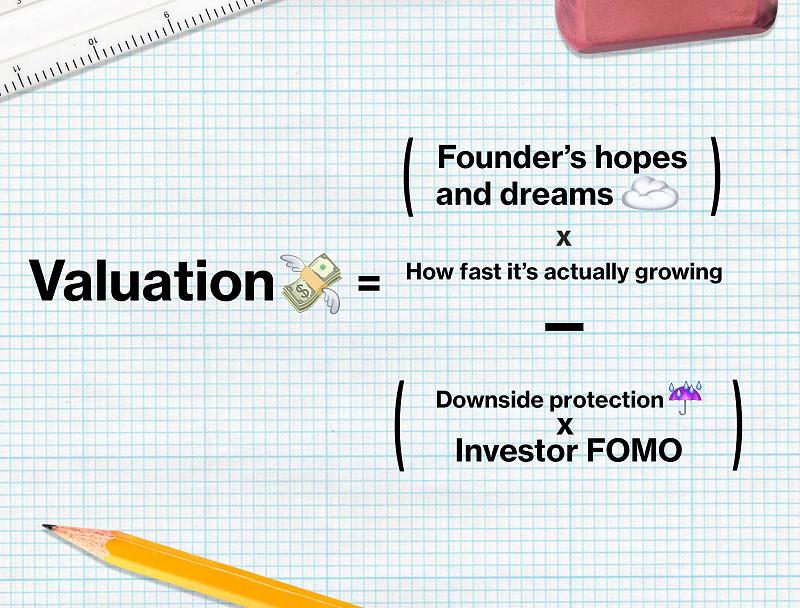

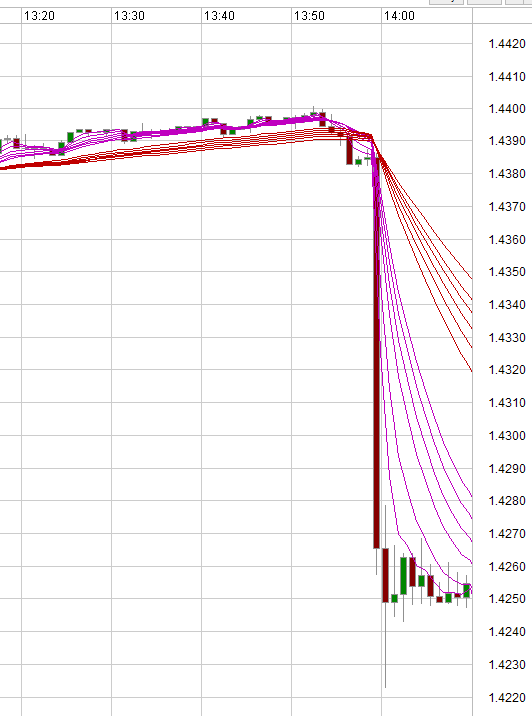

- The Fuzzy, Insane Math That’s Creating So Many Billion-Dollar Tech Companies (Bloomberg) see also Mind Games That Can Kill Investors (Stock Charts)

- Stock Performance Before, During & After Recessions (A Wealth of Common Sense)

- Commodities two-fer: Gold Futures Fall to Four-Month Low Ahead of FOMC Meeting (WSJ) and U.S. Oil Prices at Six-Year Low on Storage Concerns (WSJ)

- 86% of active managers failed to beat market in 2014 (CNN Money)

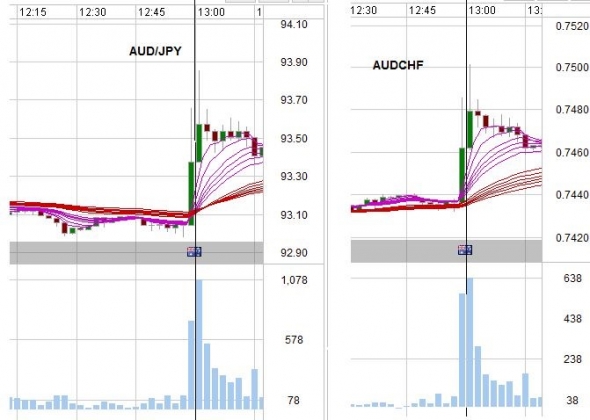

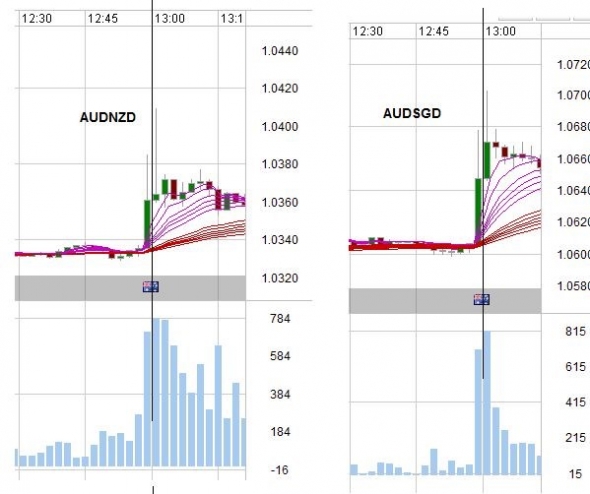

- The dollar is rising faster than any time in the last 40 years (Washington Post) see also Rising Dollar Is Creating Trouble for Emerging Economies (Upshot)

- Cheap or expensive? The one thing about equity valuation that few talk about (Humble Student of the Markets)

- For Sale: Chinese Investment Properties (The Financialist)

- Across the Globe, Big Economies Are Falling Out of Love With Coal (Slate)

- The Steve Jobs You Didn’t Know: Kind, Patient, and Human (Fast Company)

- What Cockroaches With Backpacks Can Do. Ah-mazing (NPR)

What are you reading?

8Likes

8Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

.gif)

Bookmarks