Talking Points:

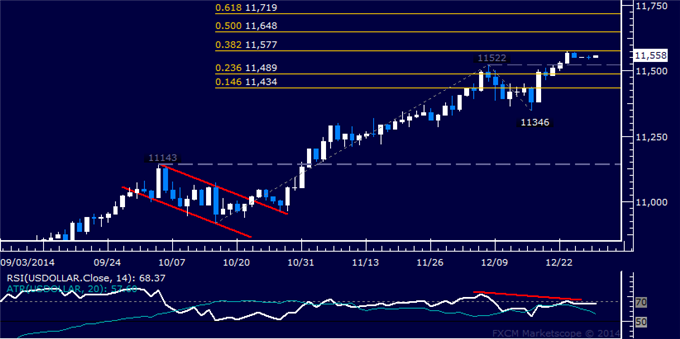

- US Dollar Corrects Higher But Topping Cues Still Intact

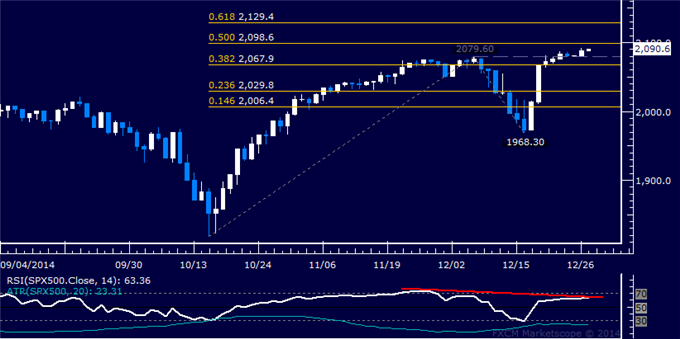

- S&P 500 Fails to Hold Onto Gains on a Recovery Attempt

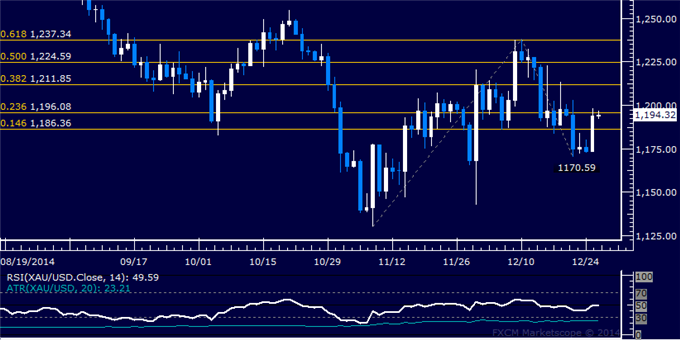

- Gold Mired in Consolidation, Crude Oil Continues to Sink

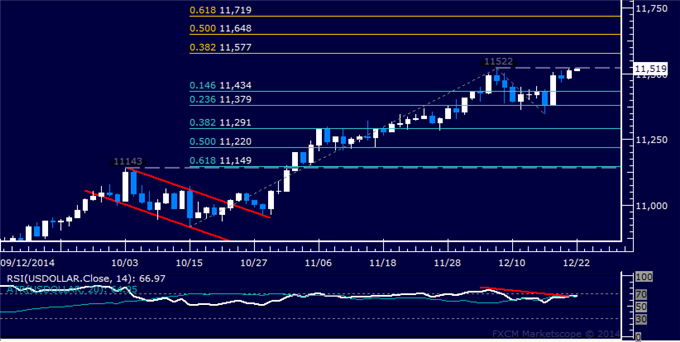

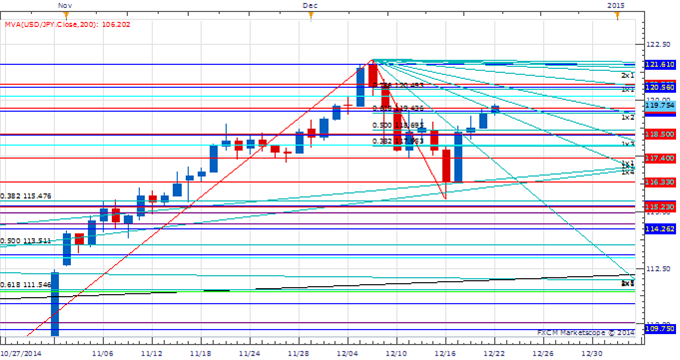

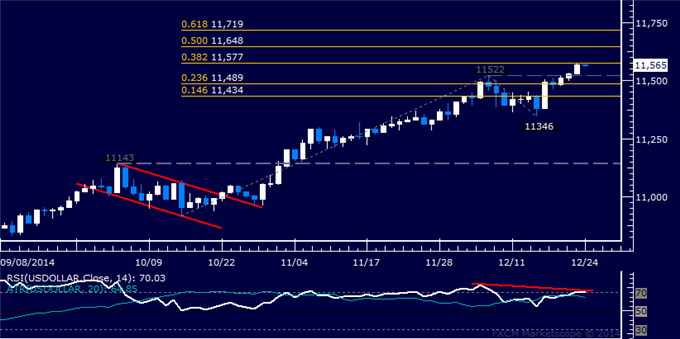

US DOLLAR TECHNICAL ANALYSIS – Prices moved lower as expected after prices put in a bearish Evening Star candlestick pattern. A daily close below the 23.6% Fibonacci retracementat 11379 exposes the 38.2% level at 11291. Alternatively, a turn above the 14.6% Fib at 11434 opens the door for a challenge of the December 8 high at 11522.

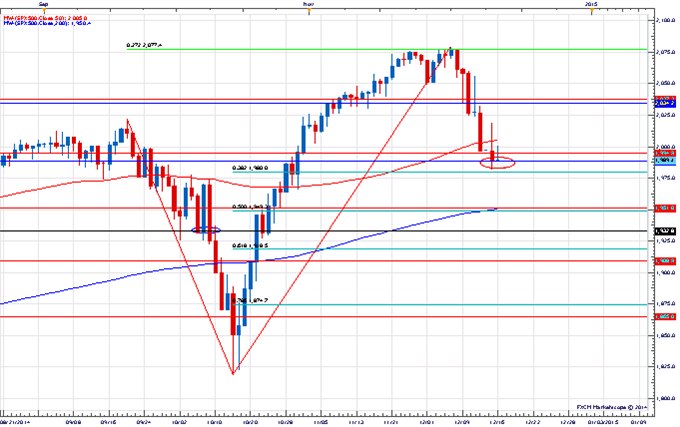

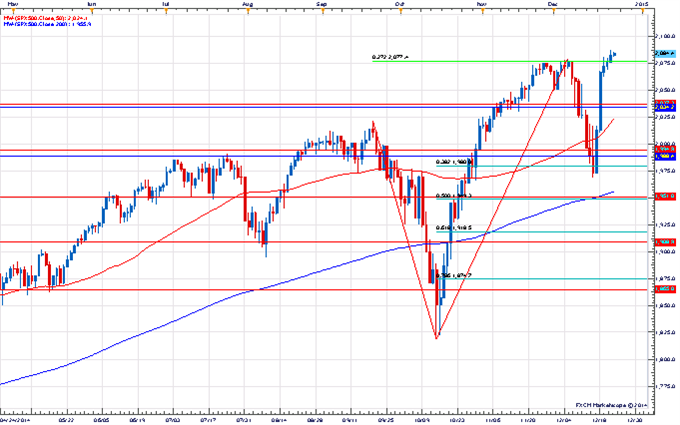

S&P 500 TECHNICAL ANALYSIS – Prices turned lower as expected, issuing the largest decline in two months. A push below the 2018.10-22.10areamarked by the 23.6%Fibonacci retracementand theSeptember 19 highexposes the 38.2% level at 1980.00. Alternatively, a reversal back above the 2041.50-49.10 zone (14.6% Fib, December 1 low) targets the 2075.90-79.60 region (November 26 and December 5 highs).

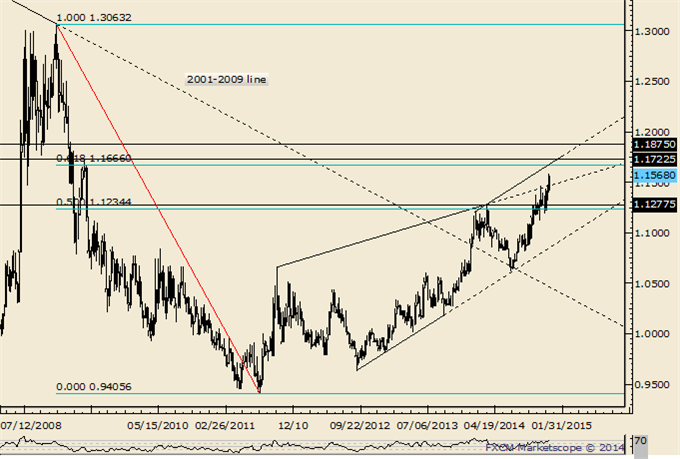

GOLD TECHNICAL ANALYSIS – Prices paused to consolidate after clearing resistance at a falling trend line set from early July. A break above the 50% Fibonacci retracement at 1237.59 on a daily closing basis exposes the 61.8% level at 1262.96. Alternatively, a turn back below the intersection of the trend line and the 38.2% Fib at 1212.23 targets the 23.6% retracement at 1180.84.

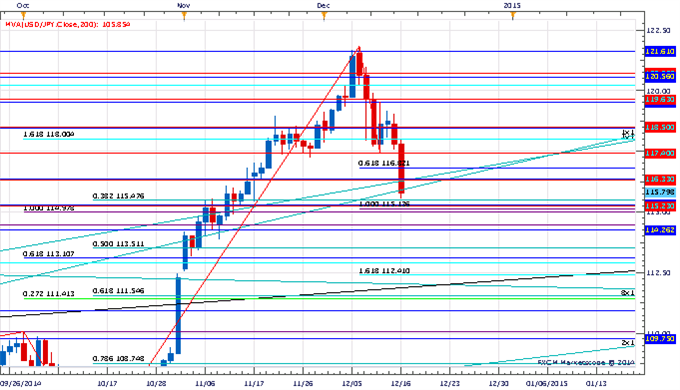

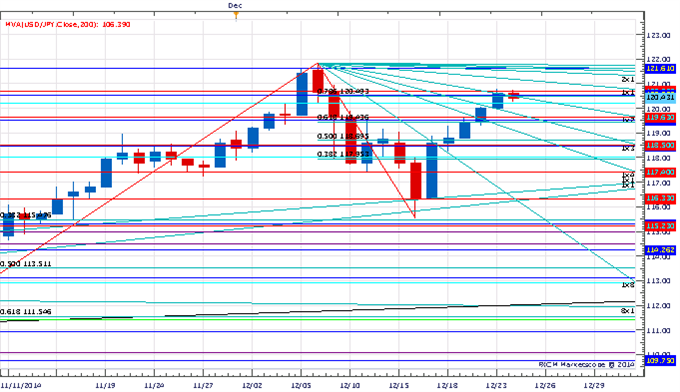

CRUDE OIL TECHNICAL ANALYSIS – Prices continued to move lower after yesterday’s brief respite, with sellers now eyeing the 76.4% Fibonacci expansion at 62.25. A break below that on a daily closing basis exposes the 100% level at 58.93. Alternatively, a reversal above the 61.8% Fib at 64.30 targets the 50% expansion at 65.96.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

D

D

Bookmarks