Trading the News: U.S. Gross Domestic Product (GDP)

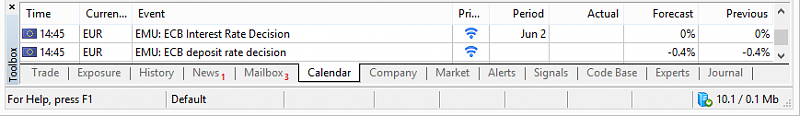

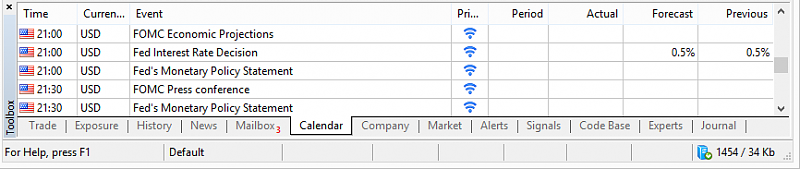

An upward revision in the preliminary 1Q Gross Domestic Product (GDP) report may trigger near-term selloff in EUR/USD as signs of a stronger recovery provide the Federal Open Market Committee (FOMC) with greater scope to implement higher borrowing-costs.

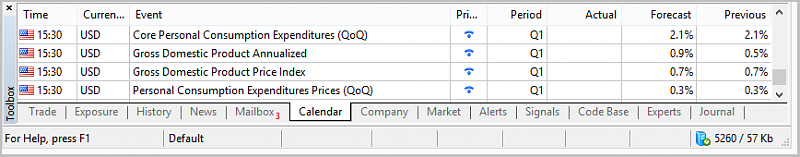

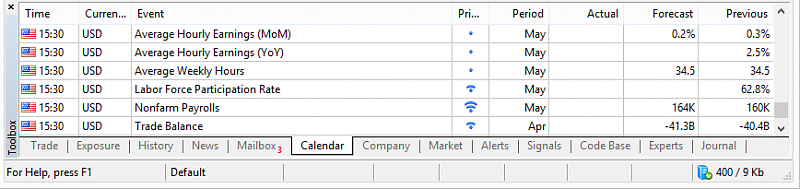

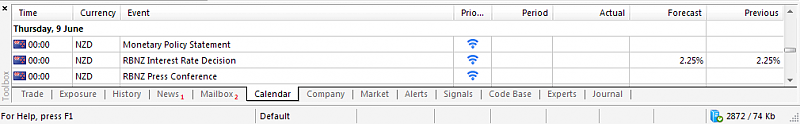

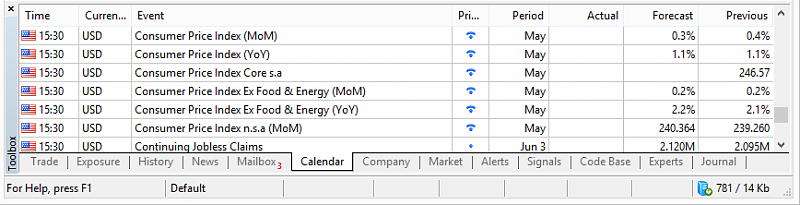

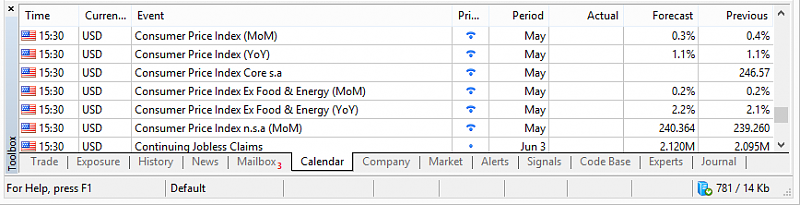

What’s Expected:

Why Is This Event Important:

With the U.S. economy approaching ‘full-employment,’ a faster rate of growth may encourage a greater number of Fed officials to vote for a rate-hike at the next quarterly meeting in June as the central bank sees a sustainable recovery over the policy horizon.

How To Trade This Event Risk

Bullish USD Trade: 1Q GDP Climbs Annualized 0.9% or Greater

- Need red, five-minute candle following the report to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Growth Report Falls Short of Market Forecast

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in reverse.

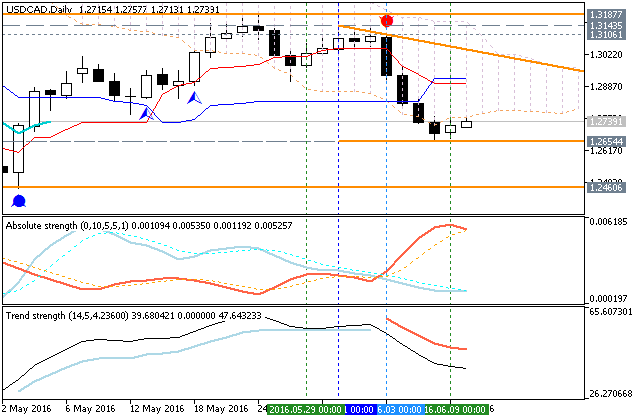

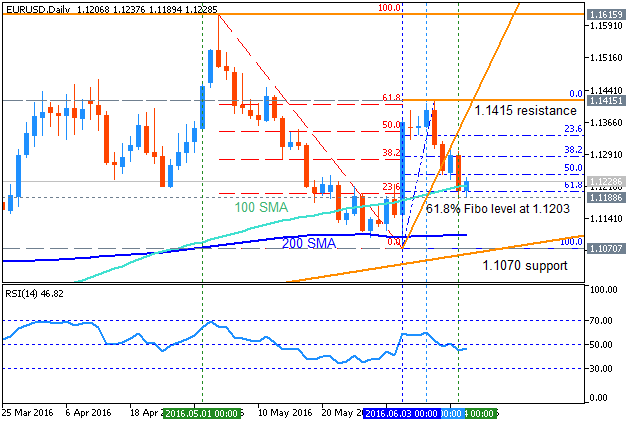

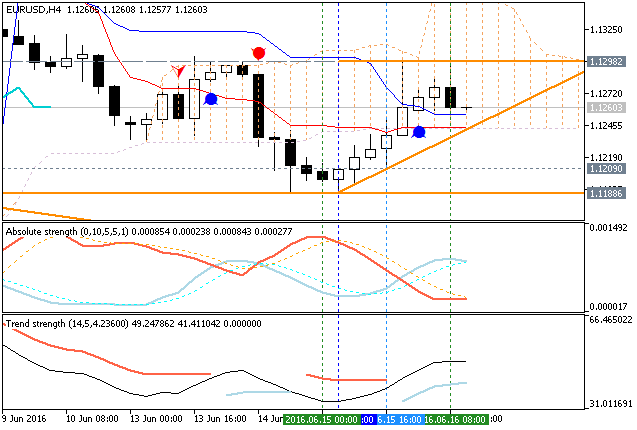

EURUSD H1

The price is located below 200 SMA for the bearish market condition - price is on ranging around 100 SMA waiting for direction of the trend:

- for the ranging bearish in case the price will be inside 100 SMA/200 SMA area, and

- for the primary bearish trend to be continuing in case the price will be located below 100 SMA/200 SMA area.

more...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks