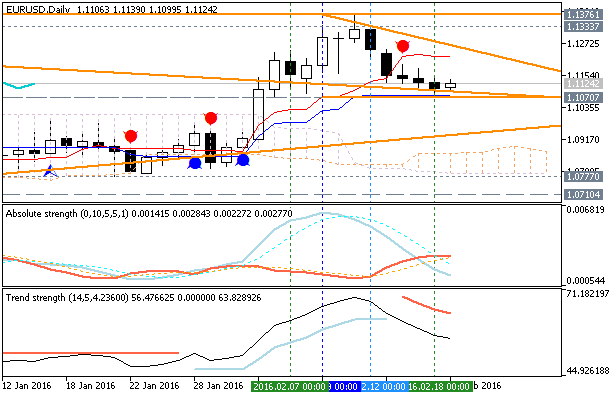

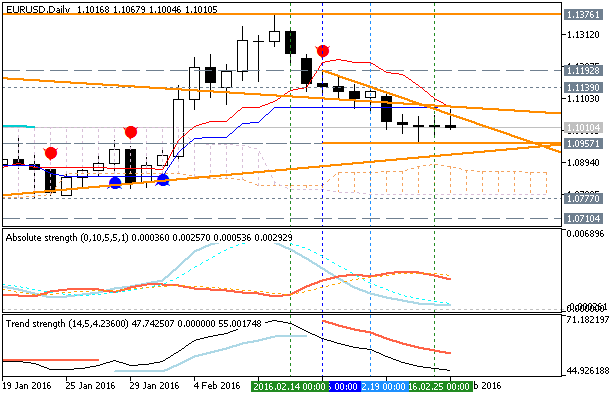

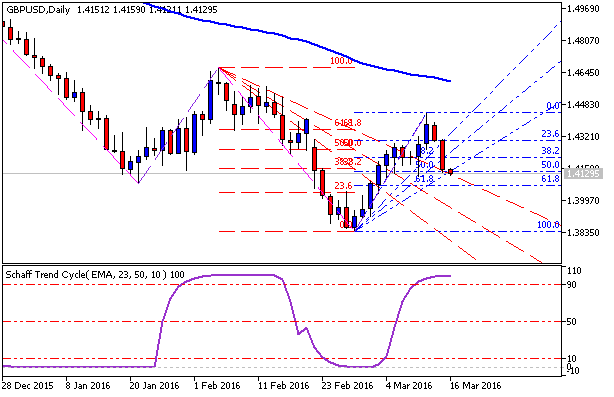

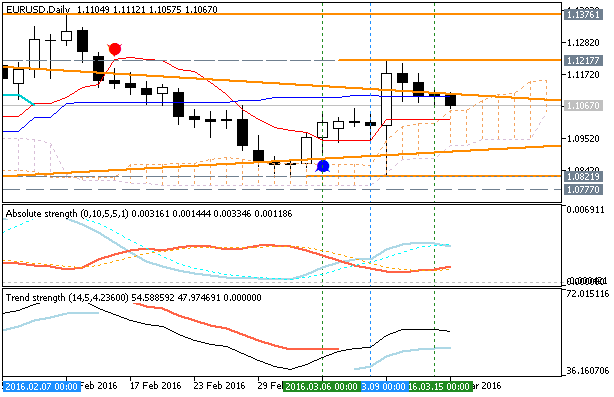

EURUSD Daily

- Even though the diverging paths for monetary policy casts a long-term bearish outlook for EUR/USD, the pair may test the broad range from the previous year as it appears to be breaking out of the downward trend carried over from the end of 2014; will keep a close eye on the Relative Strength Index (RSI) as it approaches overbought territory, with a break above 70 highlighting the risk for a further advance in the exchange rate.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

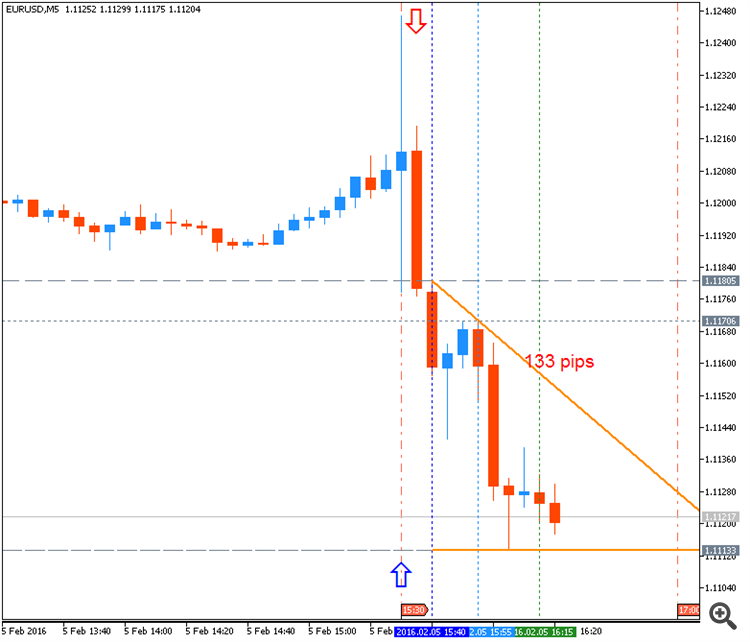

December 2015 U.S. Non-Farm Payrolls

EURUSD M5: 57 pips price movement by USD - U.S. Non-Farm Employment Change news event:

more...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks