- Canada Consumer Price Index to Increase for Second Straight Month

- Inflation Print of 1.3% Would Match the Highest Reading for 2013

Trading the News: Canada Consumer Price Index

A sharp rebound in Canada’s Consumer Price Index may spur a near-term correction in the Canadian dollar as it limits the risk for disinflation.

What’s Expected:

Time of release: 01/24/2014 13:30 GMT, 8:30 EST

Primary Pair Impact: USDCAD

Expected: 1.3%

Previous: 0.9%

DailyFX Forecast: 1.0% to 1.3%

Why Is This Event Important:

It seems as though the Bank of Canada (BoC) may revert back toits easing cycle as the persistent slack in the real economy continues to drag on growth and inflation, and Governor Stephen Poloz may continue to talk up bets for lower borrowing costs in an effort to encourage a ‘soft-landing’ for the Canadian economy.

Expectations: Bullish Argument/Scenario

Release Expected Actual Retail Sales (MoM) (NOV) 0.2% 0.6% Manufacturing Sales (MoM) (NOV) 0.3% 1.0% Business Outlook Future Sales (4Q) 20.00 29.00

The pickup in private sector consumption may prompt a marked rebound in price growth, and a strong inflation print may spur a more meaningful recovery in the Canadian dollar as market participants scale back bets for a rate cut.

Risk: Bearish Argument/Scenario

Release Expected Actual Net Change in Employment (DEC) 14.1K -45.9K Building Permits (MoM) (NOV) -2.7% -6.7% Ivey Purchasing Manager Index s.a. (DEC) 54.5 46.3

Nevertheless, firms may continue to conduct heavy discounting amid the persistent slack in the real economy, and a dismal CPI print may spur fresh highs in the USDCAD as the BoC adopts a more dovish tone for monetary policy.

How To Trade This Event Risk

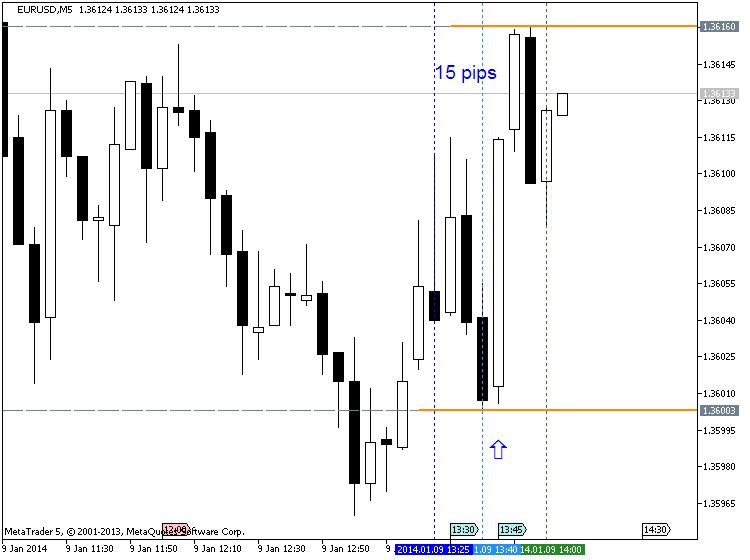

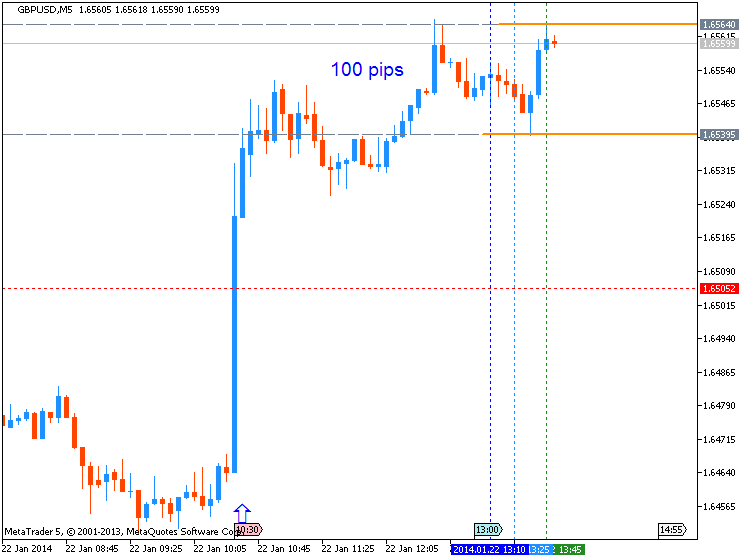

Bullish CAD Trade: Canada Inflation Climbs to 1.3% or Higher

- Need red, five-minute candle after the CPI report to consider short USDCAD entry

- If the market reaction favors a long Canadian dollar trade, establish short with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

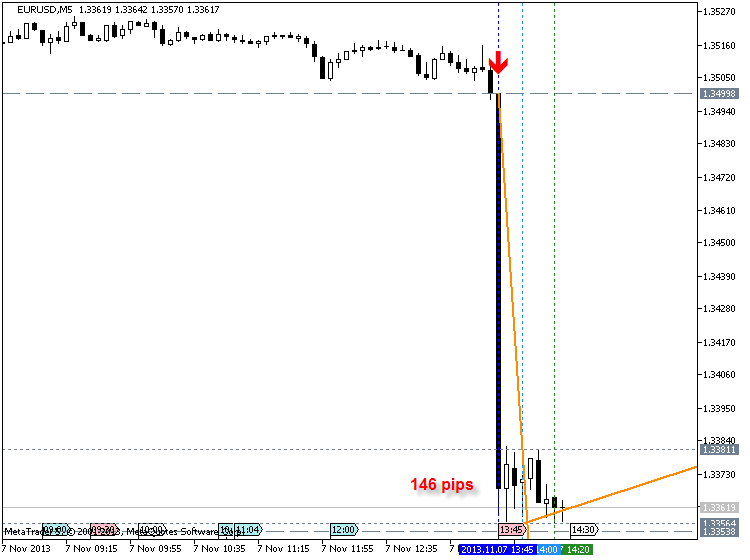

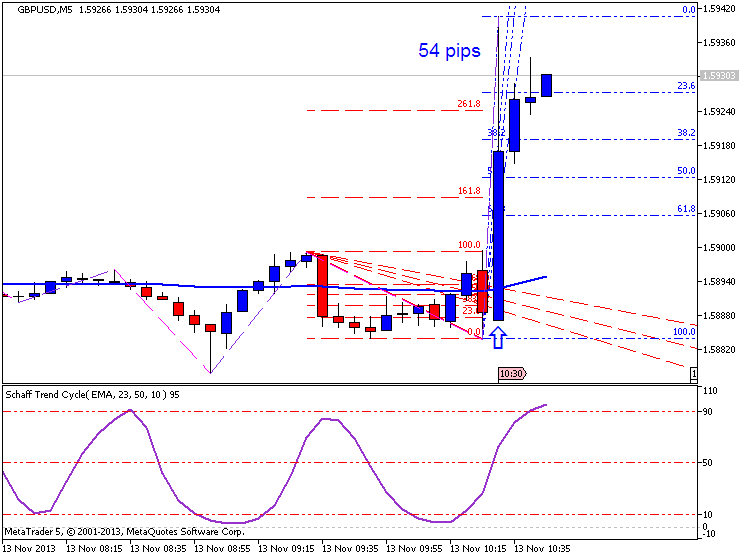

Bbearish CAD Trade: Canada Consumer Prices Disappoint

- Need green, five-minute candle following the release to look at a long USDCAD trade

- Carry out the same setup as the bearish CAD trade, just in the opposite direction

Potential Price Targets For The Release

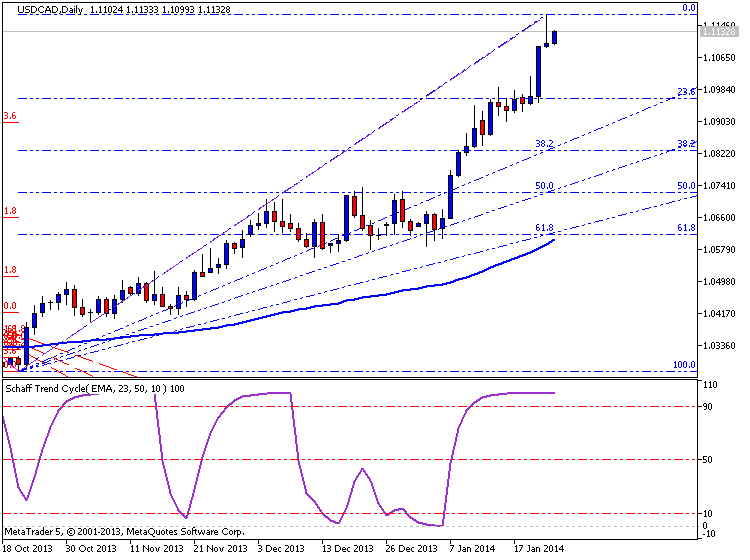

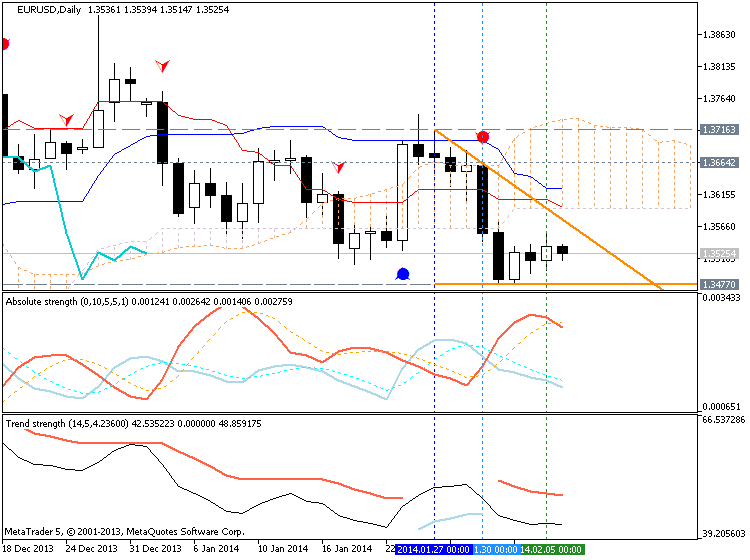

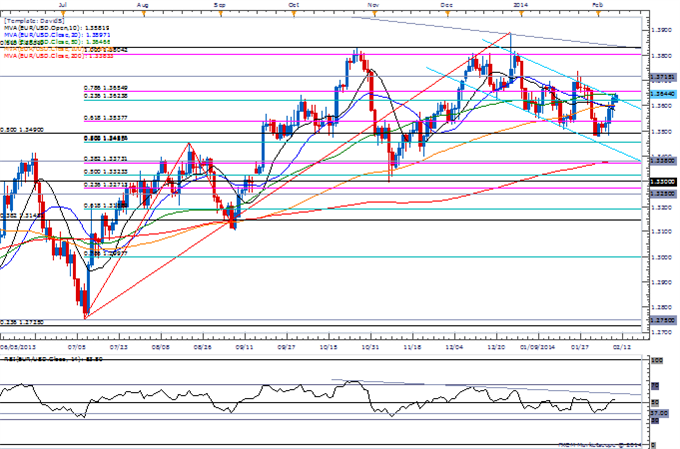

USDCAD Daily

- At Risk for Correction Following Higher High- Lower High on Horizon

- To Face Larger Pullback Once RSI Falls Back from Overbought

- Interim Resistance: 1.1172 Pivot to 1.1200 Pivot

- Interim Support: 1.0900 Pivot to 1.0930 (61.8% expansion)

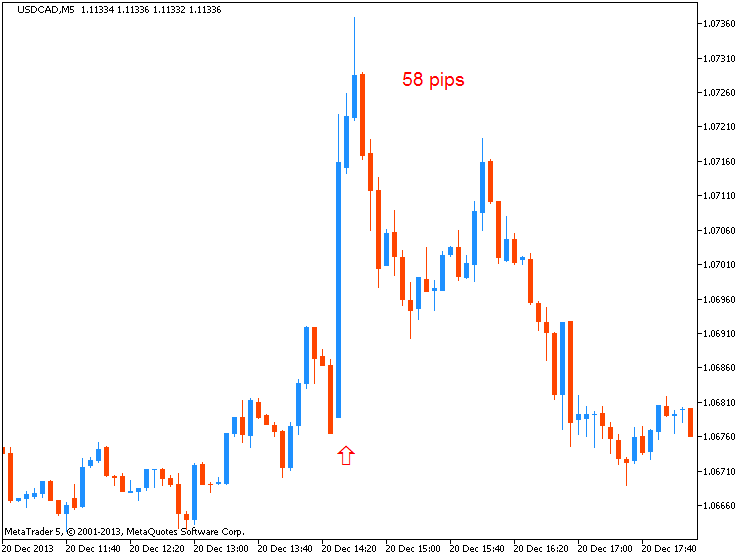

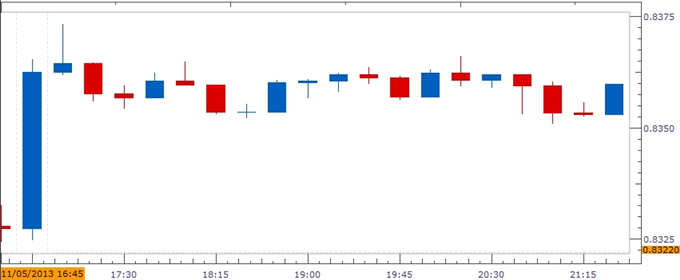

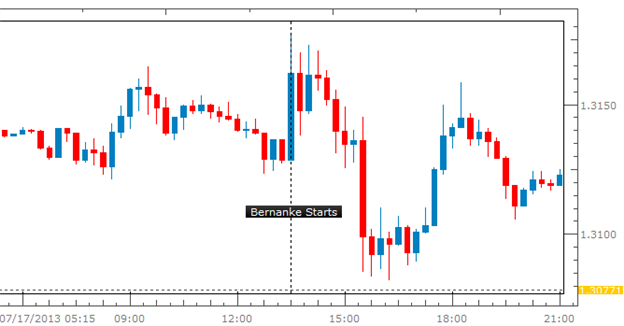

Impact that the Canada Consumer Price report has had on CAD during the last month

Period Data Released Survey Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)NOV 2013 12/20/2013 13:30 GMT 1.0% 0.9% +26 -29

November 2013 Canada Consumer Price Index

CPI data out of Canada for the month of November disappointed by a tenth of a percent and sent USD/CAD spiking to multi-year highs, but the pair failed to hold gains as the trading week came to a close. Since then, we have seen severe CAD weakness and Thursday prompted further multi-year lows, but USD weakness across the board and better than expected Retail Sales data out of Canada halted further moves to the upside. At the Bank of Canada Rate Decision on Wednesday, Gov. Poloz outlined risks of lower inflation and a meet or beat of CAD CPI on Friday could be that fundamental factor spur a USD/CAD correction. That being said, misses in expectations over the past few weeks have prompted huge moves to the upside for USD/CAD and disappointments have hardly yielded a meaningful correction.

--- Written by David Song, Currency Analyst

More...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks