- U.S. Advance Retail Sales to Rise for Fourth Straight Month

- Fed to Highlight Resilience in Private Consumption

Trading the News: U.S. Advance Retail Sales

The U.S. Advance Retail Sales report may encourage a more meaningful rebound in the dollar as private sector consumption is expected to increase at a faster pace in August.

What’s Expected:

Time of release: 09/13/2013 12:30 GMT, 8:30 EDT

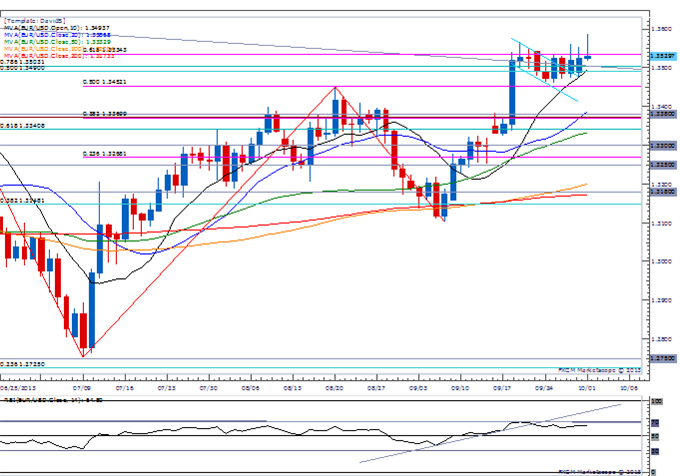

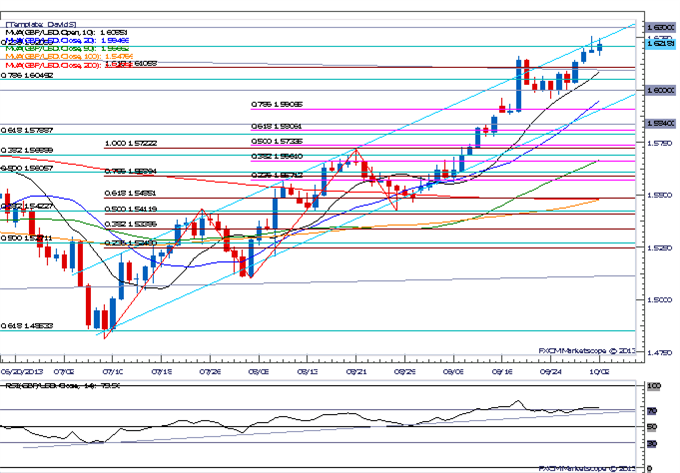

Primary Pair Impact: EURUSD

Expected: 0.5%

Previous: 0.2%

DailyFX Forecast:0.2% to 0.6%

Why Is This Event Important:

With the Federal Open Market Committee (FOMC) interest rate decision on tap for next week, fundamental developments highlighting a stronger recovery may spur a more meaningful U.S. dollar rebound going into the central bank meeting, and a material shift in the policy outlook may generate a rally in the reserve currency as the Fed slowly moves away from its easing cycle.

Expectations: Bullish Argument/Scenario

Release Expected Actual Average Weekly Earnings (YoY) (AUG) 2.1% 2.2% Consumer Confidence (AUG) 79.0 81.5 Domestic Vehicle Sales (AUG) 12.30M 12.44M

The pickup in wage growth along with the ongoing rebound in household sentiment may encourage a strong retail sales report, and a positive print may spark a near-term rally in the USD as the world’s largest economy gets on a more sustainable path.

Risk: Bearish Argument/Scenario

Release Expected Actual Change in Non-Farm Payrolls (AUG) 180K 169K Consumer Credit (JUL) $12.700B $10.437B Challenger Job Cuts (YoY) (AUG) -- 56.5%

Nevertheless, the ongoing weakness in the labor market paired with the slowdown in private sector credit may weigh on consumption, and a dismal sales report may fuel the decline from earlier this month as market participants scale back bets of seeing a less-dovish FOMC.

How To Trade This Event Risk

Bullish USD Trade: Retail Sales Climbs 0.5% or greater

- Need red, five-minute candle following the data to consider a short EURUSD trade

- If market reaction favors a short trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish USD Trade: Household Spending Disappoints

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bearish dollar trade, just in reverse

Potential Price Targets For The Rate Decision

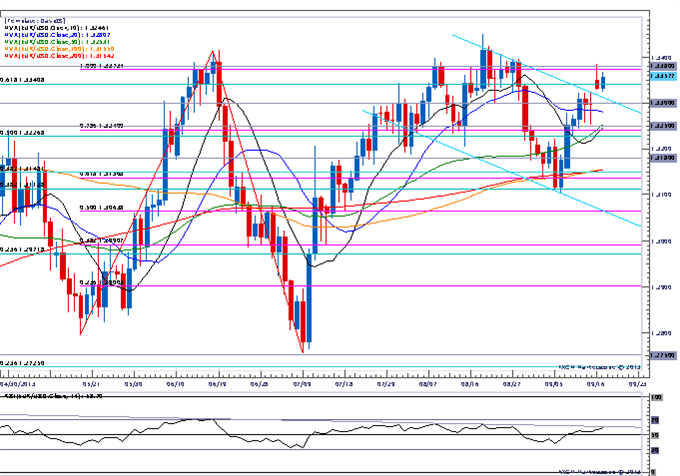

EURUSD Daily

Chart - Created

- Carves lower high ahead of FOMC meeting; Bearish RSI divergence

- Interim Resistance: 1.314 (61.8% Fib retracement)

- Interim Support: 1.3220-30 (50.0% retracement) & 1.3110-20 (38.2% retracement)

Impact that the U.S. Advance Retail Sales report has had on USD during the last release

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

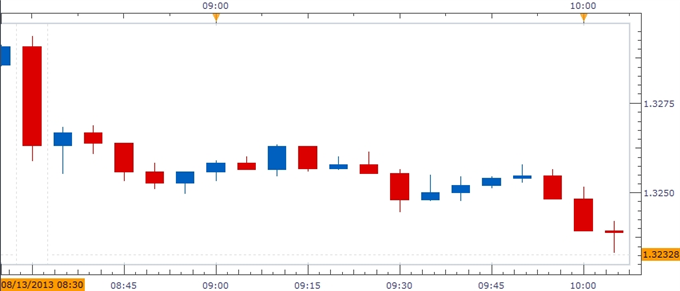

(End of Day post event)JUL 2013 08/13/2013 8:30 GMT 0.3% 0.2% -42 -30

July 2013 U.S. Advance Retail Sales

Household spending increased another 0.2% in July following the 0.6% advance the month prior, which was largely driven by higher gasoline receipts along with a pickup in discretionary spending. Despite the weaker-than-expected print, the resilience in private sector consumption, propped up the dollar, with the EURUSD slipping back below the 1.3250 region, but we saw the reserve currency consolidate during the North American trade as the pair ended the day at 1.3260.

--- Written by David Song, Currency Analyst

More...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks