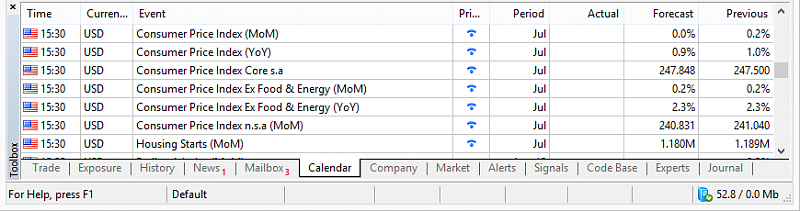

Trading the News: U.S. Consumer Price Index (CPI)

Despite forecasts for a downtick in the U.S. Consumer Price Index (CPI), stickiness in the core rate of inflation may boost the appeal of the greenback and spark a near-term pullback in EUR/USD as it puts pressure on the Federal Reserve to raise the benchmark interest rate sooner rather than later.

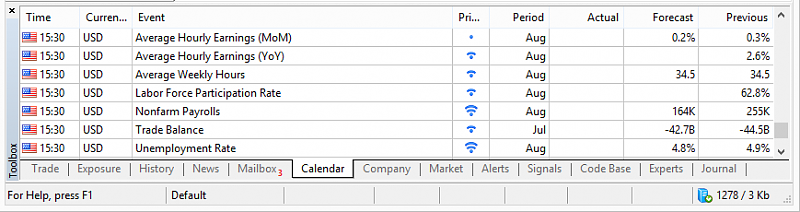

What’s Expected:

Why Is This Event Important:

The growing risk of overshooting the 2% inflation-target may spur a larger dissent within Federal Open Market Committee (FOMC), and we may see a growing number of central bank officials push for a 2016 rate-hike especially as the U.S. economy approaches ‘full-employment.’ However, Chair Janet Yellen may try to buy more time at the next quarterly meeting in September as the central bank reiterates ‘market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.’

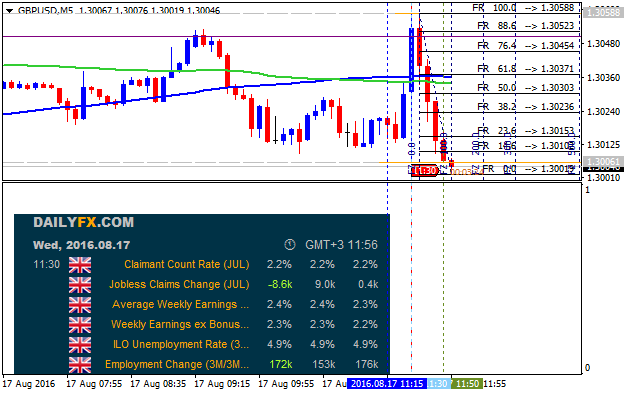

How To Trade This Event Risk

Bearish USD Trade: Headline & Core Inflation Narrow in July

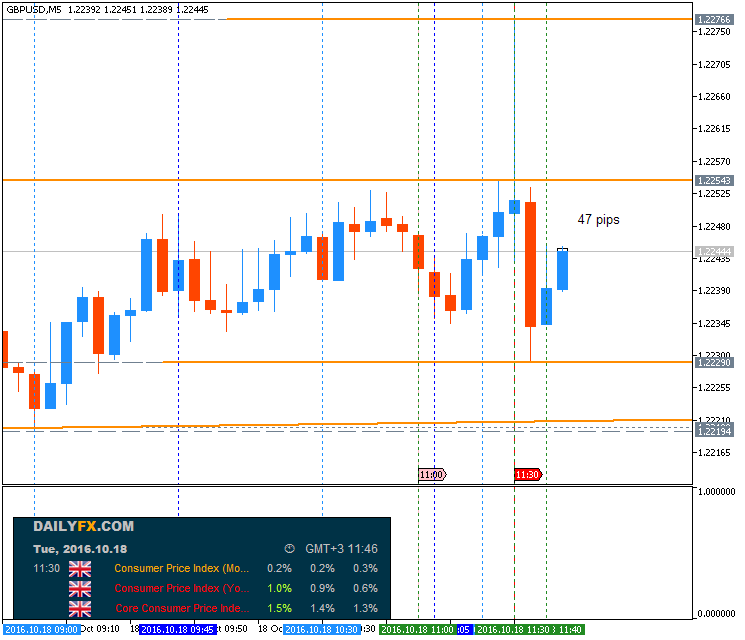

- Need green, five-minute candle following the print to consider a long position on EUR/USD.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: U.S. Consumer Price Report Exceeds Market Forecast

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

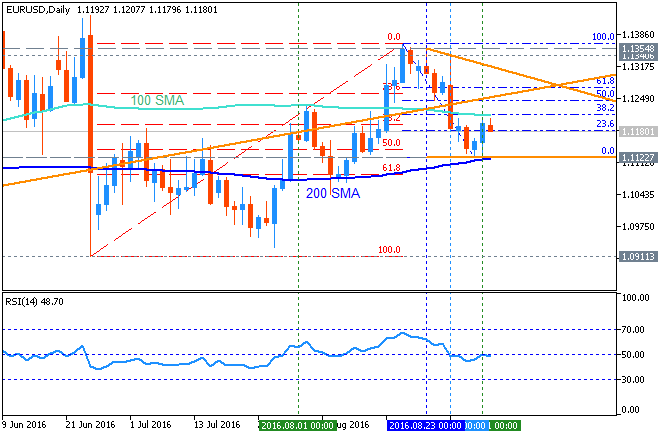

Potential Price Targets For The Release

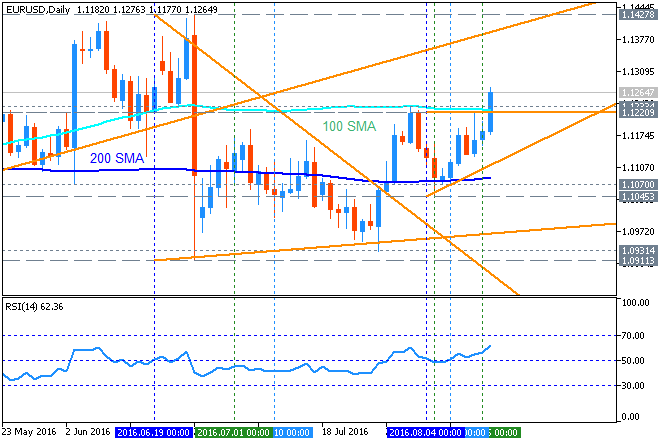

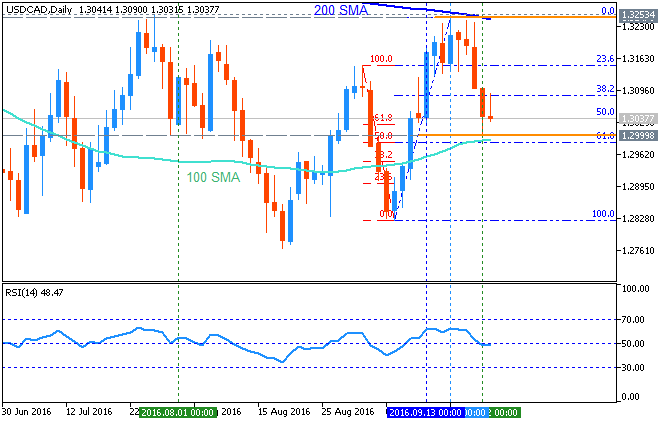

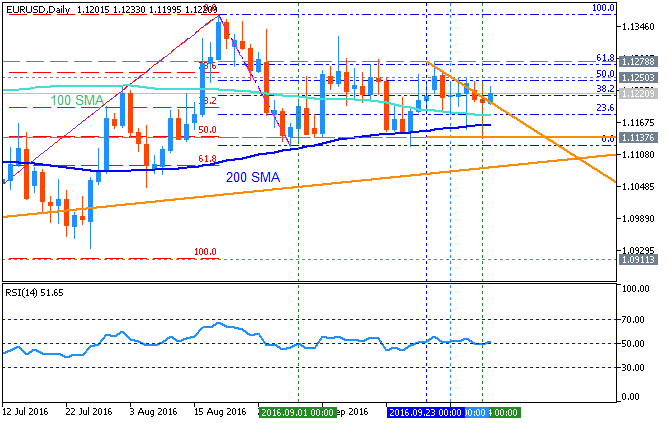

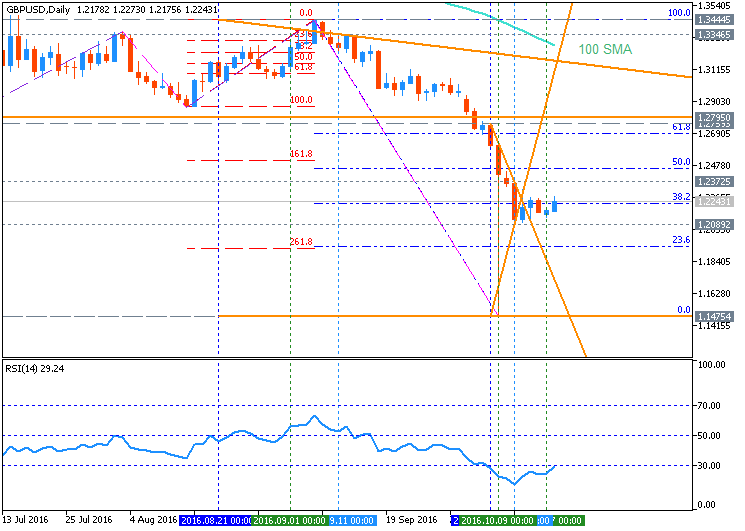

EUR/USD D1

- EUR/USD may further retrace the decline from the May high (1.1615) as the pair appears to be breaking out of the wedge/triangle formation carried over from June, with a break of the 100-Day SMA (1.1226) opening up the next topside hurdle around 1.1270 (38.2% retracement) to 1.1290 (23.6% retracement).

- Key Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Key Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

more...

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks