Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Open Market Committee (FOMC) is widely expected to retain its current policy in April even as central banks officials project two rate-hikes for 2016, but a growing dissent within the central bank may trigger a near-term selloff in EUR/USD as it boosts interest-rate expectations.

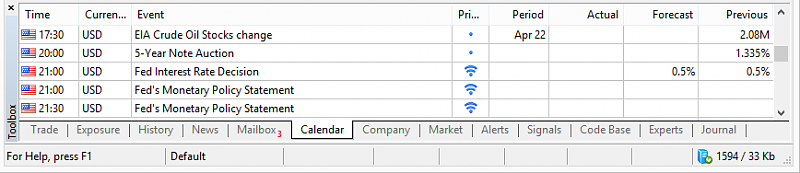

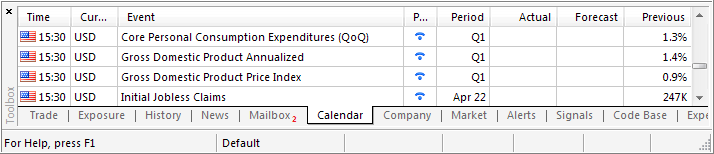

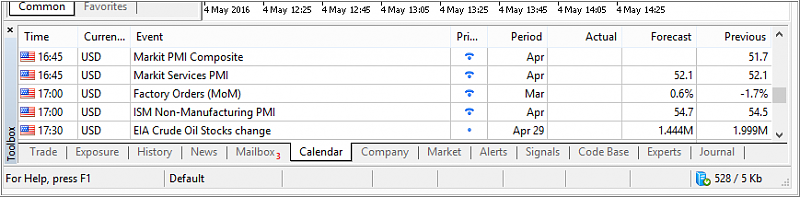

What’s Expected:

Why Is This Event Important:

Even though Fed Chair Janet Yellen remains largely concerned about the ‘external risks’ surrounding the region, a growing number of Fed officials may look to further normalize monetary policy in the first-half of 2016 especially as the U.S. economy approaches ‘full-employment.’

However, easing confidence along with the slowdown in household spending may dampen Fed expectations for a ‘consumer-led’ recovery, and more of the same from the central bank may drag on the dollar as market participants push out bets for the next Fed rate-hike.

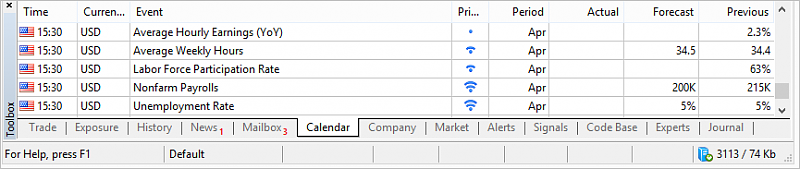

How To Trade This Event Risk

Bullish USD Trade: Policy Statement Highlights Growing Dissent Within FOMC

- Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Fed Votes 9-1 Once Again to Retain Current Policy

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

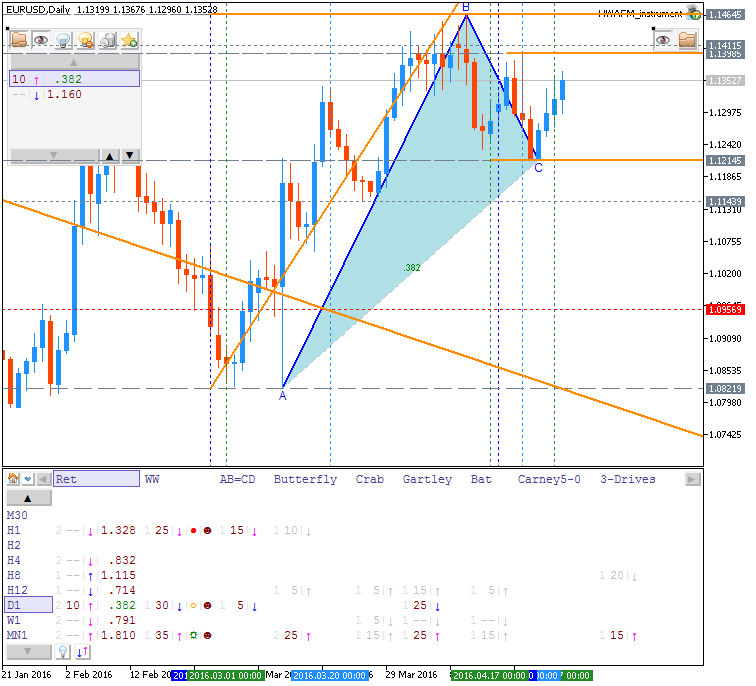

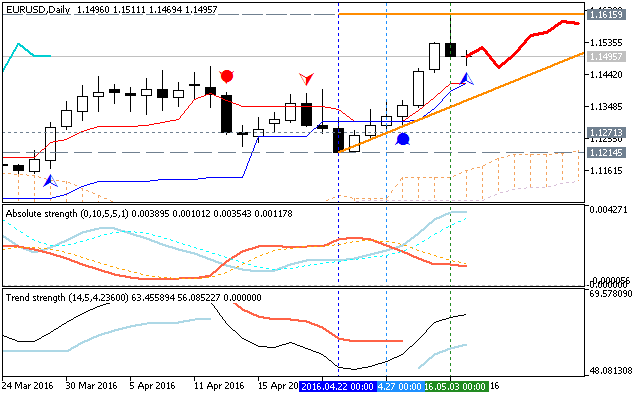

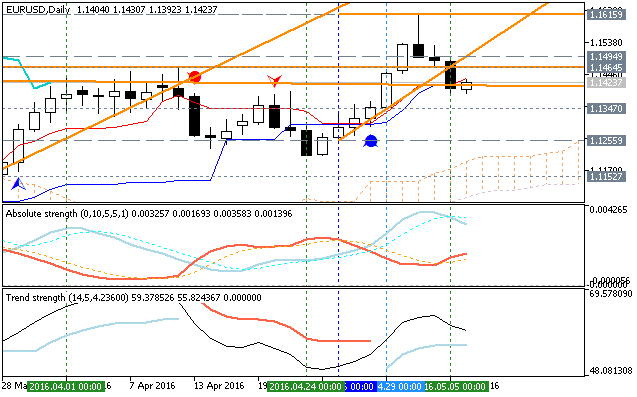

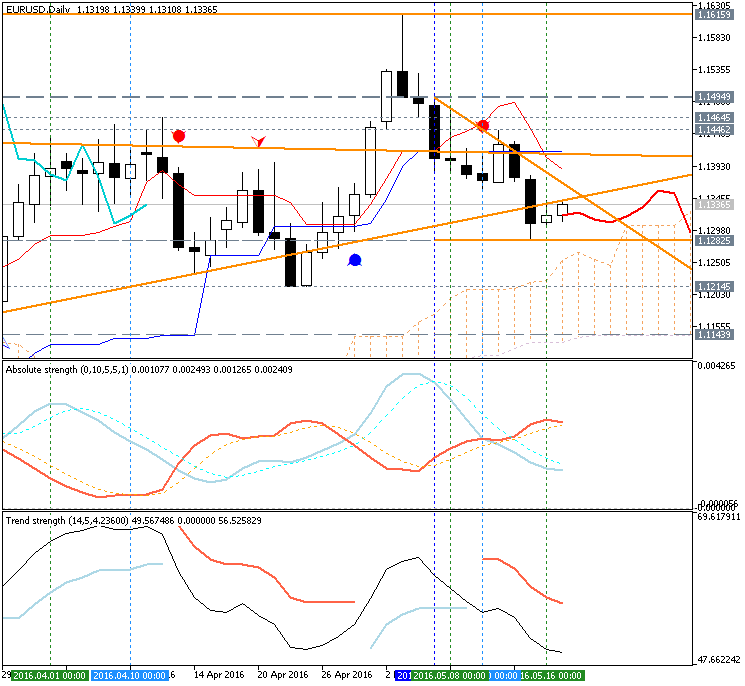

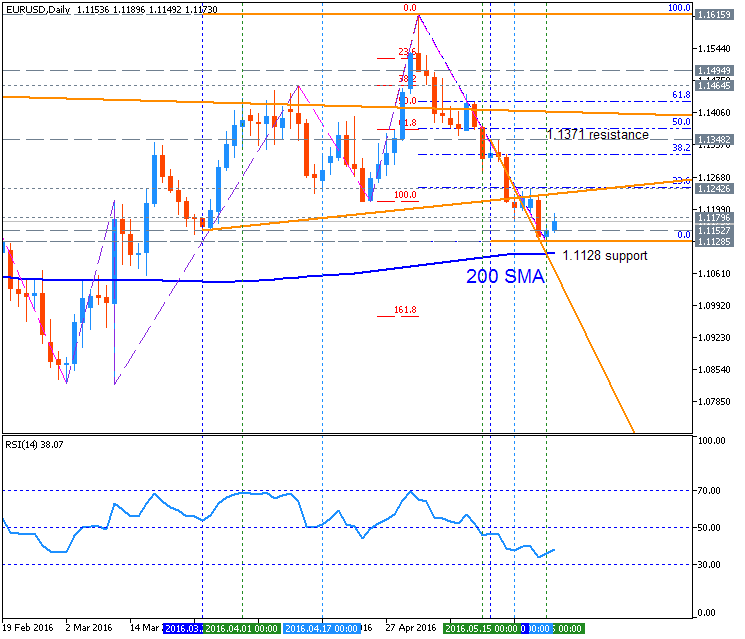

Potential Price Targets For The Release

EURUSD Daily

- The diverging paths for monetary policy casts a long-term bearish outlook for EUR/USD, but the pair appears to be carving a major bottoming-process especially as the Relative Strength Index (RSI) largely preserves the bullish formation carried over from March 2015.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0370 (38.2% expansion) to 1.0410 (61.8% expansion)

more...

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks