- Federal Open Market Committee (FOMC) Widely Expected to Remove Zero-Interest Rate Policy (ZIRP).

- Will There Be a Unanimous Vote to Implement Higher Borrowing-Costs?

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

Based on Fed Funds Futures, market participants are pricing a 76% probability for a rate-hike a the Federal Open Market Committee’s (FOMC) December 16 interest rate decision, and the fresh updates coming out of the central bank may instill a bullish U.S. dollar outlook for 2016 should Chair Janet and Co. outline a more detailed exit-strategy.

What’s Expected:

Why Is This Event Important:

Even though the FOMC remains on course to shift gears, a split decision to implement higher borrowing-costs accompanied by a downward revision in the central bank’s updated forecasts may drag on rate expectations, and the dollar stands at risk of facing near-term headwinds over the remainder of the month should the ‘data dependent’ Fed highlight a wait-and-see approach for the year ahead.

Expectations: Bullish Argument/Scenario

Release Expected Actual Consumer Price Index ex. Food & Energy (YoY) (NOV) 2.0% 2.0% Non-Farm Payrolls (NOV) 200K 211K ADP Employment Change (NOV) 190K 217K

With the U.S. economy approaching ‘full-employment,’ Fed officials may sound increasingly upbeat and endorse a more hawkish outlook for monetary policy as Chair Yellen remains confident in achieving the 2% inflation target over the policy horizon.

Risk: Bearish Argument/Scenario

Release Expected Actual Real Average Weekly Earnings (YoY) (NOV) -- 1.6% Advance Retail Sales (MoM) (NOV) 0.3% 0.2% Average Hourly Earnings (YoY) (NOV) 2.3% 2.3%

However, subdued wage growth paired with the ongoing weakness in household consumption may push the FOMC to temper market expectations, and the greenback may struggle to hold its ground should the committee outline a more shallow path for interest rates.

How To Trade This Event Risk

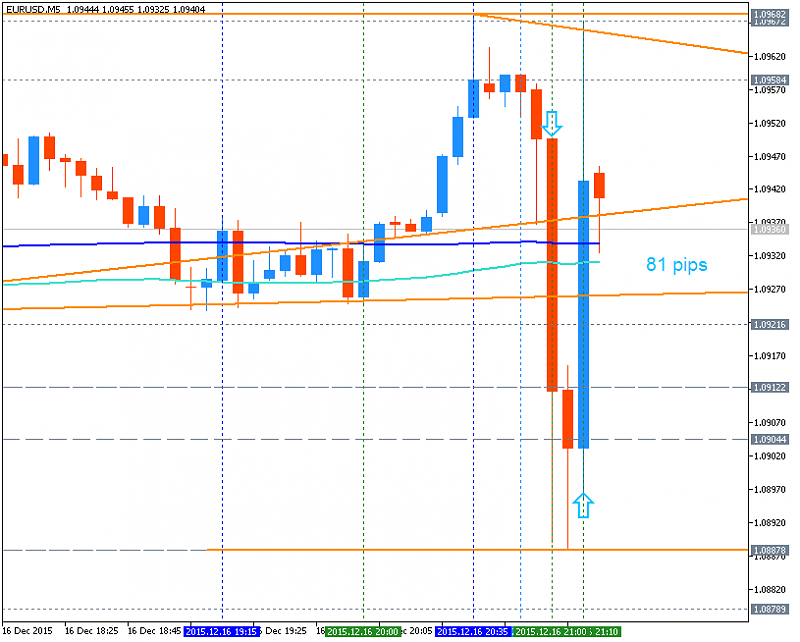

Bullish USD Trade: Fed Lifts Benchmark Interest Rate, Warns of Higher Borrowing-Costs in 2016

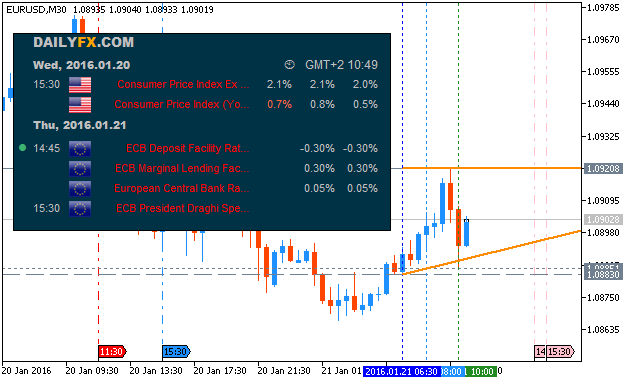

- Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

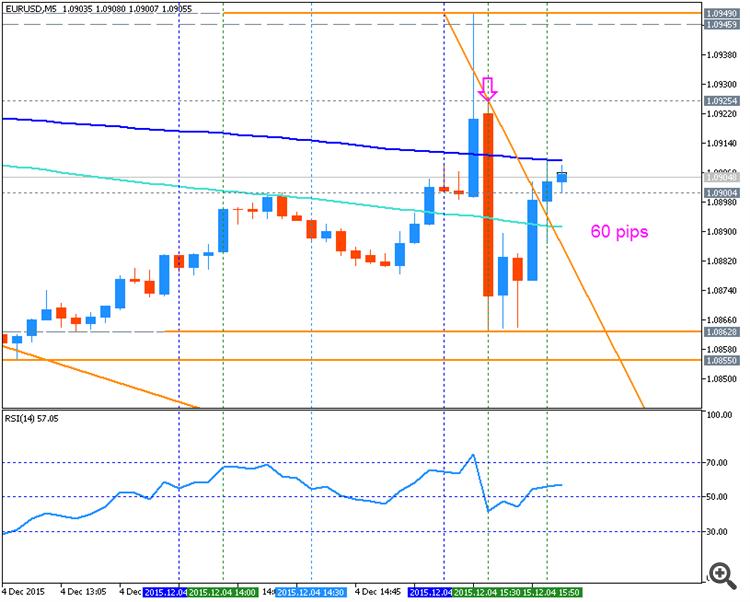

Bearish USD Trade: FOMC Implements ‘Dovish’ Rate-Hike, Endorses Wait-and-See Approach

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

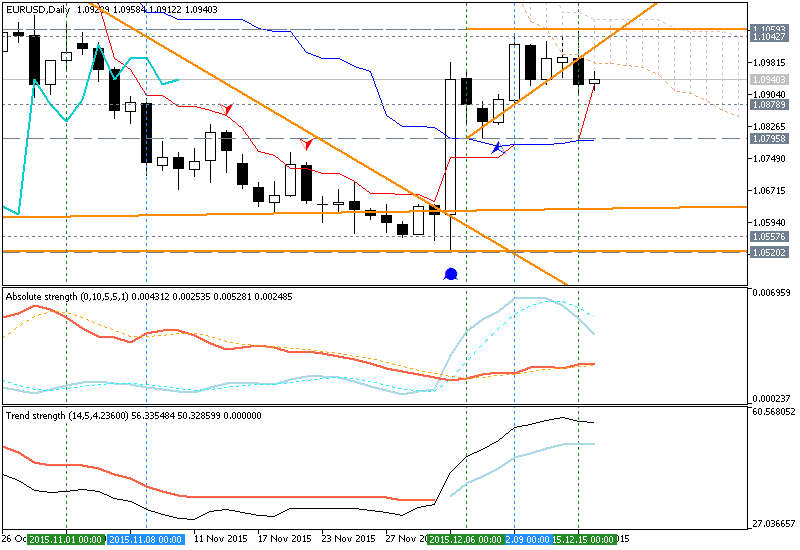

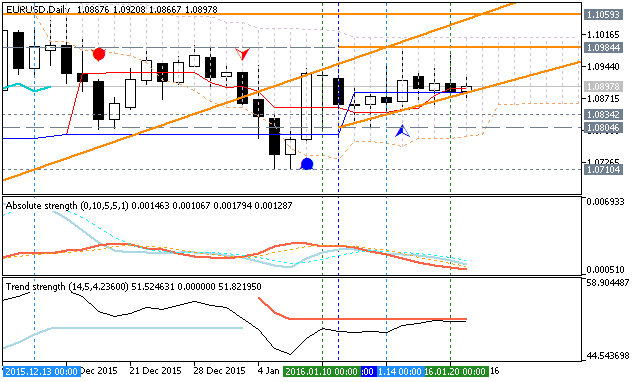

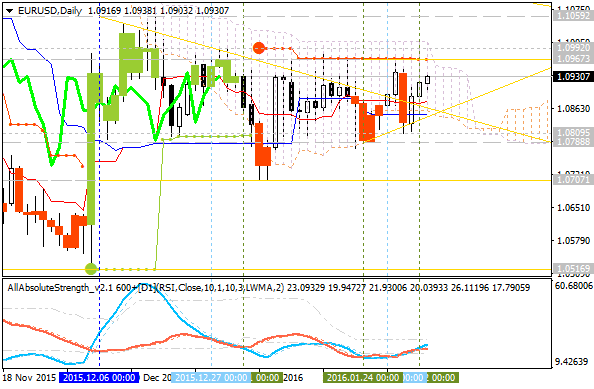

EURUSD Daily

- Despite bets for the first Fed rate-hike in nearly a decade, the near-term rally in EUR/USD following the European Central Bank (ECB) interest rate decision may gather pace in the days ahead especially as the Relative Strength Index (RSI) appears to be breaking out of the bearish formation carried over from back in August.

- Interim Resistance: 1.1052 (November high) to 1.1090 (50% retracement)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Impact that the FOMC rate decision has had on EUR/USD during the last meeting

Period Data Released Estimate Actual Pips Change

(1 Hour post event )Pips Change

(End of Day post event)OCT

201510/28/2015 18:00 GMT 0.25% 0.25% -165 -144

more...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks