- U.K. Consumer Price Index (CPI) to Slow for Fourth Time in 2014.

- Core Inflation to Fall Back From 2.0%- Marked Fastest Rate of Growth Since September.

Trading the News: U.K. Consumer Price Index

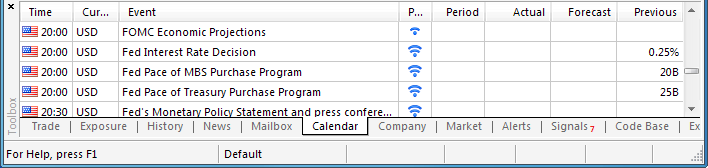

A marked slowdown in the U.K.’s Consumer Price Index (CPI) may generate a larger pullback in the GBP/USD as it limits Bank of England (BoE) scope to normalize monetary policy sooner rather than later.

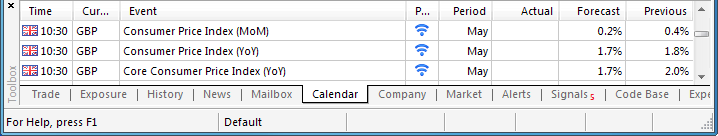

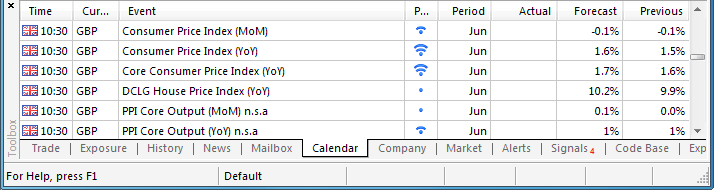

What’s Expected:

Why Is This Event Important:

Nevertheless, the BoE Minutes due out later this week may reveal a growing dissent within the Monetary Policy Committee (MPC) as U.K. officials see a stronger recovery in 2014, and the market reaction to the U.K. CPI print could be short-lived should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

Expectations: Bearish Argument/Scenario

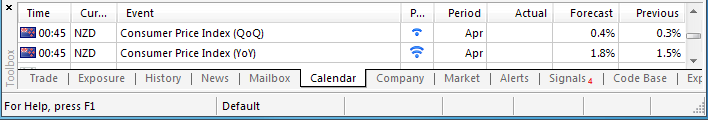

Release Expected Actual Average Weekly Earnings inc Bonus (3MoY) (APR) 1.2% 0.7% Net Consumer Credit (APR) 0.8B 0.7B CBI Trends Selling Prices (MAY) 10 4

U.K. firms may offer discounted prices amid weak wage growth paired with the slowdown in private sector credit, and a weak inflation print may undermine the near-term outlook for the GBP/USD as it drags on interest rate expectations.

Risk: Bullish Argument/Scenario

Release Expected Actual Jobless Claims Change (MAY) -25.0K -27.4K Private Consumption (QoQ) (1Q P) 0.6% 0.8% Retail Sales inc. Auto (MoM) (MAR) 0.4% 1.3%

Nevertheless, the resilience in private sector consumption along with the ongoing improvement in the labor market may limit the downside risk for price growth, and a stronger-than-expected CPI print may heighten the bullish sentiment surrounding the sterling as it fuels bets for a rate hike.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slips to 1.7% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline Reading for Inflation Exceeds Market Forecast

- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

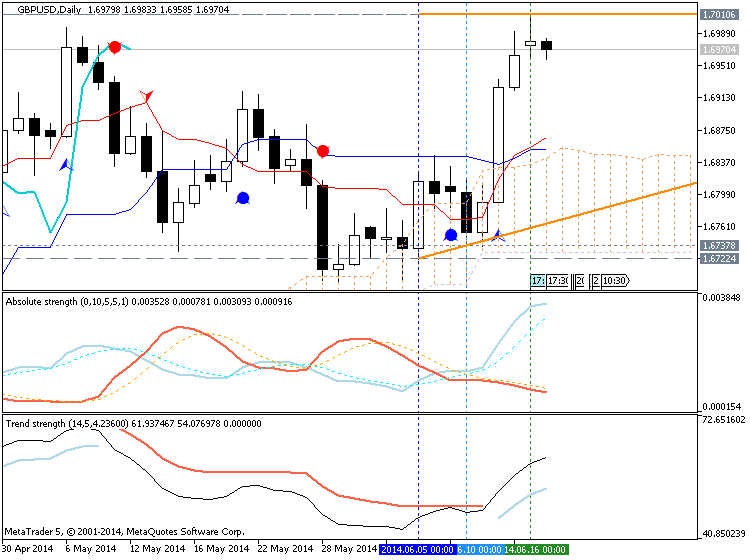

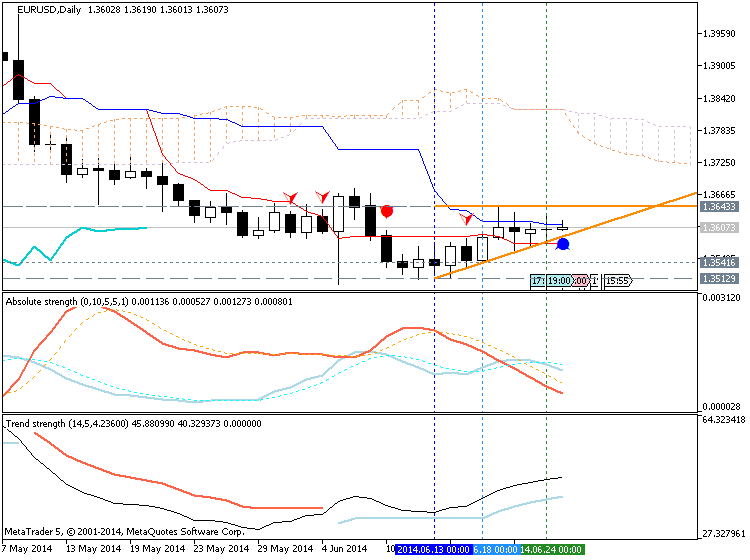

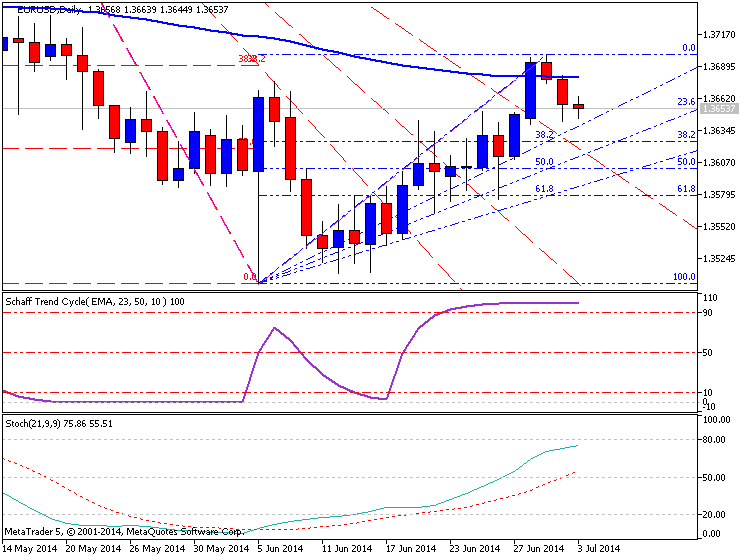

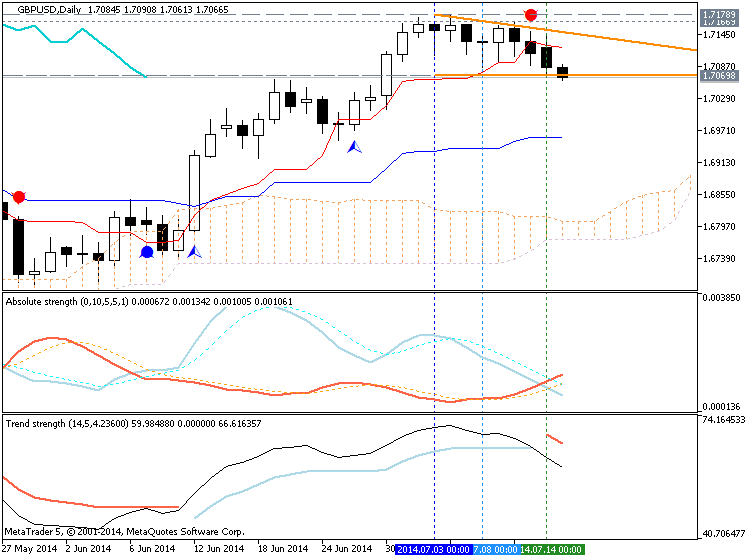

Potential Price Targets For The Release

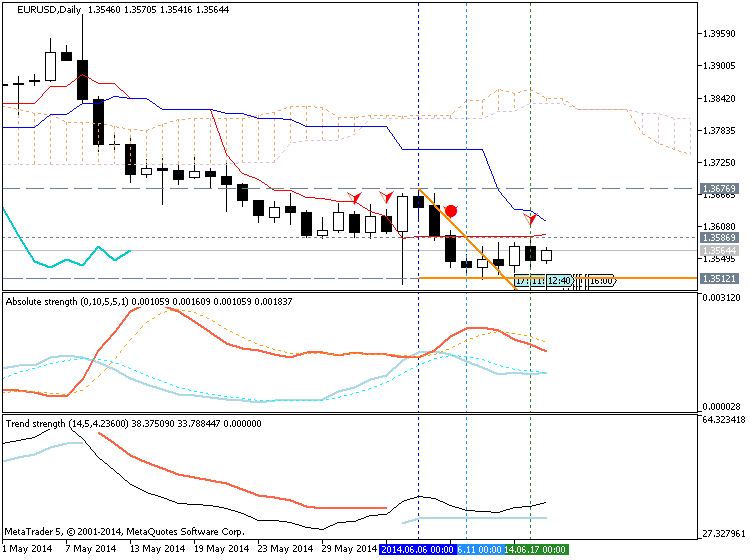

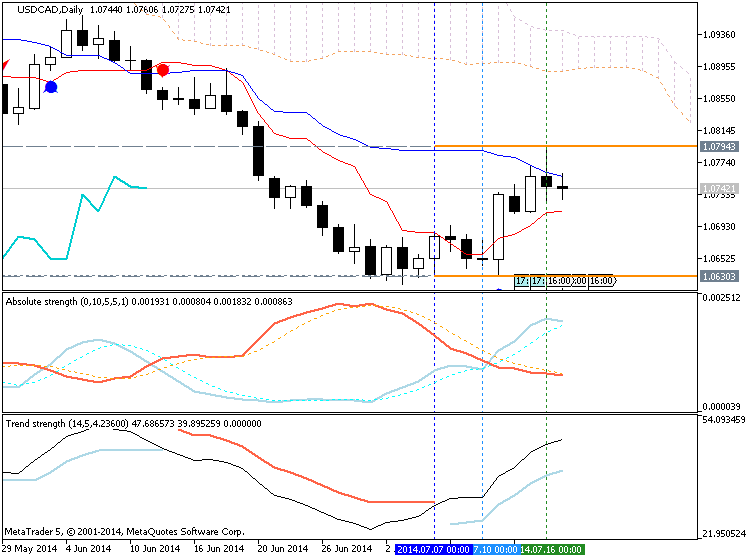

GBP/USD Daily

- Carves Series of Higher-Lows in June; Higher-High in Place?

- Interim Resistance: 1.7000 Pivot to 1.7030 (100.0% expansion)

- Interim Support: 1.6720 (61.8% expansion) to 1.6730 (50.0% retracement)

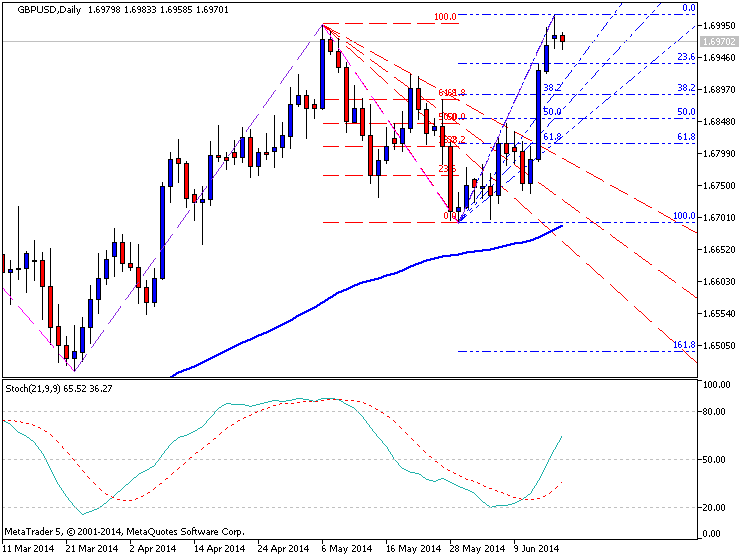

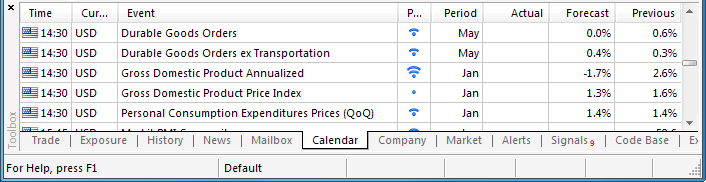

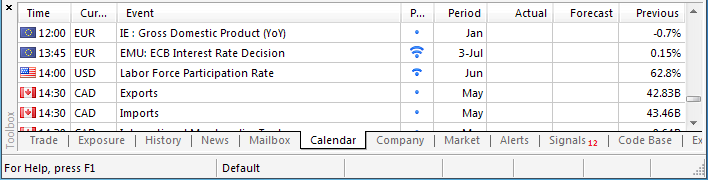

Impact that the U.K. CPI report has had on GBP during the last release

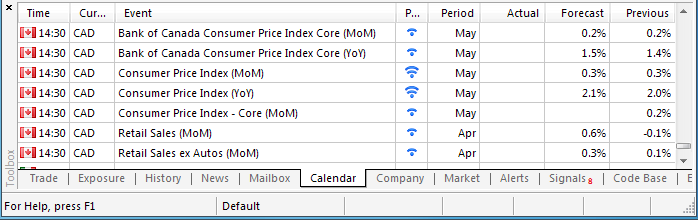

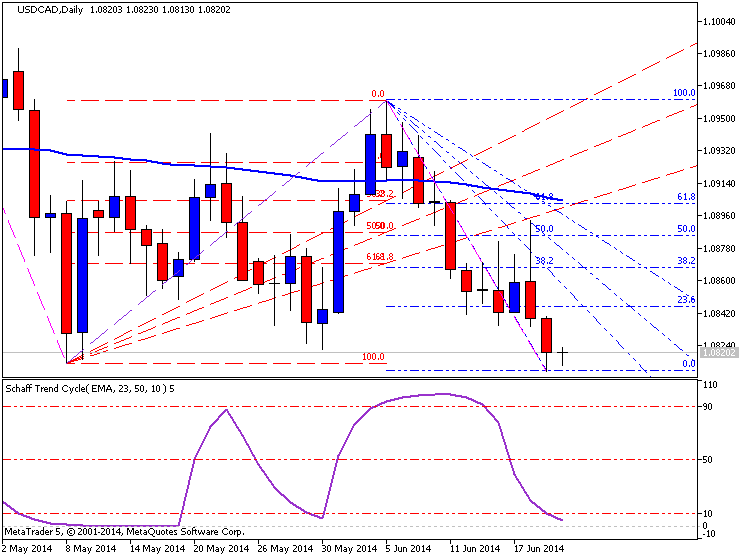

April 2014 U.K. Consumer Price Index

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)APR 2014 05/20/2014 8:30 GMT 1.7% 1.8% -23 -15

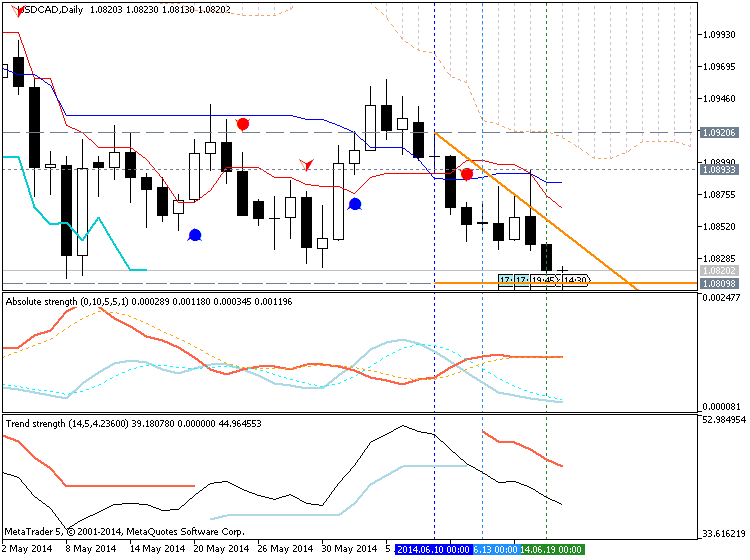

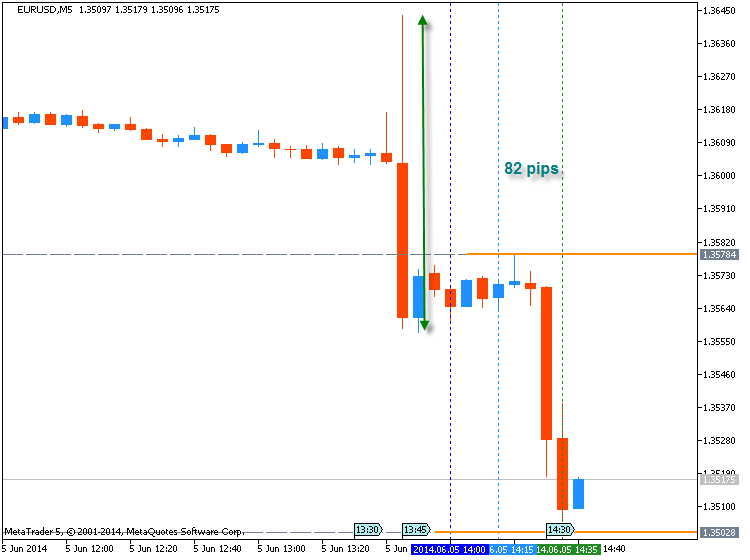

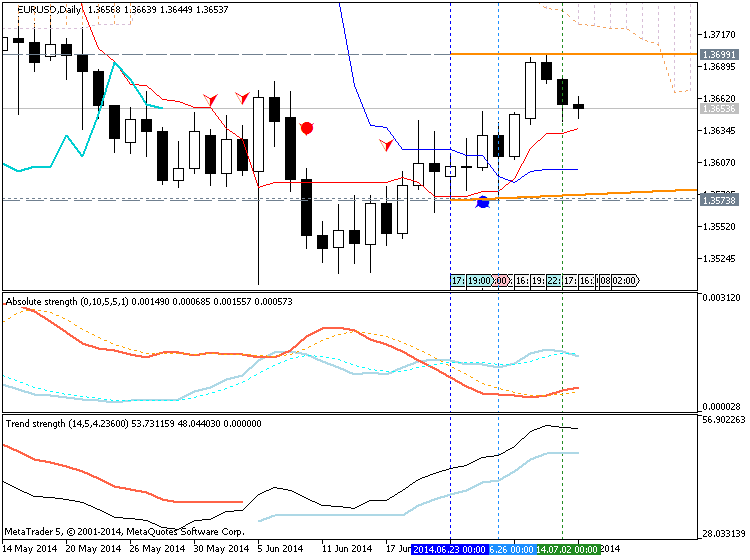

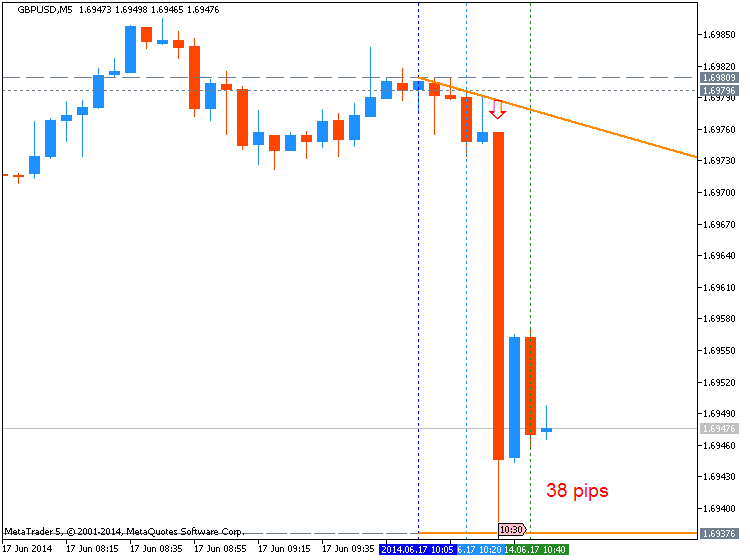

GBPUSD M5 : 34 pips price movement by GBPUSD - CPI news event:

U.K. consumer prices increased an annualized 1.8% in April after expanding 1.6% the month prior, while the core rate of inflation climbed 2.0% to mark the fastest pace of growth since September. Despite the stronger-than-expected CPI print, the GBP/USD slipped below the 1.6825 region following the release, but the British Pound pared the decline during the North American trade to close at 1.6836.

--- Written by David Song, Currency Analyst

More...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks