- Bank of England (BoE) to Raise Fundamental Outlook on Stronger Recovery

- Will BoE Implement Exit Strategy Ahead of Schedule?

Trading the News: Bank of England Inflation Report

The Bank of England’s (BoE) Inflation Report may heavily influence the near-term forecast for the British Pound as market participants see the central bank implementing its exit strategy ahead of schedule.

What’s Expected:

Time of release: 11/13/2013 10:30 GMT, 5:30 EST

Primary Pair Impact: GBPUSD

Expected: --

Previous: --

Forecast:--

Why Is This Event Important:

There’s speculation that Governor Mark Carney will rein in the optimism surrounding the U.K. economy, but the central bank may adopt a more hawkish tone for monetary policy as the stronger recovery raises the risk for a prolonged period of above-target inflation.

Expectations: Bullish Argument/Scenario

Release Expected Actual Gross Domestic Product (QoQ) (3Q A) 0.8% 0.8% Retail Sales ex Auto (MoM) (SEP) 0.3% 0.7% Jobless Claims Change (SEP) -25.0K -41.7K

The BoE looks poised raise its economic assessment for the U.K. economy on the back of the stronger recovery, and the central bank may show a greater willingness to move away from its easing cycle as the region gets on a more sustainable path.

Risk: Bearish Argument/Scenario

Release Expected Actual Consumer Price Index (YoY) (OCT) 2.5% 2.2% Trade Balance (SEP) -2.700B -3.268B BRC Shop Price Index (YoY) (OCT) 0.1% -0.5%

However, the recent slowdown in price growth may give the BoE greater scope to support the economy throughout 2014, and we may see a more meaningful correction in the British Pound should the central bank present a greater argument toretain its highly accommodative policy stance.

Potential Price Targets For The Release

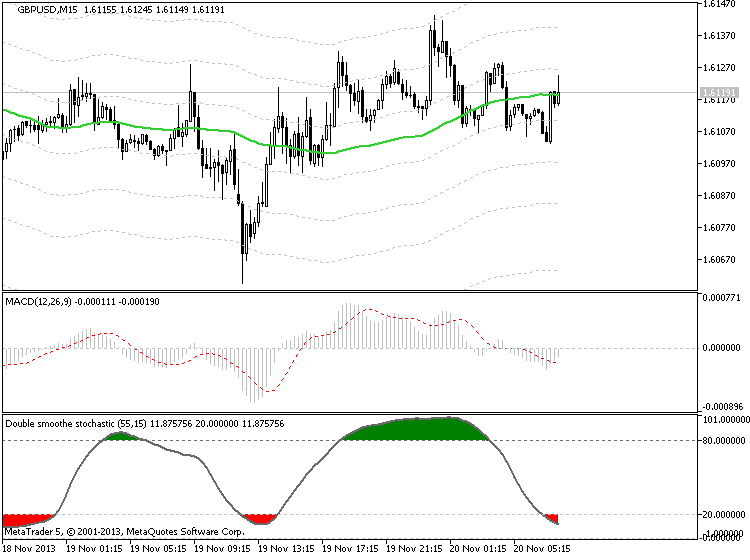

GBPUSD Daily

- Threatens Range Following U.K. CPI Report; Bearish RSI Momentum Remains Intact

- Interim Resistance: 1.6250 Pivot to 1.6300 Pivot (2012 highs)

- Interim Support: 1.5900 Pivot to 1.5910 (78.6% Fibonacci expansion)

How To Trade This Event Risk

Bullish GBP Trade: BoE Raises Forecast; Adopts More Hawkish Tone

- Need green, five-minute candle following the statement to favor a long GBP trade

- If reaction favors buying British Pound, long GBPUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: BoE to Retain Highly Accommodative Stance Throughout 2014

- Need red, five-minute candle to consider a short GBPUSD trade

- Implement same setup as the bullish British Pound trade, just in the opposite direction

Impact that the BoE Inflation report has had on GBP during the last release

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)AUG 2013 8/7/2013 9:30 GMT -- -- +119 +194

August 2013 Bank of England Inflation Report

The BoE implemented forward-guidance for monetary policy as they pegged a 7.0% threshold for unemployment, but we saw Governor Mark Carney refrain from implementing a growth target as the central bank continues to operate under its inflation-targeting framework. In turn, the initial dip in the British Pound was short-lived, with the GBPUSD climbing above the 1.5400 handle, and the sterling continued to gain ground throughout the day as the pair closed at 1.5486.

--- Written by David Song, Currency Analyst

More...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks