Talking Points:

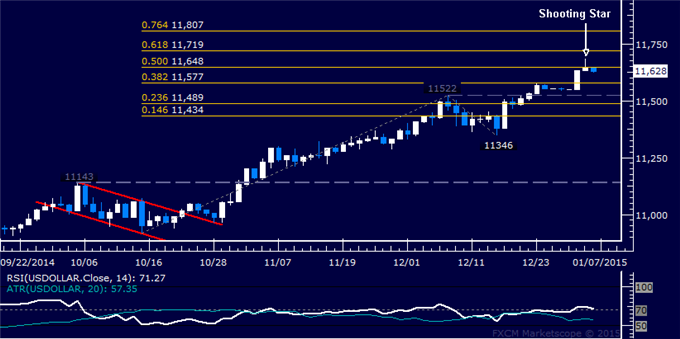

- US Dollar Continues to Consolidate in Narrow Trading Range

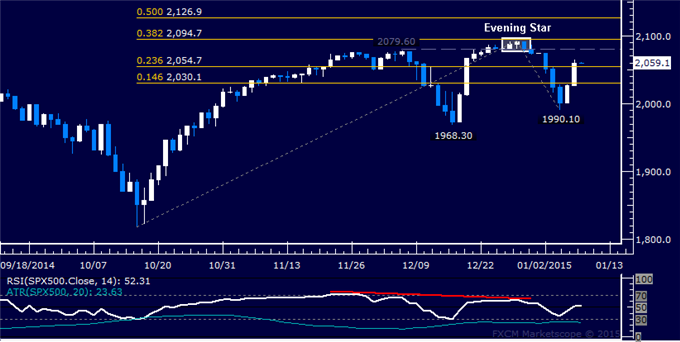

- SPX 500 Sets New Yearly High But Reversal Threat Remains

- Crude Oil Hits New 5-Year Low, Gold Rejected Below $1200

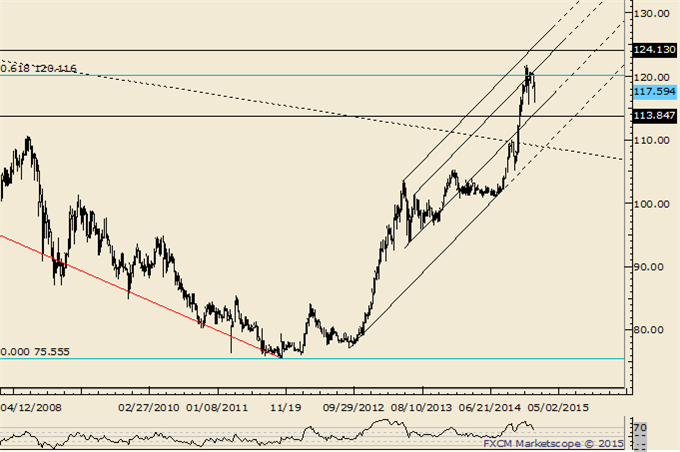

US DOLLAR TECHNICAL ANALYSIS – Prices aredigesting gains near a five-year high but negative RSI divergence casts doubt on immediate follow-through. A daily close above the 38.2% Fibonacci expansionat 11577 exposes the 50% level at 11648. Alternatively, a reversal below the 11489-522 area marked by the December 8 top and the 23.6% Fib opens the door for a challenge of the 14.6% expansion at 11434.

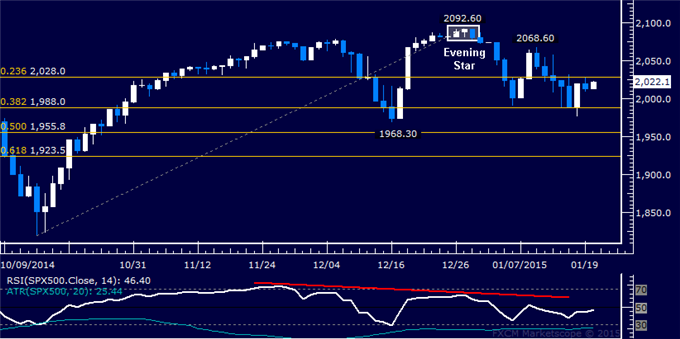

S&P 500 TECHNICAL ANALYSIS – Prices edged above the December 5 high at 2079.60, exposing the 50% Fibonacci expansion at 2098.60. A daily close above this barrier exposes the 61.8% level at 2129.40. Negative RSI divergence warns of ebbing upside momentum and hints a turn lower may be looming. A turn back below 2079.60 sees initially support at 2067.90, the 38.2% Fib.

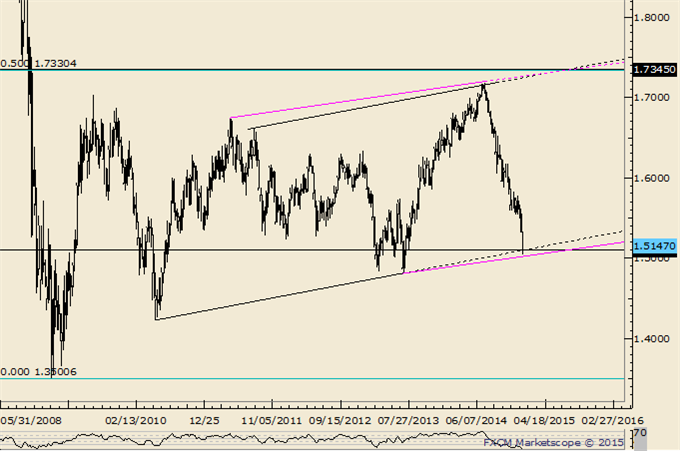

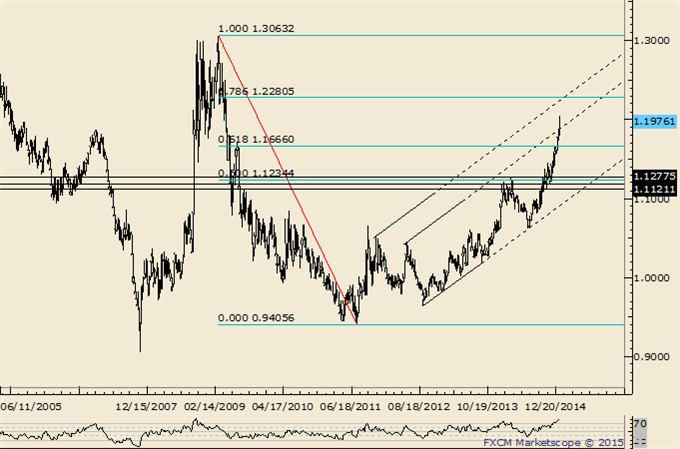

GOLD TECHNICAL ANALYSIS – Prices recoiled upward to test resistance at 1196.08, the 23.6% Fibonacci expansion, with a break above that on a daily closing basis exposing the 38.2% level at 1211.85. Near-term support is at 1170.59, the December 22 low.

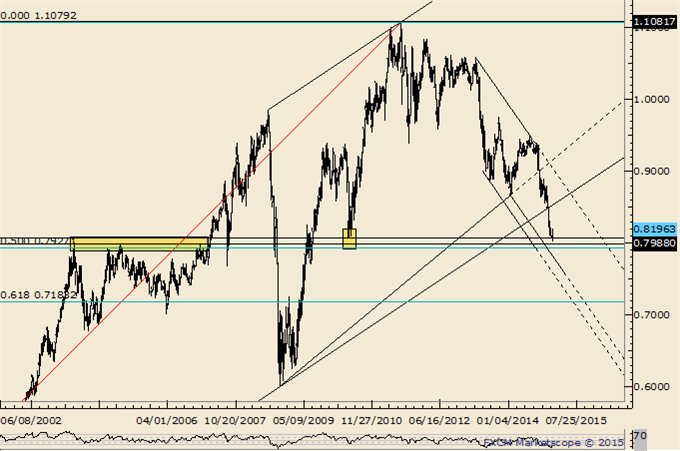

CRUDE OIL TECHNICAL ANALYSIS – Prices narrowly broke support at 58.20, the 23.6% Fibonacci expansion, with sellers now aiming to challenge the 38.2% level at 54.83. A further push beneath that targets the 50% Fib at 52.10. Alternatively, a reversal back above 58.50 aims for the December 18 high at 63.65.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks