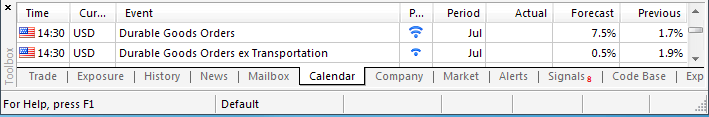

- U.S. Durable Goods Orders to Increase for Second Month.

- 7.1% Rise Would Mark Fastest Pace of Growth Since March 2011.

Trading the News: U.S. Durable Goods Orders

A 8.0% rise in demand for U.S. Durable Goods may spur a bullish reaction in the greenback (bearish EUR/USD) as it raises the scope for a stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

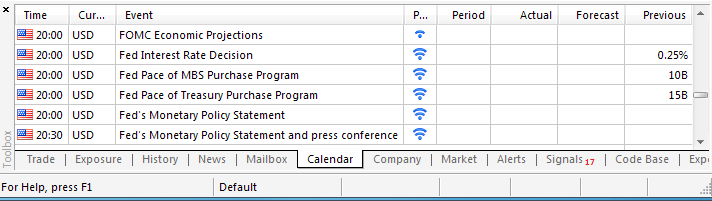

It seems as though the Federal Open Market Committee (FOMC) is running out of arguments to retain its highly accommodative policy stance amid the ongoing improvements in the world’s largest economy, and the bullish sentiment surrounding the dollar may gather pace throughout the coming months should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

Expectations: Bullish Argument/Scenario

Release Expected Actual Gross Domestic Product (Annualized) (QoQ) (2Q A) 3.0% 4.0% Personal Consumption (2Q A) 1.9% 2.5% Consumer Confidence (JUL) 85.4 90.9

The pickup in household sentiment along with the resilience in private sector consumption may generate increased demand for U.S. Durable Goods, and a positive print may heighten the bullish sentiment surrounding the dollar as it raises the outlook for growth and inflation.

Risk: Bearish Argument/Scenario

Release Expected Actual Consumer Price Index Core (YoY) (JUL) 1.9% 1.9% Consumer Credit (JUN) $18.650B $17.255B Average Hourly Earnings (YoY) (JUL) 2.2% 2.0%

However, sticky inflation paired with subdued wage growth may drag on demand for large-ticket items, and a dismal development may serve as a fundamental catalyst to spur a larger correction in the reserve currency as it weighs on interest rate expectations.

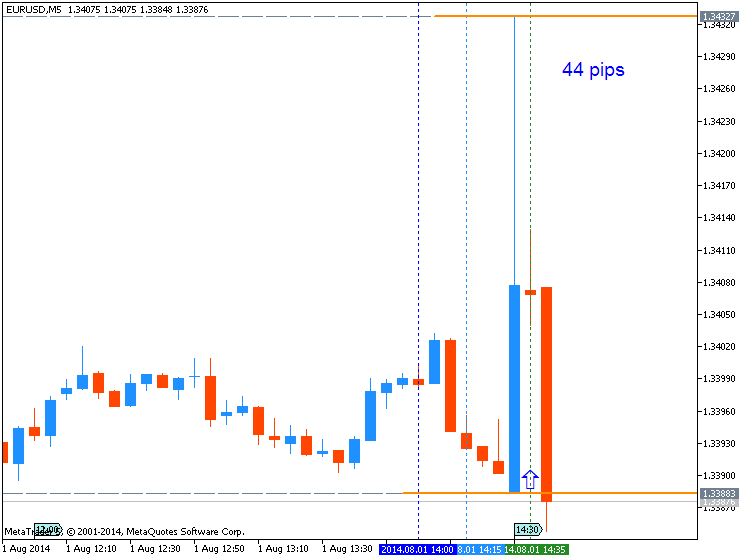

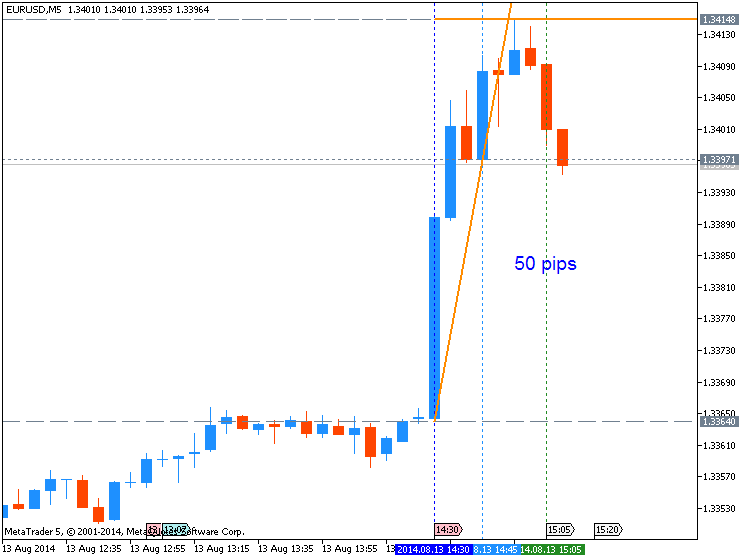

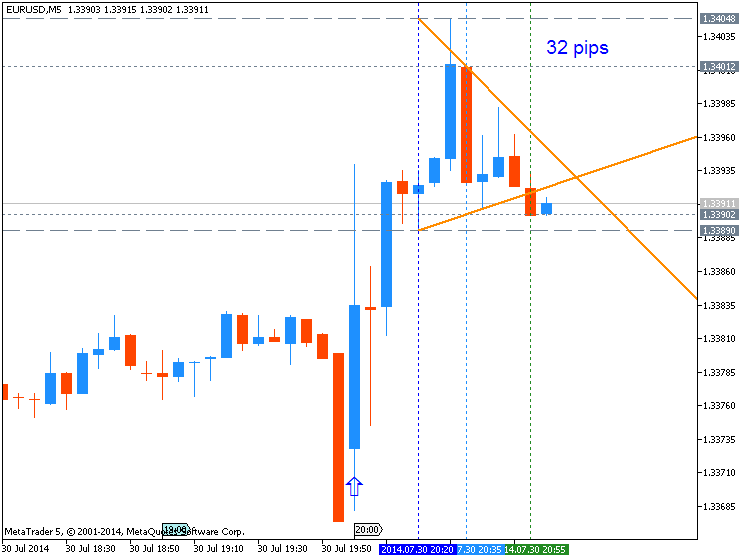

How To Trade This Event Risk

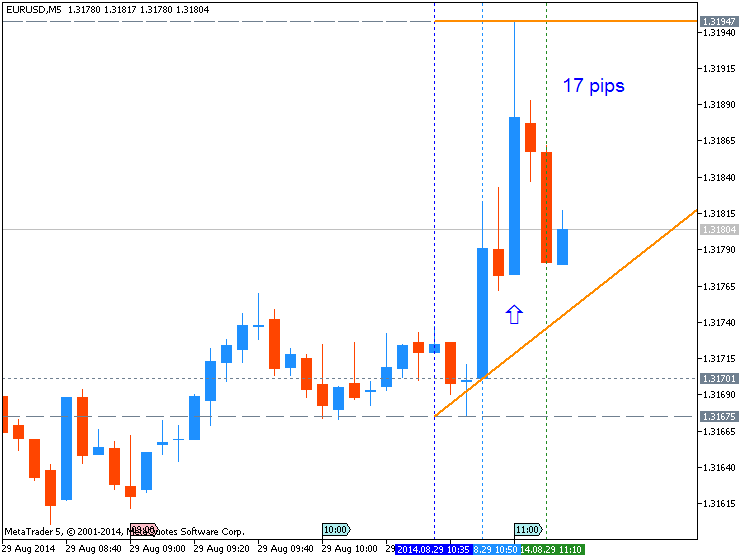

Bullish USD Trade: Orders Increase 8.0% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

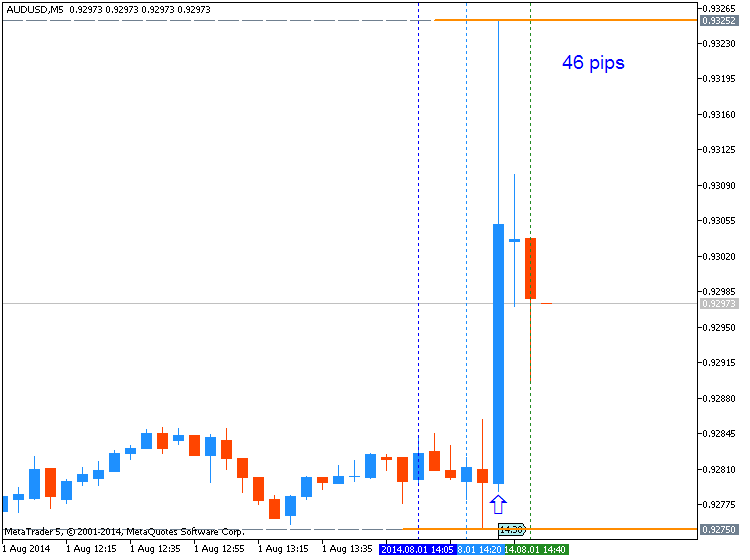

Bearish USD Trade: Durable Goods Report Disappoints

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

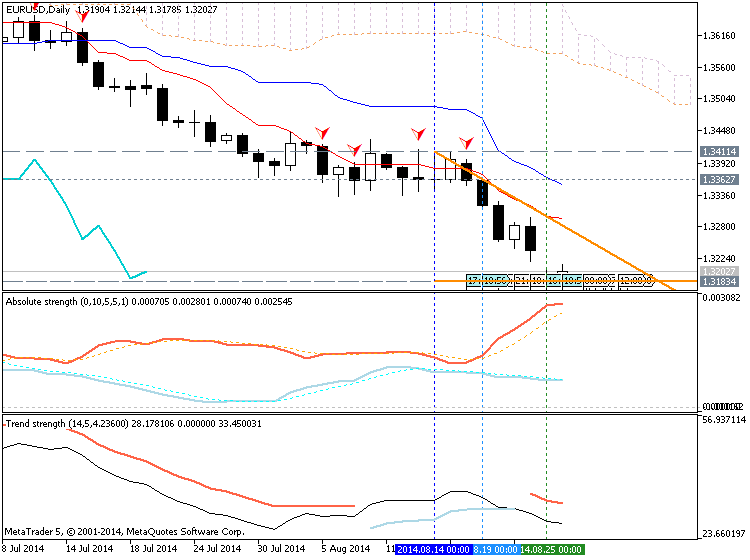

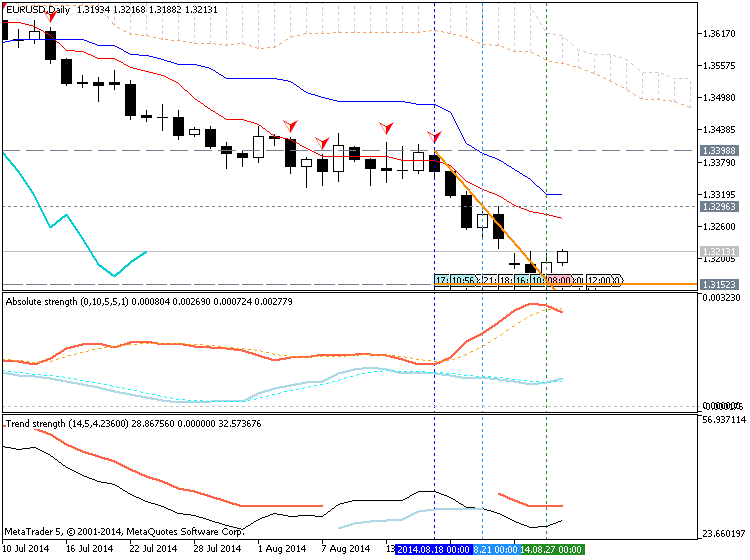

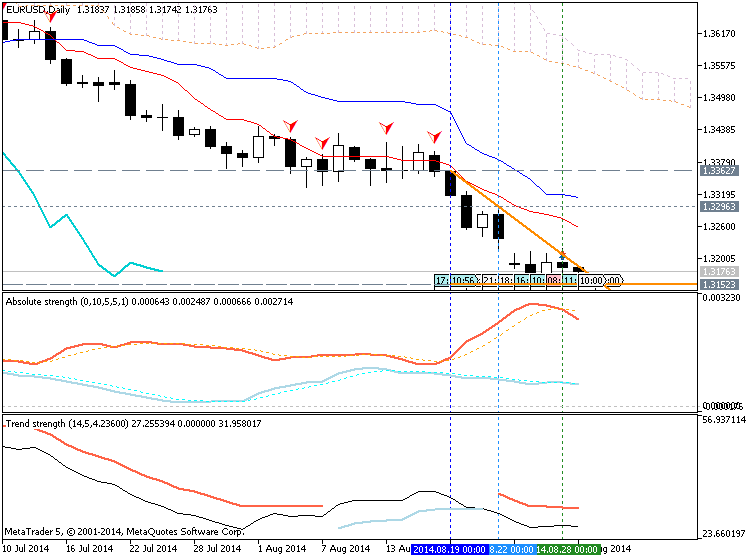

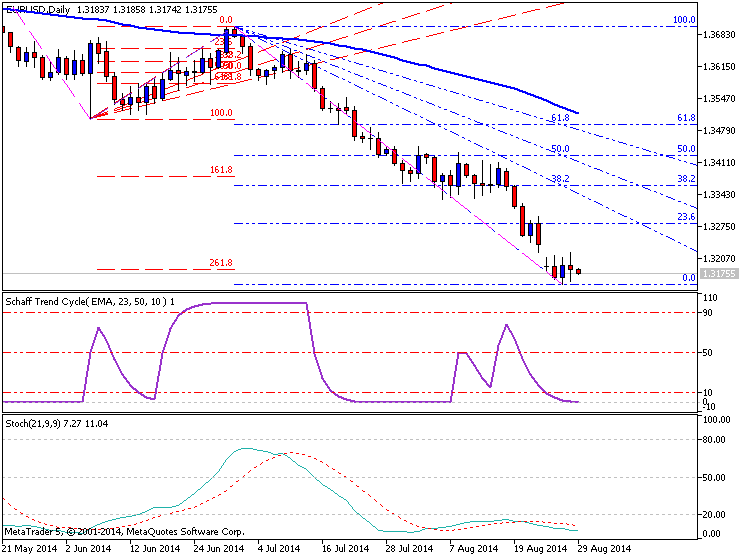

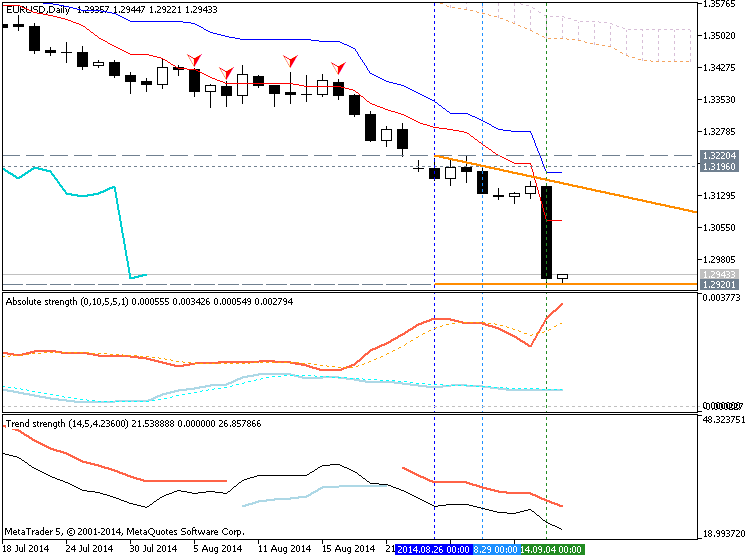

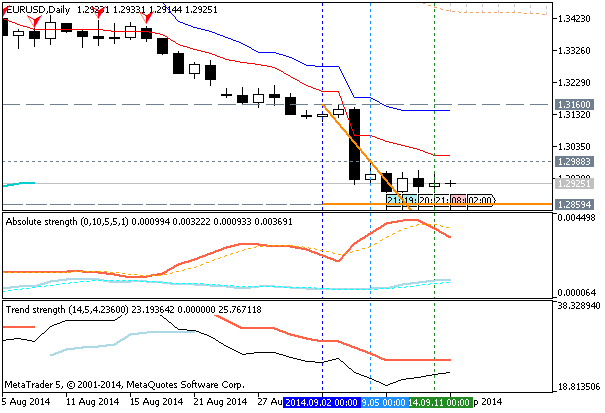

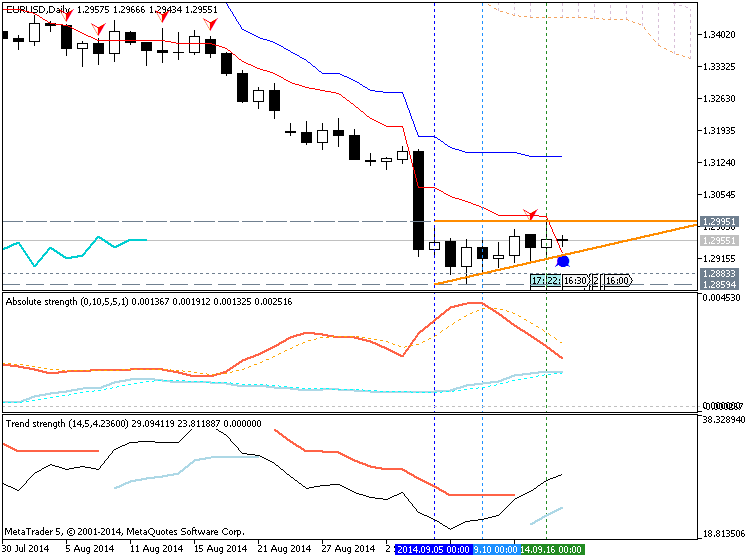

Potential Price Targets For The Release

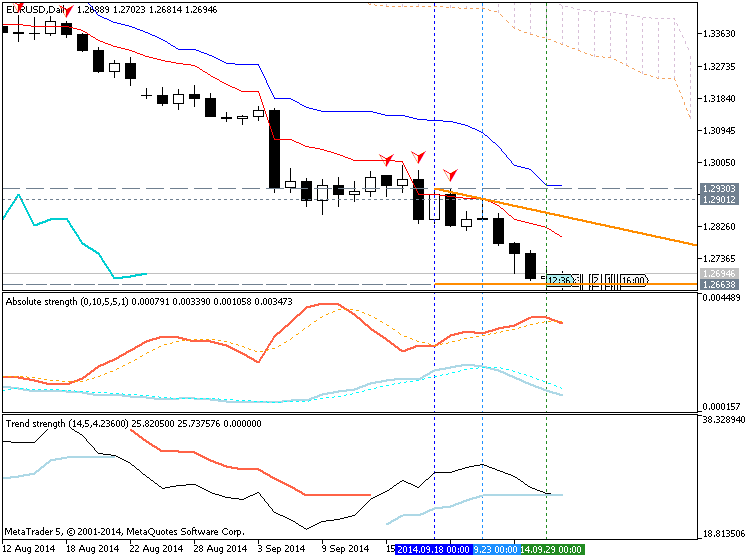

EUR/USD Daily

- Downside targets remain favored as long as RSI holds in oversold territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

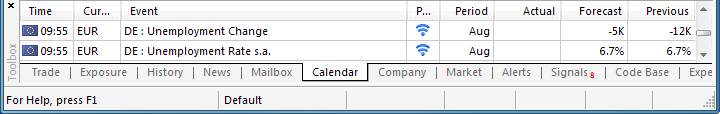

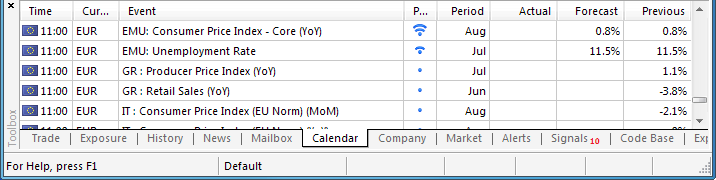

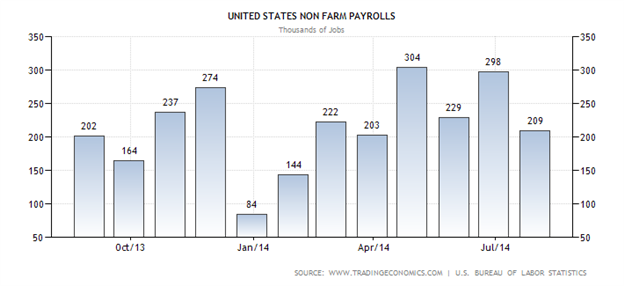

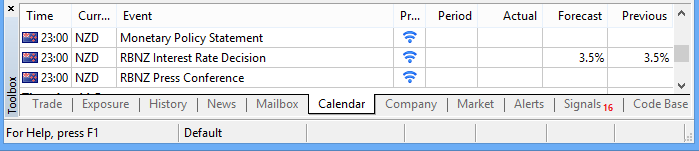

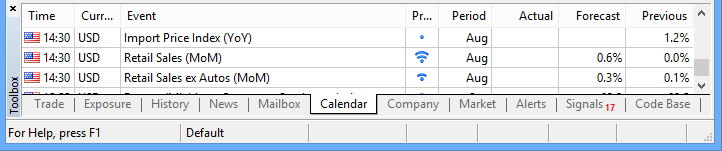

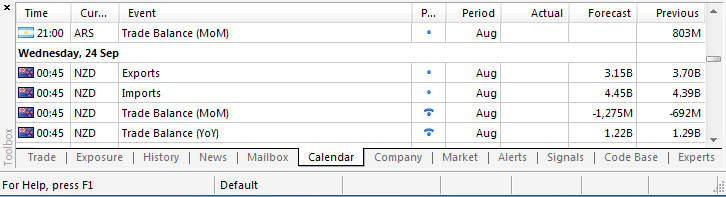

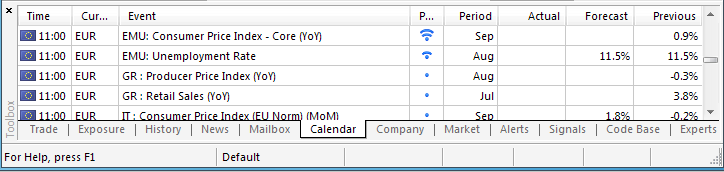

Impact that the U.S. Durable Goods report has had on EUR/USD during the last release

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)JUN

201407/25/2014 12:30 GMT 0.5% 0.7% - 4 - 8

June 2014 U.S. Durable Goods Orders

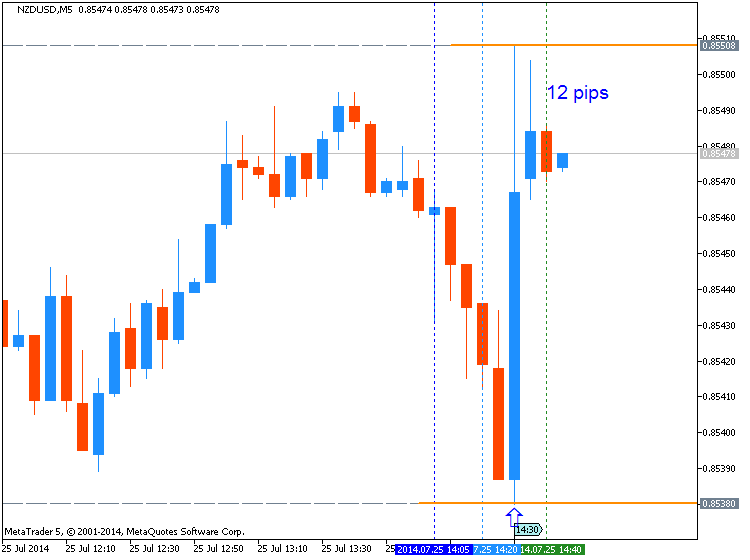

GBPUSD M5 : 15 pips price movement by USD - Durable Goods Orders news event

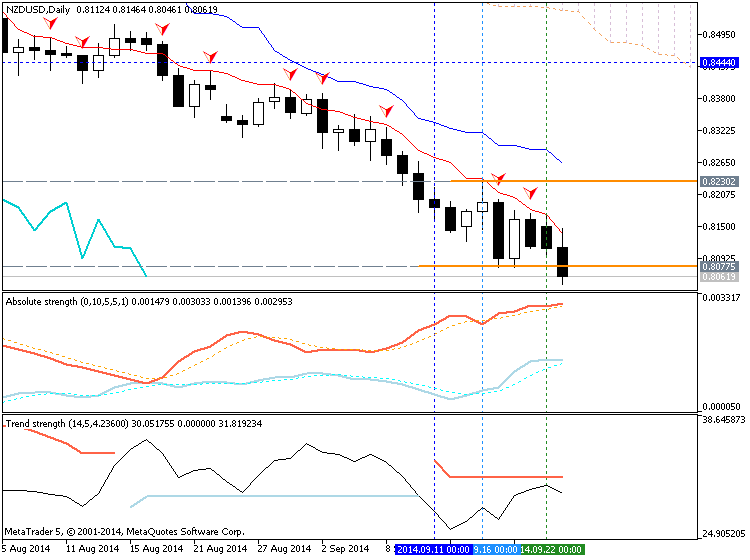

NZDUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

Orders for U.S. Durable Goods accelerated at a rate of 0.7% in June, exceeding estimates for 0.5% rise. The print was also much better than that in May, which showed a revised 1.0% contraction. The strength mainly came from increase in demand for commercial aircraft and machinery. However, the better-than-expected figure had a limited impact on the dollar. During the rest of the North America trade, the EUR/USD fluctuated around 1.3430 and closed at 1.3429.

--- Written by David Song, Currency Analyst and Shuyang Ren

More...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks