Trading the News: U.S. Non-Farm Payrolls (NFP)

The U.S. Non-Farm Payrolls (NFP) report may generate a mixed market reaction as the economy is anticipated to add 190K jobs in April, while the Unemployment Rate is projected to uptick to an annualized 4.6% from 4.5% the month prior. Moreover, household earnings are expected to hold steady at 2.7% per annum, and a lackluster labor report may fuel the near-term resilience in EUR/USD especially as market attention turns to the final around of the French election.

Why Is This Event Important:

With Fed Fund Futures now pricing a greater than 70% probability for a June rate-hike, the fresh speech from Chair Janet Yellen may trigger a more meaningful reaction as market participants continue to gauge the timing and pace of the normalization cycle. A more detailed approach in unloading the Fed’s balance sheet may curb the recent advance in the euro-dollar exchange rate as the Federal Open Market Committee (FOMC) adopts a more aggressive approach in normalizing monetary policy, but the event may fail to prop up the greenback should the central bank head merely try to buy more time.

How To Trade This Event Risk

Bearish USD Trade: Employment Report Shows U.S. Approaching Full-Employment

- Need a green, five-minute candle following the NFP report to consider a long EUR/USD position.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish USD Trade: NFP Expands 190K; Jobless Rate & Wage Growth Hold Steady

- Need a red, five-minute EUR/USD candle to favor a long dollar position.

- Carry out the same setup as the bearish dollar setup, just in reverse.

Potential Price Targets For The Release

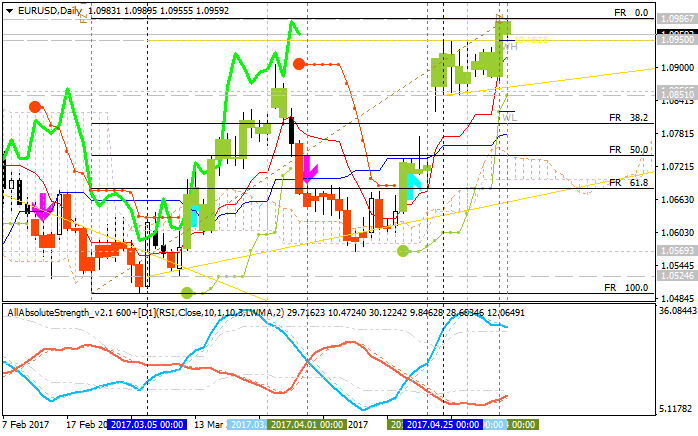

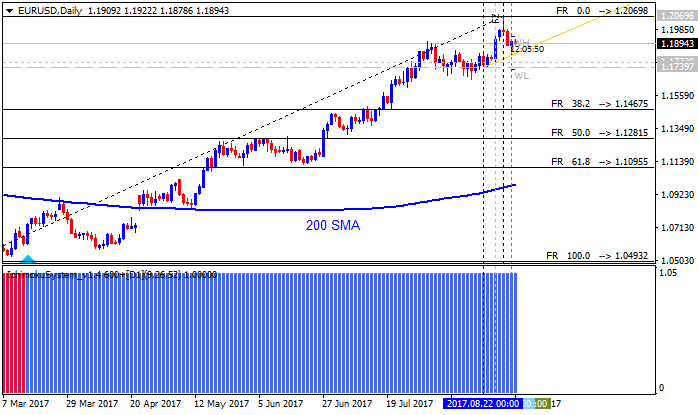

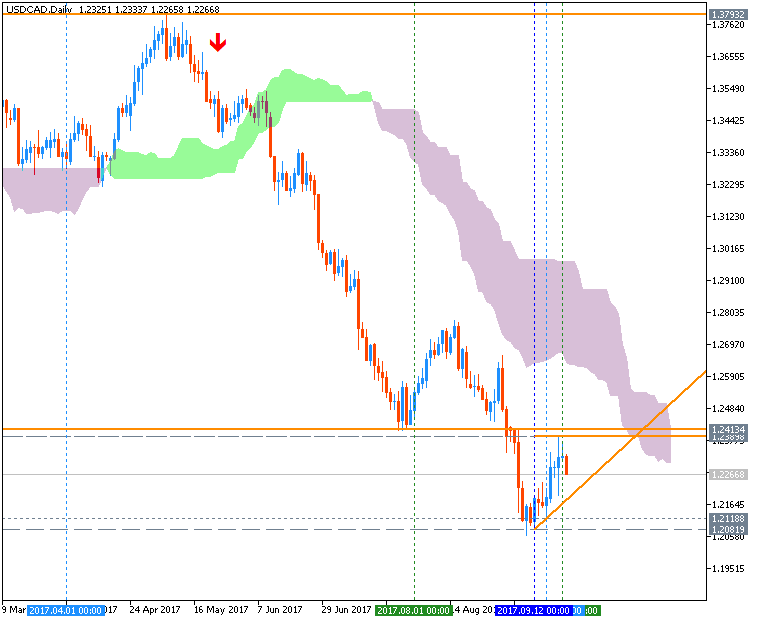

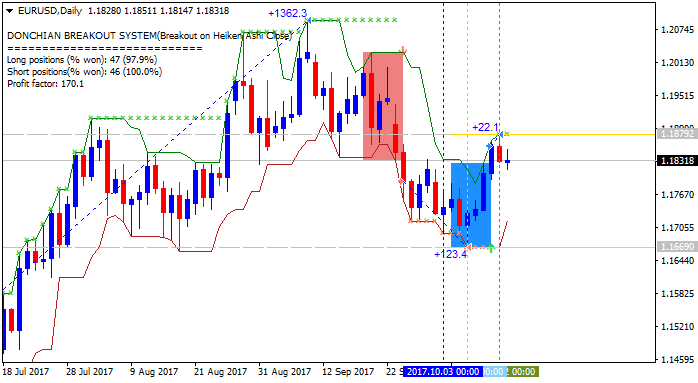

EUR/USD Daily

more...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks