- U.S. Consumer Price Index to Hold at 2.1% for Second Month.

- Core Inflation to Retain Fastest Pace of Growth Since October 2012.

Trading the News: U.S. Consumer Price Index (CPI)

The U.S. Consumer Price Index (CPI) may spur a bullish reaction in the U.S. dollar (bearish EUR/USD) should the report undermine the Fed’s dovish outlook for monetary policy.

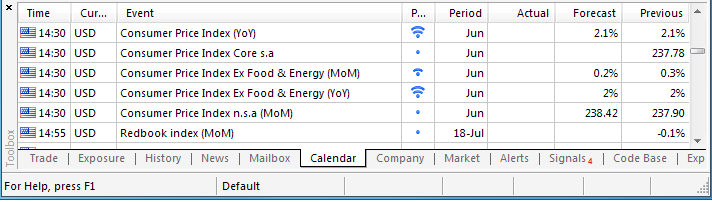

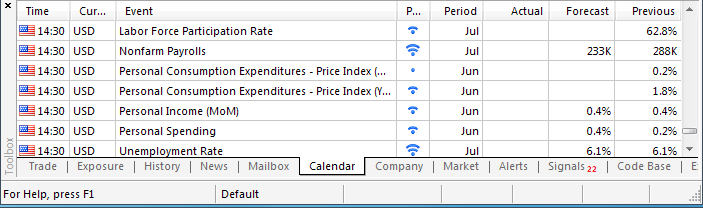

What’s Expected:

Why Is This Event Important:

Sticky price growth in the world’s largest economy may heighten the appeal of the greenback as it puts increased pressure on the Federal Reserve to move away from its easing cycle, and the next policy meeting on July 30 may generate an improved outlook for the reserve currency should a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

Expectations: Bullish Argument/Scenario

Release Expected Actual Producer Price Index ex Food and Energy (YoY) (JUN) 1.9% 2.0% Average Hourly Earnings (YoY) (JUN) 1.9% 2.0% Personal Income (MAY) 0.4% 0.4%

Higher input costs along with the pickup in wage growth may generate another stronger-than-expected inflation print, and an unexpected uptick in the CPI may fuel a near-term rally in the USD as it boosts interest rate expectations.

Risk: Bearish Argument/Scenario

Release Expected Actual U. of Michigan Confidence (JUL P) 83.0 81.3 Advance Retail Sales (MoM) (JUN) 0.6% 0.2% Consumer Credit (MAY) $20.000B $19.602B

However, the persist slack in the real economy paired with the slowdown in private sector consumption may drag on price growth, and a weak inflation print may heighten the bearish sentiment surrounding the greenback as it gives the Fed greater scope to retain its highly accommodative policy stance for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: Headline Reading for Inflation Climbs 2.1% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: U.S. CPI Falls Short of Market Forecast

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

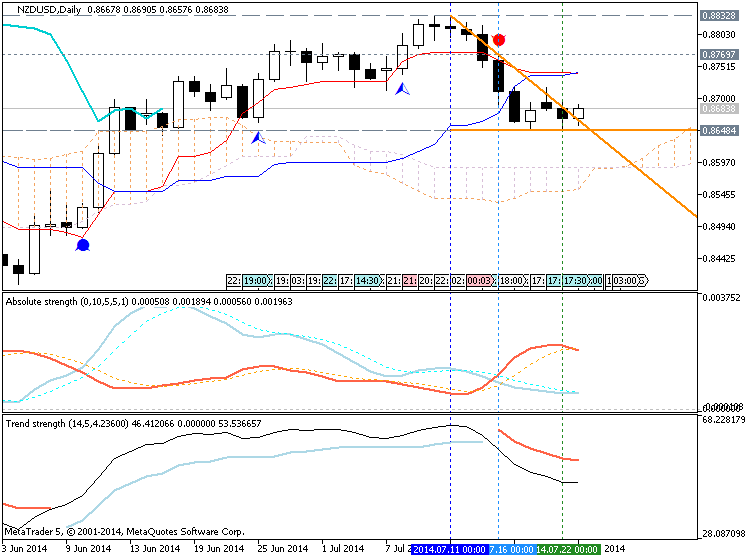

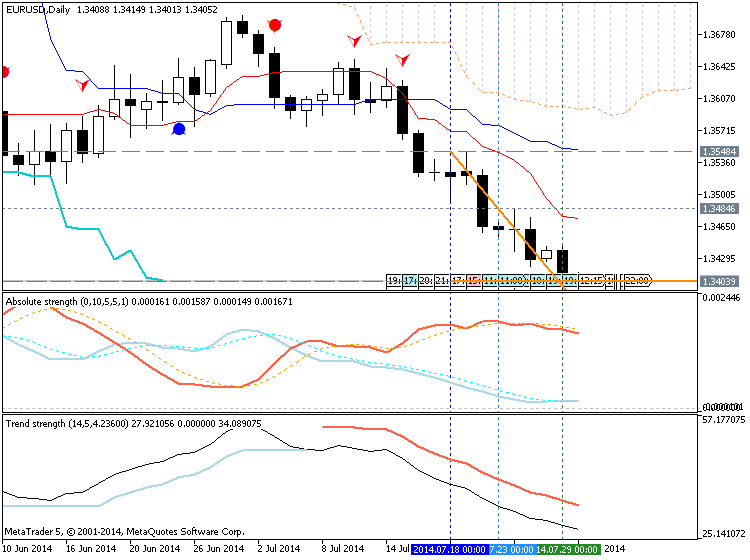

Potential Price Targets For The Release

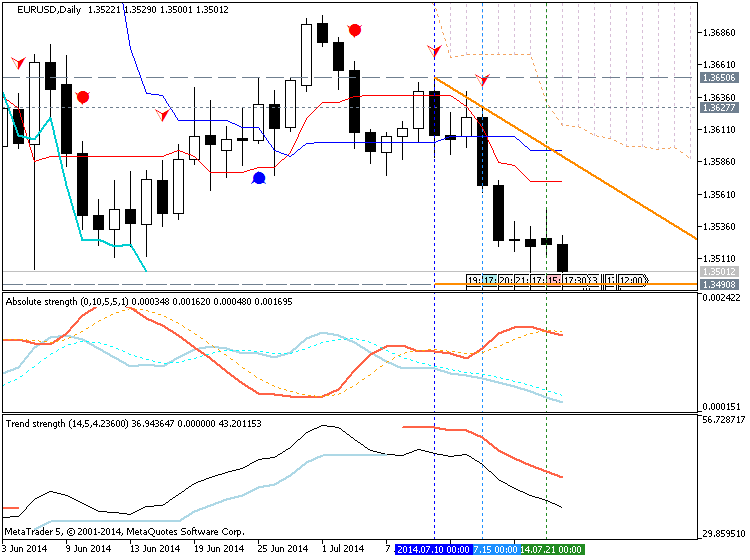

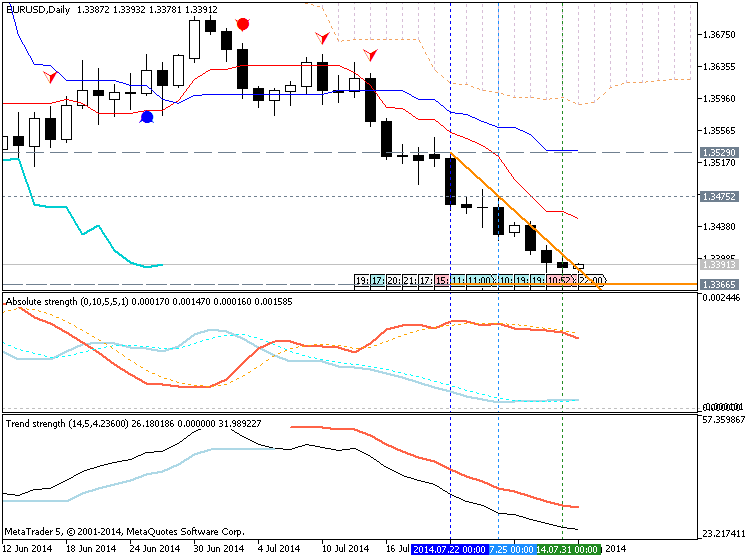

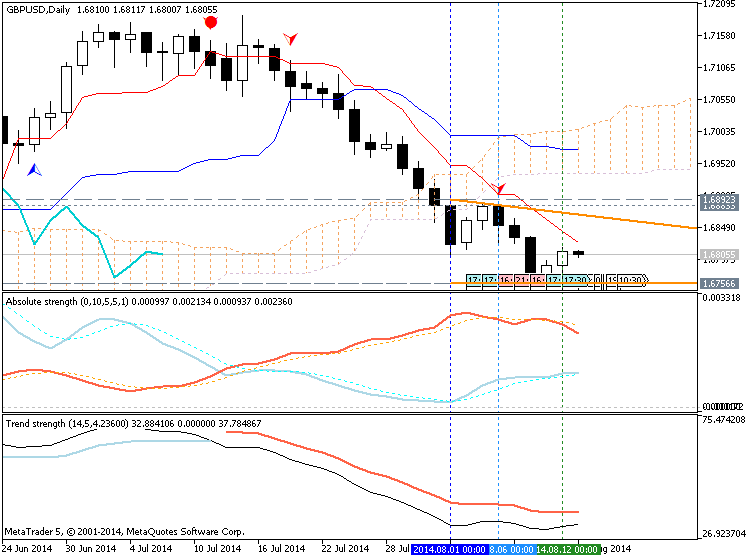

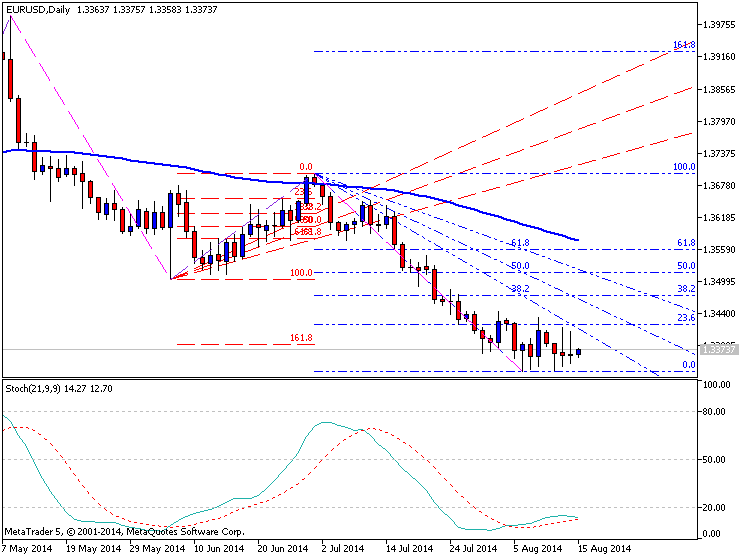

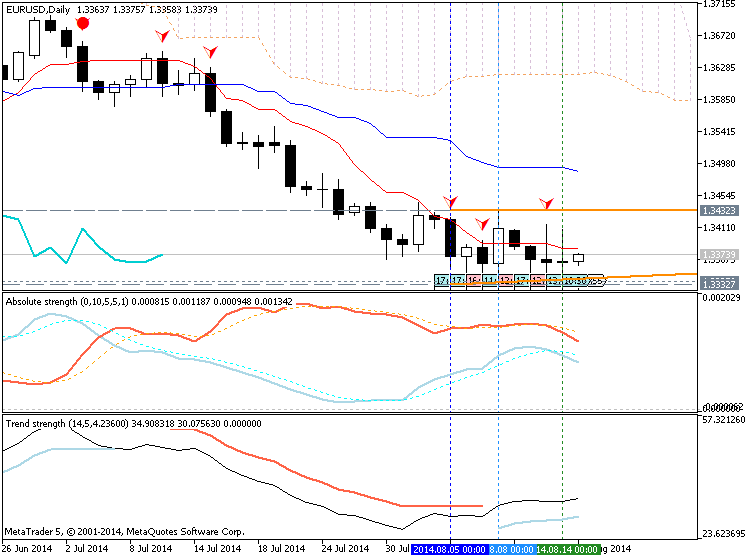

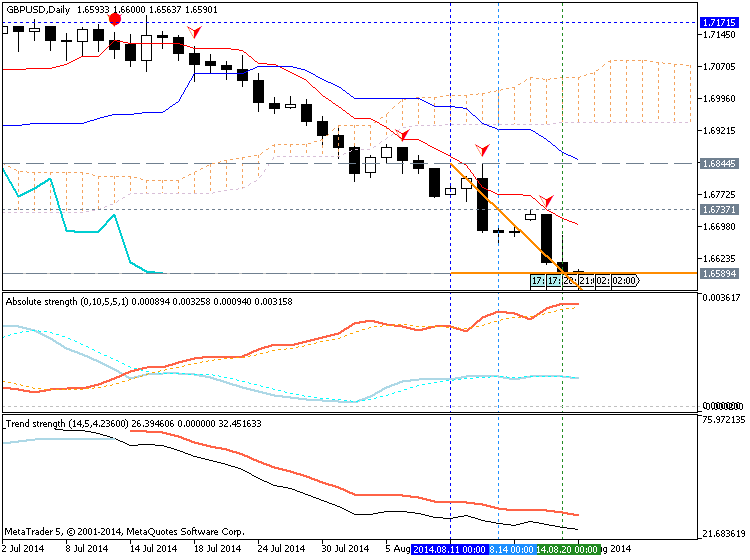

EUR/USD Daily

- Remains at Risk for a Lower-Low as Downward Trending Channel Takes Shape

- Interim Resistance: 1.3650 (78.6% expansion) to 1.3670 (61.8% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

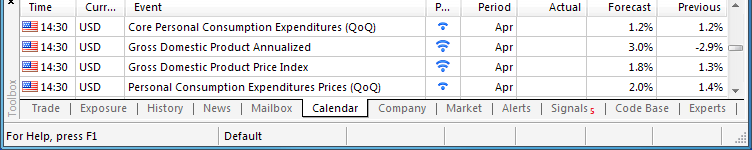

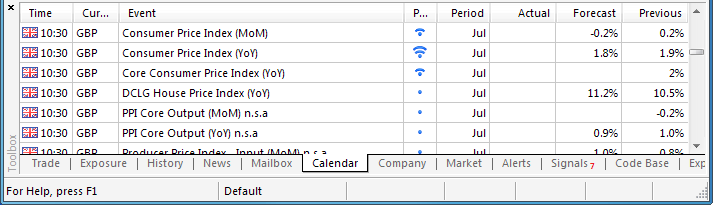

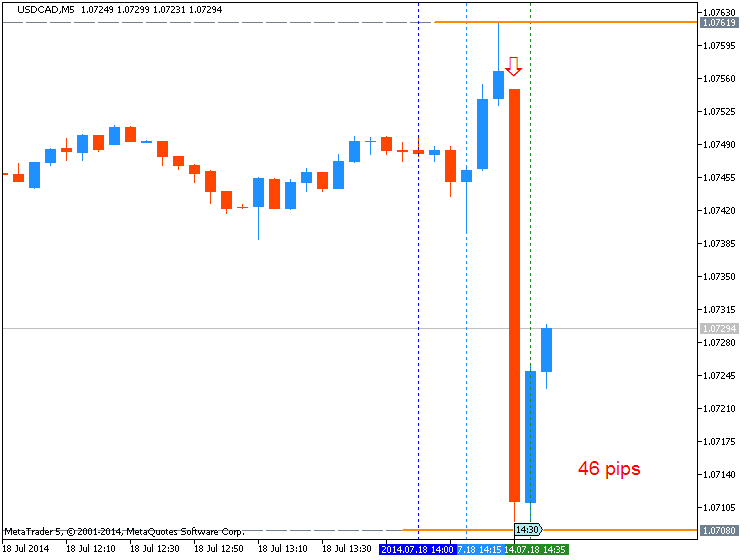

Impact that the U.S. CPI report has had on EUR/USD during the last release

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)MAY

201406/17/2014 12:30 GMT 2.0% 2.1% -23 -23

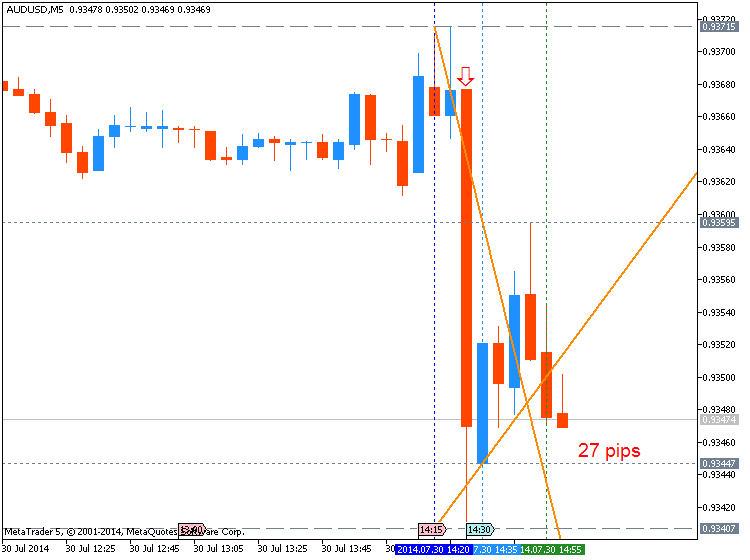

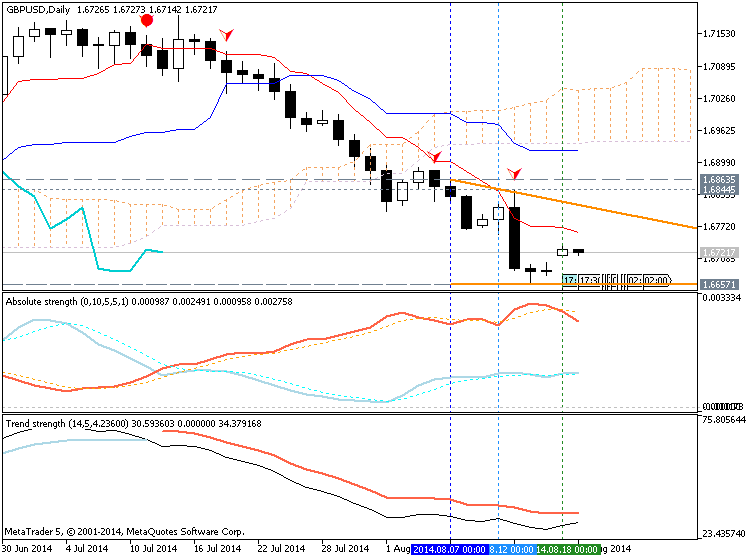

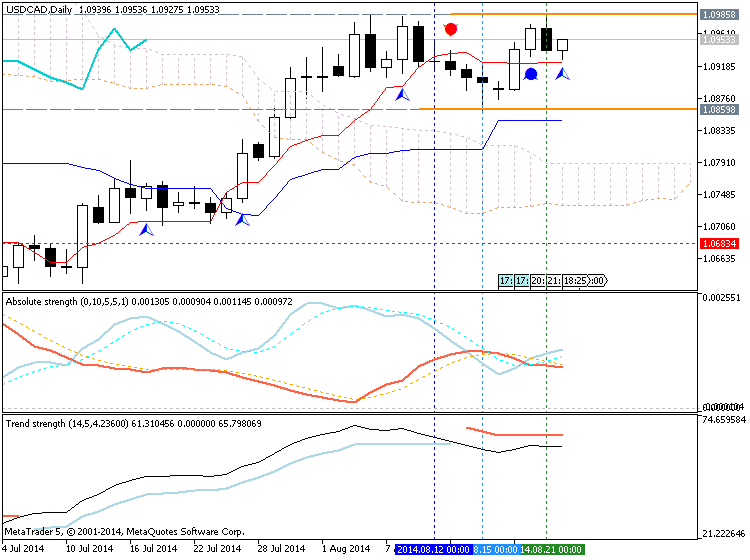

May 2014 U.S. Consumer Price Index (CPI)

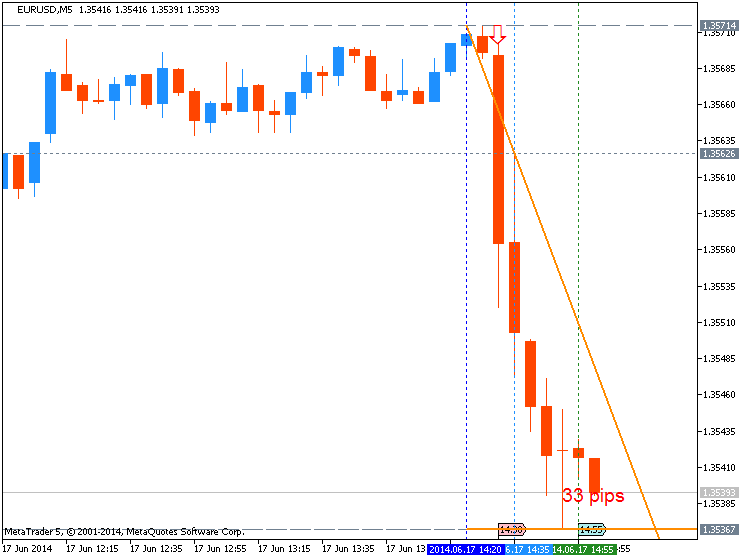

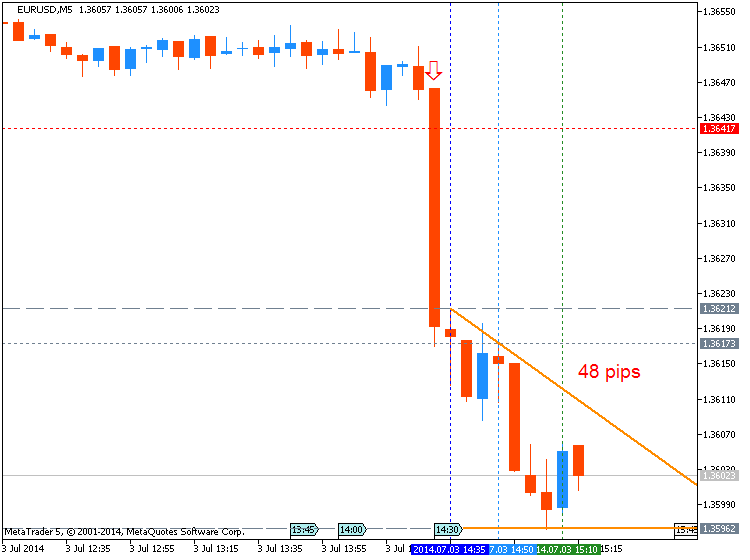

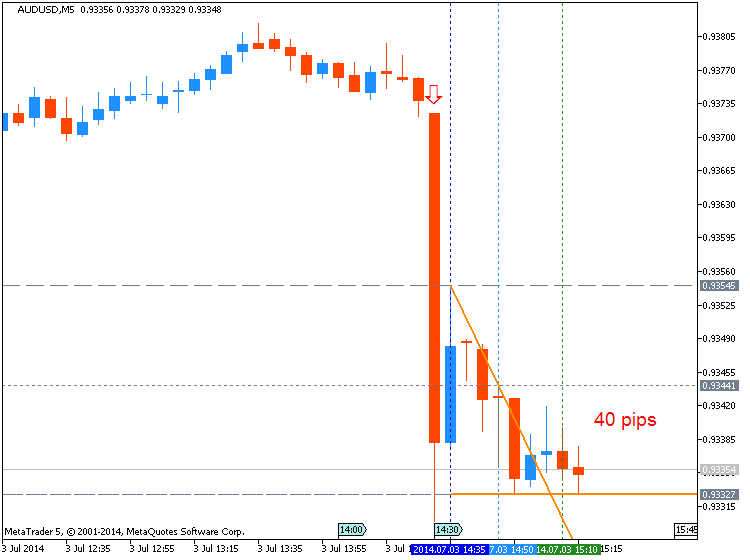

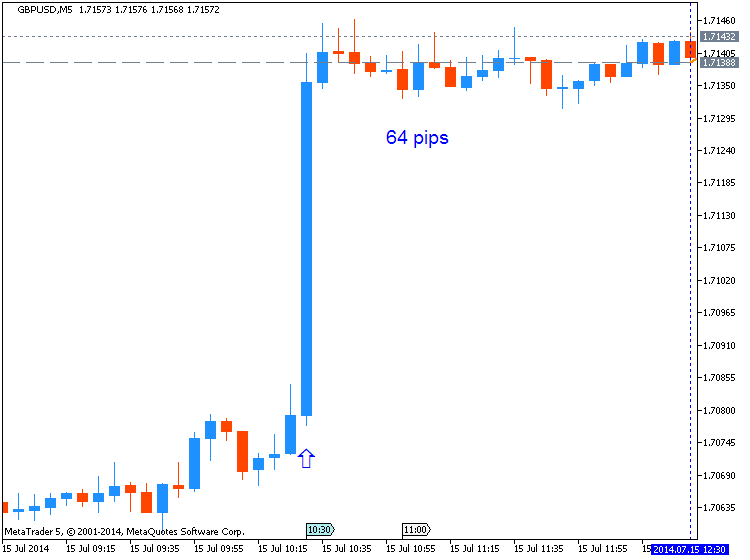

EURUSD M5 : 33 pips price movement by USD - CPI news event

The headline reading for U.S. inflation unexpectedly climbed to an annualized 2.1% in May to mark the fastest pace of growth since October 2011, while the core Consumer Price Index (CPI) advance to 2.0% amid forecasts for 1.9% print. The stronger-than-expected print sparked a bullish reaction in the reserve currency, with the EUR/USD slipping below the 1.3550 region, and the greenback retained the gains throughout the North American session as the pair ended the day at 1.3545.

--- Written by David Song, Currency Analyst

More...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks