- Headline U.S. Consumer Price Index (CPI) to Rise for First Time in 2015.

- Core Rate of Inflation to Climb to Annualized 1.8% to Mark First Uptick Since March.

Trading the News: U.S. Consumer Price Index (CPI)

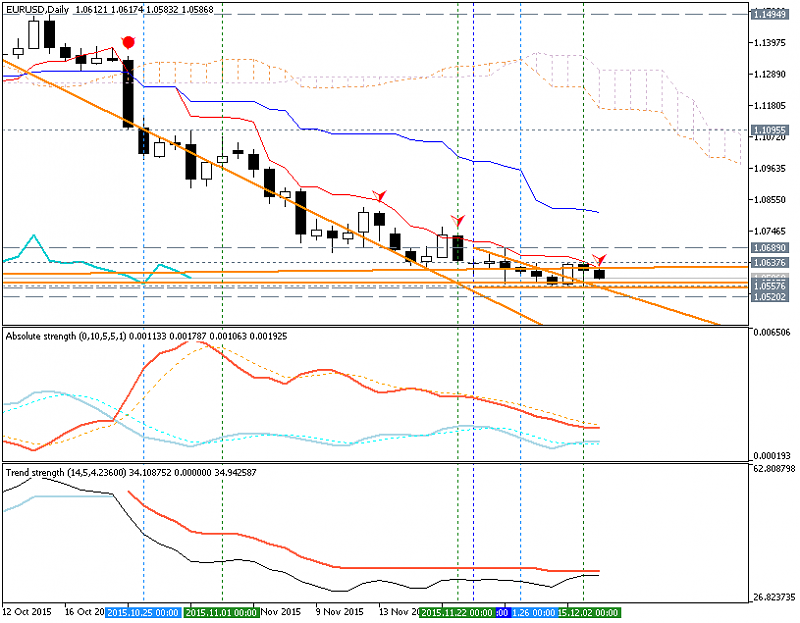

A meaningful pickup in the U.S. Consumer Price Index (CPI) may boost the appeal of the greenback and spur fresh monthly lows in EUR/USD as it fuels speculation for a Fed rate hike in 2015.

What’s Expected:

Why Is This Event Important:

Signs of stronger price growth may encourage the Fed to adopt a more hawkish tone for monetary policy, and we may see a growing number of central bank officials show a greater willingness to remove the zero-interest rate policy (ZIRP) later this year as Chair Janet Yellen remains confident in achieving the 2% target for inflation over the policy horizon.

Expectations: Bullish Argument/Scenario

Release Expected Actual Producer Price Index ex Food & Energy (YoY) (JUN) 0.1% 0.3% Unemployment Rate (JUN) 5..4% 5.3% ADP Employment Change (JUN) 218K 237K

Rising input costs along with the ongoing improvement in the labor market may push U.S. firms to raise consumer prices, and a strong inflation report may heighten the bullish sentiment surrounding the dollar as the Fed remains on course to normalize monetary policy.

Risk: Bearish Argument/Scenario

Release Expected Actual Philadelphia Fed Business Outlook Survey (JUL) 12.0 5.7 Advance Retail Sales (MoM) (JUN) 0.3% -0.3% NFIB Small Business Optimism (JUN) 98.5 94.1

However, waning business confidence paired with the weakness in private-sector consumption may continue to drag on price growth, and a dismal CPI print may generate a near-term rebound in EUR/USD as it drags on interest rate expectations.

How To Trade This Event Risk

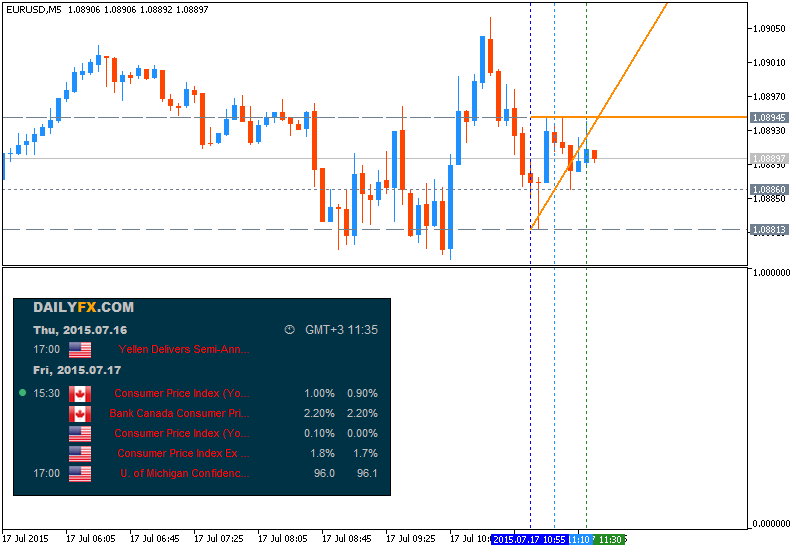

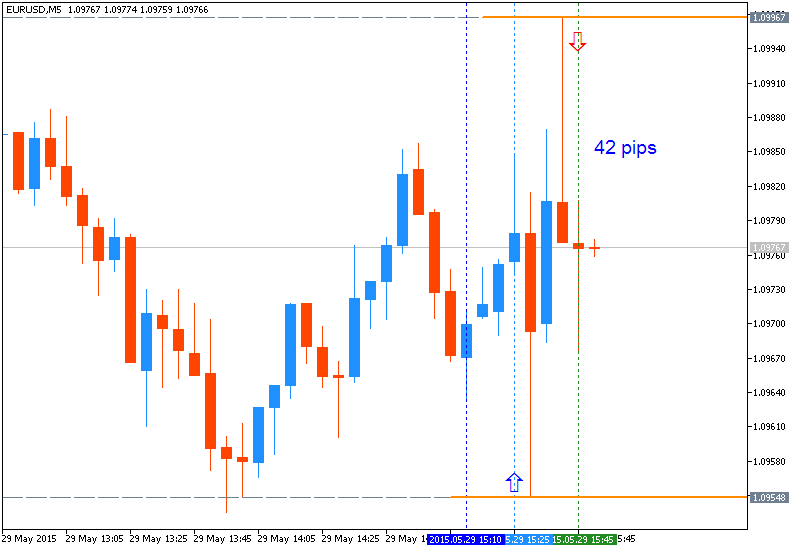

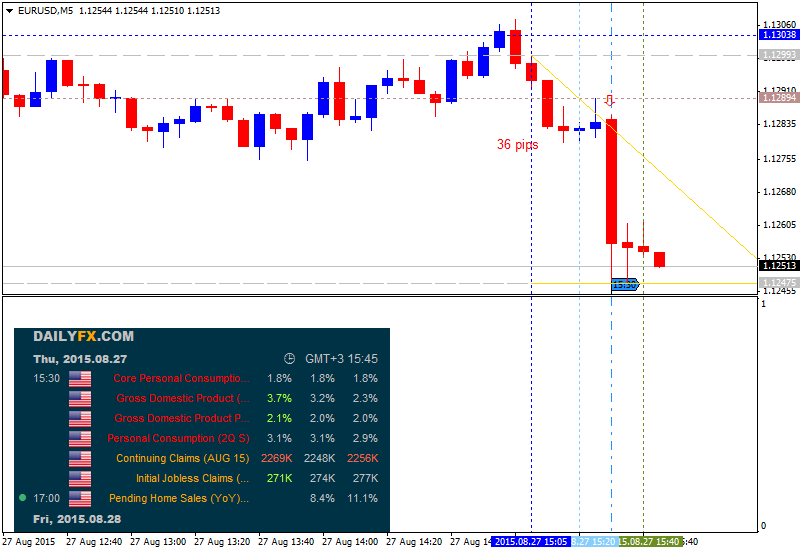

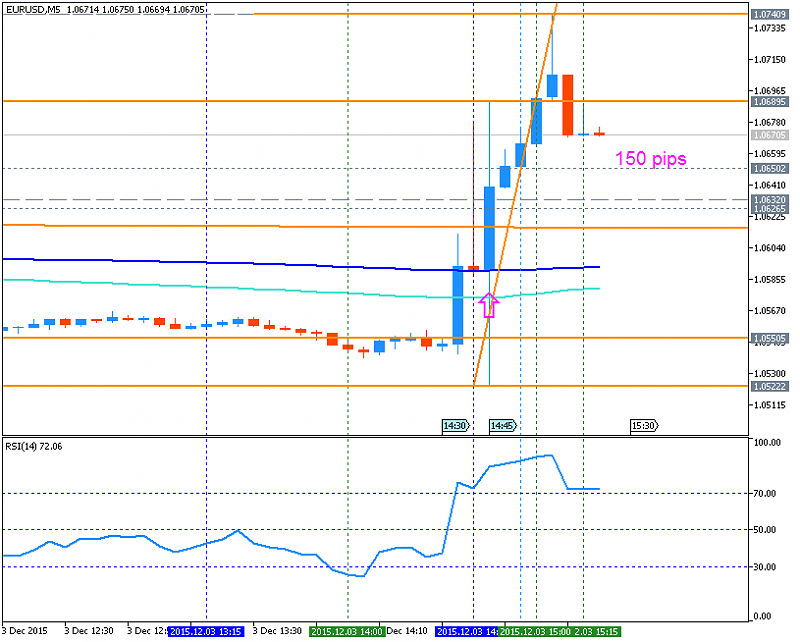

Bullish USD Trade: U.S. Headline & Core CPI Picks Up in June

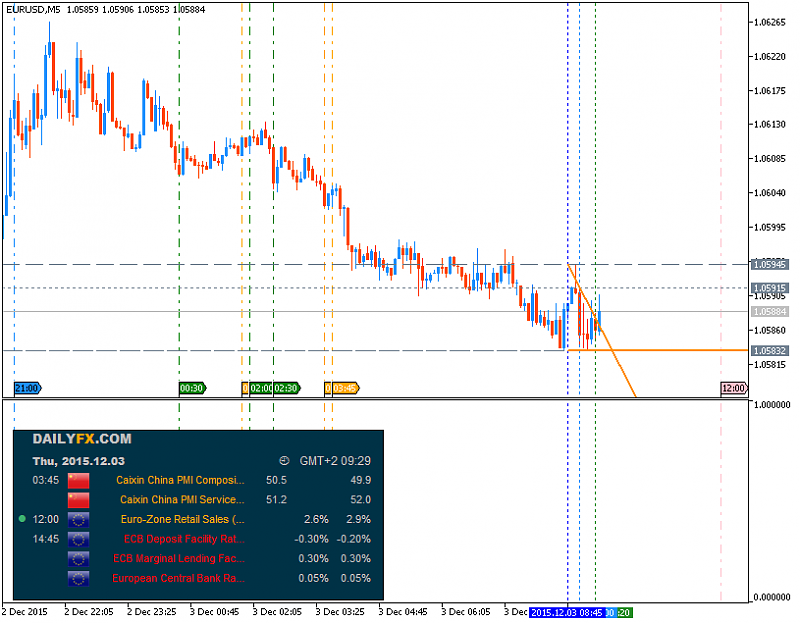

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Consumer Price Inflation Falls Short of Market Expectations

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

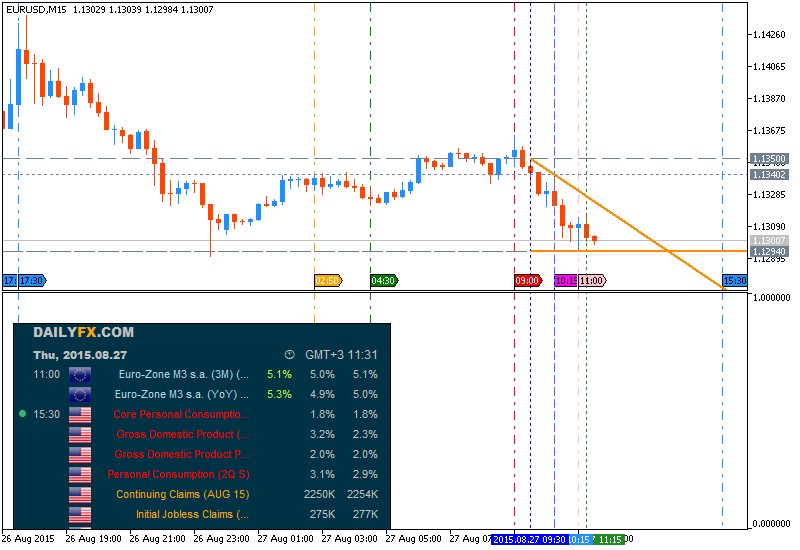

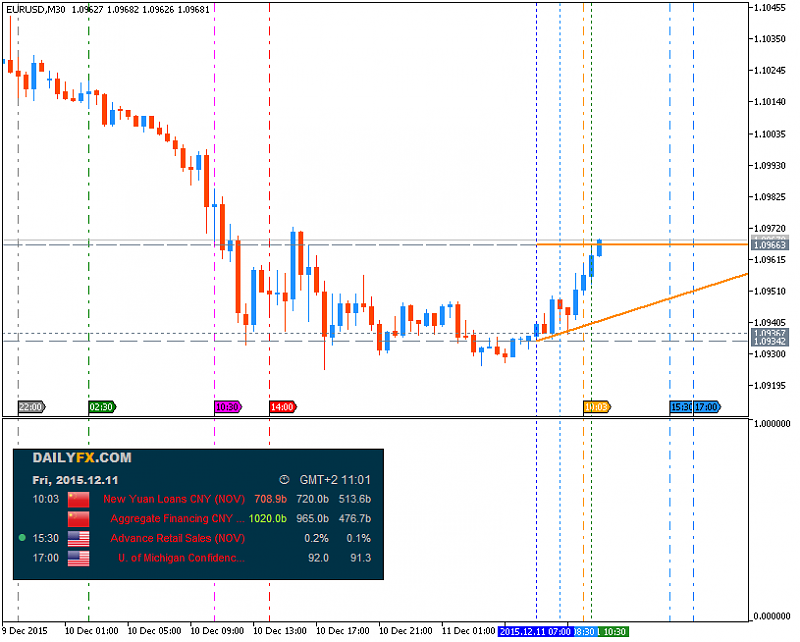

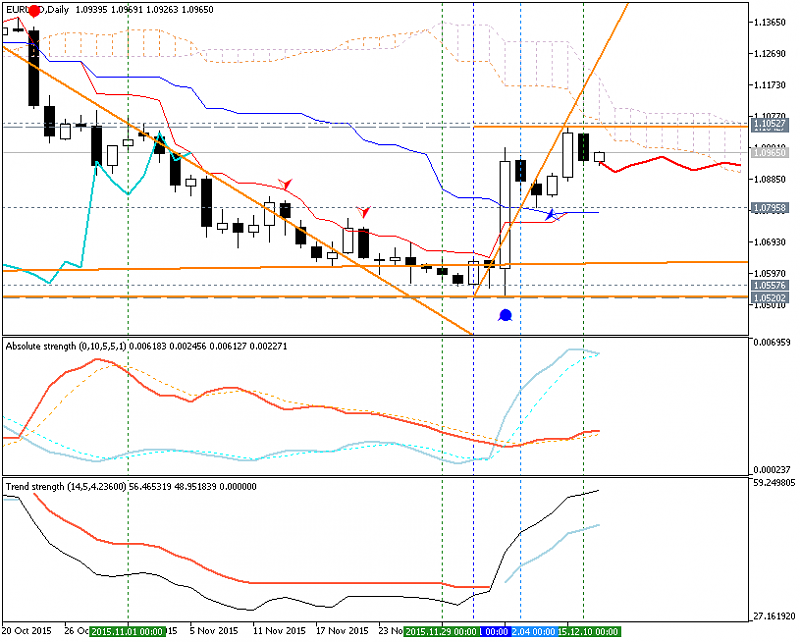

Potential Price Targets For The Release

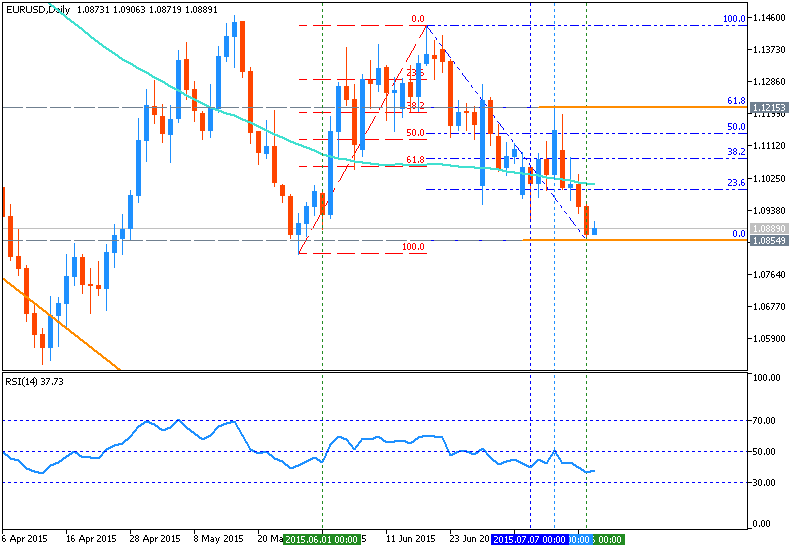

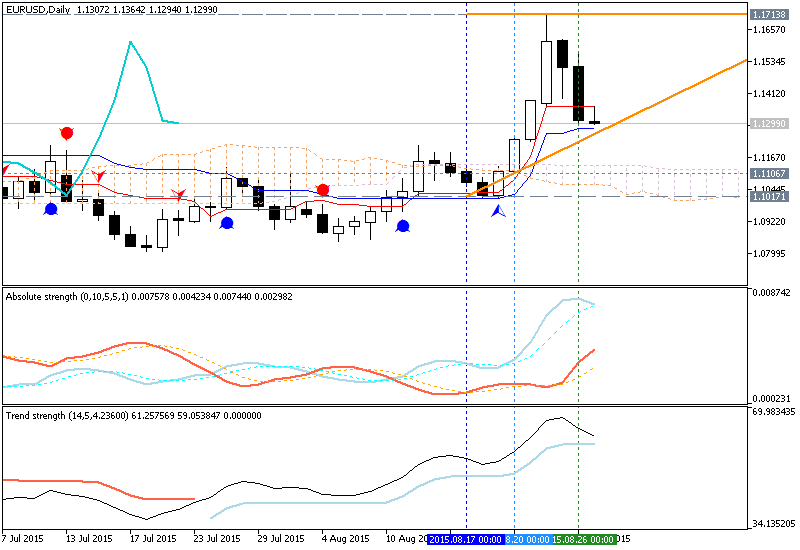

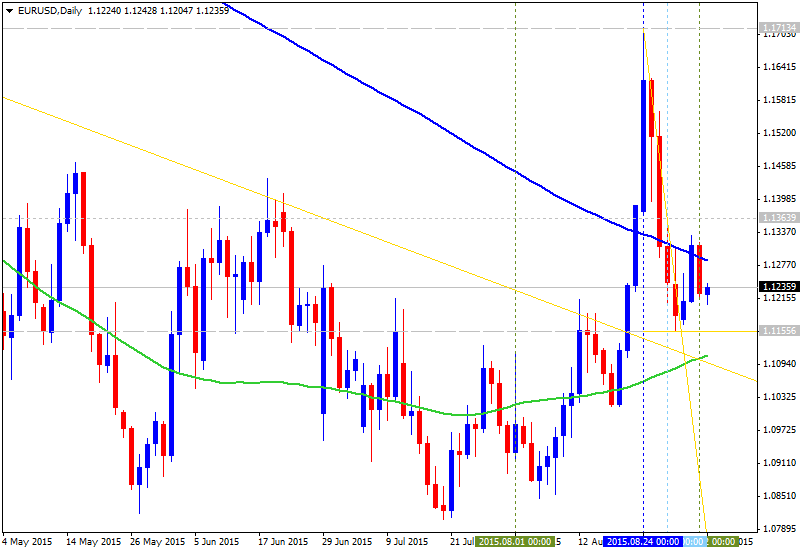

EURUSD Daily

- May see a run at the May low (1.0818) as EUR/USD fails to retain the range-bound price action carried over from the previous week; even though the long-term outlook remains bearish, the euro-dollar may continue to consolidate over the near to medium-term as it retains the wedge/triangle formation from earlier this year.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

more...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks