Trading the News: U.S. Non-Farm Payrolls (NFP)

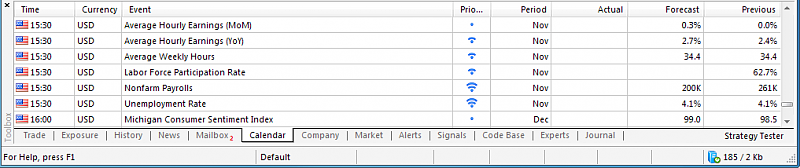

The U.S. Non-Farm Payrolls (NFP) report by fuel the near-term decline in EUR/USD as employment is projected to increase another 195K in November, while Average Hourly Earnings are expected to climb an annualized 2.7% during the same period.

A further improvement in labor market dynamics accompanied by signs of stronger wage growth may heighten the appeal of the greenback as it encourages the Federal Open Market Committee (FOMC) to further normalize monetary policy in 2018, and the dollar may exhibit a more bullish behavior over the remainder of the year should the central bank stay on its current course of delivering three rate-hikes per year.

However, another series of lackluster data prints may encourage the FOMC to adopt a more cautious tone at its last interest rate decision on December 13, and the greenback may face a more bearish fate if the fresh developments drag on interest-rate expectations.

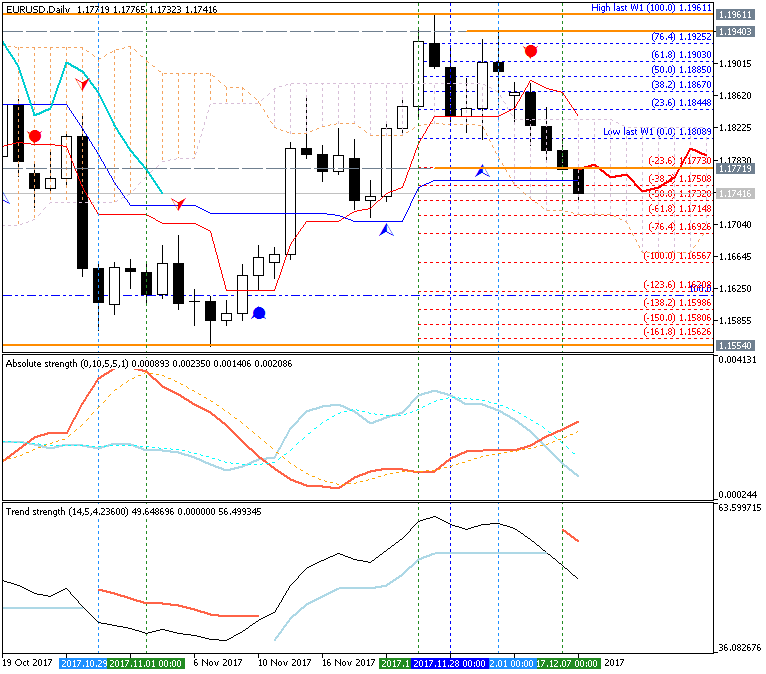

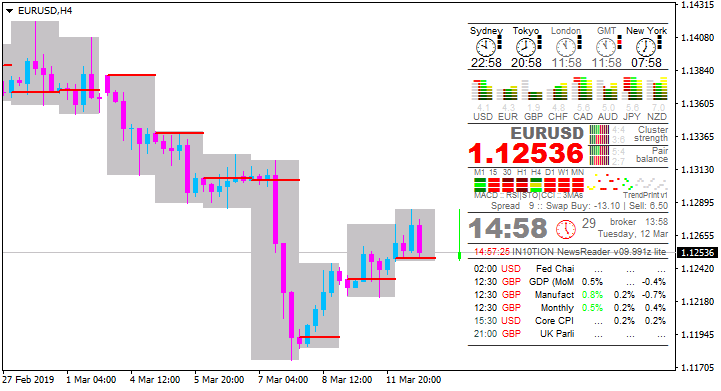

- EUR/USD stands at risk for a larger pullback as it snaps the monthly opening range, with the pair carving a fresh series of lower highs & lows following the failed attempt to break above the 1.1960 (38.2% retracement) hurdle.

- The Relative Strength Index (RSI) highlights a similar dynamic as it fails to preserve the bullish formation carried over from November, with a break below the 50-Day SMA (1.1758) raising the risk for a move back towards 1.1670 (50% retracement).

- Next downside region of interest comes in around 1.1580 (100% expansion), which sits above the November-low (1.1554), followed by the Fibonacci overlap around 1.1480 (78.6% expansion) to 1.1500 (78.6% expansion).

more...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks